Author: g_fasol

-

JVC KENWOOD Chairman: “Speed is like fresh food” – Revitalization of Japanese industry by JVC KENWOOD Chairman Haruo Kawahara (6th Ludwig Boltzmann Symposium)

JVC Kenwood Chairman Haruo Kawahara: Revitalization of Japanese Industry (Representative Director and Chairman of the Board of JVC KENWOOD Corporation) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. Background reading: JVC KENWOOD Corporation was incorporated on October 1, 2008, and has 20,033 employees as…

-

Groupthink can kill – Fukushima Accident Investigation Chairman Kiyoshi Kurokawa

Kiyoshi Kurokawa: Quo vadis Japan? – uncertain times (Academic Fellow of GRIPS and former Chairman of Fukushima Nuclear Accident Independent Investigation Commission by National Diet of Japan) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. Professor Kurokawa set the stage by describing the uncertain…

-

Ludwig Boltzmann – Energy, Entropy, Leadership by Gerhard Fasol (6th Ludwig Boltzmann Symposium)

Ludwig Boltzmann as leader (Gerhard Fasol, CEO of Eurotechnology Japan KK. Served as Associate Professor of Tokyo University, Lecturer at Cambridge University, and Manger of Hitachi Cambridge R&D Lab.) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. Ludwig Boltzmann, the scientist Ludwig Boltzmann’s greatest…

-

Boltzmann constant, temperature and the new SI system of units by Gerhard Fasol (6th Ludwig Boltzmann Symposium)

Boltzmann constant k, “What is temperature?” and the new definition of the SI system of physical units (by Gerhard Fasol, CEO of Eurotechnology Japan KK. Served as Associate Professor of Tokyo University, Lecturer at Cambridge University, and Manger of Hitachi Cambridge R&D Lab.) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014…

-

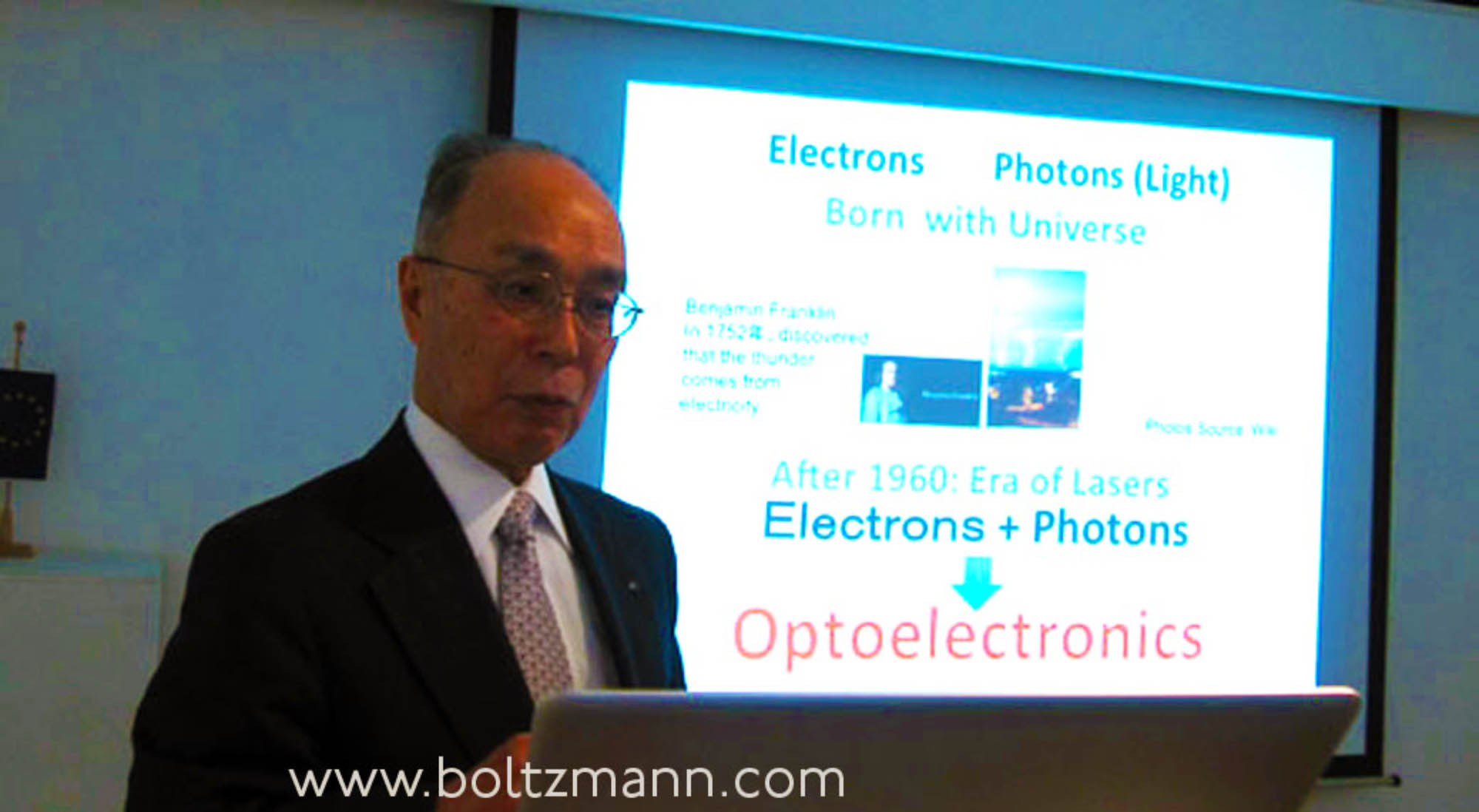

VCSEL – Vertical cavity surface emitting lasers by their inventor, Kenichi Iga (6th Ludwig Boltzmann Symposium)

VCSEL inventor Kenichi Iga: hv vs kT – Optoelectronics and Energy (Former President and Emeritus Professor of Tokyo Institute of Technology. Inventor of VCSEL (vertical cavity surface emitting lasers), widely used in photonics systems) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. VCSEL: how…

-

Israeli Venture Fund Japan meeting in Tokyo March 4, 2014

Start-up Nation Israel 2014 – Israel Japan Investment Funds meeting on March 4, 2014 at the Hotel Okura in Tokyo Israeli Venture funds introduce Israeli ventures to Japanese investors Acquisition of Viber by Rakuten draws attention in Japan to Israeli ventures The recent acquisition of the Israel-based OTT (over the top) communications company Viber by…

-

Steve Jobs and SONY: why do Steven Jobs and SONY reach opposite answers to the same question: what to do with history?

Steve Jobs and SONY: why 180 degrees opposite decisions? Steve Jobs donates history to Stanford University in order to focus on the future Steve Jobs and SONY – when Steve Jobs when returned to Apple in 1996, and now SONY are faced with the same question: what to do about corporate archives and the corporate…

-

London Stock Exchange withdraws from Tokyo AIM, Tokyo AIM becomes TOKYO PRO and TOKYO PRO BOND Markets

London Stock Exchange formed the Tokyo AIM market as a joint venture with Tokyo Stock Exchange and now withdraws from this venture and from Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo-AIM as a joint-venture company in order to create a jointly owned and jointly managed AIM Stock Market in Tokyo, modeled…

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

Flappy bird Angry Birds ultimate Japan game disruption: flappy bird flaps to the top

Flappy bird Angry Birds ultimate disruption: flappy bird effortlessly flaps to to the top of ranks, while Angry Birds are watching angrily from the sidelines Disruption of Japan’s games sector: in a previous blog post we showed that just three newcomers (Gree + DeNA + Gungho) produce more profits than the top 9 traditional game…

-

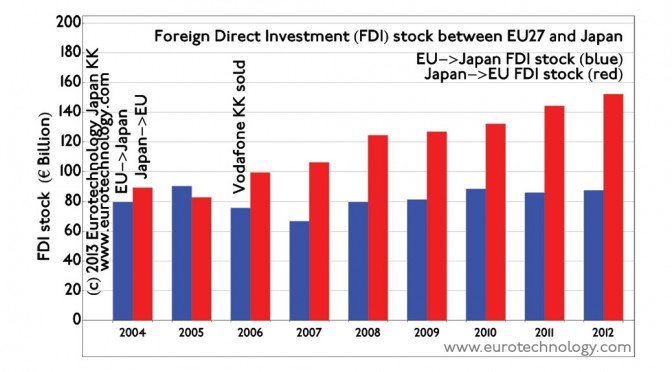

EU Japan investment stock totals about EURO 230 billion and is expected to increase

EU Japan investment stock is expected to increase with the future Economic Partnership Agreement European direct investments into Japan, European acquisitions in Japan EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from…

-

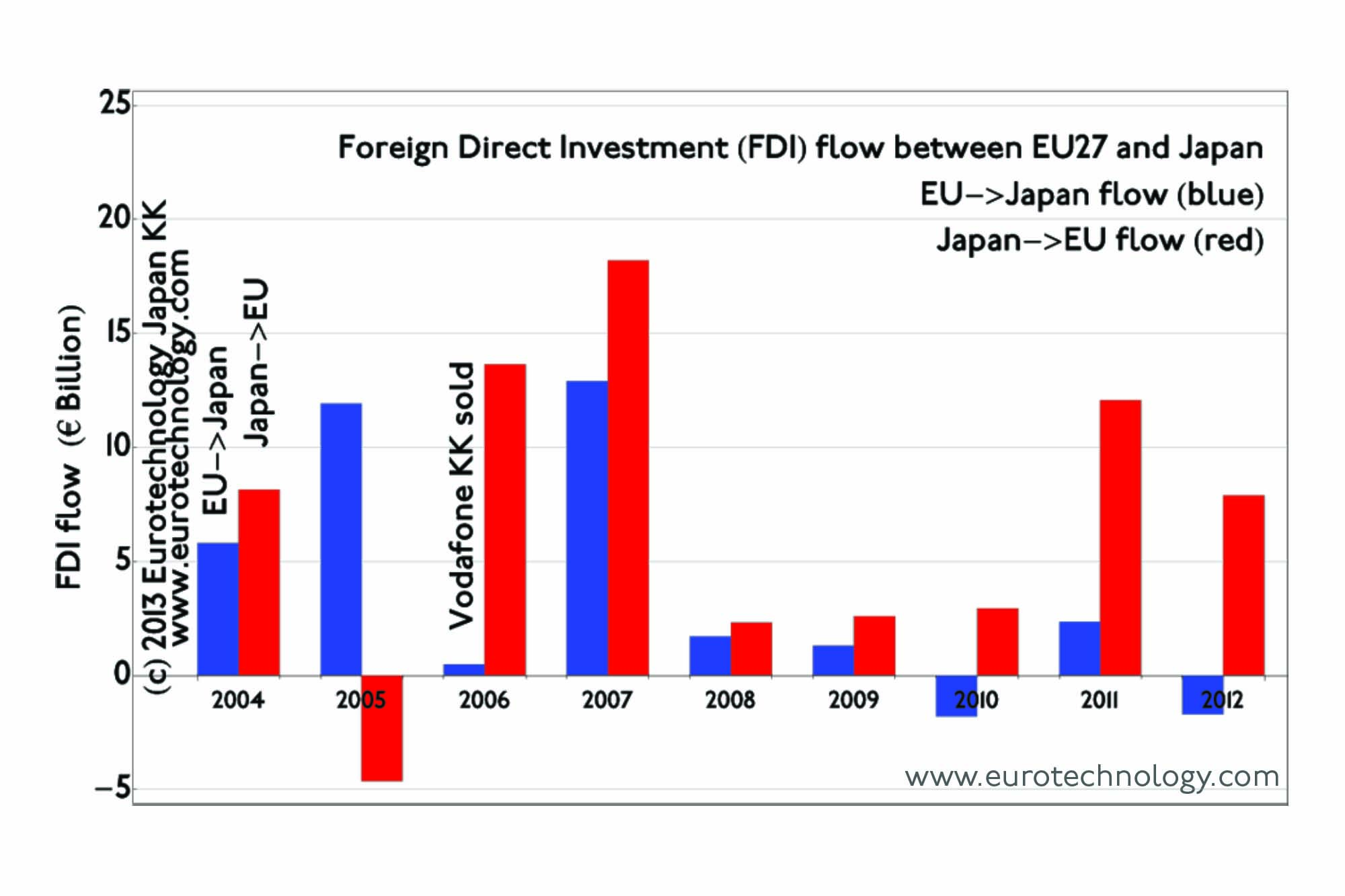

EU Japan investment and acquisition flow and M&A

EU Japan investment flow is mainly from Japan to Europe and totals about EURO 10 billion per year Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn, and was very quiet between 2008 and 2010. In recent years, mainly Japanese investments to Europe have picked up, and currently about…

-

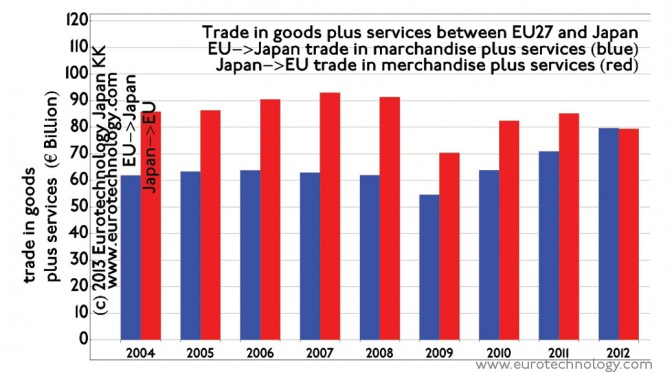

EU Japan trade totals about EURO 160 billion/year and is expected to increase with the future Economic Partnership Agreement

EU Japan trade adds up to about EURO 160 billion/year if both directions are added up Combining the amounts of trade for merchandise and commercial services, EU exports to Japan and Japanese exports to EU have reached equal levels, so that the trade between EU and Japan is now balanced around EURO 80 billion in…

-

SOMPO, member of the Japanese Insurance group NKSJ Holdings acquires UK reinsurer Canopius Group Ltd

SOMPO, a Japanese insurance company owned by NKSJ Holdings, acquired Canopius in order to globalize In order to globalize, Japanese insurance company Sompo Japan (株式会社損害保険ジャパン), part of the insurance group NKSJ Holdings (NKSJホールディングス株式会社, TSE / JPX: No. 8630) announced yesterday the acquisition of 100% of the UK re-insurer Canopius Group Limited, operating on Lloyd’s for…

-

Japanese management – why is it not global? asks Masamoto Yashiro at a Tokyo University brain storming event

Japanese management – why is it not global? What should we do? Keynote speech by Masamoto Yashiro at brainstorming by President of Tokyo University summary of Masamoto Yashiro’s talk written by Gerhard Fasol Masamoto Yashiro is a legend in Japan’s banking and energy industry. He built Shinsei Bank from the ashes of the bankrupt Long…

-

Docomo postpones Tizen OS mobile handsets for the second time

Below are notes for an interview for the French newspaper LesEchos. The full article can be found here. On Thursday January 16th, 2014, NTT Docomo announced the postponement of mobile phone handsets based on the TIZEN operating system. This is actually the second time that NTT Docomo has postponed the planned introduction of TIZEN handsets,…

-

Japan Perspectives for 2014: can Abenomics succeed? Can Japan grow again? Can Japan solve the population crisis?

Will Abenomics succeed? Stanford Economics Professor Takeo Hoshi thinks that there is a 10% chance that Abenomics will succeed to put Japan on a 2%-3% economic growth path, while the most likely outcome will be 1% economic growth. Read our notes of Professor Hoshi’s talk in detail here. Can Japanese companies globalize? “Globalization” of course…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

TowerJazz to acquire three of Panasonic’s semiconductor fabs (Nikkei headline)

TowerJazz acquires three of Panasonic’s large written off wafer fabs for around US$ 100 million Massive market entry to Japan for TowerJazz Nikkei (the world’s biggest business daily, see our J-Media report) reported as their top headline yesterday, that TowerJazz is planning to acquire interests in three of Panasonic’s reportedly largely written-off semiconductor fabs valued…

-

SIM free iPhone Japan: officially on sale by Apple in the online Apple store

SIM free iphone japan finally arrive in Japan – directly sold by Apple. SIM-lock free iPhone 5s and iPhone 5c are now officially sold via the Japanese section of the official Apple.com webstore. It has been official policy recommendation (not regulation) by Japan’s General Affairs Ministry (総務省) for Japan’s mobile operators to sell SIM-free mobile…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…

-

Scandinavian renewable energy conference in Tokyo

Was invited to attend the Scandinavian renewable energy conference in Tokyo. Topics covered: Electricity infrastructure, market and governance Electricity market reform in Japan Power of network and for green growth – learning from nordic experiences Nordic renewable energy sources Nordic solution for bio energy production Bioenergy from blue biomass Nordic way to increase efficiency of…

-

Supercell wins SoftBank and GungHo investment

Supercell investment by SoftBank and GungHo Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets. SoftBank…

-

Rakuten vs SoftBank + Yahoo vs Amazon (Bloomberg and BusinessWeek interviews)

Rakuten vs Softbank Yahoo reduces e-commerce fees to compete harder with Rakuten’s online mall Bloomberg interview and BusinessWeek interview about Yahoo KK’s aggressive reduction of ecommerce fees, a move increasing competition with Amazon.com and Rakuten. How do you see Yahoo KK’s latest move to reduce or eliminate merchant’s fees? Do you see this as an…

-

Japan’s Galapagos Effect

How Japan can capture global value from its innovations – a talk by Gerhard Fasol Dr. Gerhard Fasol dissects the history behind Japan’s unique international market separation By Hugh Ashton Originally published both in the print and online editions of the ACCJ Journal (Journal of the American Chamber of Commerce in Japan) on January 15,…

-

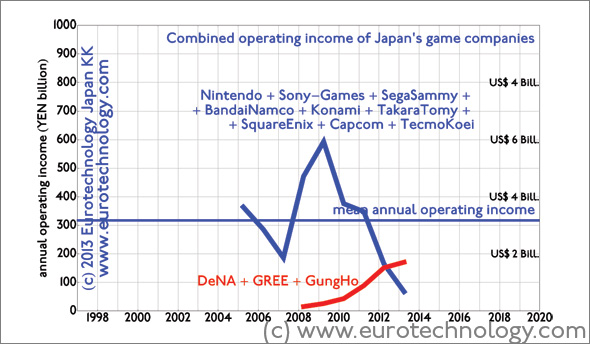

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…

-

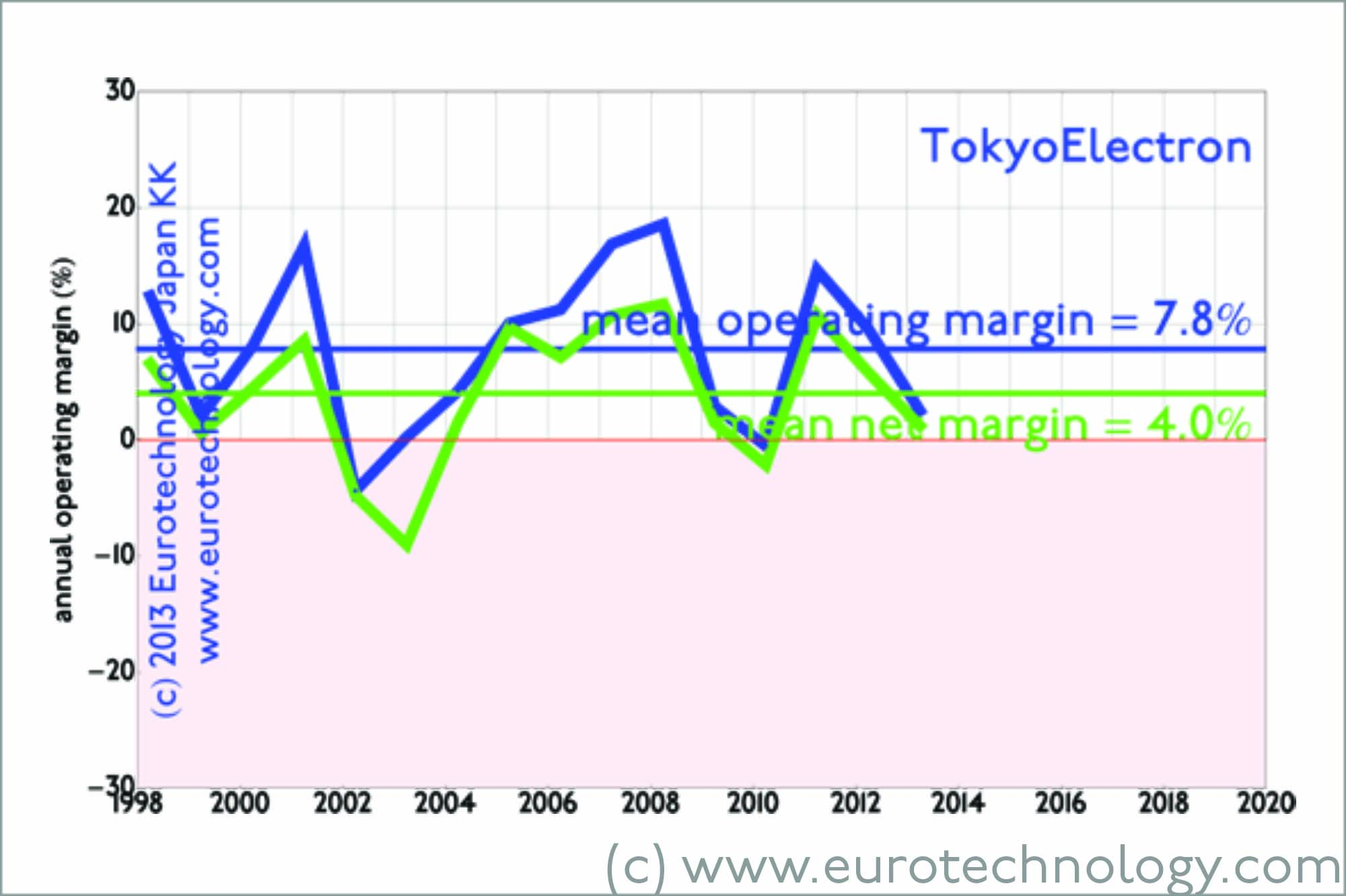

Applied Materials and Tokyo Electron plan merger (BBC interview and comments)

Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) plan merger Subject to regulatory approval in different jurisdictions Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) semiconductor manufacturing equipment makers on September 24, 2013 announced their “merger of equals” – creating a company with a nominal market capitalization of US$ 31.5 Billion,…