Smartphone games disrupt Japan’s traditional game industry

New 32nd edition: now includes 25 publicly listed Japanese smartphone game companies incl LINE + Pokemon Go!

pdf-file, Version 32 of July 13, 2016

approx. 406 pages, 141 Figures, 95 Photos, 98 tables, 5.1 Mbyte

Lead author: Gerhard Fasol PhD, works since 1984 with Japan’s technology industries.

Buy and download – Japan game market disruption market report:

[BUY corporate subscription: US$ 2375/month (cancel anytime)]

[BUY corporate license, current issue only: US$ 4750]

Summary – Japan game market disruption market report:

Japanese companies have created many of the global game genres, platforms and characters, and represent a US$ 50 billion industry sector – far higher still if Pachinko and Pachislot are included.

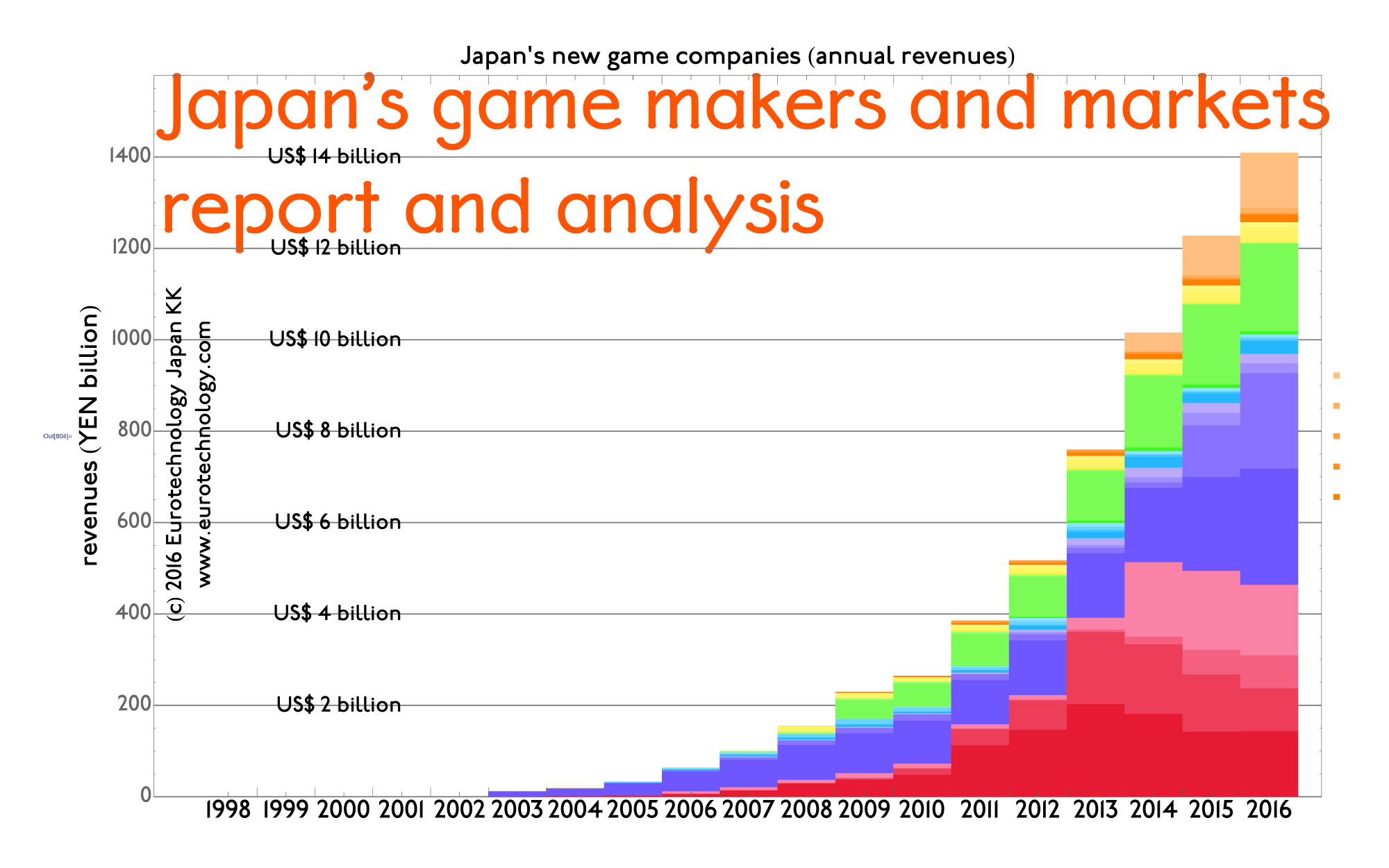

With consumer focus shifting from dedicated game platforms such as Nintendo’s Wii or DS, Sony’s Playstation or Microsoft’s Xbox to applications or online games on smartphones, Japan’s traditional game companies are facing unprecedented disruption, as shown in the figure above: three representative new game companies combined exceed all traditional game companies in operating income.

Most established game companies, including Nintendo and SONY, see an erosion of business, while at the same time new a large number of new game industry startups are rapidly growing and filling the space vacated by traditional game companies.

This report presents a detailed overview of Japan’s traditional game sector, as well as an overview of some of the new emerging players in Japan’s game sector.

Table of Contents – Japan game market disruption market report:

- Executive Summary: Japan’s game makers and markets

- Japan’s game markets compared to the rest of the world

- Japan’s game industry structure and overview

- Game platform segmentation

- Game industry landscape – graphical overview

- Game market segmentation: arcade games, video game hardware, video game software, online games, mobile phone games, graphics: quantitative data since 1996

- Game market segmentation: video game software, online games, mobile phone games, graphics: quantitative data since 1996

- Game market segmentation: arcade games, video game hardware, video game software, online games, mobile phone games, graphics: quantitative market size data since 1996

- Hardware: arcade games

- hardware segments of Japan’s game markets

- arcade games

- arcade game markets

- sega game arcades in Tokyo

- Konami’s Benami series

- Beatmania

- Dance Dance Revolution (DDR)

- Drummania (DM)

- Guitarfreaks (GF)

- Crane games, UFO catcher games

- Game machine locations, estimation of market size of Japan’s arcade game center market

- Hardware: game consoles

- video game hardware sectors: market size since 1996

- console generations

- video game platform generations: 1st, 2nd, video game crash, 3rd, 4th, 5th, 6th, 7th, 8th

- 7th generation overview

- “full high definition” gaming vs Wii EDTV

- 8th generation consoles

- global sales of Wii, PS3, XBOX360

- Mii’s and avatars

- Wii (code name: Revolution)

- creator Shigero Miyamoto’s philosophy and strategy

- controller paradigm shift

- Wii control system: Wii-remote and Nunchuk

- top selling games

- PS3, PS4

- XBOX, XBOX 360 in Japan

- XBOX 360 Japan launch on Dec 10, 2005, and promotion

- paradigm shift: Wii vs Xbox vs SONY PSP

- handheld game platforms, 7th generation

- DS vs DSI vs PSP, comparison, global sales

- Japan’s two remaining console platform companies, financial comparison

- Nintendo

- Sony Computer Entertainment (SCE)

- Japan’s Game software markets overview

- Japan’s established game software and video game makers

- video software overview, consolidation, list of major companies, financial analysis of the video game software sector

- disruption of Japan’s video game software market by online games, smartphone games, and newcomers: financial analysis and demonstration of the disruption

- Analysis of video game companies:

- Sega Sammy Holdings

- Bandai Namco Holdings

- Konami (including Konami Gaming Japan KK in preparation of the expected Japanese Casino Gaming laws enabling Casinos in Japan), Hudson

- Takara Tomy

- Square Enix, including Taito

- Capcom

- KOEI Tecmo Holdings, Koei, Tecmo

- Japan’s new game companies, online game companies, and smartphone game companies

- 25 public companies, listed on the Tokyo Stock Exchange

- Analysis of online, smartphone game companies:

- Gungho Online Entertainment

- Colopl

- DeNA

- GREE

- LINE

- discussions of 24 publicly listed Japanese smart phone game companies

- For comparison: Electronic Arts (EA) and Electronic Arts Japan

- Video game generations and historic overview

- Pachinko and Pachislot, industry overview and estimations or market size, and history

- Rating organizations: including Computer Entertainment Rating Organization, Ethics Organization of Computer Software

- Casino Law of Japan, situation of the development of Casino gaming in Japan

- Summary

Buy and download – Japan game market disruption market report:

[BUY corporate subscription: US$ 2375/month (cancel anytime)]

[BUY corporate license, current issue only: US$ 4750]

Copyright (c) 2014-2019 Eurotechnology Japan KK All Rights Reserved