Japanese electronics groups combined as of similar size as the economy of the Netherlands

Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year

Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands.

Over the last 15 years, their combined annual sales growth was zero, and their combined annual loss was YEN 50.6 billion/year (= US$ 0.6 billion/year).

Compelling evidence that new business models for Japan’s electronics sector present a huge opportunity – as explained in this BBC interview.

Contrasting Japan’s “Big-8” electronics groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) with Japan’s 7 electronic parts makers (Murata, Kyocera, TDK, Alps, Nidec, Nitto, ROHM)

Over the last 14 years since FY1997, the combined growth in revenues (=sales) of Japan’s “Big-8” electronics groups was zero.

The compound annual growth rate (CAGR) of Japan’s top 7 electronic parts makers combined was +3.1%.

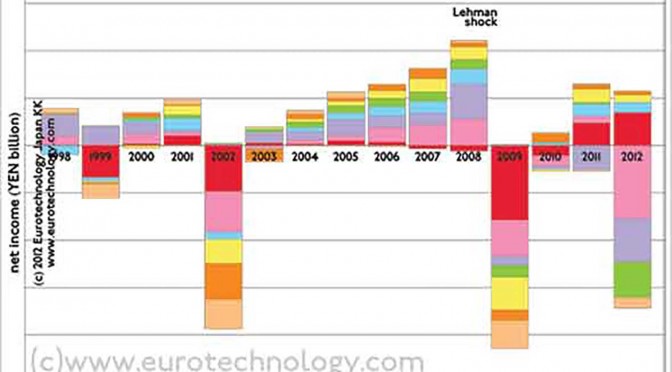

Net income (profit) of Japan’s “Big-8” electronics groups vs top-7 electronics parts makers

Over the last 14 years since FY1997, Japan’s “Big-8” electronics groups combined showed average losses of YEN 50.6 billion/year (=US$ 0.6 billion/year), while Japan’s top 7 electronic parts makers combined earned YEN 196 billion/year (= US$ 2.4 billion/year).

Net after tax income of Japan’s “Big-8” electronics groups

This figure shows net after tax income for Japan’s “Big-8” electronics groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC), for the years since FY1997. For 5 of these 14 years the industry sector reported combined losses, which in total exceeded the profits achieved in good years.

As a result, averaged over all 14 years, the industry sector shows combined losses on the order of US$ 0.6 billion/year.

Creating new business models for this very large industry sector (of similar economic size as the Netherlands) is a huge opportunity.

Net income of Japan’s top 7 electronic parts makers

Japan’s top 7 electronic parts makers are in a much better financial situation than Japan’s electrical groups.

Over the last 14 years since FY1997, this industry sector only showed a net overall loss one single time – in the year following the Lehman shock, but showed combined net profits during all other years, resulting in average annual net profits on the order of US$ 2.4 billion/year.

More detailed data and analysis in our report on Japan’s electronics industry sector.

Japan electronics industries – mono zukuri

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

Comments and discussions