Tag: hitachi

-

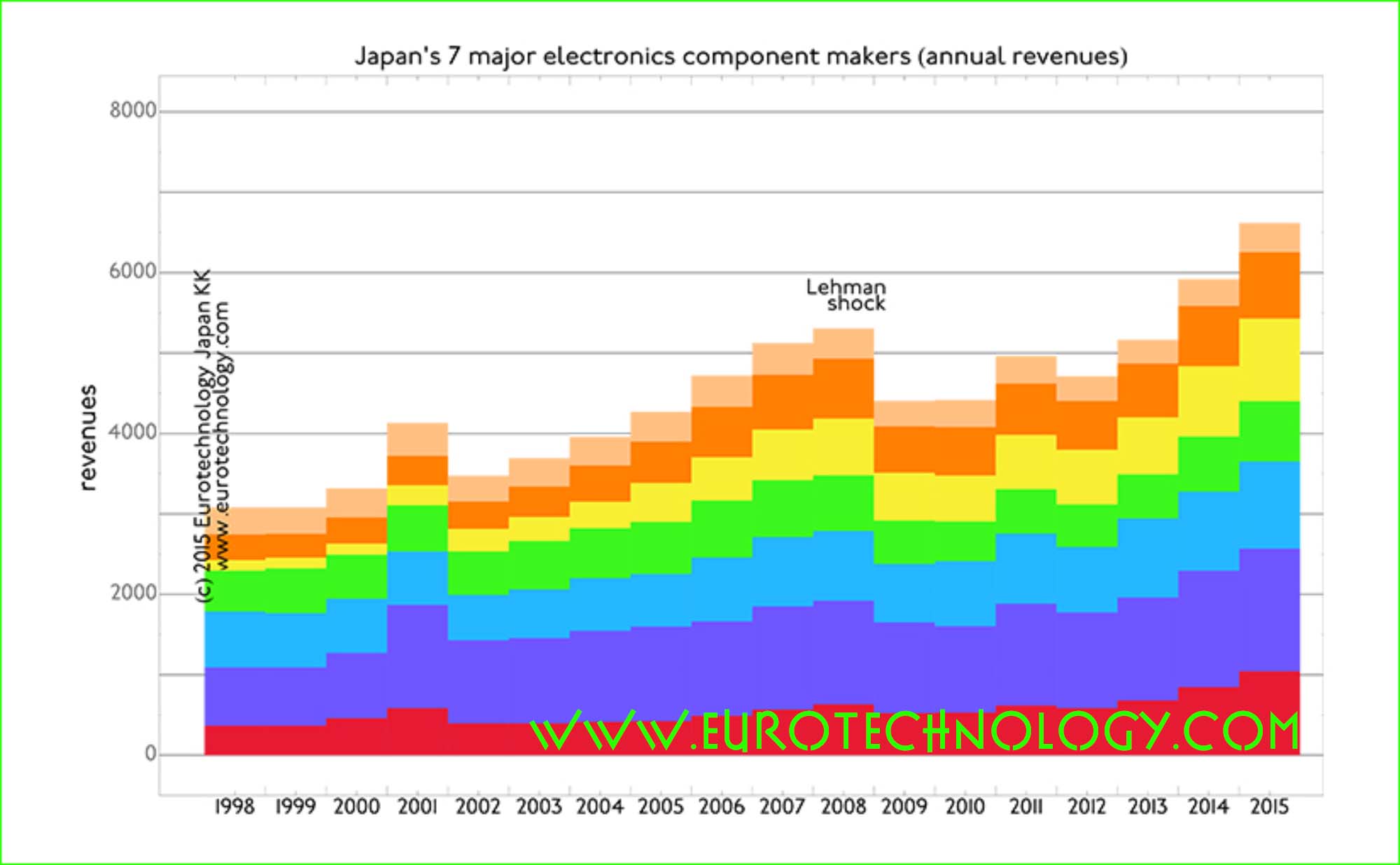

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

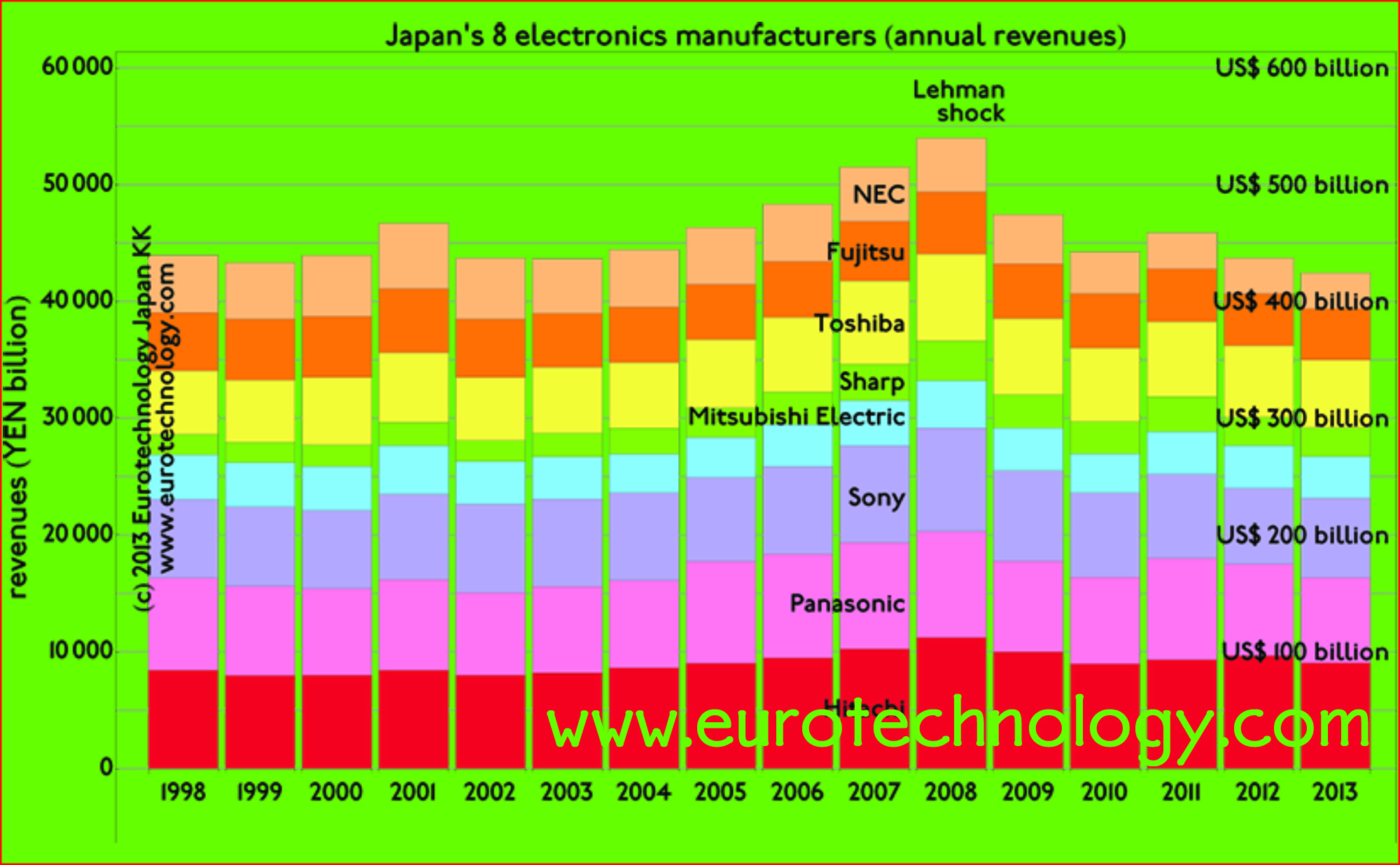

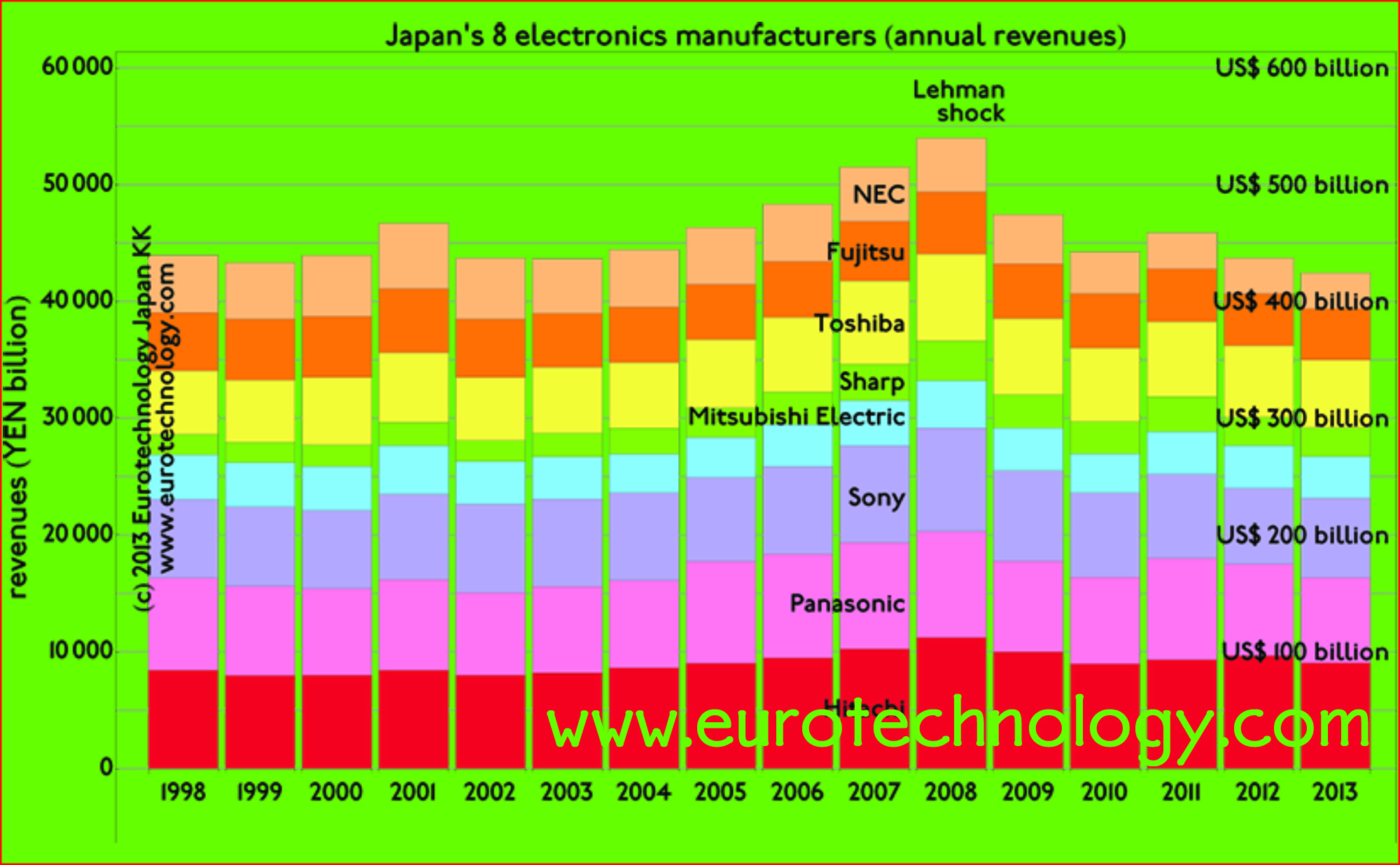

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

Sir Stephen Gomersall: Globalization and the art of tea

by Hitachi Chief Executive for Europe and subsequently Hitachi Board Director (2004-2014) Sir Stephen Gomersall: Princess Chichibu Memorial Lecture to the Japan British Society at Ueno Gakuen, Tokyo, 5 March 2015 Sir Stephen Gomersall: It is a great honour to be giving this lecture this evening. HIH Princess Chichibu was a charming and broad-minded Patron…

-

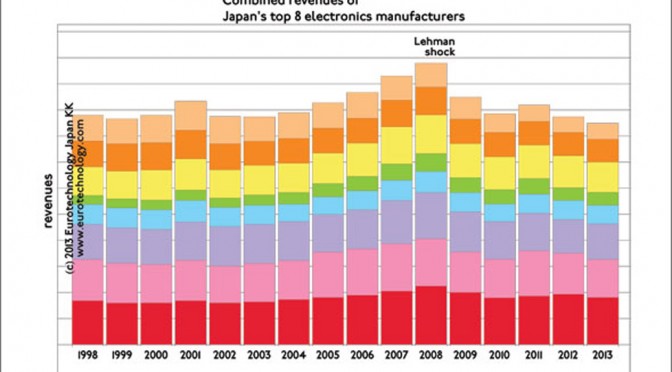

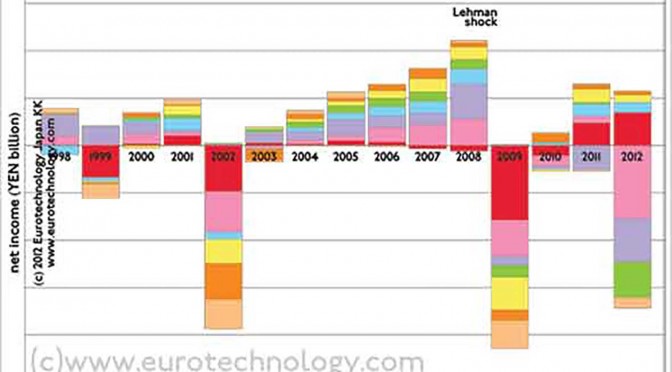

Japan’s electronics giants – FY2012 results announced. 17 years of no growth and no profits.

Japan’s electronics giants: as large as the economy of Holland, but 17 years of stagnation. No growth & no profits. Daniel Loeb: SONY’s uninvited guest gives Japan’s business culture a jolt Japan’s electronics giants combined are as large as the economy of Holland, but did not grow for about 17 years, and on average lost…

-

Intellectual Japan – BBC: “Japan has to become a brain country” – from mono zukuri to brain country

Intellectual Japan: Japan’s electronics companies need new business models – interview for the BBC The BBC recently examined why Japan’s electronics sector has to create new business models, and quotes “Japan has to become a brain country”. Japan’s top 8 electronics companies combined are as large as the Netherlands economically, but have shown zero growth…

-

Japan trends for 2013 (Christmas, Festive Season blog)

Japan trends for 2013: Energy crisis continues as a result of the Fukushima nuclear disaster Renewables: Japan’s feed in tariffs are among the world’s highest Japan trends for 2013: Japan’s energy sector: Prime-Minister Abe announced that he will review the Fukushima nuclear accident before taking decisions on nuclear power, essentially postponing the nuclear issue. Japan’s…

-

Japanese electronics groups need new business models (BBC-interview: Yen ‘not the cause of woes of Japan’s electronics firms’)

Japanese electronics groups combined as of similar size as the economy of the Netherlands Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands. Over…

-

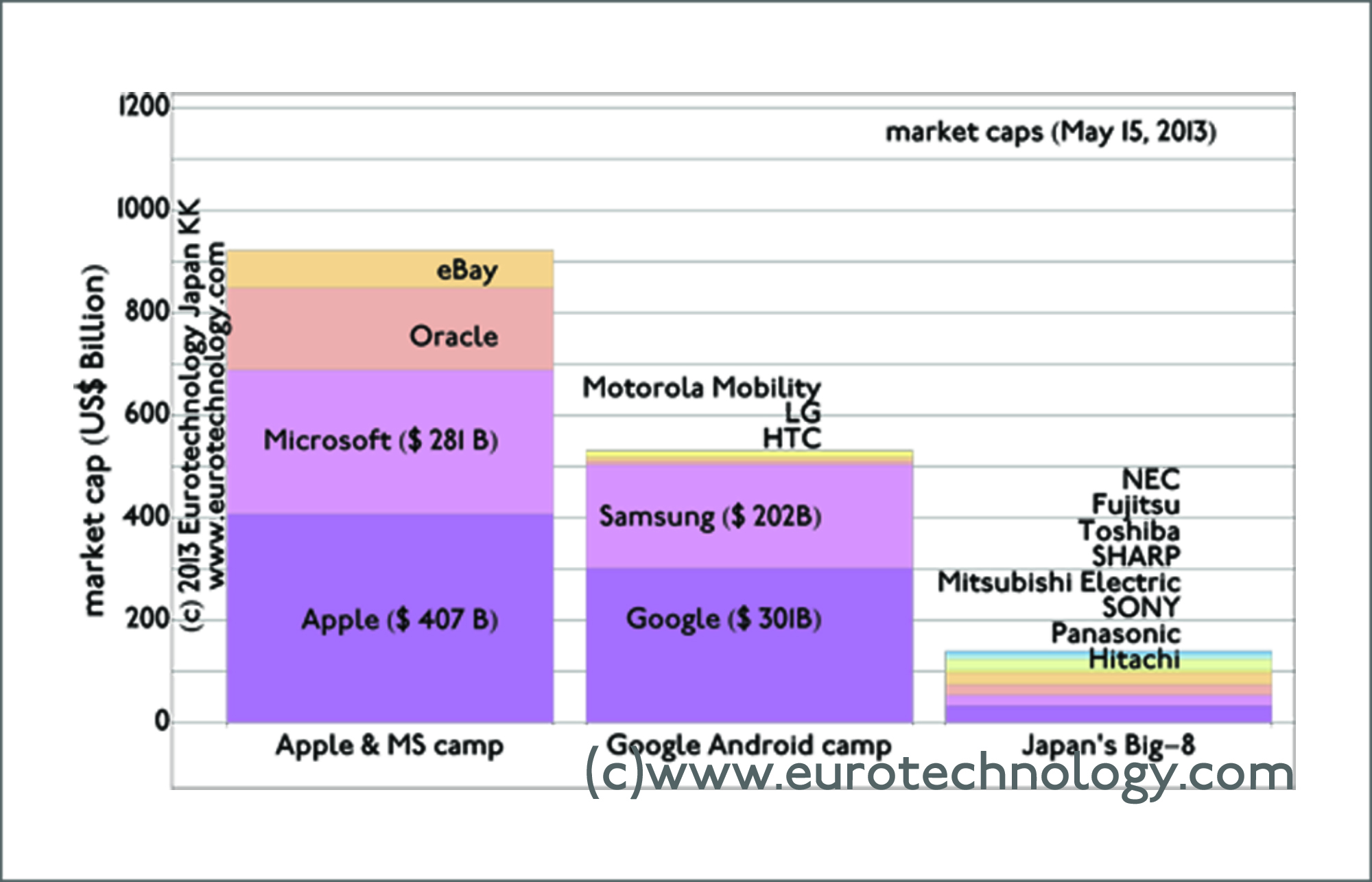

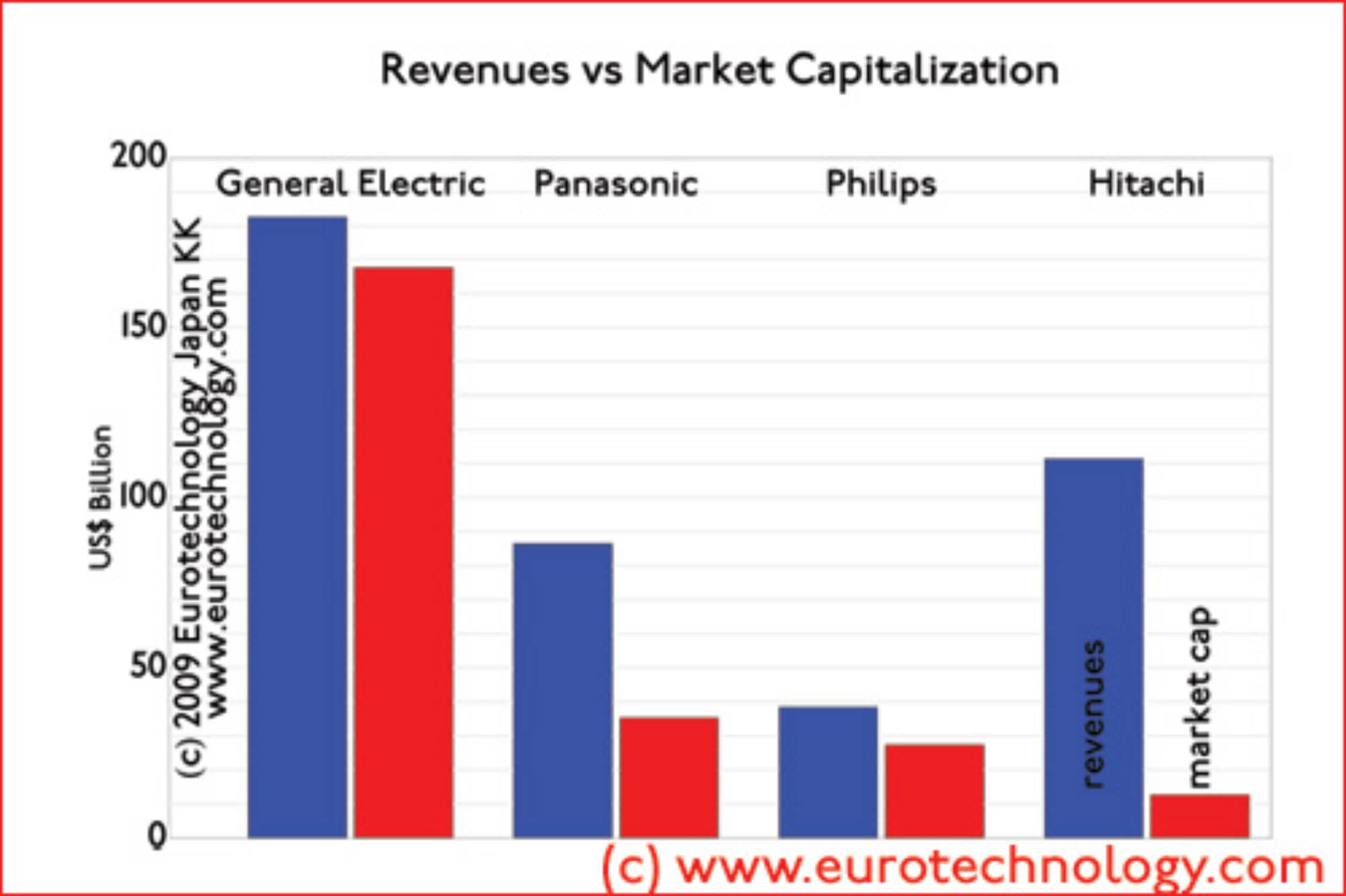

Japan’s Galapagos effect on market caps

Japan’s electronics giants market caps are remarkably low General Electric’s market cap is about 13 times higher that of Hitachi Some of Japan’s electrical corporations have remarkably low market capitalizations: General Electric has 1.6 x more sales than Hitachi, but has 13.3 x the market capitalization. Philips has 1/3 x Hitachi’s sales, but has 2.2…

-

Post-Galapagos Japan? – globalizing Japan’s fantastic technologies…

Japan Galapagos effect: “Why do Japanese companies make so beautiful mobile phones with fantastic functions, and have almost no global market share?” I asked this question back in 2003 to NTT-DoCoMo’s CEO Dr. Tachikawa (see my article “Leadership questions of the week” in Wallstreet Journal of June 12, 2006, page 31), and offered several proposals…

-

Japan’s games sector overtakes electrical sector in income

Japan’s games sector is booming – and net annual income of Japan’s top 9 game companies combined has now overtaken the combined net income of all Japan’s top 19 electronics giants (including Hitachi, Panasonic, SONY, Fujitsu, Toshiba, SHARP… at the top, and ROHM, Omron… further down the ranking list). Why does it make sense to…

-

Japan electronics groups: global benchmarking

Japan electronics groups have far lower income/profits than EU or US comparable corporations Ripe for drastic reform and transformation: 18 years no growth and almost no profits Lets look at global benchmarking of Japan’s top electrical groups Panasonic and Hitachi (representative of Japan’s top ten electrical giants) – in our previous blog we suggested that…

-

Japan’s electronics companies & the crisis

Japan’s top 20 electronics companies combined are about as large as The Netherlands economically, and have big impact on the world economy. Our analysis shows how dramatically Japan’s electronics companies have been hit by the current crisis (except for Nintendo). We suggest that full recovery to 2008 (FY2007) levels may take until 2016 – about…

-

Foggy Outlook for Global Tech Sector (CNBC TV interview)

Foggy Outlook for Global Tech Sector (Airtime: Tues. Feb. 10 2009) Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved