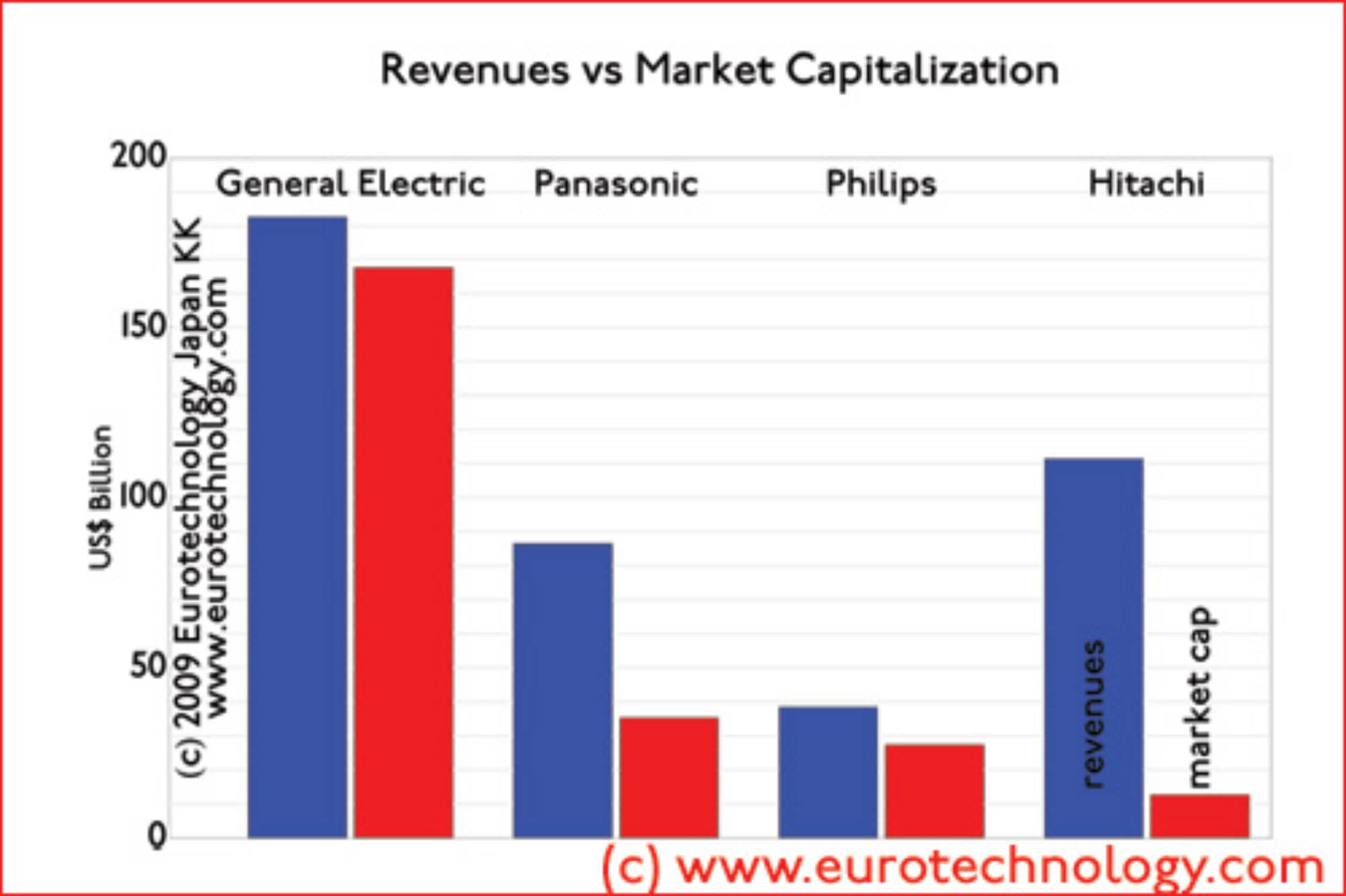

Japan’s electronics giants market caps are remarkably low

General Electric’s market cap is about 13 times higher that of Hitachi

Some of Japan’s electrical corporations have remarkably low market capitalizations: General Electric has 1.6 x more sales than Hitachi, but has 13.3 x the market capitalization. Philips has 1/3 x Hitachi’s sales, but has 2.2 times higher market cap.

Low market values do not help big recent public share offerings:

Hitachi raising YEN 250.7 Billion (US$ 2.8 Billion),

Toshiba raising YEN 298.7 Billion (US$ 3.3 Billion), and

NEC raising YEN 115.5 Billion (US$ 1.3 Billion).

Low valuations increase the pressure for change in Japan’s electrical sector, and the SANYO-Panasonic merger is an indication of changes to come.

In the “post-Galapagos committee” we are working with some of Japan’s brightest leaders on understanding the reasons and on how to drive this change.

Benchmarking Japan’s electrical companies – Philips= 1/3 x Hitachi’s sales and 2.2 x Hitachi’s market cap:

GE= 1.6 x Hitachi’s sales and 13.3 x Hitachi’s market cap

More in our report on Japan’s electrical industries.

Japan electronics industries – mono zukuri

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Comments and discussions