Tag: panasonic

-

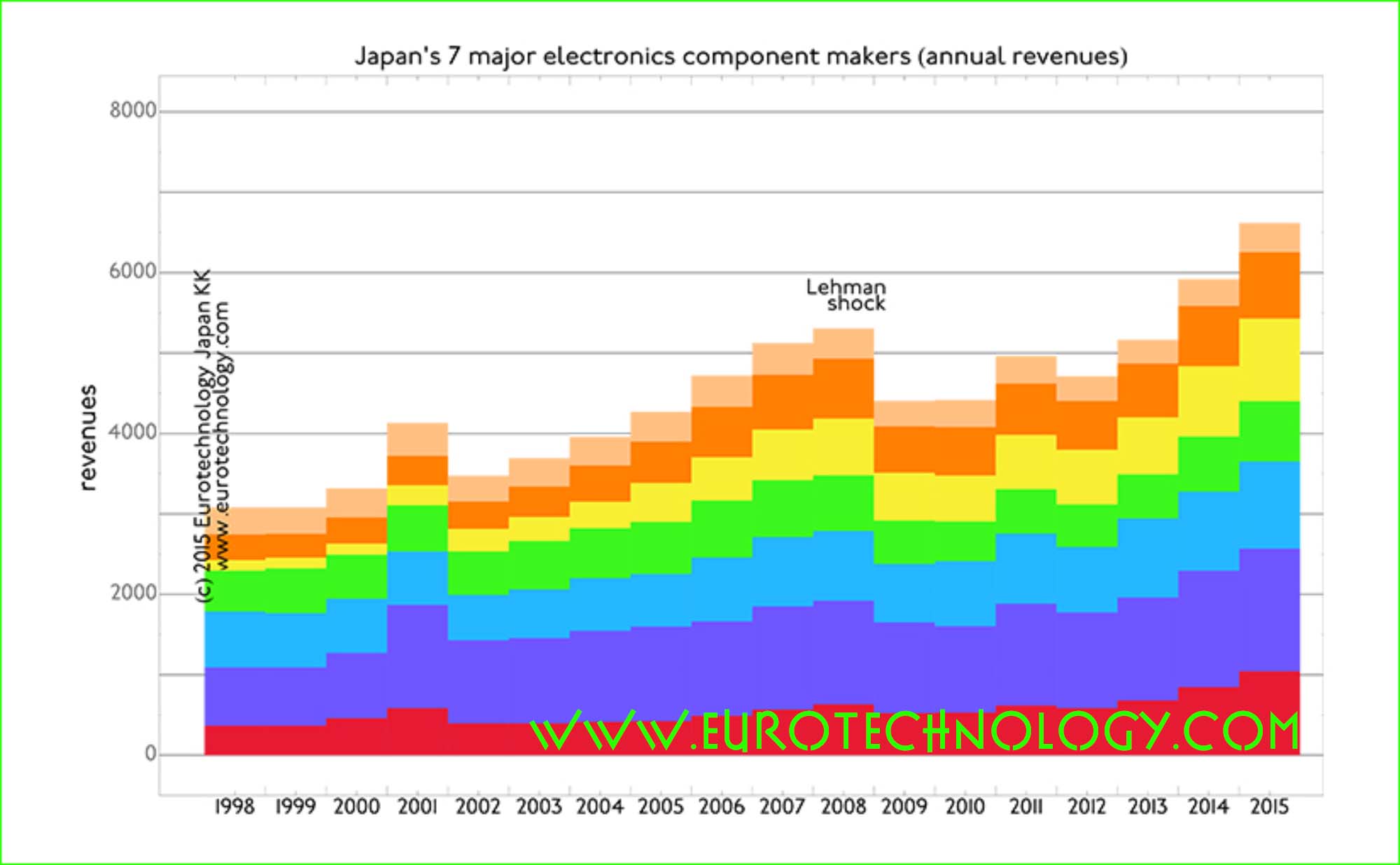

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

Nokia No. 1 in Japan! – Panasonic to sell mobile phone base station division to Nokia

Nokia strengthens No. 1 market position in Japan’s mobile phone base station market! Japan’s mobile phone base station market Japan’s mobile phone base station market is about US$ 2.6 billion/year and for European companies Ericsson and Nokia the most important market globally, although certainly also the most difficult one. Nokia is No. 1 with a…

-

TowerJazz to acquire three of Panasonic’s semiconductor fabs (Nikkei headline)

TowerJazz acquires three of Panasonic’s large written off wafer fabs for around US$ 100 million Massive market entry to Japan for TowerJazz Nikkei (the world’s biggest business daily, see our J-Media report) reported as their top headline yesterday, that TowerJazz is planning to acquire interests in three of Panasonic’s reportedly largely written-off semiconductor fabs valued…

-

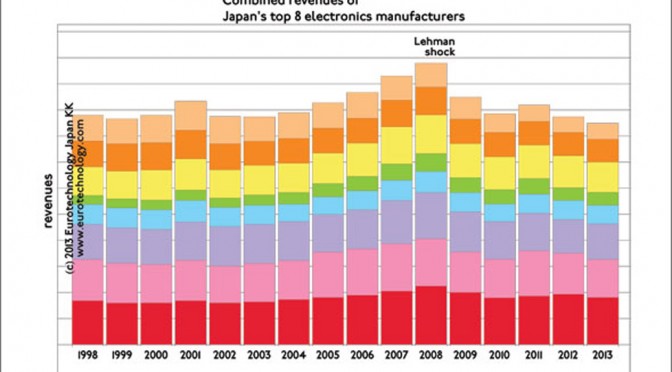

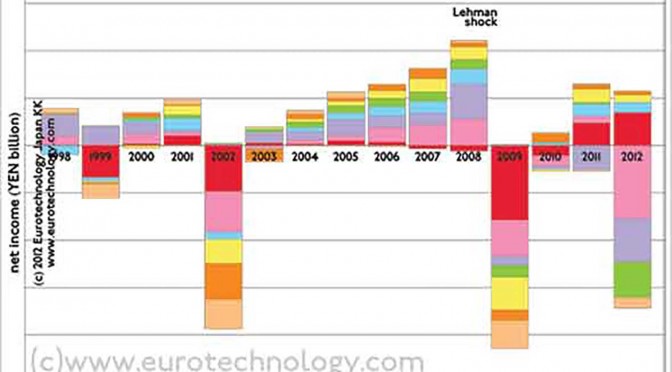

Japan’s electronics giants – FY2012 results announced. 17 years of no growth and no profits.

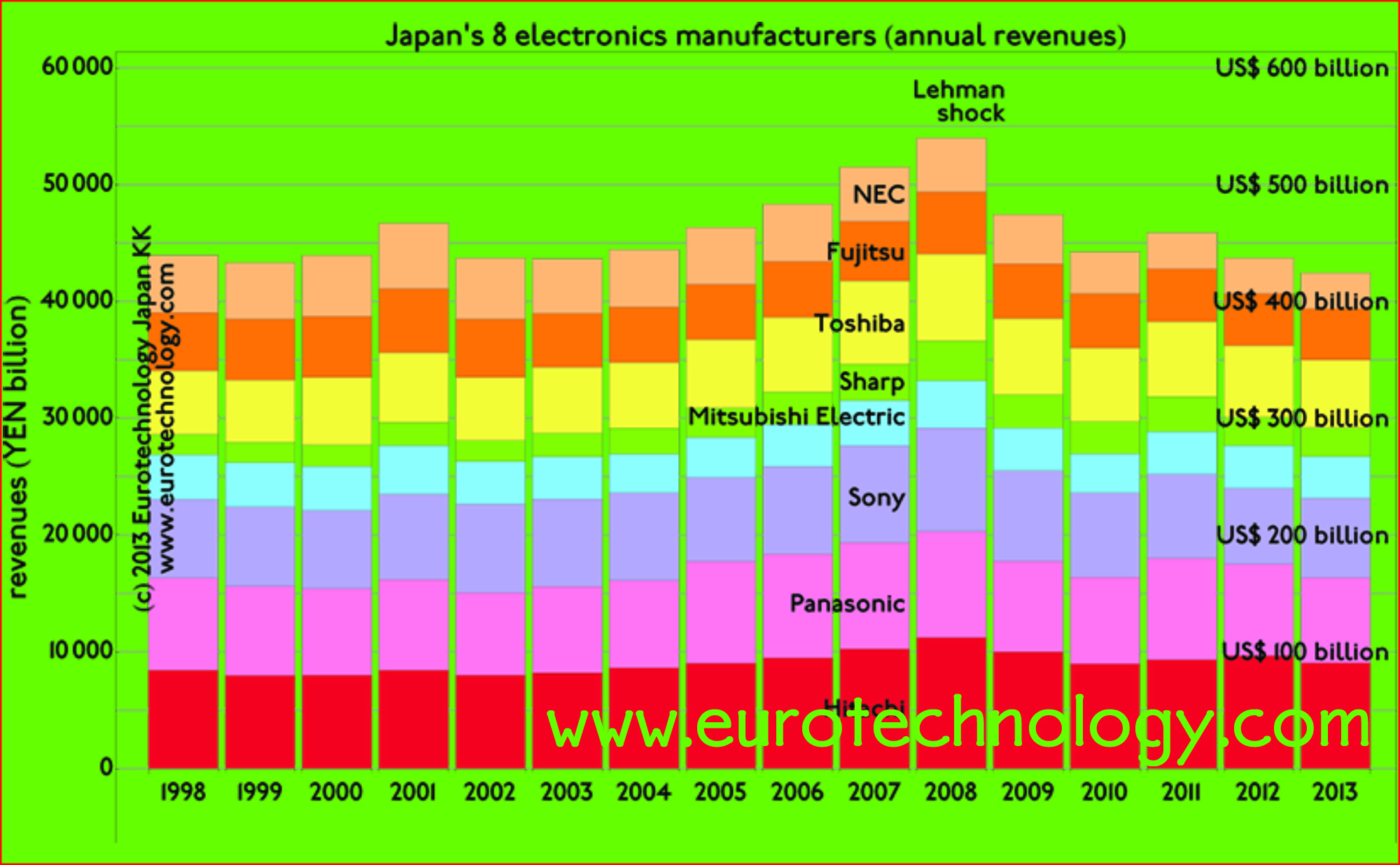

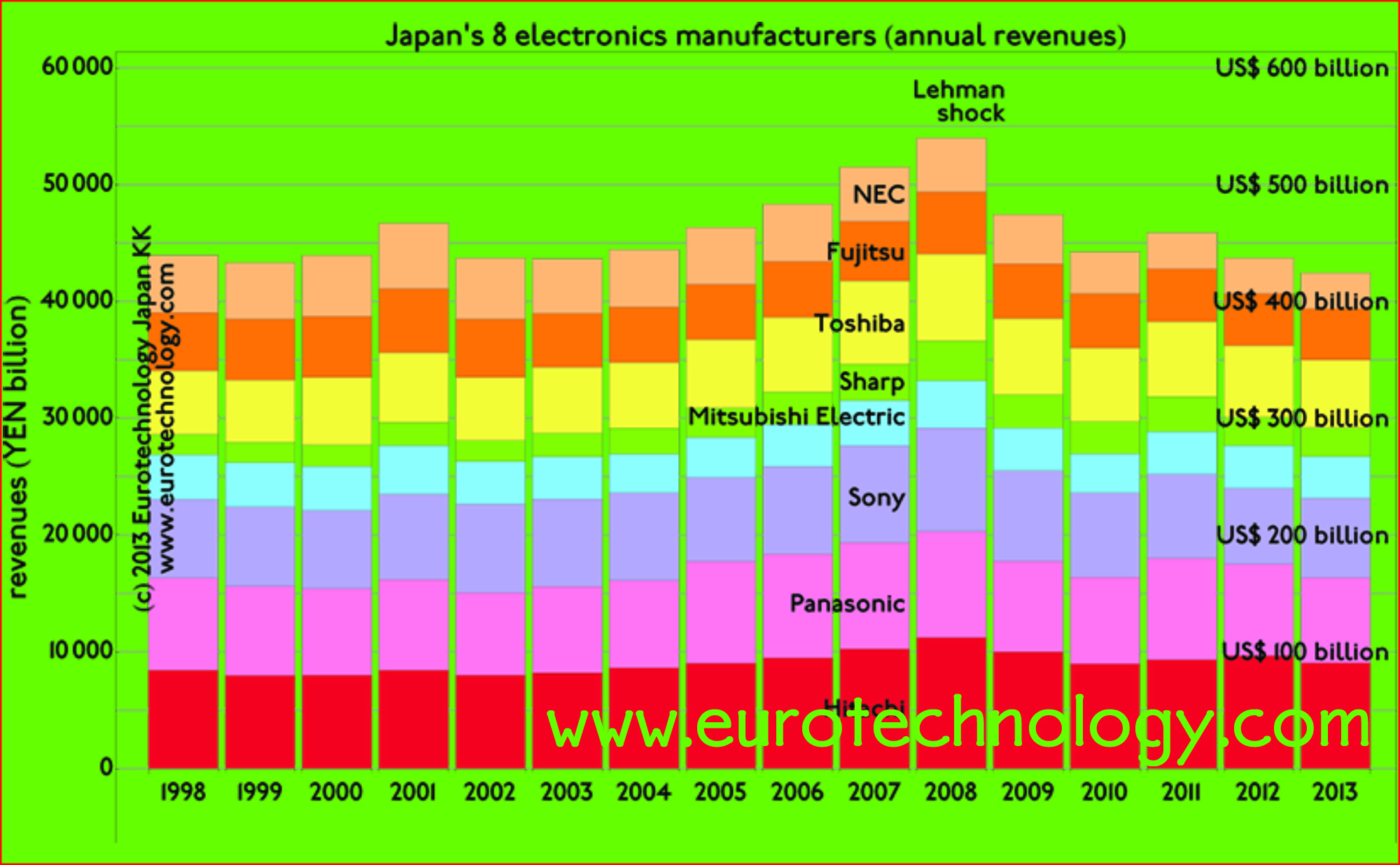

Japan’s electronics giants: as large as the economy of Holland, but 17 years of stagnation. No growth & no profits. Daniel Loeb: SONY’s uninvited guest gives Japan’s business culture a jolt Japan’s electronics giants combined are as large as the economy of Holland, but did not grow for about 17 years, and on average lost…

-

Intellectual Japan – BBC: “Japan has to become a brain country” – from mono zukuri to brain country

Intellectual Japan: Japan’s electronics companies need new business models – interview for the BBC The BBC recently examined why Japan’s electronics sector has to create new business models, and quotes “Japan has to become a brain country”. Japan’s top 8 electronics companies combined are as large as the Netherlands economically, but have shown zero growth…

-

Japanese electronics groups need new business models (BBC-interview: Yen ‘not the cause of woes of Japan’s electronics firms’)

Japanese electronics groups combined as of similar size as the economy of the Netherlands Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands. Over…

-

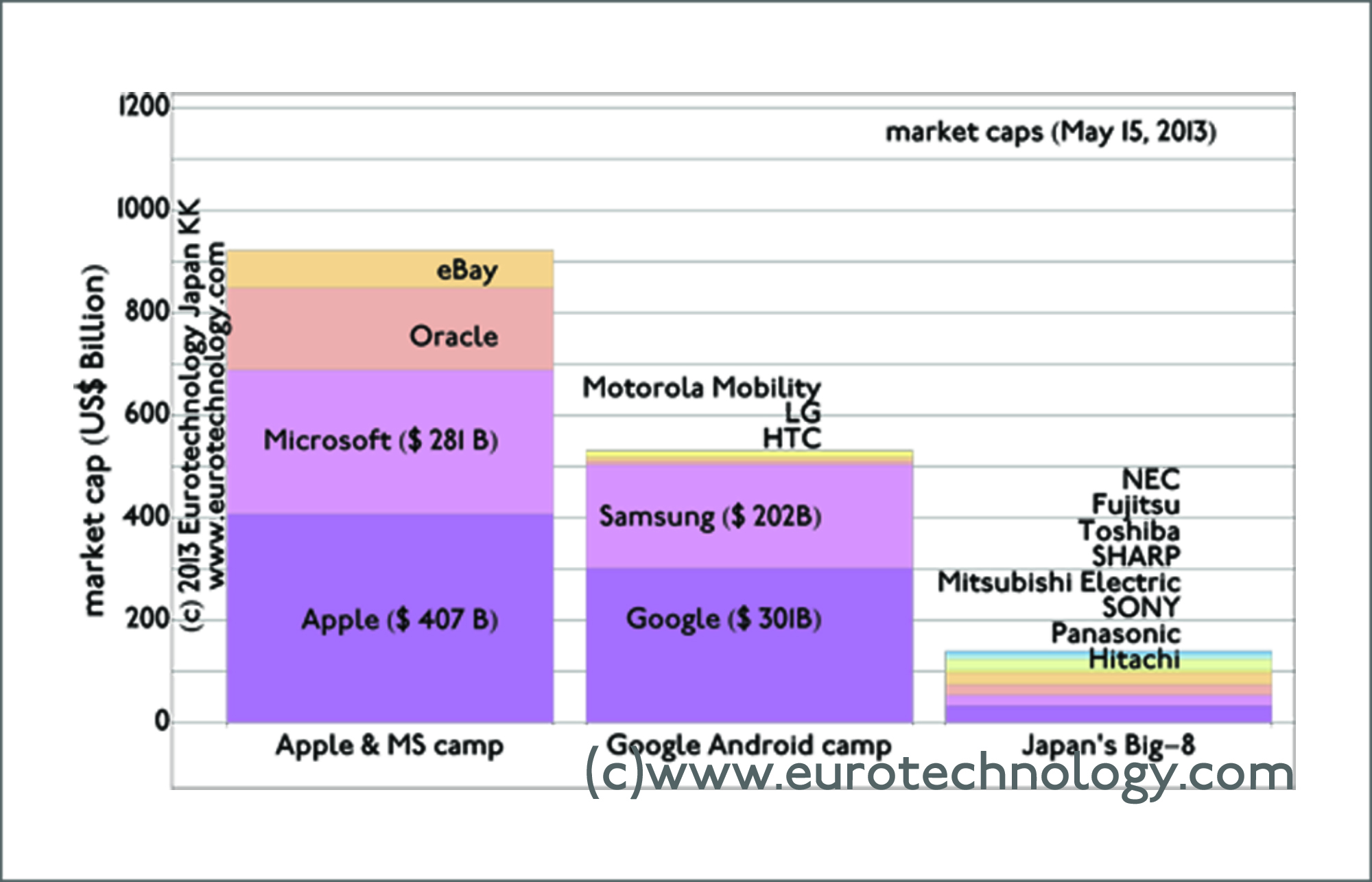

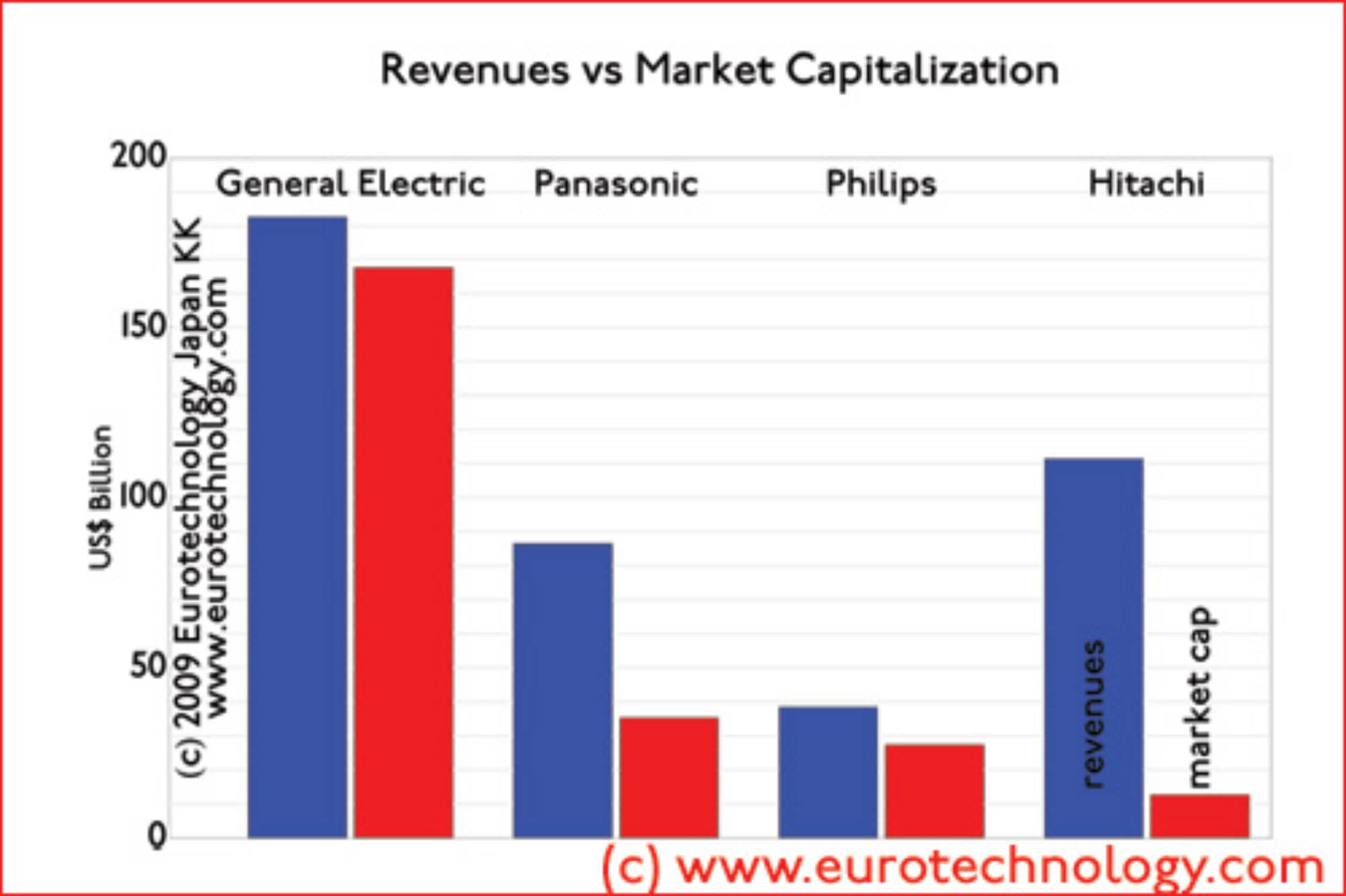

Japan’s Galapagos effect on market caps

Japan’s electronics giants market caps are remarkably low General Electric’s market cap is about 13 times higher that of Hitachi Some of Japan’s electrical corporations have remarkably low market capitalizations: General Electric has 1.6 x more sales than Hitachi, but has 13.3 x the market capitalization. Philips has 1/3 x Hitachi’s sales, but has 2.2…

-

Post-Galapagos Japan? – globalizing Japan’s fantastic technologies…

Japan Galapagos effect: “Why do Japanese companies make so beautiful mobile phones with fantastic functions, and have almost no global market share?” I asked this question back in 2003 to NTT-DoCoMo’s CEO Dr. Tachikawa (see my article “Leadership questions of the week” in Wallstreet Journal of June 12, 2006, page 31), and offered several proposals…

-

Japan’s games sector overtakes electrical sector in income

Japan’s games sector is booming – and net annual income of Japan’s top 9 game companies combined has now overtaken the combined net income of all Japan’s top 19 electronics giants (including Hitachi, Panasonic, SONY, Fujitsu, Toshiba, SHARP… at the top, and ROHM, Omron… further down the ranking list). Why does it make sense to…

-

Japan electronics groups: global benchmarking

Japan electronics groups have far lower income/profits than EU or US comparable corporations Ripe for drastic reform and transformation: 18 years no growth and almost no profits Lets look at global benchmarking of Japan’s top electrical groups Panasonic and Hitachi (representative of Japan’s top ten electrical giants) – in our previous blog we suggested that…

-

Japan’s electronics companies & the crisis

Japan’s top 20 electronics companies combined are about as large as The Netherlands economically, and have big impact on the world economy. Our analysis shows how dramatically Japan’s electronics companies have been hit by the current crisis (except for Nintendo). We suggest that full recovery to 2008 (FY2007) levels may take until 2016 – about…

-

Foggy Outlook for Global Tech Sector (CNBC TV interview)

Foggy Outlook for Global Tech Sector (Airtime: Tues. Feb. 10 2009) Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Panasonic Warns on Loss (CNBC TV interview)

Panasonic Warns on Loss (Airtime: Wed. Feb. 4 2009) Read more about Japan’s electrical sector: http://www.eurotechnology.com/store/j_electric/ More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Japan trends 2008/2009

One of our clients in the financial industry asked me several trend questions: Q1: Biggest surprises in Japan in 2008? Collapse of Japan’s mobile phone handset market (read our blog). In this context the Japanese telecom equipment makers association invited me to give a presentation, which was booked out 2-3 weeks ahead – about 100…

-

Panasonic negotiates to acquire SANYO to form US$ 110 billion group

SANYO suffered from Niigata Chuetsu earthquake of Oct. 23, 2004 Panasonic attracted to SANYO’s battery and energy technologies On November 7, 2008 Panasonic (“Ideas for Life”) and Sanyo (slogan: “Think GAIA”) announced that they entered negotiations which can potentially lead to an acquisition of Sanyo by Panasonic to form one of the largest electronics groups…

-

Tech Sector Outlook (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…