Tag: Japan

-

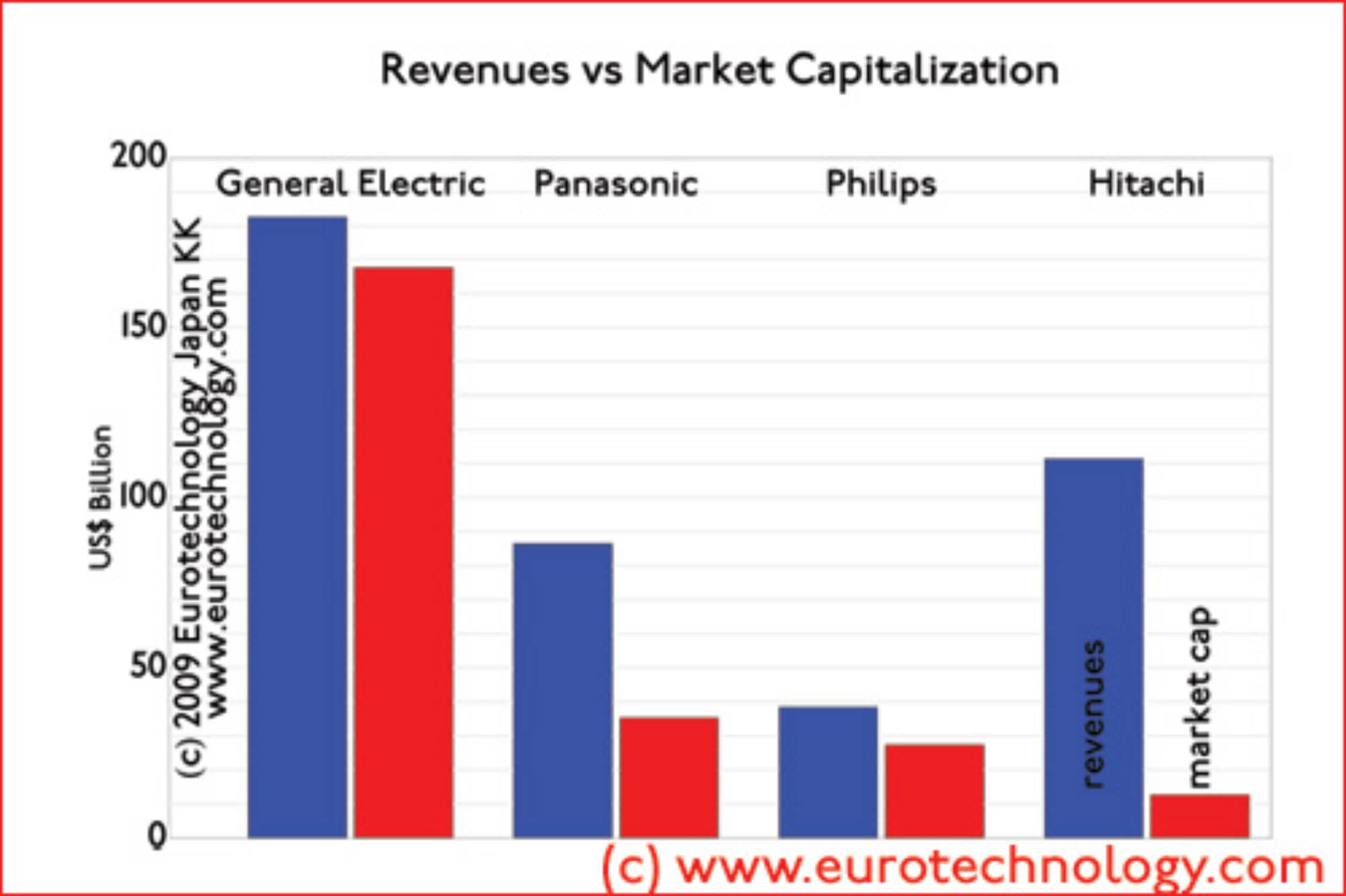

Japan’s Galapagos effect on market caps

Japan’s electronics giants market caps are remarkably low General Electric’s market cap is about 13 times higher that of Hitachi Some of Japan’s electrical corporations have remarkably low market capitalizations: General Electric has 1.6 x more sales than Hitachi, but has 13.3 x the market capitalization. Philips has 1/3 x Hitachi’s sales, but has 2.2…

-

Japan trends 2008/2009

One of our clients in the financial industry asked me several trend questions: Q1: Biggest surprises in Japan in 2008? Collapse of Japan’s mobile phone handset market (read our blog). In this context the Japanese telecom equipment makers association invited me to give a presentation, which was booked out 2-3 weeks ahead – about 100…

-

ICT trends for Japan for 2009

Smartphones, European exits from Japan, and M&A ICT trends for Japan: Ericsson and Nokia Siemens Networks (NSN) remain engaged in Japan’s ICT sector by Gerhard Fasol One of the Embassies here in Tokyo asked me to write a report about ICT trends for Japan… ICT trends for Japan: Mobile phone sector Pushed by the Government…

-

NOKIA quits Japan – for now… NOKIA’s market share in Japan’s mobile phone handset market was 0.39% – after 20 years of market entry efforts

NOKIA’s Japan subsidiary was founded on April 3, 1989 – almost 20 years ago. On November 27, 2008 NOKIA announced to terminate selling mobile phones to Japan’s mobile operators, effectively withdrawing from Japan (except for purchasing, R&D and VERTU). NOKIA’s sales figures in Japan were a well kept secret until last week when several Japanese…

-

Japan’s mobile phone disaster

Japan’s mobile phone sector is admired the world over, and Japanese mobile phones are years ahead the rest of the world regarding functionality. However, Japan’s mobile phone industry may be heading for a disaster, similar to the European 3G spectrum license fee disaster which almost bankrupted Europe’s mobile phone operators – unless changes are made…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

presentation by Gerhard Fasol, at the Industry Association of Japanese telecom and networking equipment makers, Friday November 27, 2008, 15:00-16:30 Presentation was fully booked several weeks before the talk, attended by about 100 managers and executives of Japan’s telecom equipment makers, and included also the Vice-Minister/Secretary of State of Japan’s General Affairs Ministry, which is…

-

The Opaquenes of Japan’s social network systems (SNS)

Opaqueness of Japan’s SNS was a point of discussion at the Next Context Conference. When you use Japan’s social network systems, instead of portrait photographs and real names in Western SNS, in Japan you’ll find that most people use phantasy names and pictures of churches, cats, airplanes, clowns and cartoons instead of passport photographs. Japanese…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…

-

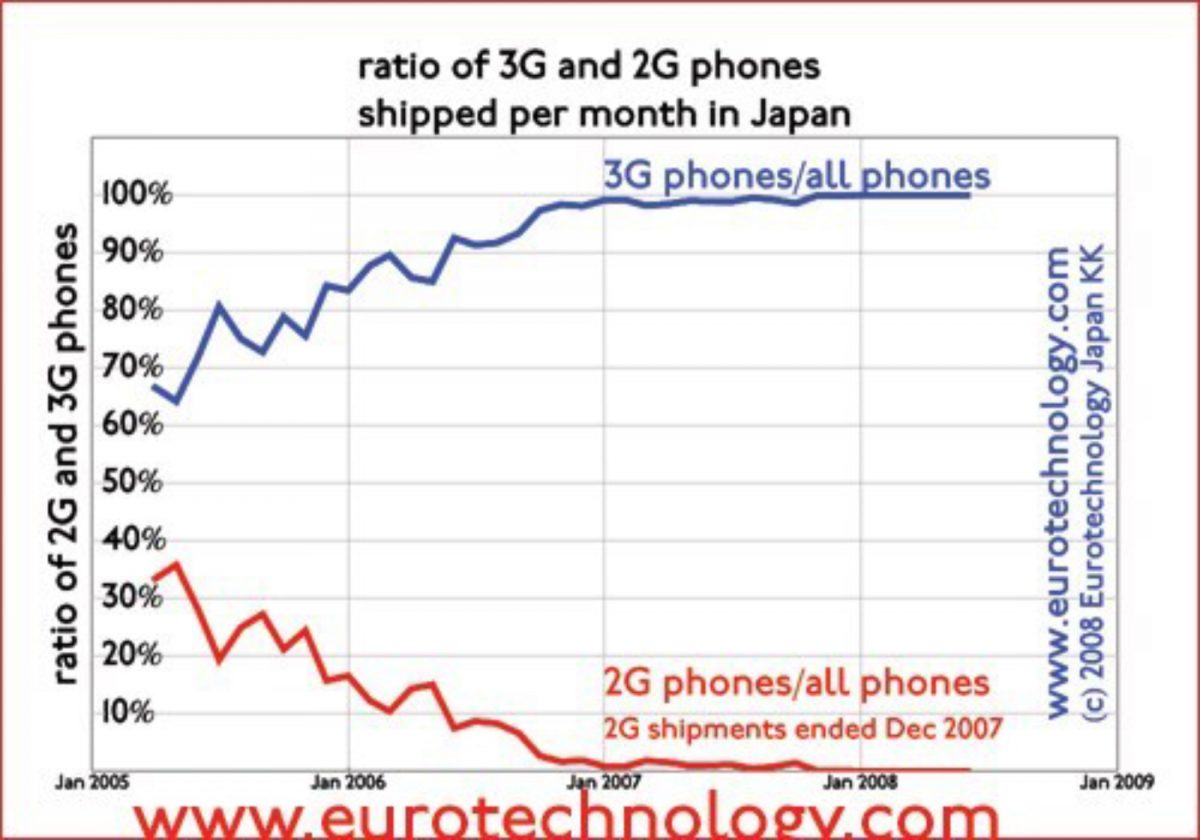

Last 2G phone shipped 8 months ago in Japan, 2G networks are switched off

KDDI/AU switched off 2G radio network in March 2008, Docomo and SoftBank to switch off 2G networks in 2009 Second generation (2G) phones silently bowed out of Japan’s market 8 months ago: the last 2G phones in Japan were shipped in December 2007. KDDI/AU switched off their 2G radio network in March 2008, this year,…

-

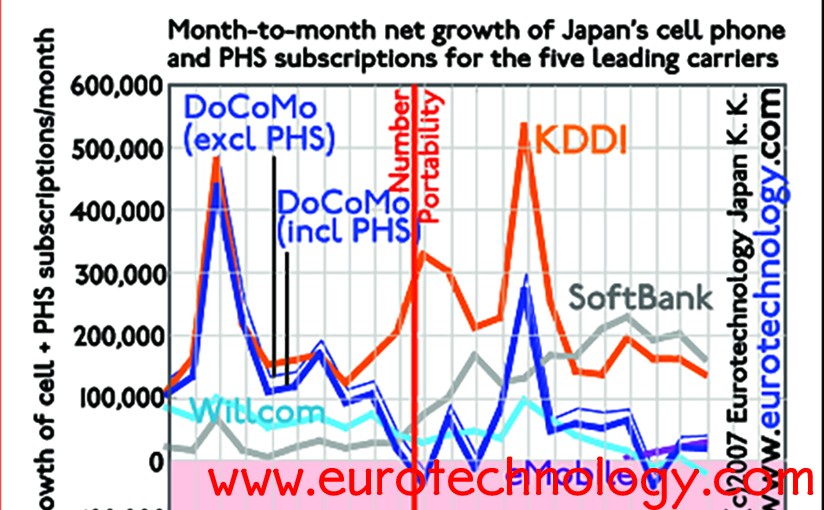

SoftBank and KDDI win market share, Docomo loses

SoftBank from 4th to 1st position within less than 12 months… SoftBank‘s turn-round of x-Vodafone-Japan, went faster than many expected. Within less than 12 months SoftBank went from last place to first place in customer sign-ups, overtaking even KDDI‘s super-popular AU. Willcom recently suffers from SoftBank‘s revival, as well as from eMobile‘s flat rate data…

-

First half FY2008 results: SoftBank and KDDI profits increase, DoCoMo’s trends is downward

In the last few days NTT, NTT-DoCoMo, KDDI and SoftBank announced their first half financial results. SoftBank and KDDI are the winners both for market share and for profits, while DoCoMo‘s results and market shares are sinking, and pulling the NTT-Group down at this time. Extrapolation indicates that DoCoMo‘s net profits may fall into the…

-

Mobile subscriptions grow by 5 million in Japan during 2006

Japan’s mobile subscriber numbers grew by about 5 million in 2006. Because of the much higher ARPU, Japan’s mobile market again grew by a couple of Finlands during 2006. A growing number of people have more than one mobile phone, to take advantage of the best rates, eg for mail, voice and data. We expect…

-

Briefing TeliaSonera top management

The day before the Finland-Japan Ubiquitous Society Conference in Tokyo, I briefed the top-management (CEO, CTO and other top managers) of TeliaSonera, on October 26, 2006. The next day, October 27, 2006, the Finland-Japan Ubiquitous Society Conference was held. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications,…

-

Bio-Nanotechnology in Japan – Impact on Foreign Corporations

Presentation at the EU-Japan Center Tokyo and at Stanford University on April 11, 2002 in the SPRING 2002 Seminar/Public Lecture Series – Topics in International Advanced Technology of the US-Asia Technology Management Center. Copyright 1997-2013 Eurotechnology Japan KK All Rights Reserved

-

M-Commerce in Japan

Presentation given by Gerhard Fasol, to the Asia/Pacific – Midwest Business ConferencePanel Presentation “E-commerce in Asia”, on Wednesday April 10, 2002, 8:00-9:30am, organized by the US Department of Commerce and the Illinois District Export Council. Copyright (c) 1997-2013 Eurotechnology Japan KK All Rights Reserved

-

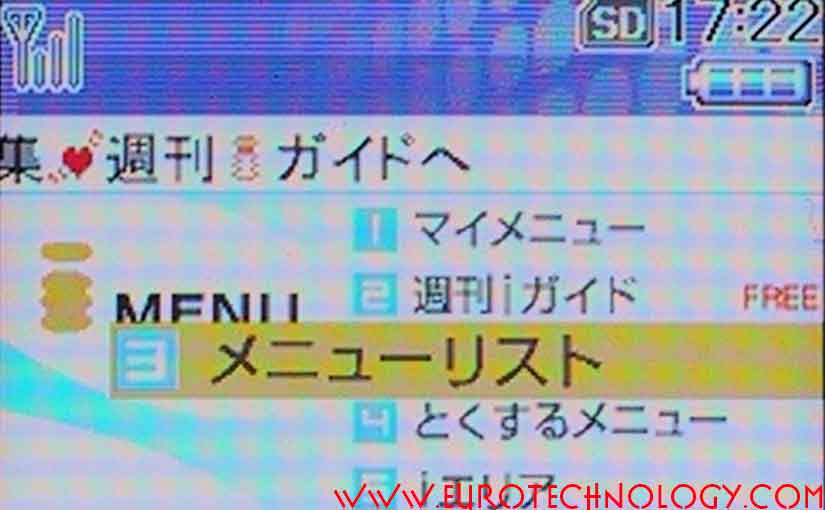

i-Mode: business models for mobile communications

Full day tutorial by Gerhard Fasol, organized by Seminario Internacional Prisma, held at the Hotel Metropolitan, Lisboa, March 21, 2002. Attendance: about 50 executives from Portugal’s telecom operators, major consulting firms, and IT professionals attended the full day tutorial. Download and update presentation as a pdf-file Copyright·©1997-2013 ·Eurotechnology Japan KK·All Rights Reserved·