Category: games

-

Pokemon Go – everybody loves Pikachu…

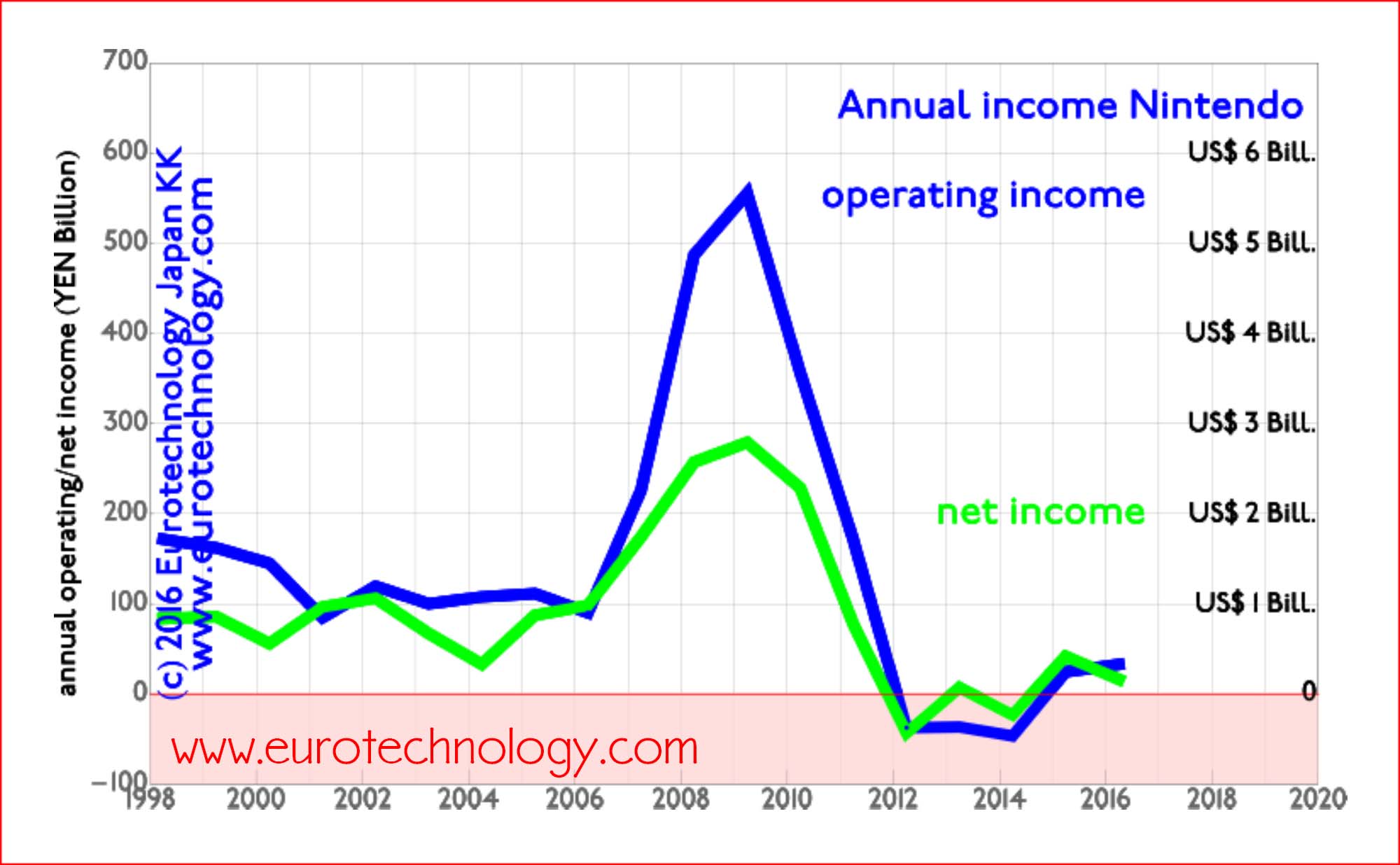

Pokemon Go is great – but will it bring another Nintendo boom as in 2009? or even exceed 2009? Google spin-out Niantic Labs’ augmented reality smartphone game booms to the top of charts Niantic Labs is specialized on augmented reality games. In a previous game, Ingress, players selected about 15 million memorable locations globally. Niantic…

-

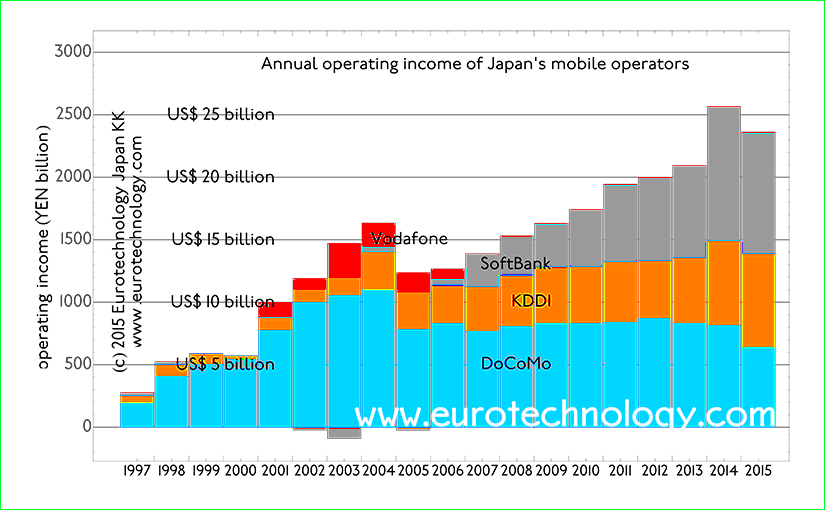

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

Japan top grossing smartphone apps

5 top listed smartphone app companies have combined market cap of US$ 14 billion (excluding LINE) LINE is currently a private company and LINE’s company value is generally estimated in the US$ 10-15 billion range, so if we include LINE, the combined market value of Japan’s top 5 smartphone game companies is on the order…

-

Japan Google Play top grossing Android apps

25 Japan Google Play top grossing Android Apps of June 6, 2015 (All Categories) Japan game market report (398 pages, pdf-file) No. 1 Monster strike (by Mixi) No. 2 Puzzle & Dragons by GungHo No. 3「LINE: ディズニーツムツム」LINE Disney tsumu tsumu (by LINE Corporation & Disney) No. 4「白猫プロジェクト」”White Cat project” by COLOPL Inc. No. 5 「剣と魔法のログレスいにしえの女神・人気の本格オンラインRPG」Sword…

-

Japan iOS App store 25 top grossing

25 Top Grossing iPhone Apps of June 6, 2015 (All Categories) Japan game market report (398 pages, pdf-file) Copyright 2015 -2019 Eurotechnology Japan KK All Rights Reserved

-

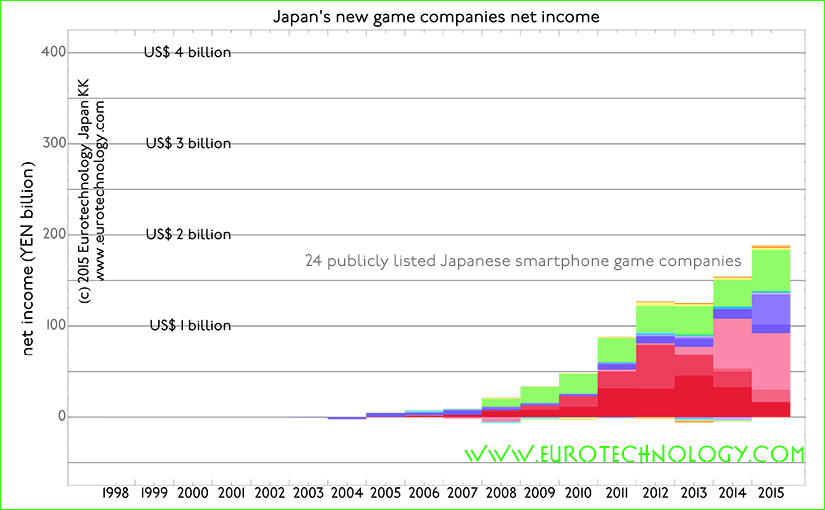

Smartphone games disrupt Japanese video game industry

24 new listed smartphone game companies achieve net income twice as high as all top 8 traditional video game companies combined Its not just Nintendo being disrupted, its the whole Japanese video games industry In the most recent version of our report on Japan’s game industry, we added 24 publicly listed new smartphone game companies…

-

Nintendo smartphone pivot?!

Nintendo partners with DeNA Taking Nintendo intellectual property and characters to smartphones Nintendo was founded on September 23, 1889 by Fujasiro Yamauchi in Kyoto for the production of handmade “hanafuda” cards. Nintendo Headquarters are still located in Kyoto (you can see the Nintendo headquarters building from the Kyoto railway station). The Chinese characters used to…

-

Google Play Japan – top grossing Android Apps ranking

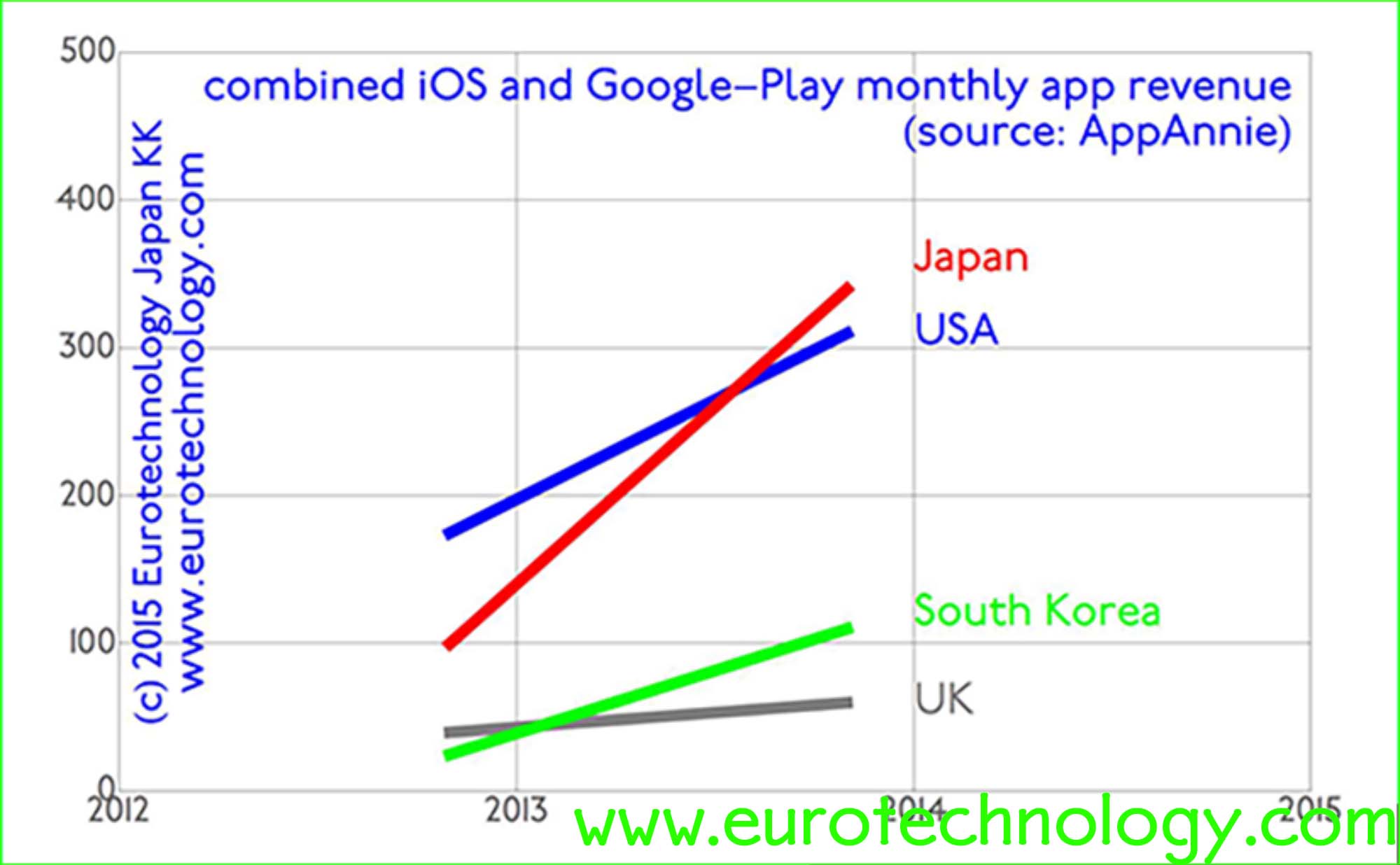

Android smart phone apps ranking in Japan by gross revenues (Feb. 18, 2015) Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is No. 1 globally, spending more than the USA. Therefore Japan is naturally the No. 1 target globally for many mobile…

-

Japan smartphone app rankings by cash revenue (iOS)

Top grossing app ranking (Feb. 10, 2015) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is No. 1 globally, spending more than the USA. Therefore Japan is naturally the No. 1 target globally for many mobile game companies, and quite a few of the top grossing apps in Japan…

-

Japan iPhone AppStore: world’s top grossing!

iPhone AppStore-Japan “Top Grossing” games ranking of July 13, 2014: iOS App Store ranking of June 6, 2015 here. Google Play Store ranking of June 6, 2015 here. Japan game market report (398 pages, pdf-file): Bold figures show rankings in February 2014 No. 1 Puzzle & Dragons by GungHo No. 2 Monster strike (by Mixi)…

-

Top Japanese game companies

25 listed top game companies listed on Tokyo Stock Exchange have total market cap of US$ 30 billion Japan game market report (398 pages, pdf-file): Japan is the cradle of many global games Japan created much of today’s global game market with icon’s such as Nintendo. However, today the moment has been taken over by…

-

Supercell Japan advertises to improve today’s top-ten rank in Japan’s i-Phone/iOS App-Store

Supercell Japan is not satisfied with 10th rank for Clash of Clans in the Japanese iPhone app store… by Gerhard Fasol Report on Japan’s game makers and game markets Japan is the world’s No. 1 top grossing app market both for iOS apps and for Android apps, as we discussed before. Supercell Japan: investments by…

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

Flappy bird Angry Birds ultimate Japan game disruption: flappy bird flaps to the top

Flappy bird Angry Birds ultimate disruption: flappy bird effortlessly flaps to to the top of ranks, while Angry Birds are watching angrily from the sidelines Disruption of Japan’s games sector: in a previous blog post we showed that just three newcomers (Gree + DeNA + Gungho) produce more profits than the top 9 traditional game…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…

-

Supercell wins SoftBank and GungHo investment

Supercell investment by SoftBank and GungHo Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets. SoftBank…

-

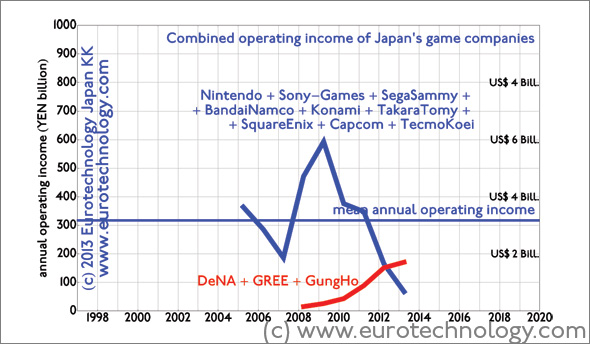

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…

-

Future of Video Game Sector (CNBC Airtime: Thurs. Jul. 30 2009)

Read more about Nintendo and the games sector: http://www.eurotechnology.com/store/jgames/ Read more about Japan’s electrical industry sector in our Japan’s electronics industry report (pdf file) Subscribe to our newsletters: technology newsletters from Japan

-

Do mobile app-stores and online games disrupt Nintendo’s blue ocean?

Japan introduced the mobile internet with i-Mode in 1999, while i-Phone and friends are now getting the rest of the world hooked onto the mobile internet. Games used to be played in game parlors, and some of Japan’s game giants were originally and still are game parlor machine makers – a round of Dance-Dance-Revolution anyone?…

-

Japan’s games sector overtakes electrical sector in income

Japan’s games sector is booming – and net annual income of Japan’s top 9 game companies combined has now overtaken the combined net income of all Japan’s top 19 electronics giants (including Hitachi, Panasonic, SONY, Fujitsu, Toshiba, SHARP… at the top, and ROHM, Omron… further down the ranking list). Why does it make sense to…

-

Sanrio licenses "Hello Kitty" to Diseno Textil SA (ZARA)

Diseno Textile SA (ZARA) entered Japan’s market earlier than H&M and can now collect some fruits from timing advantage: Diseno succeeded to obtain a license for Sanrio’s Hello Kitty character, and plans to market Hello Kitty branded goods. Will be interesting to see if H&M will do quid-pro-quo and seek to license other famous Japanese…

-

Nintendo’s CEO Satoru Iwata and Games Developer Superstar Shigeru Miyamoto

Nintendo’s CEO Satoru Iwata and games developer superstar Shigeru Miyamoto presented in Tokyo on April 9, 2009 about Nintendo’s situation and future plans. Iwata emphasized plans to move from one DS per household to one DS per person, by personalizing the DS, and by seeing that DS enriches everyday life. As examples he mentioned applications…

-

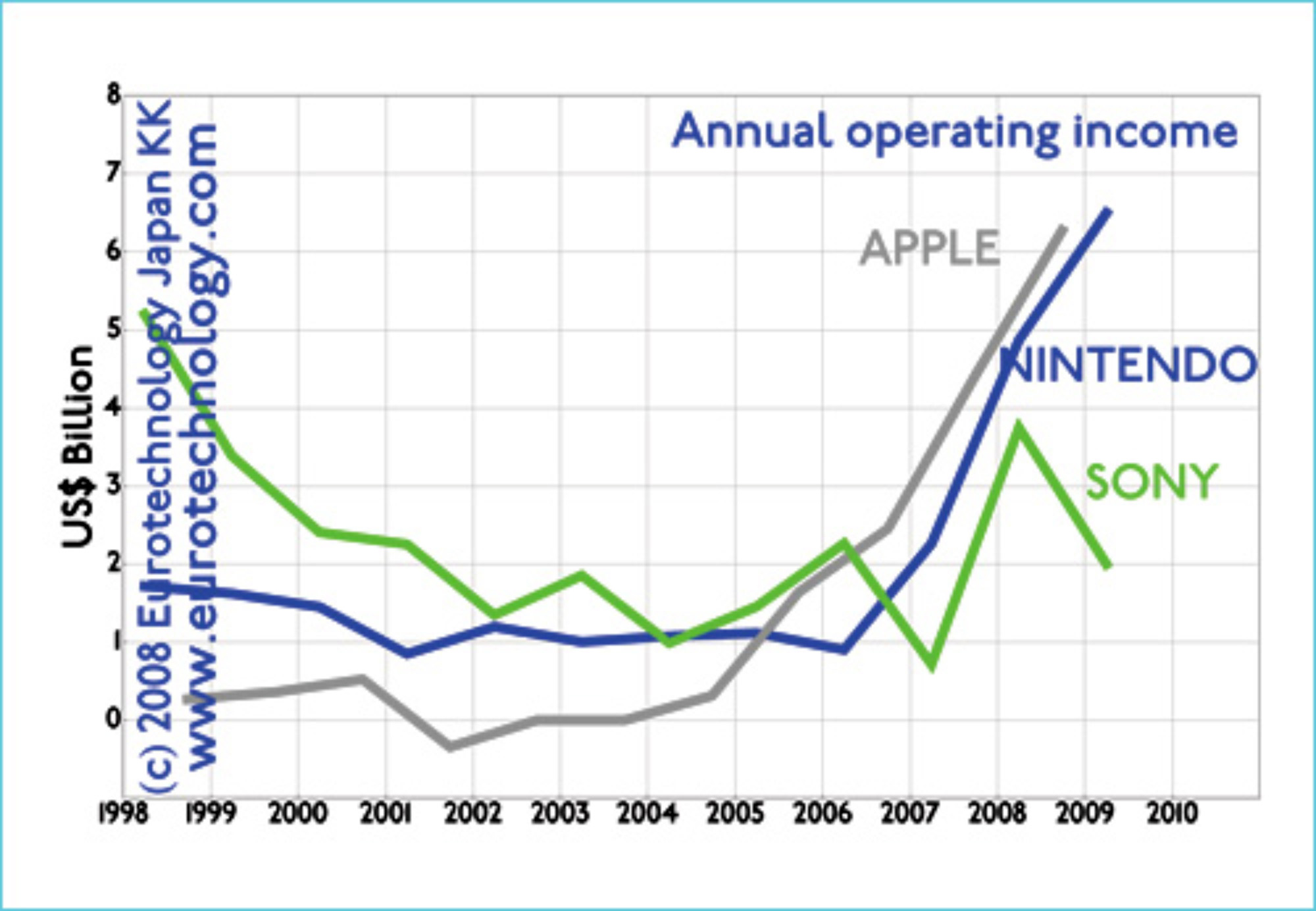

Apple Nintendo Sony: The power of focus

Lets benchmark three iconic companies: Apple Nintendo Sony Apple Nintendo Sony: three iconic companies evolving along very different paths. Apple’s current physical products famously all fit onto a single mid-sized table. Nintendo’s current physical products as well, for SONY you’d need a warehouse. Apple Nintendo Sony – Lets look at today’s market caps: Apple Nintendo…

-

Today’s APPLE 4th quarter results vs NINTENDO

A few hours ago (Oct 22, 2008, 6am Tokyo Time) APPLE announced 4th Quarter and Full Year results – we are here updating our comparison between APPLE and NINTENDO. With 6.9 million iPhones sold in APPLE’s 4th Quarter (July + August + September 2008), APPLE has achieved 2.76% market share of all mobile phones globally.…

-

Games: Nintendo – the winner takes it all

Game industries in total are MUCH bigger than music industries… in Japan game industries are about 10 times bigger business than music industries… Last weekend we had the Tokyo Game Show – read some key points below! From 2006 Japan’s game sector changed dramatically- Nintendo created several paradigm shifts, and “took off”. Read more about…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…

-

XBOX Japan entry

XBOX still faces difficulties in Japan XBOX Japan entry: Microsoft reduces prices by 30% Microsoft announced to reduce prices for Xbox-360 by 30% in Japan. We believe that this price reduction will not be enough to bring the breakthrough for Xbox in Japan. Nintendo has reinvented the game industry, created a completely new paradigm. Nintendo…

-

XBOX Japan strategy – Microsoft still struggling

Microsoft XBOX introduced XBOX to Japan on February 22, 2002 XBOX Japan Strategy – CNBC interview Microsoft introduced the original XBOX game console in the USA on November 15, 2001, in Japan on February 22, 2002, and in Europe on March 14, 2002. During the period January-June 2005, three years after introduction of the XBOX…