Category: mobile payment

-

i-Mode was launched February 22, 1999 in Tokyo – birth of mobile internet

The mobile internet was born 16 years ago in Japan Galapagos-Syndrome: NTT Docomo failed to capture global value On February 22, 1999, the mobile internet was born when Mari Matsunaga, Takeshi Natsuno and Keiichi Enoki launched Docomo’s i-Mode to a handful of people who had made the effort to the Press Conference introducing Docomo’s new…

-

ApplePay vs Osaifu-Keitai – CNBC interview

ApplePay is expected to start in October 2014 – Docomo’s Osaifu-keitai wallet phones started on July 10, 2004. https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) In business the first-comer does not always win the game Japan’s NTT-Docomo tested two types of wallet phones, manufactured by Panasonic and SONY with 5000…

-

Apple Pay vs Japan’s Osaifu-keitai – the precursor to Apple Pay

What can we learn from 10+ years of mobile payments in Japan? Apple Pay vs Japan’s Osaifu-Keitai: watch the interview on CNBC https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html?play=1 Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) Japan’s Osaifu keitai mobile payments started on July 10, 2004, after public testing during December 2003 – June 2004 Two different…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

Mobile payments: 10 years to reinvent the wheel?

Mobile payments for train travel was demonstrated in Tokyo in 2003, but has not reached London yet Mobile payments: Tokyo (mobile SUICA) vs. London (OYSTER) Mobile payments are big: Reuters estimates that the mobile payment market will be about US$ 1000 Billion by 2016, and in Japan just a single railway line achieves already now…

-

Will cash become obsolete?

Gave presentation to the Telecommunications Committee of the American Chamber of Commerce in Japan (ACCJ) on October 7, 2009, entitled “Will cash become obsolete? E-money, mobile payments and mobile commerce”. Talk was attended by about 30-40 executives from major global telecom operators, global banks, new-age payment companies, and from major internet companies. Outline: What is…

-

M-payments and e-money grow exponentially

1 Billion e-money transactions/month around 2014 Exponential growth: The number of e-cash payments per month increases by a factor of 10 about every 4 years E-money transactions (including mobile e-cash) grow exponentially in Japan, and we expect to see 1 Billion e-money transactions/month around 2014 (this figure would be much bigger if contactless train travel…

-

10 years e-cash and mobile payments

Mobile phone payments with RFID start in Japan in 2003 i-Mode mobile payments started in Japan in 1999 10 years ago – 1999 – the global mobile payment revolution started in Japan: with i-mode introducing an essentially Japan-only highly successful micropayment system for online content and brick-and-mortar based m-commerce, and SONY’s Edy starting e-cash experiments…

-

Top 10 mobile trends for 2009

Answering the question “Top 10 mobile trends for 2009: what would you choose?” We answer from our perspective here in Tokyo: Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

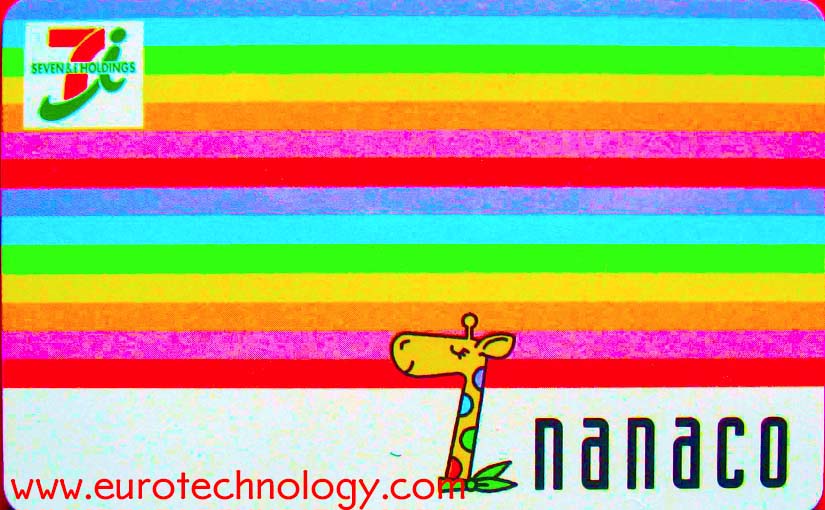

Nanaco – e-cash and m-cash for Seven-Eleven

Seven-Eleven rolls out national electronic money and mobile payment system Retail chain AEON follows with WAON e-cash and mobile money This week two of Japan’s largest retail chains roll out electronic and mobile cash: Monday April 23rd, 2007 the Seven & I Holdings Group started “nanaco” and tomorrow, Friday April 27th, 2007, the AEON retail…

-

PASMO: IC cards for transport

On Sunday, March 18, 2007, about 100 transportation companies in the Tokyo region switched to the near-field electronic money and payment system PASMO. Electronic money is a new battle field which JR-East pioneered with SUICA. Seven & I is still to throw it’s weight into the battle – read about today’s status of the electronic…

-

Mobile payment and the future of money (presentation at CLSA Japan Forum)

Can e-money and mobile payment replace cash? Example: mobile payment for the world’s busiest train line CLSA – Asia-Pacific Markets – last week organized the “CLSA Japan Forum” here in Tokyo. About 800-1000 investment bankers, portfolio managers, investors, analysts came together. Since last year interest of global investors in Japan has increased a lot. Eurotechnology…

-

3G Summit and Mobile Payment workshop

Mobile Payment workshop and Global 3G Evolution Forum in Tokyo – Makuhari 3GPP, UMTS-Forum, Verizon and Docomo and others 22-25 January 2007 MarcusEvans organized the “Global 3G Evolution Forum” in Makuhari near Tokyo. Speakers included: Takanori Utano, Executive Vice-President and CTO of DoCoMo, Takehiro Nakamura of NTT and Vice-Chairman of 3GPP Jean-Pierre Bienaime, Chairman of…

-

NFC prepaid fare cards are Nikkei Marketing Journals most popular product of the year 2006

Annual Nikkei Marketing Journal (NMJ) ranking list of most successful products NFC prepaid fare cards ranked near the top of most popular products for 2006 Every year Nikkei Marketing Journal publishes a ranking list of the most successful products of the past year in the form Sumo wrestling results are traditionally displayed: there is a…

-

PASMO: IC cards for transport

On March 18, 2007, more than 100 transportation companies (26 railway companies and 75 bus companies) – moving 30 million people of the Tokyo region – will switch to the IC card ticketing and e-cash system named “PASMO”. PASMO will interoperate and partially compete with SUICA. Preparations go back more than 20 years, when Japan’s…

-

FeliCa and Mifare cooperation

Paying with the mobile phone in shops and trains, unlocking doors, security check in offices, paying the air ticket and checking in, all just by waving the wallet phone close to a reader/writer unit is addictive – and daily life in Japan today. SUICA in Tokyo, Octopus in Hong Kong and Oyster in London are…

-

Briefing TeliaSonera top management

The day before the Finland-Japan Ubiquitous Society Conference in Tokyo, I briefed the top-management (CEO, CTO and other top managers) of TeliaSonera, on October 26, 2006. The next day, October 27, 2006, the Finland-Japan Ubiquitous Society Conference was held. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications,…

-

NTT Docomo acquisitions: Tower Records – No music, no life!

Docomo acquires music retail know-how and a laboratory for mobile payments at the point-of-sale NTT Docomo acquisitions: 32.34% of Tower Records a major share of Japan’s second largest Credit Card issuer Nikkei reports several NTT Docomo acquisitions: DoCoMo will use a total investment of around YEN 10 Billion (approx US$ 100 million) to acquire 32.24%…

-

BBC TV interview about FeliCa wallet phones

Read our CEO’s interview on BBC World TV about FeliCa wallet phones. Watch the movie of the interview:Windows Media Player – Bandwith = Low|Medium|HighReal Player – Bandwith = Low|Medium|High Read our report Mobile payments in Japan. Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

US$ 0.5 Billion/year m-commerce on a single train line?!

We worked out that about US$ 0.5 Billion/year worth of train tickets for the Tokyo-Osaka Shinkansen train line are sold by mobile phone. Not a bad m-commerce record for a single train line. For details see our Mobile Payment report. The picture shows a Shinkansen train preparing to stop for 2-3 minutes in Nagoya on…

-

Mobile Payment Forum meeting in Tokyo

Mobile Payment Forum and Eurotechnology Japan KK jointly organize the Mobile Payment Forum meeting in Tokyo Japan leads the world in mobile payments and m-commerce by Gerhard Fasol The Mobile Payment Forum promotes usage of mobile phones for payments, and works on interoperability, usability and standardization issues. The major credit card companies (VISA, Mastercard, American…

-

Wireless Japan 2004 exhibition (Tokyo, July 21-23, 2004)

FeliCa mobile payment wallet phones at the centre of attention by Gerhard Fasol Wireless, mobile phone industry trends years before they reach outside Japan Every year the Wireless Japan sets global trends in wireless communications and mobile phones. Mobile phone industry professionals cannot afford to miss this trend setting show. It is here that Japanese…

-

Wireless Japan 2002 exhibition (July 17-19, 2002) in Tokyo

Global mobile trends start in Japan by Gerhard Fasol Docomo’s first 3G phones, KDDI brings design to mobile phones The annual Wireless-Japan exhibition highlights the trends of mobile communications in Japan. At Wireless-Japan 2002 KDDI started setting the trend of concept phones. KDDI/AU “Design Project:” Design study for the bestselling “INFOBAR”. The KDDI/AU design study…