Category: Leadership

-

Japan’s corporate governance reforms: Joint event with the alumni of HEC, École Polytechnique, Sciences Po, Edhec, Essec and Trinity College/Cambridge University. Thursday 7 March 2019 in Tokyo

Japan’s corporate governance reforms joint event with the alumni organizations of HEC, École Polytechnique, Sciences Po, Edhec, Essec and Trinity College/ Cambridge University. Thursday 7 March 2019 19:00 in Tokyo On Thursday 7 March 2019 we will have a joint event by the alumni organizations of several French Grandes Écoles, HEC, École Polytechnique, Sciences Po,…

-

Corporate Governance Reforms in Japan, Swiss-Japanese Chamber of Commerce in Geneva

Corporate Governance Reforms: How the Way Japanese Corporations Take Decisions is Changing SJCC Swiss-Japanese Chamber of Commerce Friday 12 October 2018, 18:30-19:45, JETRO Office Geneva Prime Minister Abe’s corporate governance reforms are arguably one of the biggest success stories of his reform program to promote Japan’s economic growth. Japan’s Government in coordination with the Tokyo…

-

Corporate governance reforms: making Japanese corporations great again? Monday, May 28, 2018, 19:00-21:00 at CCIFJ

Corporate governance reforms: making Japanese corporations great again? Understanding how Japanese Boards of Directors function helps you close deals Monday, May 28, 2018, 19:00-21:00 at CCIFJ Stimulating Japanese companies’ growth is a key element of Prime Minister Abe’s economic growth policies. For companies to grow, management needs to be improved, Boards of Directors need to…

-

EFTA Court – impact on business and our emerging new world order: former EFTA Court President Carl Baudenbacher

Former President of the EFTA Court, Carl Baudenbacher Gerhard Fasol: Professor Baudenbacher, could you explain in simple terms, what the EFTA Court and your work leading the EFTA Court for many years, means for businesses in Europe, and also businesses in Japan. Carl Baudenbacher: The EFTA Court is the second tribunal in the European Economic…

-

Corporate Governance Reforms in Japan, Gerhard Fasol at the Foreign Correspondents Club FCCJ 12 March 2018

Corporate Governance Reforms in Japan Monday, March 12, 2018, 12:00 – 13:30 at the Foreign Correspondents Club in Japan FCCJ While many Japanese corporations are still admired around the world, too many have for years suffered sluggish growth and low profitability. A string of corporate scandals and failures have shocked the pubic and corroded confidence…

-

Japanese Corporate Governance – The Inside Story, Daiwa Anglo-Japanese Foundation HQ London, Tuesday 16 January 2018

Gerhard Fasol and Sir Stephen Gomersall Daiwa Anglo-Japanese Foundation, London, Tuesday 16 January 2018, 6:00pm Topic: Japanese Corporate Governance – The Inside Story Speakers: Gerhard Fasol and Sir Stephen Gomersall Program: Tuesday 16 January 2018, 6:00pm – 7:00pm, Drinks reception from 7:00pm Location: 13/14 Cornwall Terrace, Outer Circle (entrance facing Regent’s Park), London NW1 4QP,…

-

Corporate governance reforms in Japan: hands-on insights as Board Director of a Japanese group

Corporate governance reforms are one of the key components of Abenomics, to improve economic growth in Japan Corporate governance reforms in Japan: talk at the OAG House in Tokyo, Wednesday 20 September 2017, 18:30-20:00 Wednesday 20 September 2017, 18:30-20:00 Talk: Gerhard Fasol: „Corporate Governance Reformen in Japan: Erfahrungen als Aufsichtsratsdirektor einer japanischen Firmengruppe“ Free of…

-

EU-Japan Free Trade Agreement (FTA) and Economic Partnership Agreement (EPA) closer to conclusion

With US withdrawal from TPP and BREXIT, the EU-Japan Free Trade Agreement moves to the center of attention EU-Japan Free Trade Agreement and Economic Partnership Agreement nearing conclusion, maybe this summer. EU and Japan started to prepare for Free Trade Agreement (FTA) and the political framework Economic Partnership Agreement (EPA) at the 20th EU-Japan Summit…

-

Japan GDP growth and losses at Japan Post – Gerhard Fasol interviewed by Rico Hizon on BBC TV

Japan’s economy grows five quarters in a row, and Japan Post books losses of YEN 400.33 billion (US$ 3.6 billion) for an acquisition in Australia Japan GDP growth, growth of 2%/year. Still, Japan’s economy is the same size as in 2000, while countries like France, Germany, UK today are double the size as in the…

-

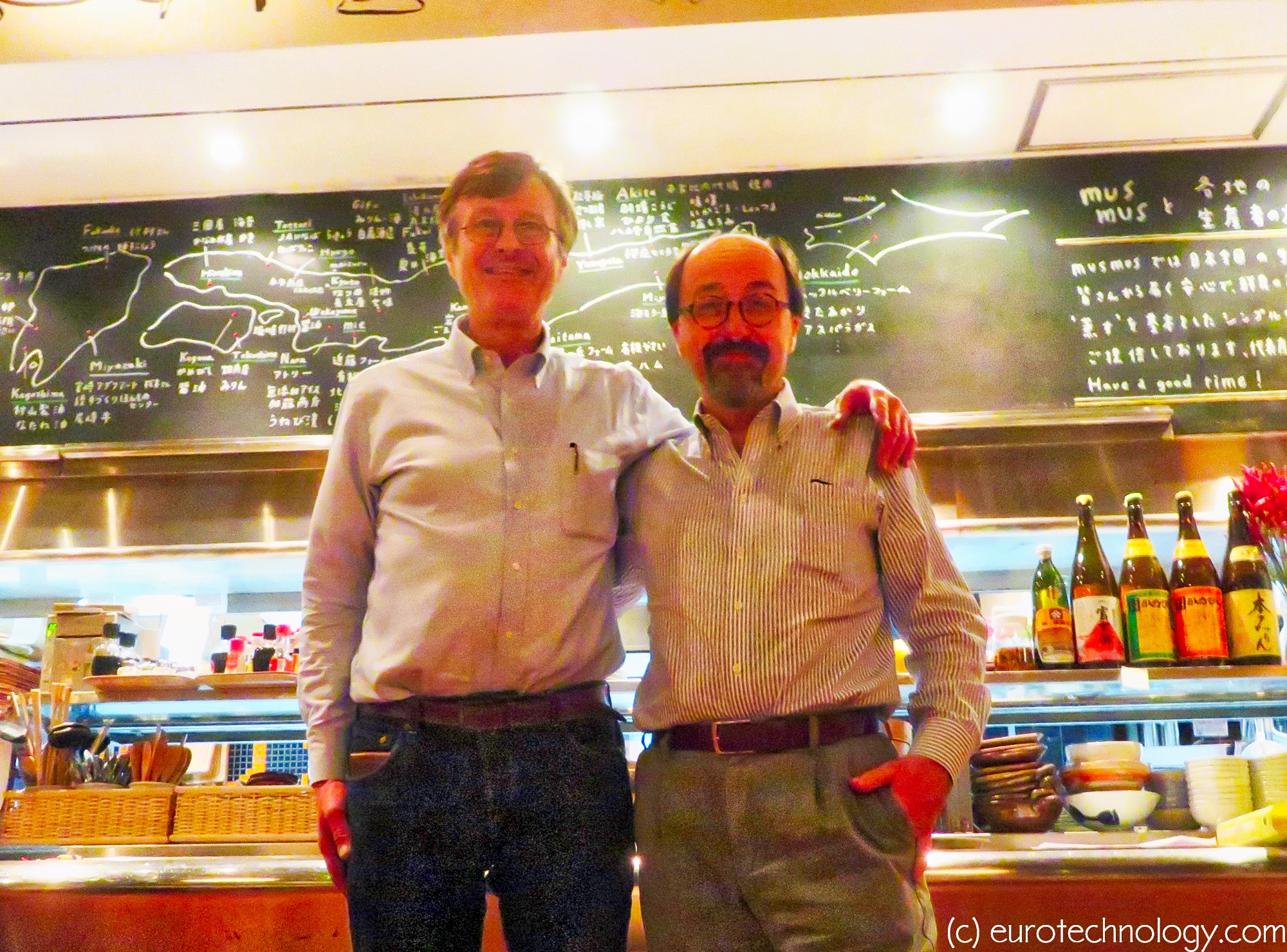

Bill Emmott and Gerhard Fasol – A conversation about Japan’s future

Bill Emmott and Gerhard Fasol Bill Emmott is an independent writer and consultant on international affairs, board director, and from 1993 until 2006 was editor of The Economist. http://www.billemmott.com Gerhard Fasol is physicist, board director, entrepreneur, M&A advisor in Tokyo. http://fasol.com/ A conversation about Japan’s future Bill Emmott: I came first to Japan in 1983…

-

Toshiba nuclear write-off. BBC interview about Toshiba’s latest nuclear industry write-offs

Toshiba is expected to announce write-off provisions on the order of US$ 6 billion today Toshiba is on Tokyo Stock Exchange warning list for possible delisting in March 2017 by Gerhard Fasol This morning 7:30am I was interviewed on BBC TV Asia Business Report about an update of Toshiba’s ongoing crisis, which has been 20…

-

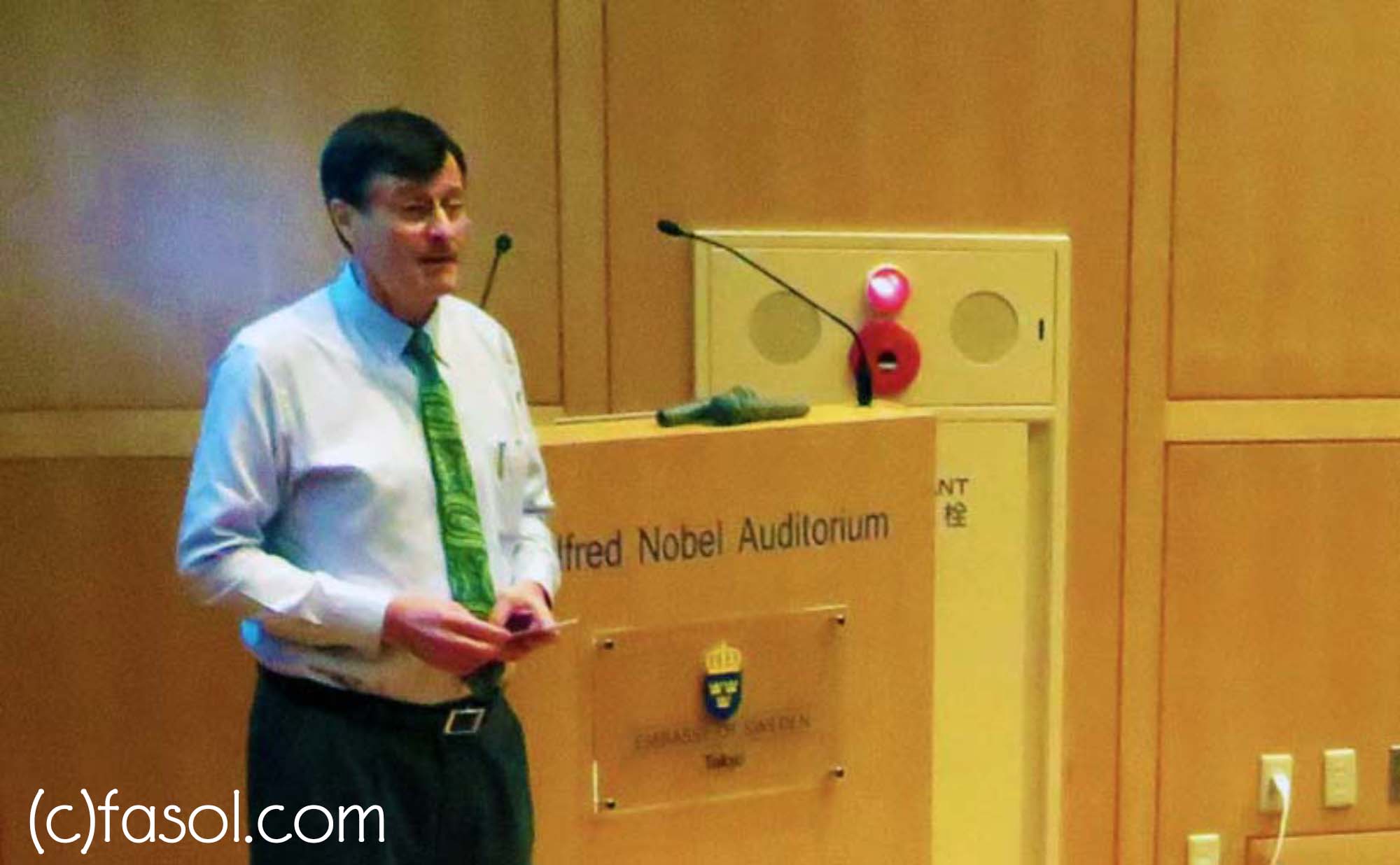

Changing Japanese management – a talk on 6 October 2016 at the Embassy of Sweden

Corporate governance reforms in Japan Changing the way Japanese corporations are managed: Can it make Japanese iconic corporations great again? A talk by Gerhard Fasol at the Embassy of Sweden organized by the Embassy of Sweden, The Swedish Chamber of Commerce in Japan (SCCJ), and the Stockholm School of Economics You need to know more…

-

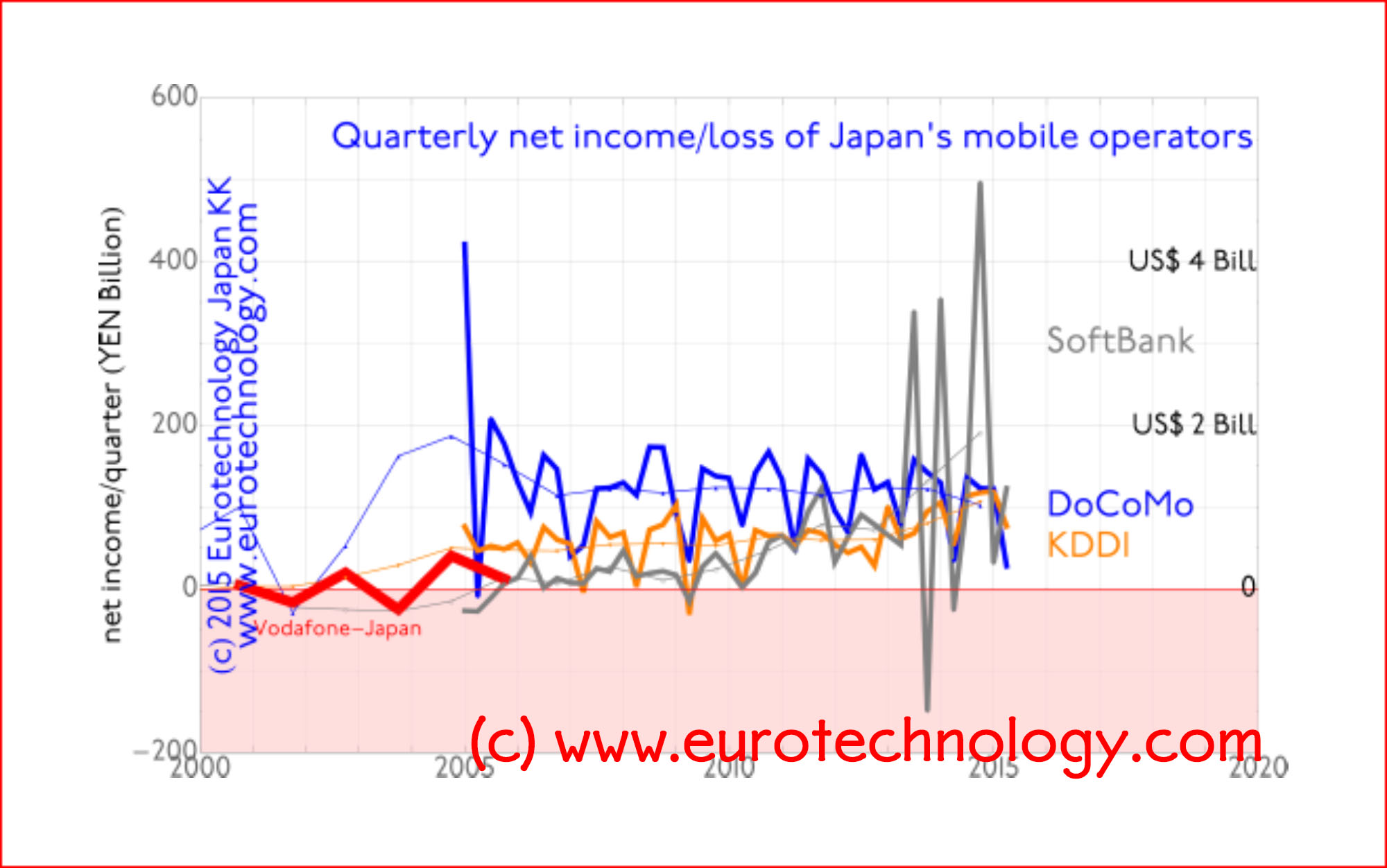

SoftBank acquires ARM Holdings plc: paradigm shift to internet of things (IoT) and a Vodafone angle

On 18 July 2016 SoftBank announced to acquire ARM Holdings plc for £17 per share, corresponding to £24.0 billion (US$ 31.4 billion) SoftBank acquires ARM: acquisition completed on 5 September 2016, following 10 years of “unreciprocated love” for ARM On 18 July 2016 SoftBank announced a “Strategic Agreement”, that SoftBank plans to acquire ARM Holdings…

-

Kiyoko Kato: Current state of female doctors in Japanese Obstetrics and Gynecology

The current state of female doctors in Japanese Obstetrics and Gynecology 「日本の産科婦人科における女性医師の現状」 Kiyoko Kato, Professor, Department of Gynecology and Obstetrics, Graduate School of Medical Sciences, Kyushu University 加藤聖子、教授。九州大学大学院医学研究院。生殖病態生理学 The Ludwig Boltzmann Forum on Women’s development and leadership was held on Monday 16 May 2016 in Tokyo in honor of Dame Carol Black’s visit to Japan.…

-

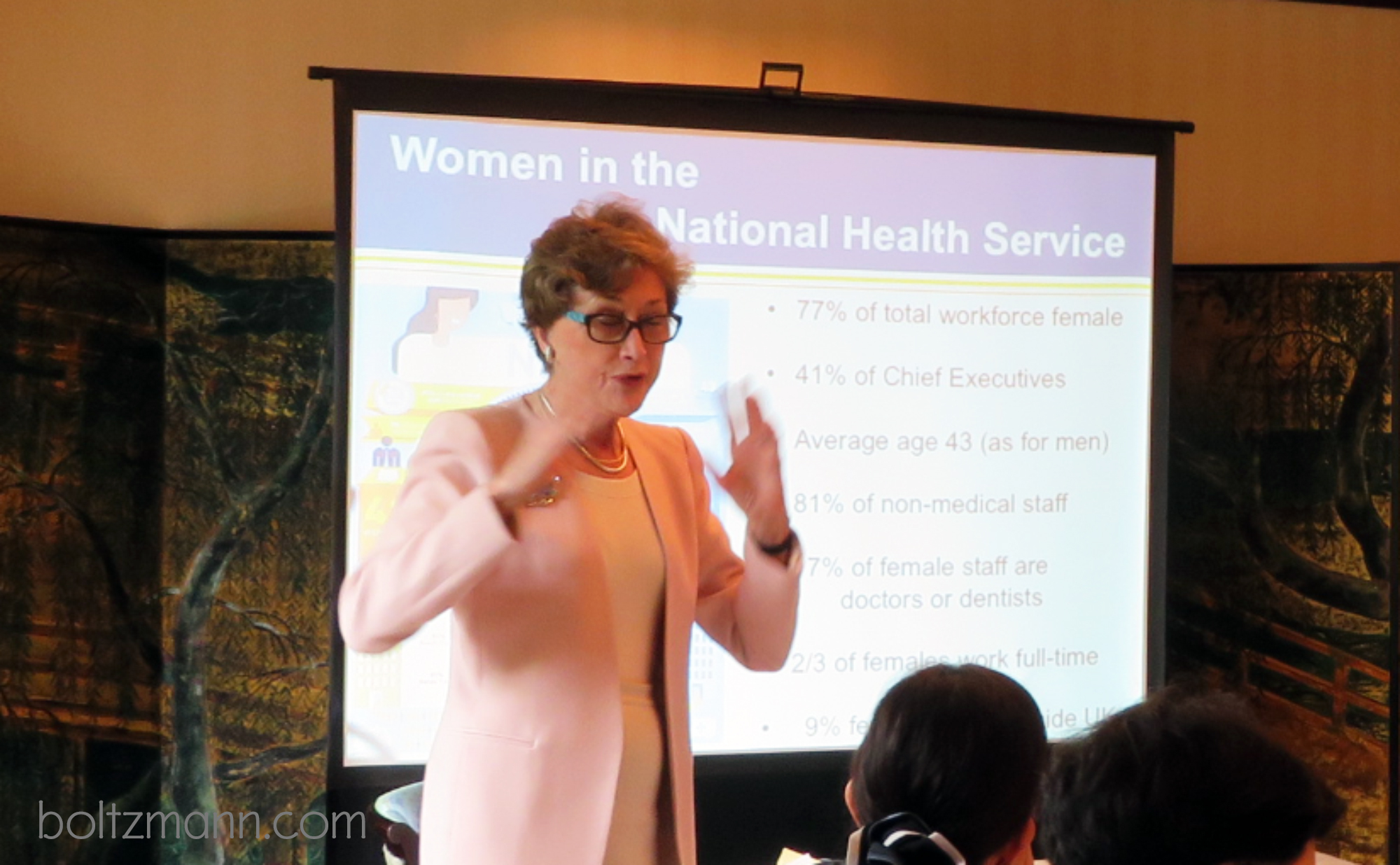

Dame Carol Black: Advancing women in healthcare

Advancing women in healthcare Dame Carol Black DBE FRCP FMedSci, Principal of Newnham College, Cambridge University, and Expert Adviser on Health and Work, Department of Health and Public Health England The Ludwig Boltzmann Forum on Women’s development and leadership was held on Monday 16 May 2016 in Tokyo in honor of Dame Carol Black’s visit…

-

Ludwig Boltzmann Forum on Women’s development and leadership – objective

Ludwig Boltzmann Forum on Women’s development and leadership – workshop objective The Ludwig Boltzmann Forum on Women’s development and leadership was held on Monday 16 May 2016 in Tokyo. View the full workshop program here, Gerhard Fasol’s keynote lays out the objectives of the workshop in the present article. Gerhard Fasol CEO, Eurotechnology Japan KK,…

-

Shuji Nakamura on 2nd and 3rd Generation Solid State Lighting

—

by

Shuji Nakamura’s invention to save energy corresponding to about 60 nuclear power stations by 2020 2nd and 3rd Generation Solid State Lighting For Shuji Nakamura’s invention of high-efficiency GaN double-heterostructure LEDs he was awarded the Nobel Prize in Physics 2014, while his employer sued him in the USA for leaking intellectual property – Shuji Nakamura…

-

Makoto Suematsu: fast-tracking medical research in Japan

Makoto Suematsu, Founding President of Japan’s new Agency for Medical Research and Development AMED: The situation in Japan is so crazy, but now I will stay in Japan because I have a mission summary of Professor Makoto Suematsu’s talk by Gerhard Fasol Medical research in Japan: Fast-tracking medical research and development in Japan In April…

-

Top-down vs bottom-up innovation: Japan’s R&D leaders at the 8th Ludwig Boltzmann Forum

How to fast-track innovation in Japan Shuji Nakamura’s invention of high efficiency LEDs enable us to reduce global energy consumption by an amount corresponding to 60 nuclear power stations by 2020, for which he was awarded the 2014 Nobel Prize in Physics. Still, a poster child for bottom-up innovation, Shuji Nakamura was sued by his…

-

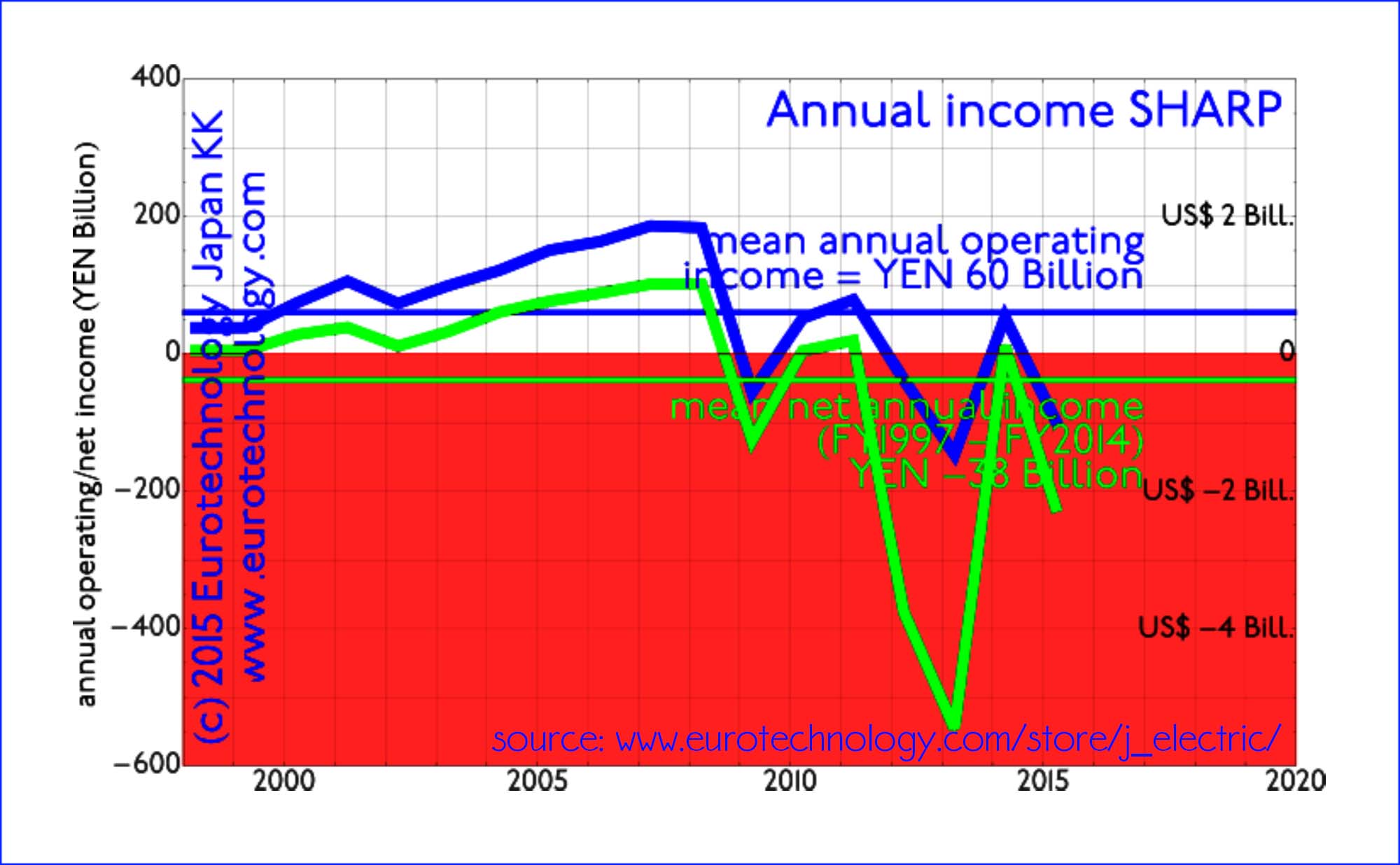

SHARP and the future of Japan’s electronics

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

Economic growth for Japan? A New Year 2016 preview

Economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood Chairman Kawahara), and adjusting…

-

Corporate governance reforms in Japan – practical views of a Board Director

A Board Director’s view Corporate governance reforms in Japan progress faster than even one of their key promoters expected, and cost almost no tax payers money Author: Gerhard Fasol Corporate governance reforms in Japan are one component of “Abenomics” to bring back economic growth to Japan. Corporate governance reforms in Japan are driven at least…

-

Was Osamu Suzuki first to understand Volkswagen’s Diesel issues?

Osamu Suzuki: “we looked at Wagen’s technologies, and could not find anything we need” (Nikkei, 1 July 2011) by Gerhard Fasol Did Volkswagen underestimate Mr Suzuki? Over the last 18 years myself and our company have worked on many foreign-Japanese company partnerships, therefore we always have great interest in business partnerships involving Japanese companies, and…

-

Mr. Suzuki didn’t want to be a Volkswagen employee, and that’s understandable (Prof. Dudenhoeffer via Bloomberg)

Mr Suzuki (Chairman of Suzuki Motors), wrote in his Japanese blog, that “ending the partnership with Volkswagen (Wagen-san as he calls VW) was like the relieve I feel after having a fishbone stuck in my throat removed” No partnership works without meeting of minds, with opposite agendas and colliding expectations by Gerhard Fasol, All Rights…

-

Quarterly financial reports to go away: UK and EU remove requirements for quarterly financial reports

Voluntary quarterly reporting? Quarterly financial reports: can they be the trees which obscure long term growth of the forrest? As a Board Director of a Japanese company traded on the Tokyo Stock Exchange I have to study and approve monthly, quarterly and annual financial reports, and I share responsibility for the future success of the…

-

Burberry Japan: breaking up is hard to do

Burberry Japan pivots from successful partnership to direct business by Gerhard Fasol, All Rights Reserved. many of the underlying issues also apply in all other business areas, such as electronics, and technology. Sanyo Shokai pivots from Burberry to Mackintosh and other brands Burberry Japan pivots to direct business to solve Burberry’s “Japan Problem”: for the…

-

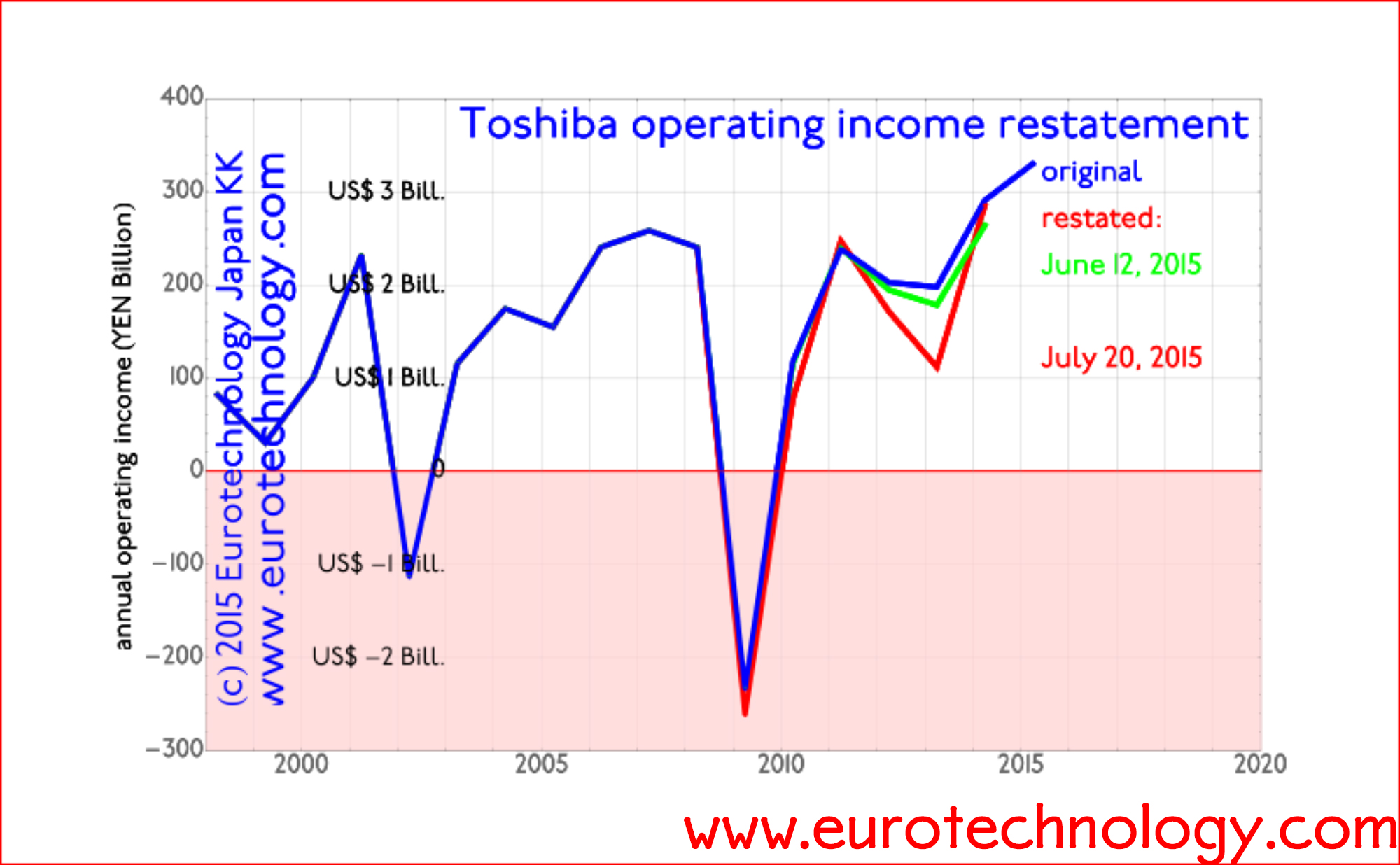

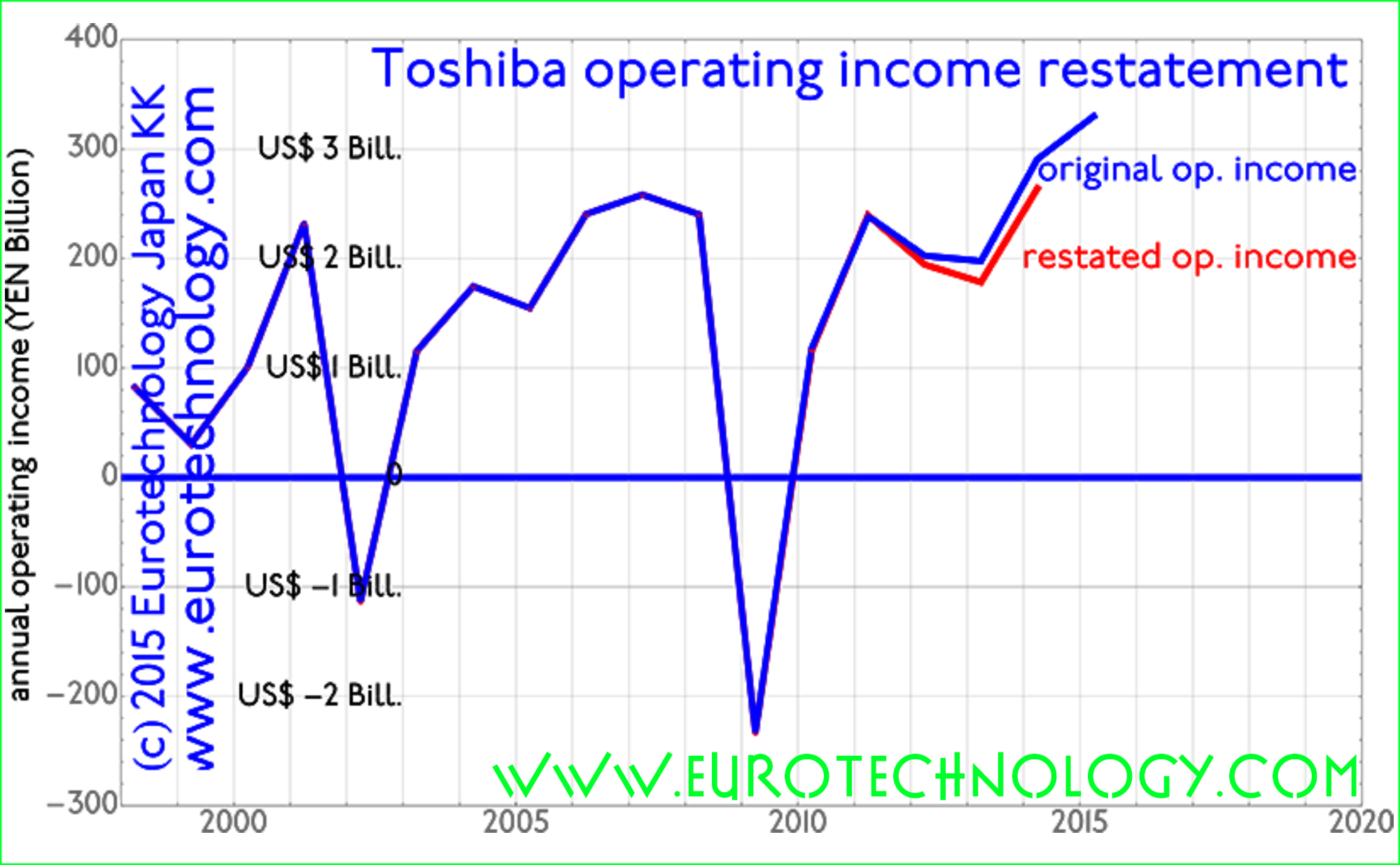

Toshiba income restatement: corresponds to one full year of average operating income

Toshiba’s income restatement announced by the independent 3rd party committee by Gerhard Fasol Independent 3rd party committee chaired by former Chief Prosecutor of Tokyo High Court On 12 June, 2015, Toshiba announced corrections to income reports, and at the same time engaged an independent 3rd party investigation committee headed by former Chief Prosecutor at the…

-

Masahiro Morimoto, entrepreneur, CEO and Chairman of the Board, UBIC Inc. (today: Fronteo) A discussion with Dr. Gerhard Fasol

UBIC Inc (today: Fronteo): founded to curb huge losses of Japanese corporations due to litigation abroad A discussion between UBIC (today: Fronteo) CEO Masahiro Morimoto and Dr. Gerhard Fasol From Japanese/Chinese/Korean (CJK) e-discovery, to data forensics, virtual data scientist and predictive coding Masahiro Morimoto founded UBIC Inc. on August 8, 2003 to stem the huge…

-

Toshiba accounting restatements in context

July 21, 2015: Update – report of the independent 3rd party committee chaired by former Chief Prosecutor of the Tokyo High Court. Corrections amount to 2 1/2 years (31.5 months) of average annual net profits by Gerhard Fasol Sales stagnation combined with almost zero net profit of Japan’s top 8 electronics companies creates increasing pressure…