SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector

The need for focus and active portfolio management

SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March.

Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete for control of SHARP.

While SHARP makes headlines, the big-picture issues are:

- corporate governance reforms in Japan

- the future of Japan’s US$ 600 billion electronics sector, which dominated world electronics in the 1980s but failed to keep up with the evolution and growth of global electronics.

To survive Japan’s old established electronics conglomerates have two choices:

- focus on a small number of key products (remember Apple CEO Tim Cook showing that all of Apple’s products fit on one small table)

- actively managed portfolio model

however, for Japan’s economy to prosper, Japan needs many more young fresh new companies in addition to the old established conglomerates.

Interviews for BBC-TV and French Les Echos

Last week I was interviewed both live on BBC-TV and also by the French paper Les Echos about SHARP’s future:

- BBC TV

- Les Echos: Foxconn veut racheter Sharp (22 January 2016)

- Les Echos: Foxconn et un fonds japonais se disputent le sauvetage de Sharp (21 January 2016)

In summary, I said that its not just about SHARP’s current predicament, but its about corporate governance reform in Japan, about reinventing Japan’s electronics sector, and that its more likely at this stage that Japan’s Innovation Network Corporation (INCJ) will take control SHARP, since INCJ is not just concerned with SHARP but with the bigger picture of restructuring Japan’s electronics sector.

INCJ has concepts for combining SHARP’s display division with Japan Display, and has plans for SHARP’s electronics components divisions, and for the white goods division, and other divisions.

SHARP governance: How and why did SHARP get into this very difficult situation?

SHARP is a poster child for the urgent need for corporate governance reform in Japan.

Essentially SHARP assumed that the world market for TVs and PC displays will continue to demand larger and larger and more expensive display sizes, and thus took bank loans to build a very large liquid crystal display factory in Sakai-shi, south of Osaka.

In addition, SHARP, has a huge portfolio of many different products ranging from office copying machines and printers and scanners, mobile phones, high-tech toilets, liquid crystal displays, solar panels, and hundreds of other products. SHARP keeps adding new product ranges constantly expanding its portfolio of businesses, and rarely sells loss making divisions.

Effective and strong independent, outside Directors on the Board might have asked questions during the decision making leading to the building of the Sakai factory. They might have asked for a Plan B, in case the global display market takes a turn away from larger and larger and more expensive displays, or if the competition heats up and prices start decreasing, they might have asked about SHARP’s competitive strengths, they might have also questioned the wisdom to finance an expensive factory via short-term bank loans as opposed to issuing shares to spread the risks to investors.

Its not just outside Directors, shareholders could have also asked such questions.

SHARP has about YEN 678 billion (US$ 5.6 billion) debt, most is short-term debt, and in a few weeks, in March 2016, SHARP needs to repay about YEN 510 billion (US$ 4.2 billion), and needs to find this amount outside.

SHARP is a Japanese electronics company, founded in 1912 by Tokuji Hayakawa in Tokyo as a metal workshop making belt buckles “Tokubijo”, and today one of the major suppliers of liquid crystal displays for Apple’s iPhones, iPads and Macs.

SHARP today has about 44,000 employees, many factories across the globe, sales peaked around YEN 3000 billion (US$ 30 billion) in 2008, and show a steady downward trend since 2008.

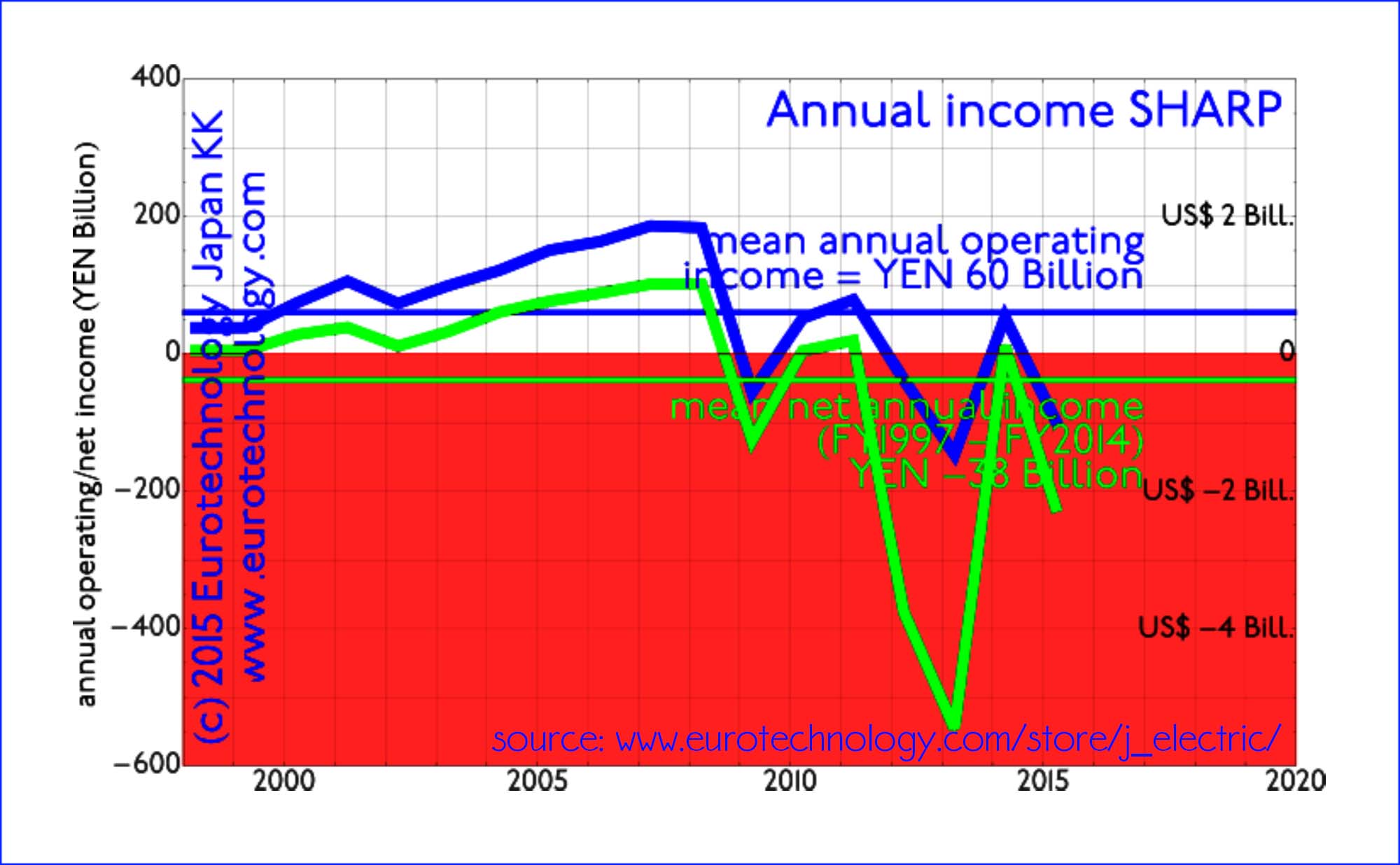

Revenues (profits) peaked in 2008, and have fallen into the red since.

What future for SHARP? Focus vs portfolio company

SHARP (or rather, its creditors, the two “main banks” Mizuho and Mitsubishi-Tokyo-Bank, and others controlling the fate of today’s SHARP) needs to decide whether it focuses on a group of core products, in which case it needs to be No. 1 or No. 2 globally for these products. Successful examples are Japan’s electronic component companies.

Or on the other hand, SHARP could be a portfolio company, in which case this portfolio must be actively managed.

What future for Japan’s US$ 600 billion electronics sector?

Japan’s 8 large electronics conglomerates:

- Hitachi

- Toshiba

- Fujitsu

- NEC

- Mitsubishi Electric

- Panasonic

- SONY

- SHARP

combined have sales of about US$ 600 Billion, similar to the economic size of The Netherlands, but combined for about 15 years have shown no growth and no profits. They are poster children for the urgent need for corporate governance reform in Japan.

These 8 electronics conglomerates are portfolio companies, and they need to manage these portfolios actively, such as General Electric (GE) or the German chemical industry are doing. Germany’s large chemical and pharmaceutical industries started active and drastic product portfolio management in the 1990s, and are continuing constant and active portfolio optimization via acquisitions, spin-outs, and other M&A actions, and so is GE.

A stark contrast are Japan’s very successful, profitable and growing electronics component companies.

Innovation Network Corporation of Japan INCJ (産業革新機構)’s dilemma

INCJ aims “to promote the creation of next generation businesses through open innovation” according to its website.

Japan’s NIKKEI financial daily mentions INCJ’s dilemma, whether attempting the rescue of an old conglomerate is compatible with its mission to create next generation business through open innovation.

Why “let zombie companies die” is beside the point

Concerning SHARP some media wrote headlines along the lines of “let zombie companies die”. Thats easy to write, however, SHARP is a group with 44,000 employees, many factories, about US$ 30 billion in sales annually.

“Let this zombie die” is not an option, SHARP has 100s of products, and divisions, and the best solution for each of these divisions is different. And that is exactly what the Innovation Network Corporation of Japan seems to be considering in its plans for SHARP.

I think the way forward is not “to let zombies die”, but to develop private equity in Japan

I think the move of Atsushi Saito, one of the key drivers of Japan’s corporate governance reforms, from CEO of Tokyo Stock Exchange/ Japan Exchange Group, to Chairman of the private equity group KKR is a tremendously important one in this context.

Will there be native Japanese private equity groups with sufficient know-how and ability to take responsibility of restructuring Japan’s electronics sector? Thats maybe the key question.

Why its not really about nationalism

Some media bring a nationalist angle into SHARP’s issues. However, Nissan was rescued by French Renault, UK’s Vodafone acquired Japan Telecom, and there are many other examples, where foreign companies acquire Japanese technology companies.

I don’t think nationalism is an issue here. The key issues is to create and implement valid business models for Japan’s huge existing electronics sector, and more importantly, create a basis for the growth valid new companies – not just reviving old ones.

Japan electronics industries – mono zukuri

Copyright (c) 2016-2019 Eurotechnology Japan KK All Rights Reserved

Comments and discussions