Tag: sharp

-

SHARP and the future of Japan’s electronics

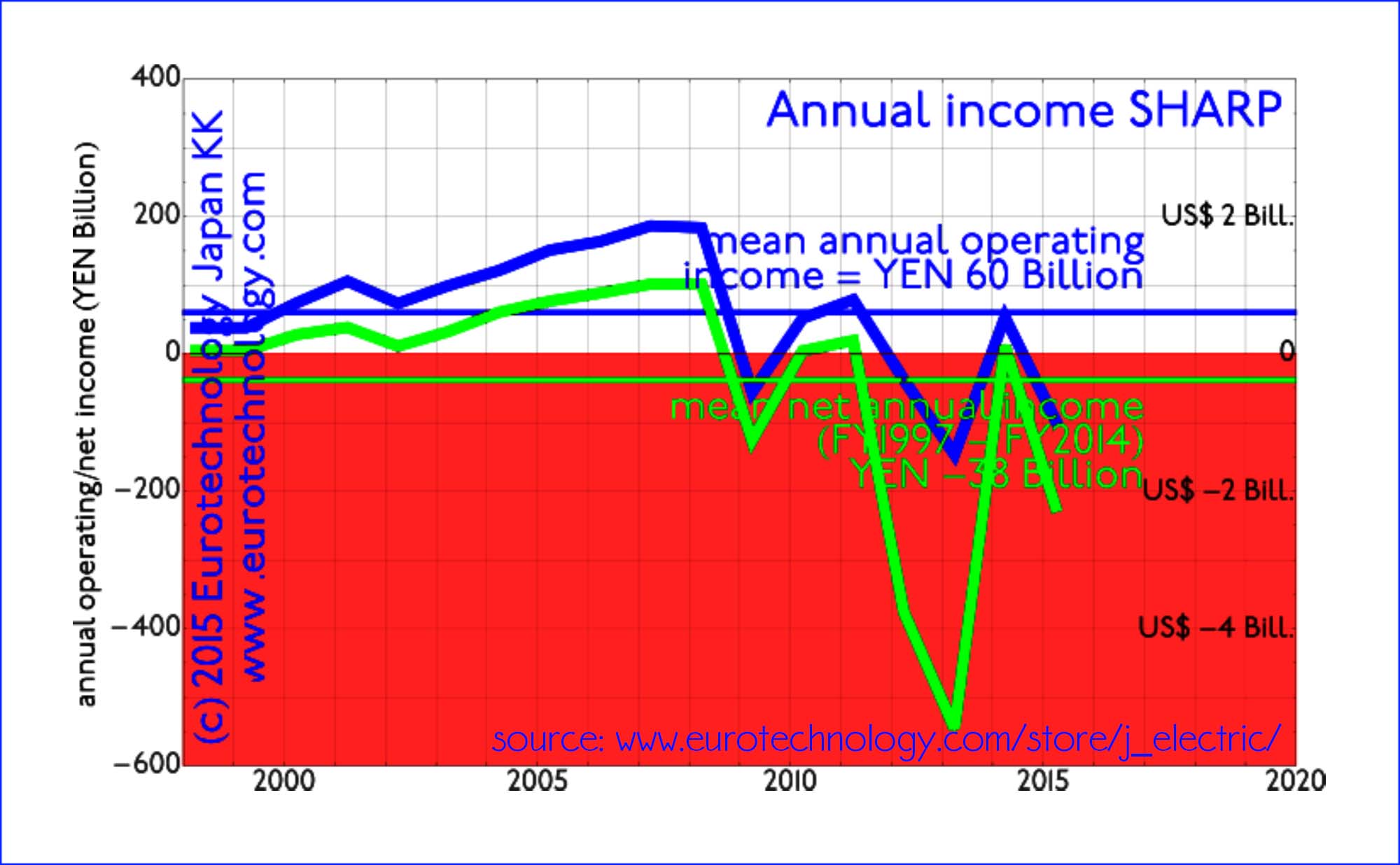

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

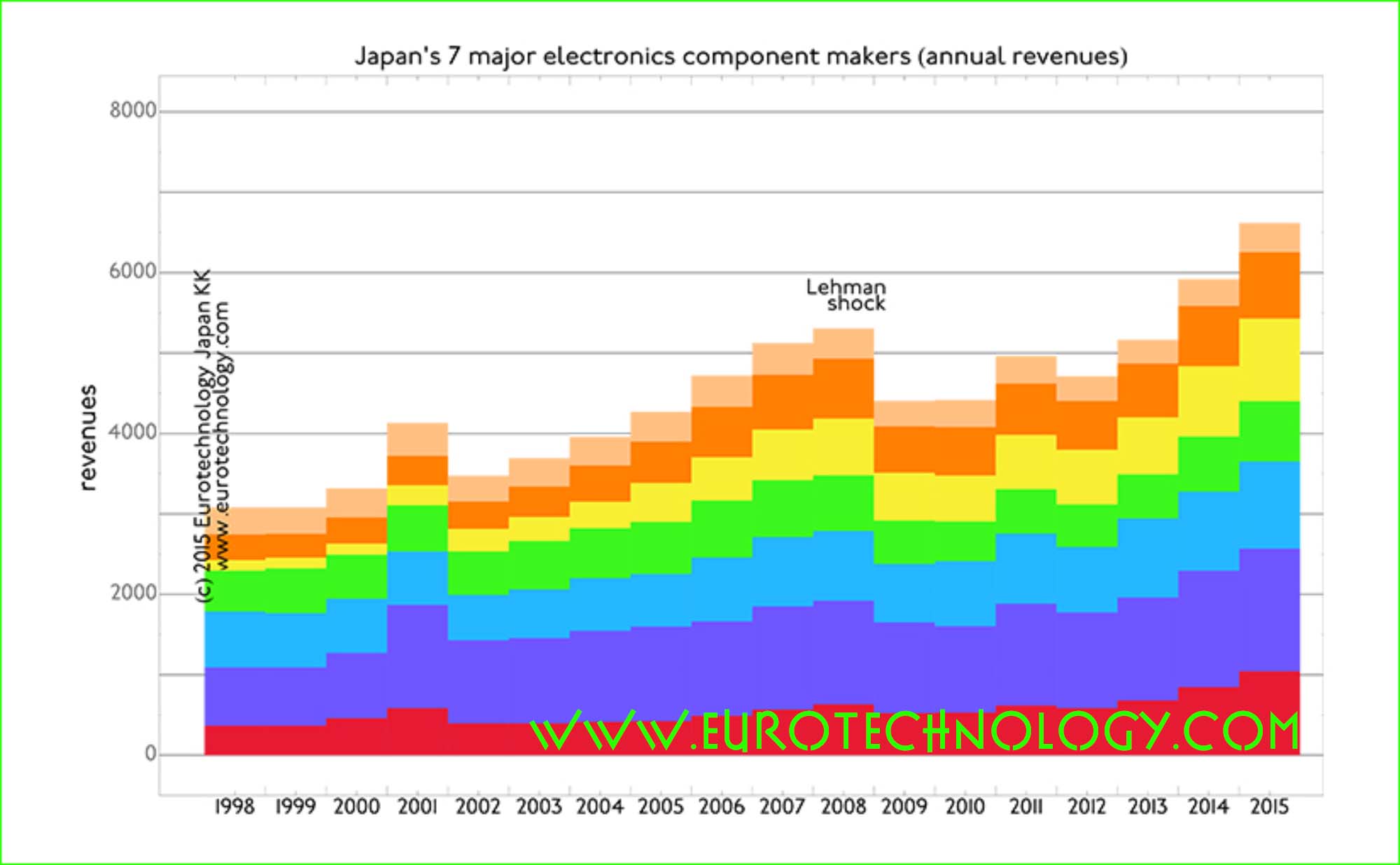

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

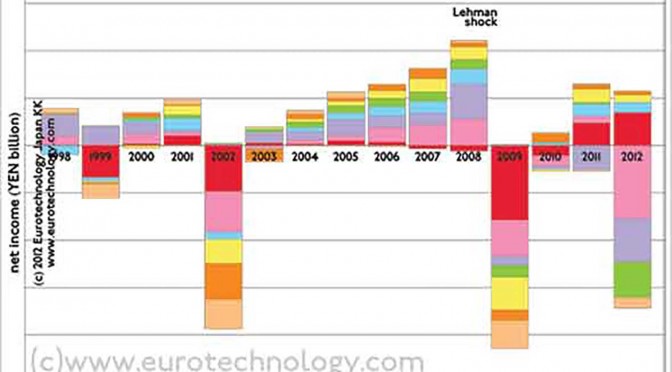

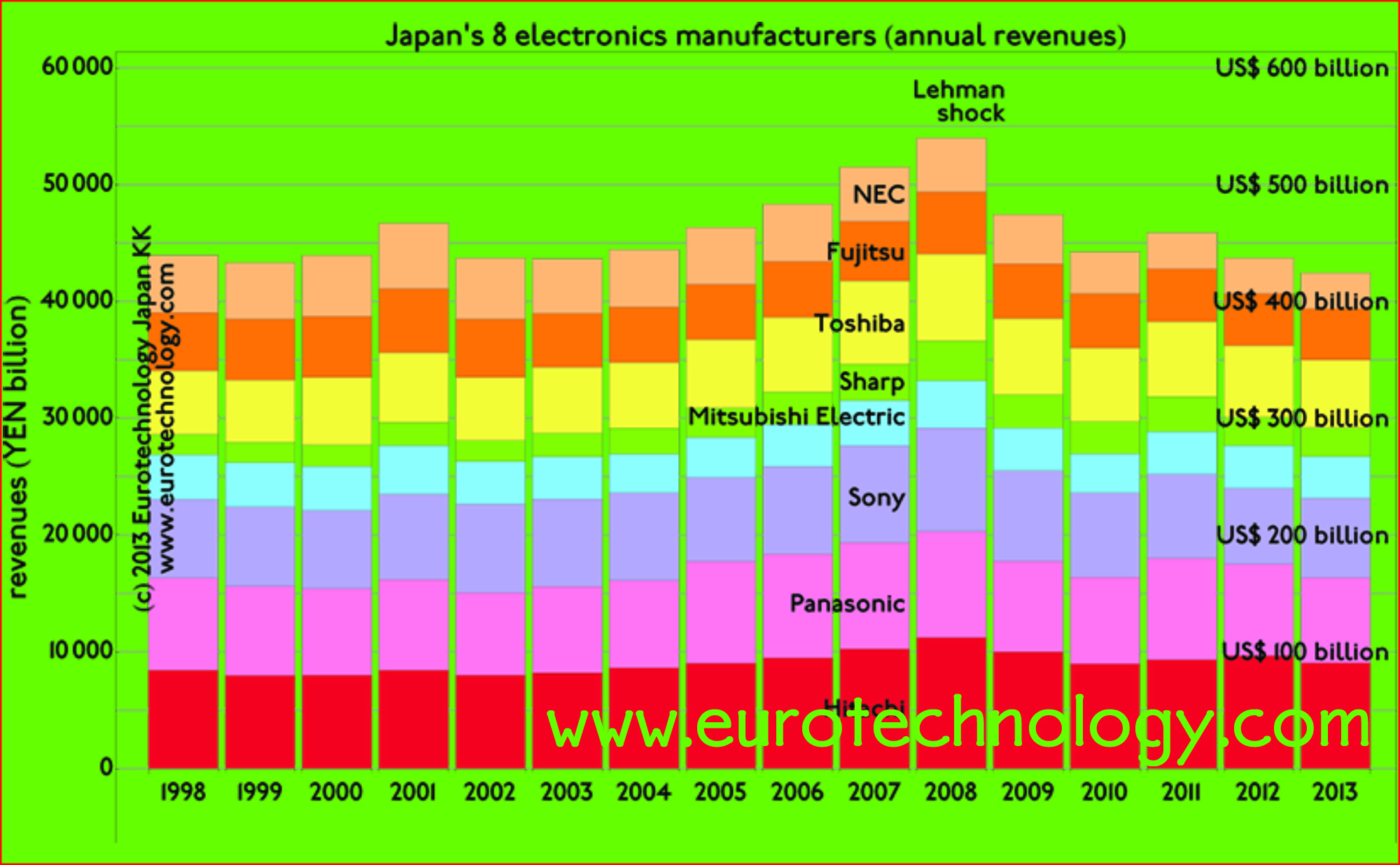

Japan’s electronics giants – FY2012 results announced. 17 years of no growth and no profits.

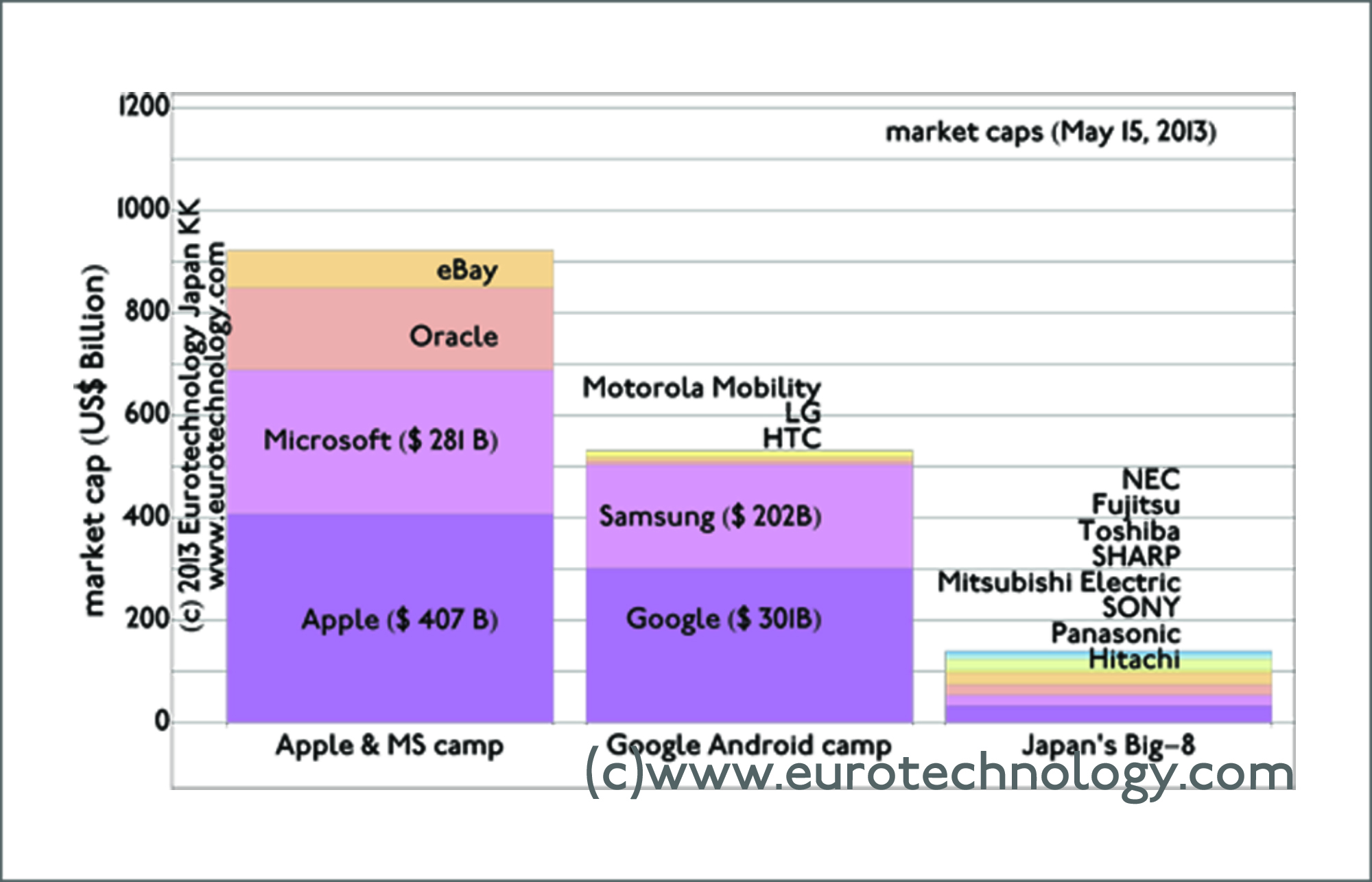

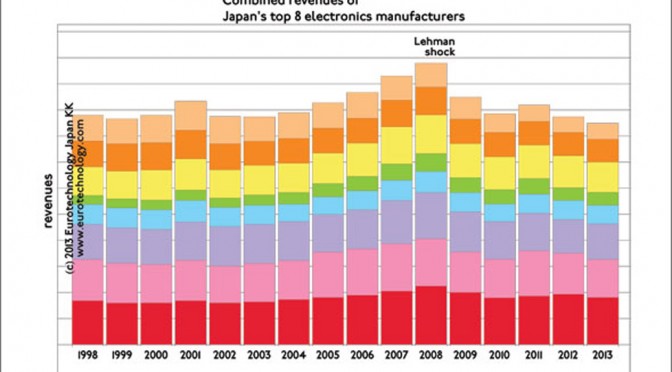

Japan’s electronics giants: as large as the economy of Holland, but 17 years of stagnation. No growth & no profits. Daniel Loeb: SONY’s uninvited guest gives Japan’s business culture a jolt Japan’s electronics giants combined are as large as the economy of Holland, but did not grow for about 17 years, and on average lost…

-

Intellectual Japan – BBC: “Japan has to become a brain country” – from mono zukuri to brain country

Intellectual Japan: Japan’s electronics companies need new business models – interview for the BBC The BBC recently examined why Japan’s electronics sector has to create new business models, and quotes “Japan has to become a brain country”. Japan’s top 8 electronics companies combined are as large as the Netherlands economically, but have shown zero growth…

-

Japanese electronics groups need new business models (BBC-interview: Yen ‘not the cause of woes of Japan’s electronics firms’)

Japanese electronics groups combined as of similar size as the economy of the Netherlands Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands. Over…

-

Taiwan’s Hon Hai Group invests in SHARP

Crunch time? – reviving Japan’s huge electrical/electronics sector SHARP fighting for survival SHARP (6753) last month forecast a record YEN 290 Billion (US$ 3.5 Billion) loss for this financial year – more than 1/2 of SHARP’s market cap, and SHARP’s new Sakai factory is reported to work at 1/2 capacity. Taiwan’s Hon Hai Group (which…

-

When did qr-codes start on mobile phones? (in August 2002)

qr-codes were developed by Toyota subsidiary denso-wave When did qr-codes start on mobile phones: First mobile phone with qr-code reader was the J-SH09 by SHARP for Japanese mobile operator J-Phone When did qr-codes for mobile phones start in Japan? Here is the answer: the first mobile phone with qr-code reader was the J-SH09 produced by…

-

Japan’s games sector overtakes electrical sector in income

Japan’s games sector is booming – and net annual income of Japan’s top 9 game companies combined has now overtaken the combined net income of all Japan’s top 19 electronics giants (including Hitachi, Panasonic, SONY, Fujitsu, Toshiba, SHARP… at the top, and ROHM, Omron… further down the ranking list). Why does it make sense to…

-

Japan electronics groups: global benchmarking

Japan electronics groups have far lower income/profits than EU or US comparable corporations Ripe for drastic reform and transformation: 18 years no growth and almost no profits Lets look at global benchmarking of Japan’s top electrical groups Panasonic and Hitachi (representative of Japan’s top ten electrical giants) – in our previous blog we suggested that…

-

Foggy Outlook for Global Tech Sector (CNBC TV interview)

Foggy Outlook for Global Tech Sector (Airtime: Tues. Feb. 10 2009) Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Japan trends 2008/2009

One of our clients in the financial industry asked me several trend questions: Q1: Biggest surprises in Japan in 2008? Collapse of Japan’s mobile phone handset market (read our blog). In this context the Japanese telecom equipment makers association invited me to give a presentation, which was booked out 2-3 weeks ahead – about 100…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…

-

SHARP pretax profit increases 26%

When BusinessWeek interviewed me for an article about SHARP in October 2004, the journalist interviewing me was very surprised that I was talking to him on a SHARP mobile phone. While NEC and Matsushita are merging their mobile phone development, SHARP has leveraged the power to make the best displays into market leadership in Japan’s…

-

Eurotechnology Japan in the press: Bloomberg, BusinessWeek, Economist

Eurotechnology Japan KK in the press: Bloomberg: Vodafone K.K.’s Tsuda Seeks Growth in Japan, Not Sale BusinessWeek: How Sharp Stays On The Cutting Edge. More on SHARP in our report on Japan’s electronics industries BusinessWeek: Lasers Are About to Enter Their Blue Period BusinessWeek: Vodafone’s Bad Connection In Japan The Economist: Vodafone – not so…