Category: Software

-

Masahiro Morimoto, entrepreneur, CEO and Chairman of the Board, UBIC Inc. (today: Fronteo) A discussion with Dr. Gerhard Fasol

UBIC Inc (today: Fronteo): founded to curb huge losses of Japanese corporations due to litigation abroad A discussion between UBIC (today: Fronteo) CEO Masahiro Morimoto and Dr. Gerhard Fasol From Japanese/Chinese/Korean (CJK) e-discovery, to data forensics, virtual data scientist and predictive coding Masahiro Morimoto founded UBIC Inc. on August 8, 2003 to stem the huge…

-

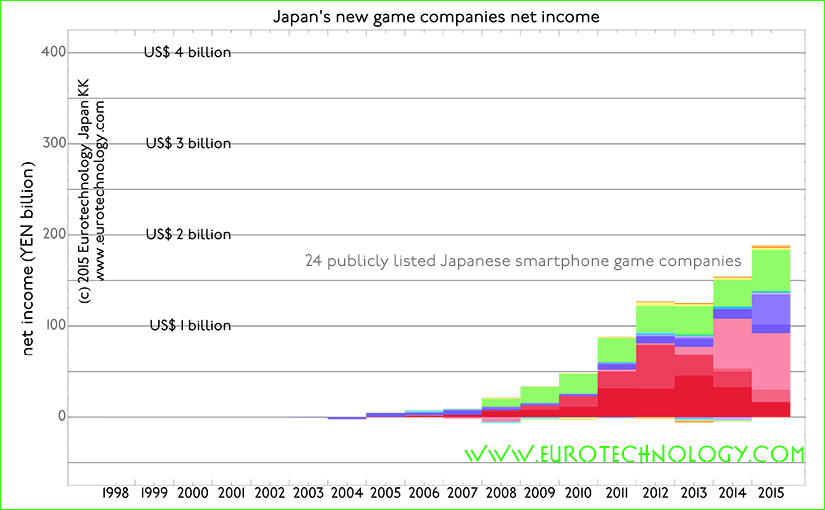

Smartphone games disrupt Japanese video game industry

24 new listed smartphone game companies achieve net income twice as high as all top 8 traditional video game companies combined Its not just Nintendo being disrupted, its the whole Japanese video games industry In the most recent version of our report on Japan’s game industry, we added 24 publicly listed new smartphone game companies…

-

Israeli Venture Fund Japan meeting in Tokyo March 4, 2014

Start-up Nation Israel 2014 – Israel Japan Investment Funds meeting on March 4, 2014 at the Hotel Okura in Tokyo Israeli Venture funds introduce Israeli ventures to Japanese investors Acquisition of Viber by Rakuten draws attention in Japan to Israeli ventures The recent acquisition of the Israel-based OTT (over the top) communications company Viber by…

-

Docomo postpones Tizen OS mobile handsets for the second time

Below are notes for an interview for the French newspaper LesEchos. The full article can be found here. On Thursday January 16th, 2014, NTT Docomo announced the postponement of mobile phone handsets based on the TIZEN operating system. This is actually the second time that NTT Docomo has postponed the planned introduction of TIZEN handsets,…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…

-

Assessing Oracle-Sun Deal (CNBC TV interview) (Airtime: Tues. Apr. 21 2009)

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

NTT-Data expands to Europe: Acquisition of Cirquent GmbH

NTT Data and BMW agreed today, that NTT Data will acquire 72.9% of outstanding shares of Cirquent GmbH NTT Data thus gains BMW as largest customer in Europe Today, August 1, 2008, NTT Data and BMW agreed, that NTT Data will acquire 72.9% of the outstanding shares of Cirquent GmbH in order to globalize. Cirquent…

-

Outsourcing Japan market research and strategy consulting to India, Philippines?? – a recipe for business failure in Japan?

Business decisions unrelated to market realities are a prime reason for failure of foreign companies in Japan In a quest to reduce market research costs, Japan market research is often outsourced to India, Philippines, Indonesia etc With shock and surprise we recently found out that a very famous telecom and IT industry market research and…

-

About Tokyo Stock Exchange Turbulence on CNBC and RedHerring

Wednesday January 18, 2006 I was interviewed live on CNBC’s “Worldwide Exchange” news program about the turbulence on the Tokyo Stock Exchange following lower than expected quarterly earning reports by Intel, Yahoo and IBM, and a sell-off of Livedoor shares. Here is a summary of what I said in the interview: Overall I am very…

-

Simulation and Visualization of the Dynamics of Electron Wave Packets on a Femto-Second Time-Scale

Conference presentation by Gerhard Fasol at the 5th International Workshop on Femtosecond Technology FST’98, Tsukuba, Japan, February 12-13, 1998, on “Simulation and Visualization of the Dynamics of Electron Wave Packets on a Femto-Second Time-Scale” Details of our work on the simulation and visualization of electron wave packet motion.