Category: mobile games

-

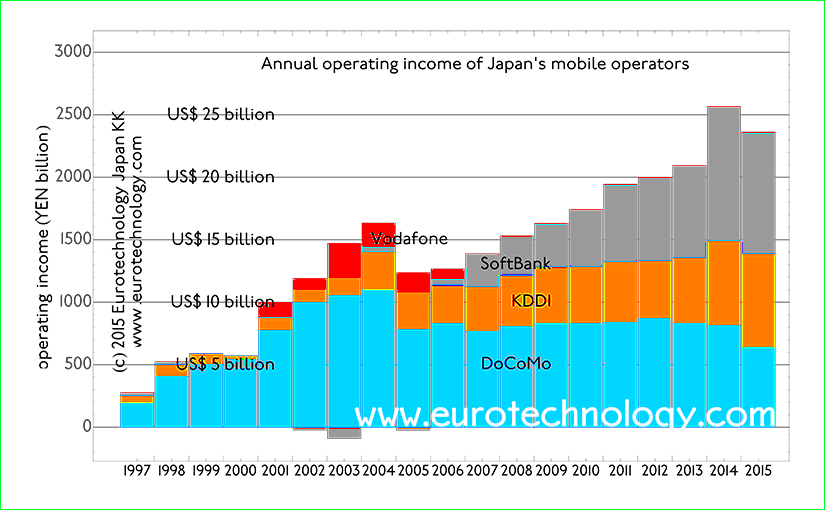

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

Nintendo smartphone pivot?!

Nintendo partners with DeNA Taking Nintendo intellectual property and characters to smartphones Nintendo was founded on September 23, 1889 by Fujasiro Yamauchi in Kyoto for the production of handmade “hanafuda” cards. Nintendo Headquarters are still located in Kyoto (you can see the Nintendo headquarters building from the Kyoto railway station). The Chinese characters used to…

-

Top Japanese game companies

25 listed top game companies listed on Tokyo Stock Exchange have total market cap of US$ 30 billion Japan game market report (398 pages, pdf-file): Japan is the cradle of many global games Japan created much of today’s global game market with icon’s such as Nintendo. However, today the moment has been taken over by…

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…