Annual revenues exceed US$ 170 billion in FY2014

Japan’s mobile telecommunications sector continues to grow

The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile apps (i-Appli in Japan), and mobile payments were invented and first to market in Japan.

Globally the first mobile internet started in Japan in February 1999 when NTT-Docomo brought i-Mode to market. NTT-Docomo did not succeed to develop global business based on i-Mode, however, SoftBank took the lead, and is now building a global business built on Japan’s telecommunications sector’s strengths.

To understand Japan’s telecommunications market read our report:

Japan mobile operators grow revenues to over US$ 170 billion in FY2014

While former monopoly operator NTT-Docomo’s business continues to shrink since its peak in 2002, KDDI is growing its predominantly domestic Japanese business slowly but steadily.

SoftBank on the other hand drives rapid growth with domestic Japanese acquisitions (Vodafone-Japan, Japan Telecom, eMobile and Willcom) and overseas acquisitions, which include US operator SPRINT, US mobile phone retailer BrightStar, Finnish game company SuperCell and many others – not to mention SoftBank’s investment in Alibaba.

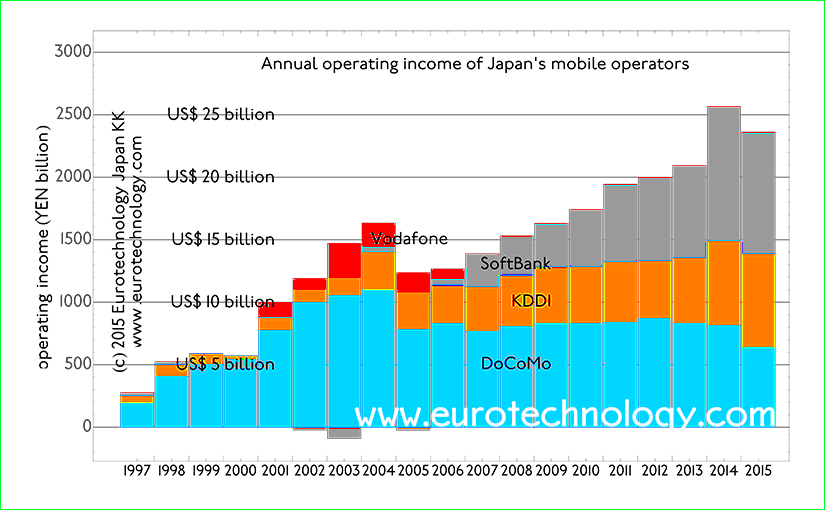

Operating profits rise to approx. US$ 25 billion in FY2014

Operating profits and net profits are steadily increasing for Japan’s three mobile operators combined.

Former monopoly operator NTT-Docomo’s operating profits peaked in 2002, and have been steadily decreasing since this peak.

Both challengers KDDI and SoftBank on the other hand are growing operating profits steadily: KDDI mainly domestically in Japan, with relatively small global business, while SoftBank has dramatically increased business outside Japan with a series of acquisitions and investments, including US operator Sprint, US mobile phone distributor BrightStar and Finnish game developer SuperCell.

To understand Japan’s telecommunications market read our report:

Copyright 2015 -2019 Eurotechnology Japan KK All Rights Reserved

Comments and discussions