Tag: ntt

-

Mobile internet’s 17th birthday

The global mobile internet revolution started with Docomo’s i-Mode on February 22, 1999 i-Mode, Happy Birthday! Today, exactly 17 years ago, on February 22, 1999, NTT-Docomo launched the world’s first mobile internet service, i-Mode, at a press conference attended only by a handful of people. NTT-Docomo created the foundation of the global mobile internet revolution,…

-

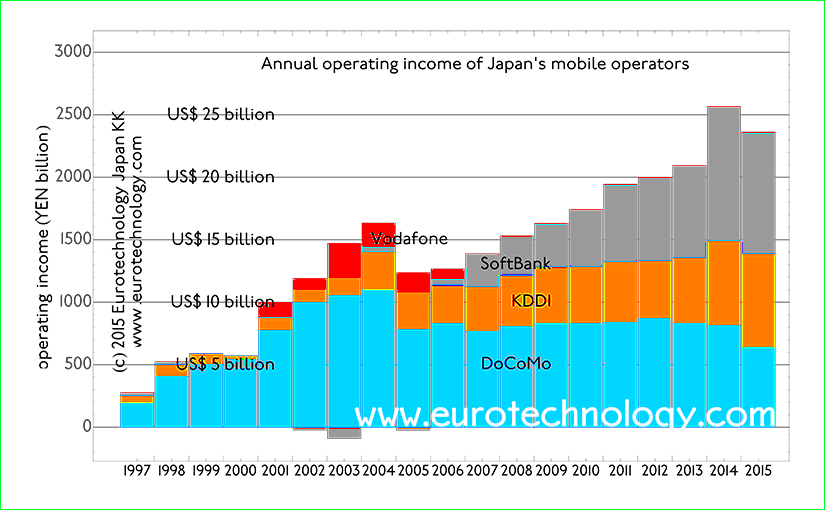

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

Docomo financial report for FY2013: operating income of YEN 819 billion (US$ 8.2 billion)

Docomo financial report for FY2013: US$8.2 billion operating profits but withdraws from India by Gerhard Fasol On April 25, 2014 NTT-Docomo announced annual results for FY2013 (April 1, 2013 – March 31, 2014) and explained the way forward. Annual revenues are YEN 4461.2 billion (US$ 33.6 billion), operating income is YEN 819.2 billion (US$ 8.19…

-

Potential Flu Pandemic Positive for Telcos

Potential Flu Pandemic Positive for Telcos (Airtime: Tuesday, April 28, 2009) Read more about Japan’s telecom sector: http://www.eurotechnology.com/store/jcomm/ Read more about DoCoMo: http://www.eurotechnology.com/store/imode/ Read more about KDDI: http://www.eurotechnology.com/store/kddi/ Read more about Softbank: http://www.eurotechnology.com/store/softbank/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Tech Sector Outlook (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

NTT-Data expands to Europe: Acquisition of Cirquent GmbH

NTT Data and BMW agreed today, that NTT Data will acquire 72.9% of outstanding shares of Cirquent GmbH NTT Data thus gains BMW as largest customer in Europe Today, August 1, 2008, NTT Data and BMW agreed, that NTT Data will acquire 72.9% of the outstanding shares of Cirquent GmbH in order to globalize. Cirquent…

-

Japan’s Mobile Space Not Saturated

More in our J-COMM report: http://www.eurotechnology.com/store/jcomm/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Market caps of companies in mobile: global vs local

Google, Apple, Nokia, HTC, Vodafone and are winning the driver’s seat of the global internet revolution. DoCoMo, KDDI and SoftBank essentially stay inside Japan for now – limiting their growth prospects and leaving global opportunities to others. GOOGLE with Android and APPLE with iPhone are reaching for the driver’s seat of the global mobile data…

-

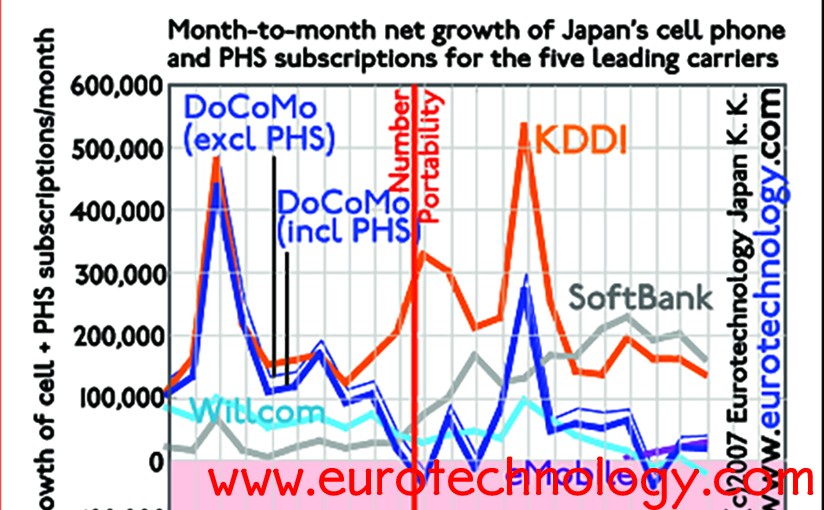

SoftBank and KDDI win market share, Docomo loses

SoftBank from 4th to 1st position within less than 12 months… SoftBank‘s turn-round of x-Vodafone-Japan, went faster than many expected. Within less than 12 months SoftBank went from last place to first place in customer sign-ups, overtaking even KDDI‘s super-popular AU. Willcom recently suffers from SoftBank‘s revival, as well as from eMobile‘s flat rate data…

-

First half FY2008 results: SoftBank and KDDI profits increase, DoCoMo’s trends is downward

In the last few days NTT, NTT-DoCoMo, KDDI and SoftBank announced their first half financial results. SoftBank and KDDI are the winners both for market share and for profits, while DoCoMo‘s results and market shares are sinking, and pulling the NTT-Group down at this time. Extrapolation indicates that DoCoMo‘s net profits may fall into the…

-

3G RAZR for DoCoMo and i-Mode

At the Wireless Japan Exhibition, DoCoMo showed two types of Motorola’s RAZR phone for 3G: one RAZR purely for 3G, including i-Mode, for DoCoMo’s FOMA 3G service. This phone has similar dimensions as the standard US version of RAZR (shown on the left hand side of the image below) a second, much thicker version of…

-

DoCoMo speeds up 3G by 10 times

DoCoMo has upgraded radio networks to 3.6 Mbps in the Tokyo region, and NEC’s N902iX handsets will be released very shortly. DoCoMo has upgraded 3G networks in the Tokyo region to 3.6 Mbps (data download) in the Tokyo region using HSDPA technology (HSDPA = High-Speed Downlink Packet Access), and will soon sell NEC’s N902iX handsets.…

-

NTT Docomo CEO: Wall Street Journal “Leadership Question of the Week” – Japanese leadership

Learning from Dr. Keiji Tachikawa, NTT Docomo CEO NTT Docomo CEO: Japanese leadership in the Wall Street Journal Wall Street Journal, in the section “Leadership Question of the Week”, on Monday June 12, 2006 on page 31, published an article I wrote about a very extraordinary experience I had several years ago at the German…

-

BlackBerry for Japan

DoCoMo plans to sell BlackBerry to corporates in Japan With the RiM/NTP patent infringement lawsuit settled with a US$612.5 million payment, DoCoMo and Research in Motion (RiM) announced on June 8, 2006 that DoCoMo plans to start selling BlackBerry in Japan from autumn 2006 to corporate customers. Will RiM invest US$ 612.5 million to build…

-

Blackberry comes to Japan (interview for Red Herring)

On June 8, 2006, DoCoMo and Research in Motion (RiM) announced that DoCoMo will start marketing RiM’s BlackBerry to corporate customers from autumn 2006. DoCoMo will offer a version of BlackBerry which will use wCDMA (FOMA) 3G network connection in Japan, and will also be able to operate on legacy GSM/GPRS networks which are still…

-

NTT to invest US$ 45 Billion over 6 years

Softbank is rapidly becoming the third universal telco in Japan, targeting NTT’s most important income streams. KDDI of course is also targeting NTT’s fixed line income. On November 2, 2004, NTT announced plans to compete: NTT will invest 5 Chou YEN (YEN 5000 Billion = US$ 45 Billion) over 6 years (2005-2010), i.e. about US$…