Category: telecommunications

-

Mobile internet coming of age: i-Mode’s 18th birthday

The global mobile internet was born today 18 years ago, on February 22, 1999 by Gerhard Fasol NTT Docomo announced the start of i-Mode on February 22, 1999 at a press conference in Tokyo Today, 18 years ago, on February 22, 1999, Mari Matsunaga, Takeshi Natsuno, and Keiichi Enoki announced the start of the world’s…

-

SoftBank acquires ARM Holdings plc: paradigm shift to internet of things (IoT) and a Vodafone angle

On 18 July 2016 SoftBank announced to acquire ARM Holdings plc for £17 per share, corresponding to £24.0 billion (US$ 31.4 billion) SoftBank acquires ARM: acquisition completed on 5 September 2016, following 10 years of “unreciprocated love” for ARM On 18 July 2016 SoftBank announced a “Strategic Agreement”, that SoftBank plans to acquire ARM Holdings…

-

Mobile internet’s 17th birthday

The global mobile internet revolution started with Docomo’s i-Mode on February 22, 1999 i-Mode, Happy Birthday! Today, exactly 17 years ago, on February 22, 1999, NTT-Docomo launched the world’s first mobile internet service, i-Mode, at a press conference attended only by a handful of people. NTT-Docomo created the foundation of the global mobile internet revolution,…

-

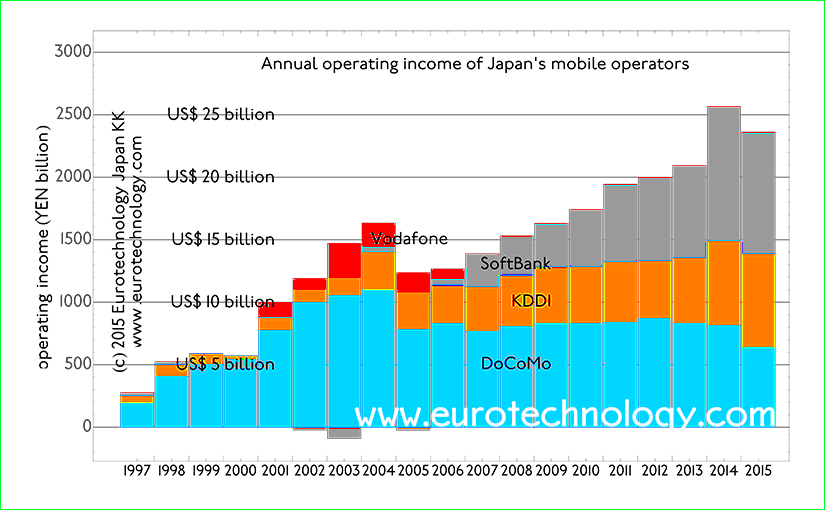

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

i-Mode was launched February 22, 1999 in Tokyo – birth of mobile internet

The mobile internet was born 16 years ago in Japan Galapagos-Syndrome: NTT Docomo failed to capture global value On February 22, 1999, the mobile internet was born when Mari Matsunaga, Takeshi Natsuno and Keiichi Enoki launched Docomo’s i-Mode to a handful of people who had made the effort to the Press Conference introducing Docomo’s new…

-

ApplePay vs Osaifu-Keitai – CNBC interview

ApplePay is expected to start in October 2014 – Docomo’s Osaifu-keitai wallet phones started on July 10, 2004. https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) In business the first-comer does not always win the game Japan’s NTT-Docomo tested two types of wallet phones, manufactured by Panasonic and SONY with 5000…

-

Apple Pay vs Japan’s Osaifu-keitai – the precursor to Apple Pay

What can we learn from 10+ years of mobile payments in Japan? Apple Pay vs Japan’s Osaifu-Keitai: watch the interview on CNBC https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html?play=1 Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) Japan’s Osaifu keitai mobile payments started on July 10, 2004, after public testing during December 2003 – June 2004 Two different…

-

Nokia No. 1 in Japan! – Panasonic to sell mobile phone base station division to Nokia

Nokia strengthens No. 1 market position in Japan’s mobile phone base station market! Japan’s mobile phone base station market Japan’s mobile phone base station market is about US$ 2.6 billion/year and for European companies Ericsson and Nokia the most important market globally, although certainly also the most difficult one. Nokia is No. 1 with a…

-

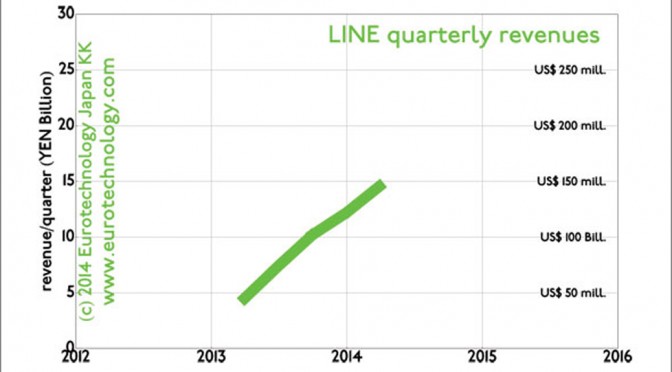

LINE revenues: LINE announces YEN 14.6 billion first quarter revenues

LINE revenues: LINE announced quarterly revenues on their website, the revenue data are redrawn below, with approximate US$ amounts shown as well. Extrapolating assuming continued linear growth, we can estimate expected annual LINE revenues of YEN 70 billion (US$ 700 million) for the full year 2014. Yesterday I was interviewed by Wall Street Journal about…

-

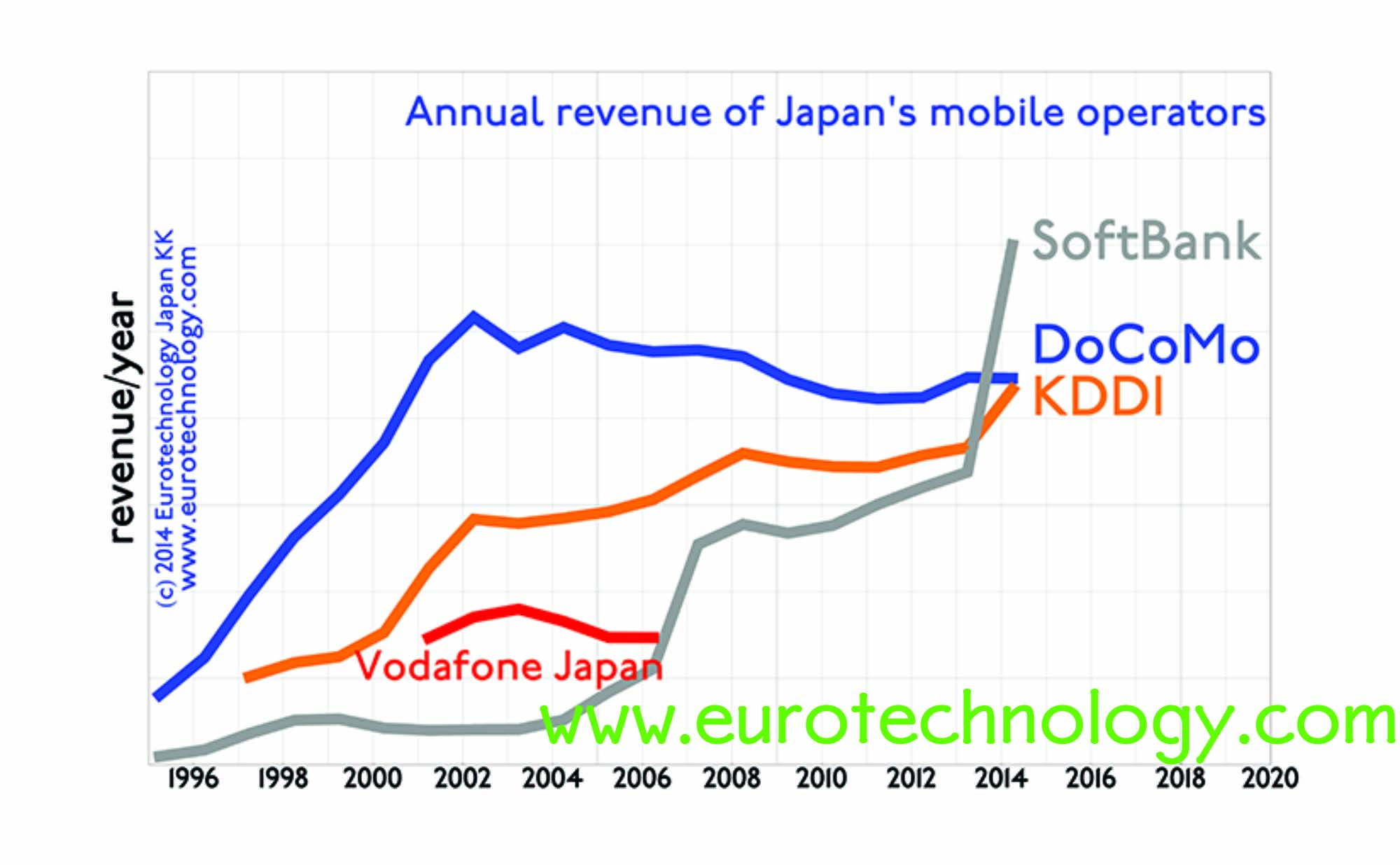

SoftBank overtakes Docomo and KDDI in revenues and income and market cap

SoftBank overtakes Docomo and KDDI in all major KPIs SoftBank presents annual results for the Financial Year which ended March 31, 2014 today, NTT-Docomo and KDDI presented their results a few days ago. Using projections published by SoftBank and using data found in the Japanese business press over the recent days, we have compared SoftBank,…

-

Docomo financial report for FY2013: operating income of YEN 819 billion (US$ 8.2 billion)

Docomo financial report for FY2013: US$8.2 billion operating profits but withdraws from India by Gerhard Fasol On April 25, 2014 NTT-Docomo announced annual results for FY2013 (April 1, 2013 – March 31, 2014) and explained the way forward. Annual revenues are YEN 4461.2 billion (US$ 33.6 billion), operating income is YEN 819.2 billion (US$ 8.19…

-

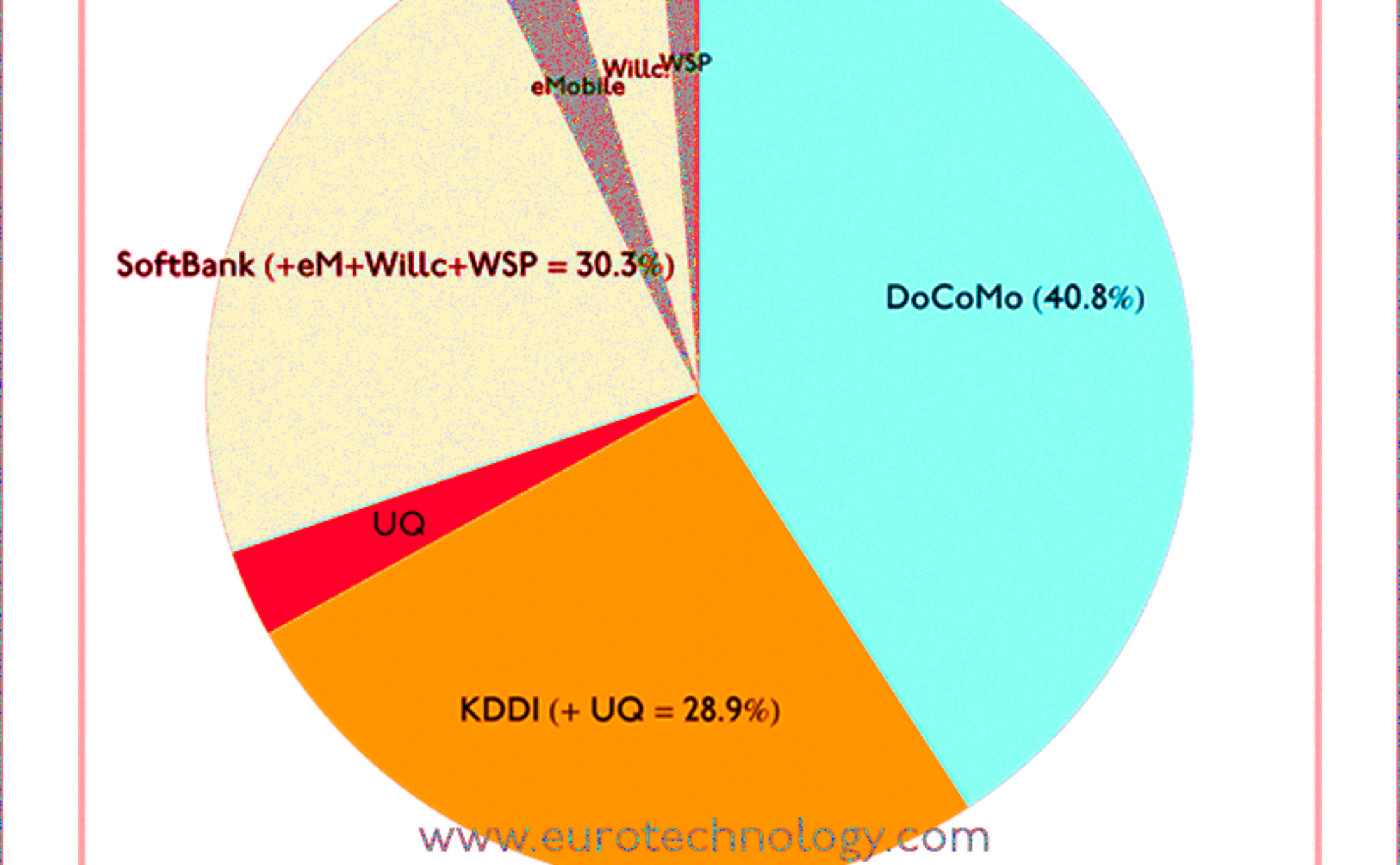

SoftBank market share in Japan – many articles get it wrong. What is SoftBank’s true market share in Japan?

by Gerhard Fasol Many press articles get SoftBank market share in Japan wrong With SoftBank‘s acquisition of US No. 3 mobile operators Sprint and the possibility that Softbank/Sprint will also acquire No. 4 T-Mobile-USA, SoftBank and Masayoshi Son are catching global headlines. SoftBank market share in Japan: Many media articles report wrong data, because they…

-

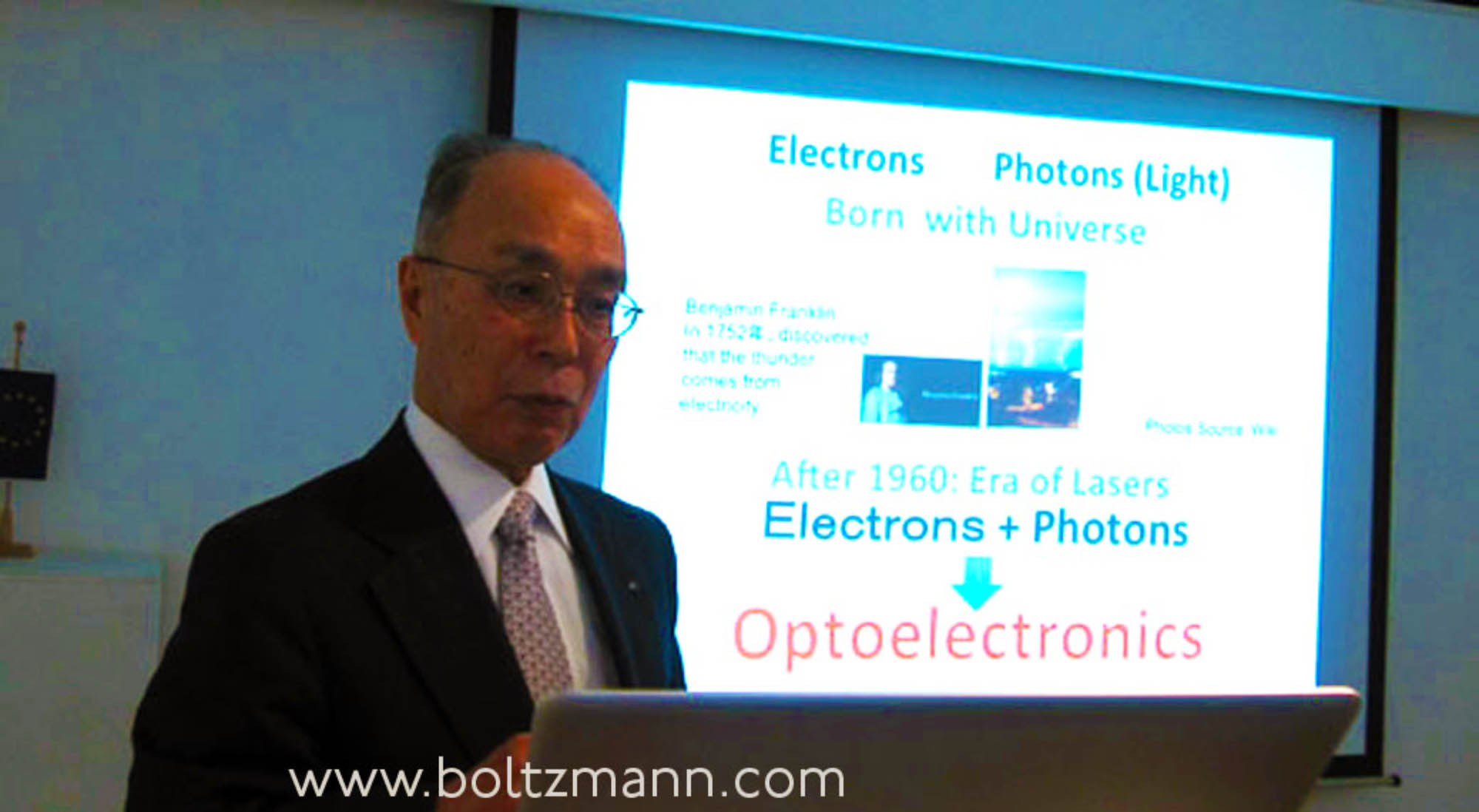

VCSEL – Vertical cavity surface emitting lasers by their inventor, Kenichi Iga (6th Ludwig Boltzmann Symposium)

VCSEL inventor Kenichi Iga: hv vs kT – Optoelectronics and Energy (Former President and Emeritus Professor of Tokyo Institute of Technology. Inventor of VCSEL (vertical cavity surface emitting lasers), widely used in photonics systems) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. VCSEL: how…

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

Docomo postpones Tizen OS mobile handsets for the second time

Below are notes for an interview for the French newspaper LesEchos. The full article can be found here. On Thursday January 16th, 2014, NTT Docomo announced the postponement of mobile phone handsets based on the TIZEN operating system. This is actually the second time that NTT Docomo has postponed the planned introduction of TIZEN handsets,…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

SIM free iPhone Japan: officially on sale by Apple in the online Apple store

SIM free iphone japan finally arrive in Japan – directly sold by Apple. SIM-lock free iPhone 5s and iPhone 5c are now officially sold via the Japanese section of the official Apple.com webstore. It has been official policy recommendation (not regulation) by Japan’s General Affairs Ministry (総務省) for Japan’s mobile operators to sell SIM-free mobile…

-

Supercell wins SoftBank and GungHo investment

Supercell investment by SoftBank and GungHo Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets. SoftBank…

-

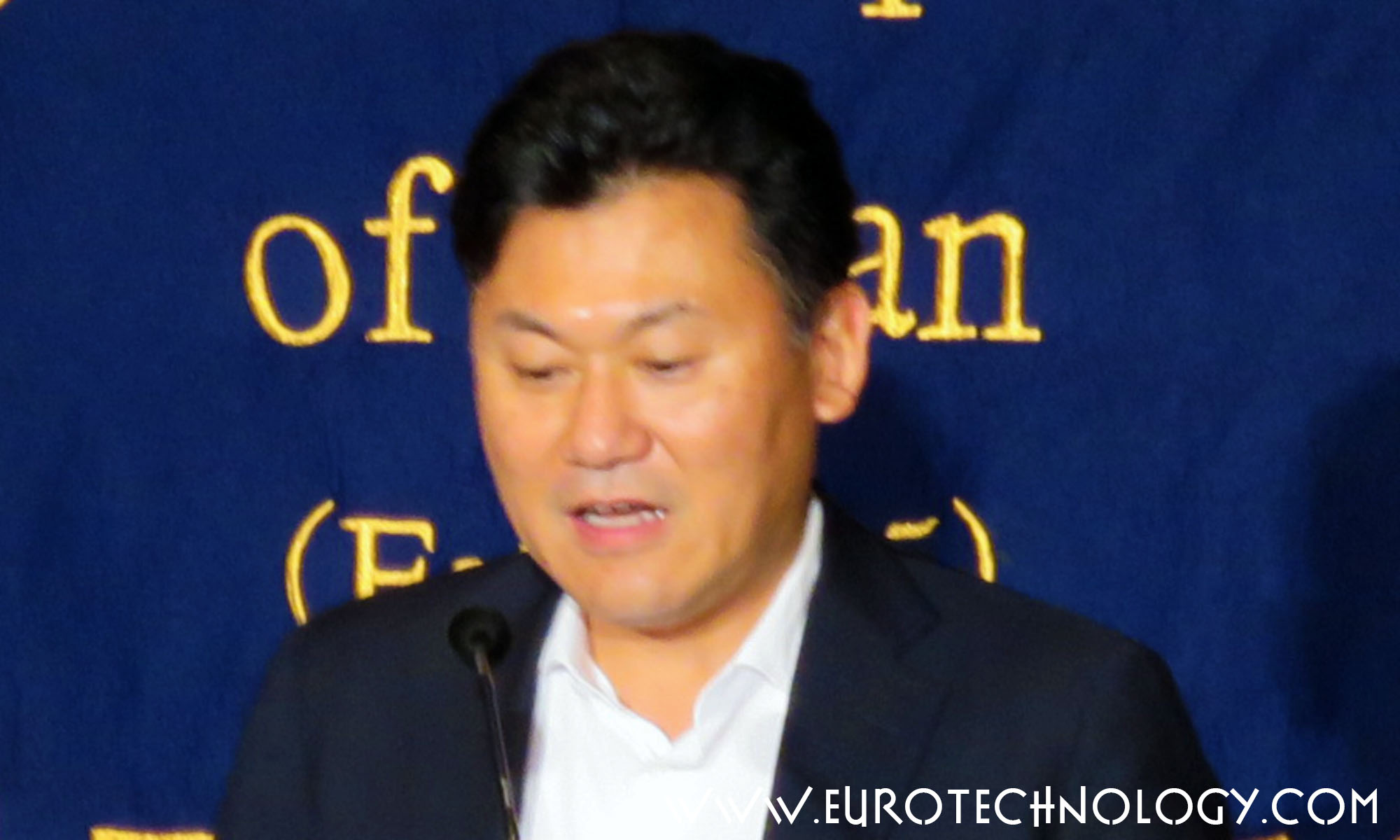

Rakuten vs SoftBank + Yahoo vs Amazon (Bloomberg and BusinessWeek interviews)

Rakuten vs Softbank Yahoo reduces e-commerce fees to compete harder with Rakuten’s online mall Bloomberg interview and BusinessWeek interview about Yahoo KK’s aggressive reduction of ecommerce fees, a move increasing competition with Amazon.com and Rakuten. How do you see Yahoo KK’s latest move to reduce or eliminate merchant’s fees? Do you see this as an…

-

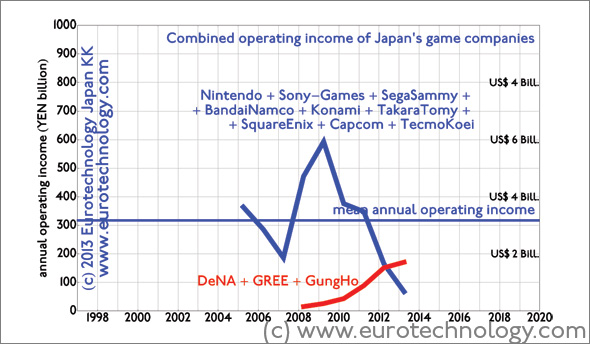

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…

-

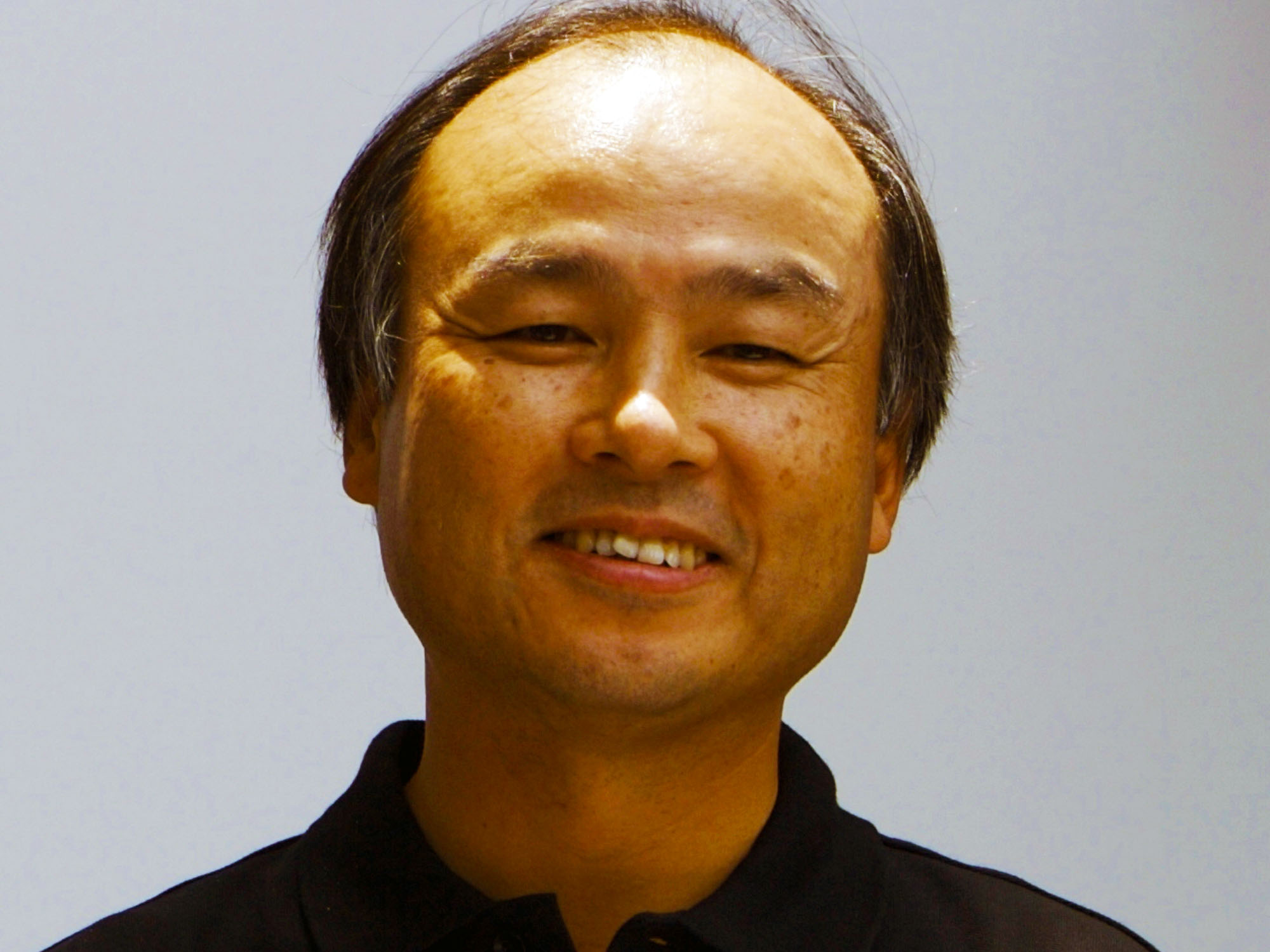

Masayoshi Son threatened to set himself on fire in Japan’s Postal Ministry?!

Masayoshi Son threatened to set himself on fire in Japan’s Post and Telecommunications Ministry? Is it really true? by Gerhard Fasol Masayoshi Son is known for his unbreakable will to achieve his and his companies’ business goals, and the will to take risks. Masayoshi Son threatened to set himself on fire in the Ministry?!? Spectrum…

-

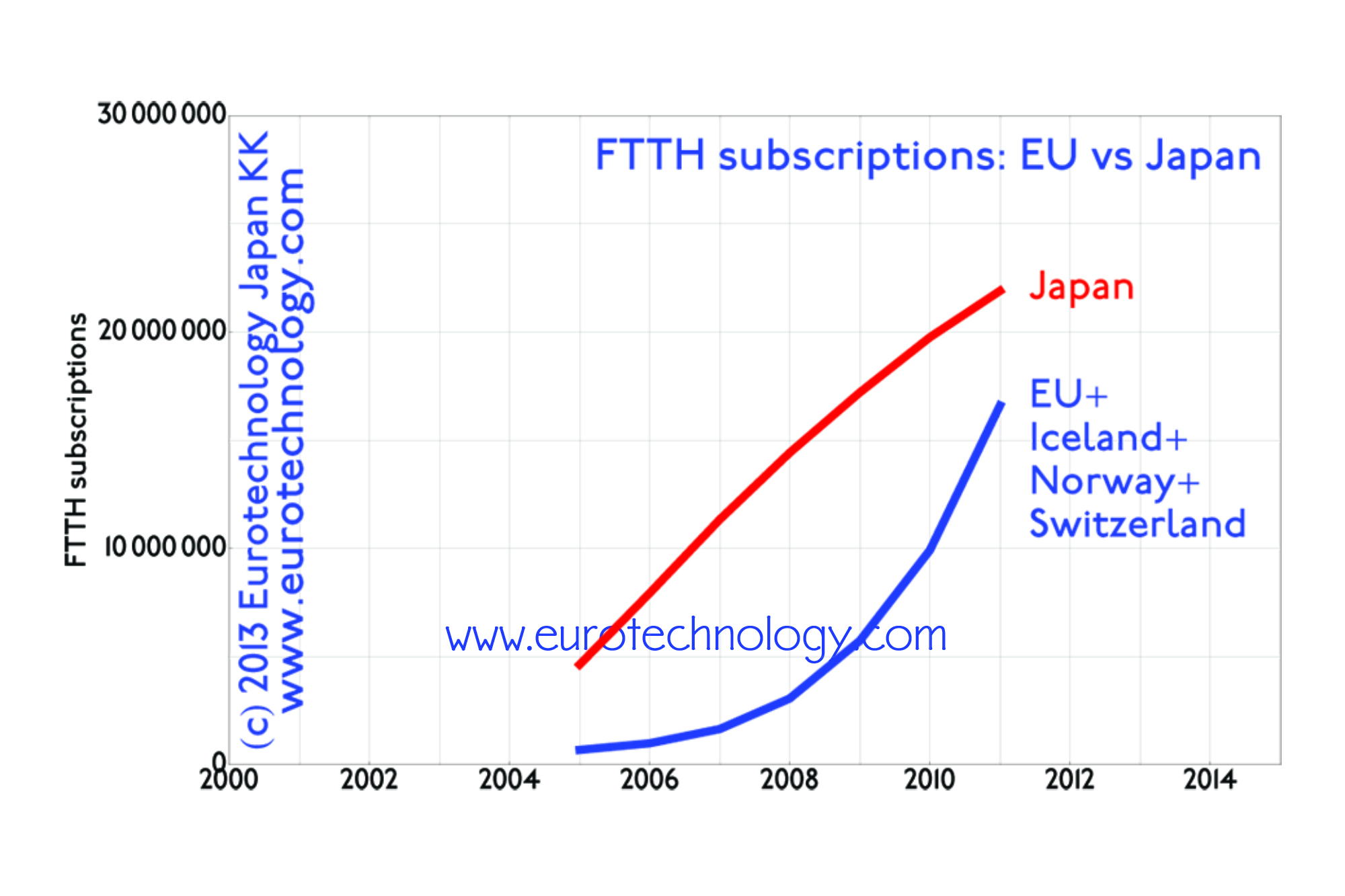

FTTH Japan Europe: more FTTH broadband subscriptions in Japan than in all of EU + Norway + Switzerland + Iceland

by Gerhard Fasol Japan has more broadband fixed internet subscriptions than all of the European Union + Switzerland + Norway + Iceland FTTH Japan Europe: While Japan initially was late in waking up to the commercial introduction of the Internet – Japan was fast to catch up and overtake Japan alone currently has about 30%…

-

Growth in Japan: the SoftBank group

SoftBank gaining market share in Japan SoftBank market cap catching up with Docomo Mobile subscription data released last week show, that the SoftBank group continues to gain market share while incumbent NTT-docomo continues to lose market share – an upward trend for SoftBank, and a downward trend for NTT-docomo essentially unbroken since SoftBank acquired Vodafone-Japan…

-

Masayoshi Son: “I am a man – and I want to be Number 1”

SoftBank aims for global No. 1 position…acquiring SPRINT on the way to the top SoftBank: towards global No. 1 with a 300 year vision To understand SoftBank, and the planned SPRINT acquisition, you need to understand Masayoshi Son – and Masayoshi Son says: “I am a man – and I want to be Number 1”.…

-

Japan telecom sector financial results and the Softbank-Sprint take-over battle

SoftBank seeks to win, where Docomo failed – taking Japan’s telecoms know-how global Japan telecom sector financial results: very very healthy With SoftBank and DISH battling for US mobile operator SPRINT, the eyes are on Japan’s very healthy mobile phone sector, which a few days ago announced financial results for FY 2012. Japan’s mobile operators…

-

Japan wireless industry boom driven by smartphones. Japan adds about two Finlands worth of wireless subscriptions per year.

Japan wireless industry adds 11 million subscriptions/year currently Softbank targets ¥ 1 Trillion operational income Japan wireless industry is growing, and Japan’s mobile operators add 11 million subscriptions/year currently: Japan adds about two Finlands worth of wireless subscriptions per year. Softbank entered the telecom arena in 2001 with Yahoo BB, Nagoya Metallic and later Osaka…

-

Japan trends for 2013 (New Year post)

Japan replaced nuclear electricity generation by LNG, by imported gas Japan trends for 2013: Nuclear reactor restarts are on their way Japan trends for 2013 Japan’s energy sector: Japan has essentially replaced the 30% of its electricity energy supply which was from nuclear power plants, by electricity produced in aging thermal power plants from urgently…

-

Japan trends for 2013 (Christmas, Festive Season blog)

Japan trends for 2013: Energy crisis continues as a result of the Fukushima nuclear disaster Renewables: Japan’s feed in tariffs are among the world’s highest Japan trends for 2013: Japan’s energy sector: Prime-Minister Abe announced that he will review the Fukushima nuclear accident before taking decisions on nuclear power, essentially postponing the nuclear issue. Japan’s…