Category: electronics component makers

-

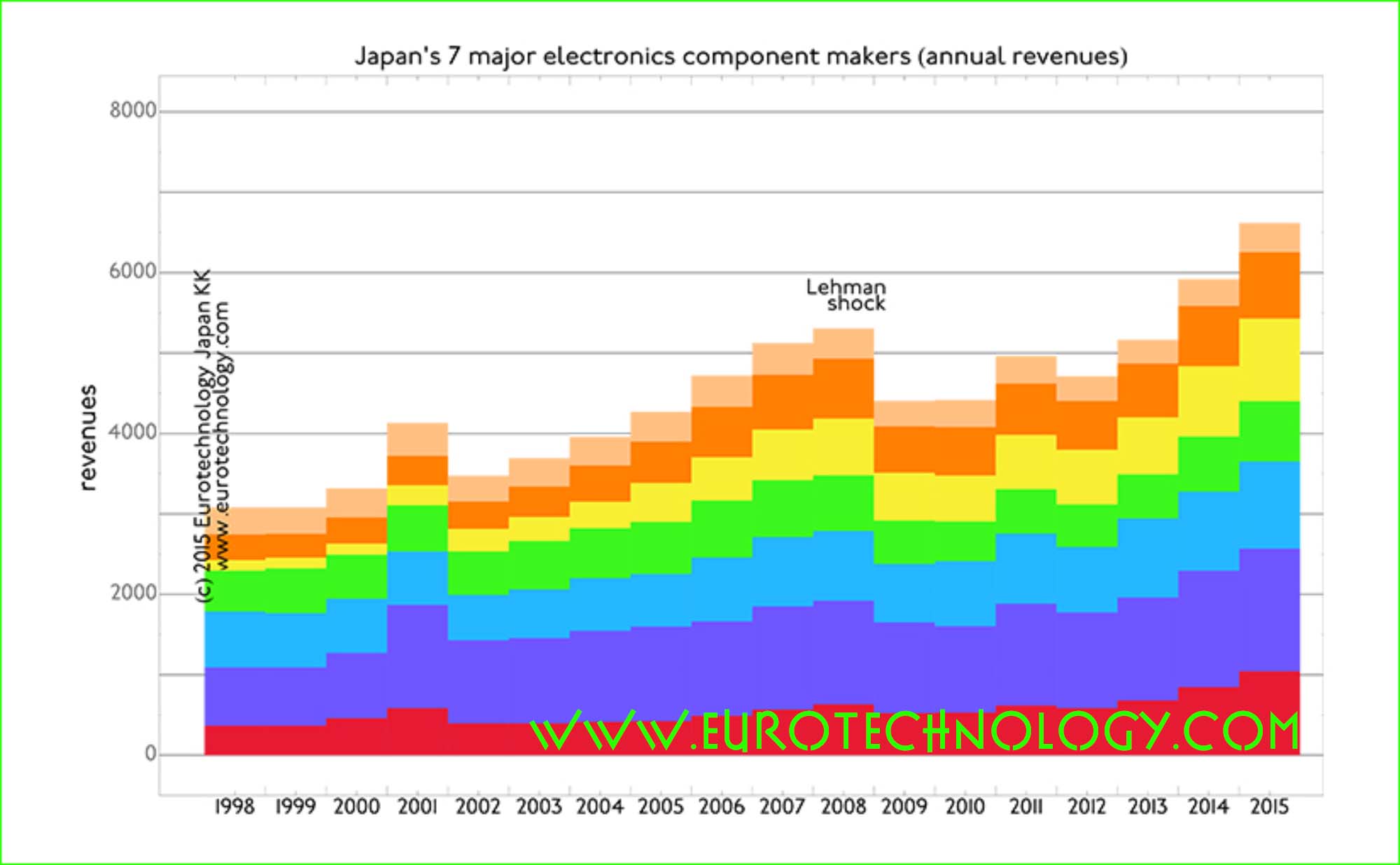

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

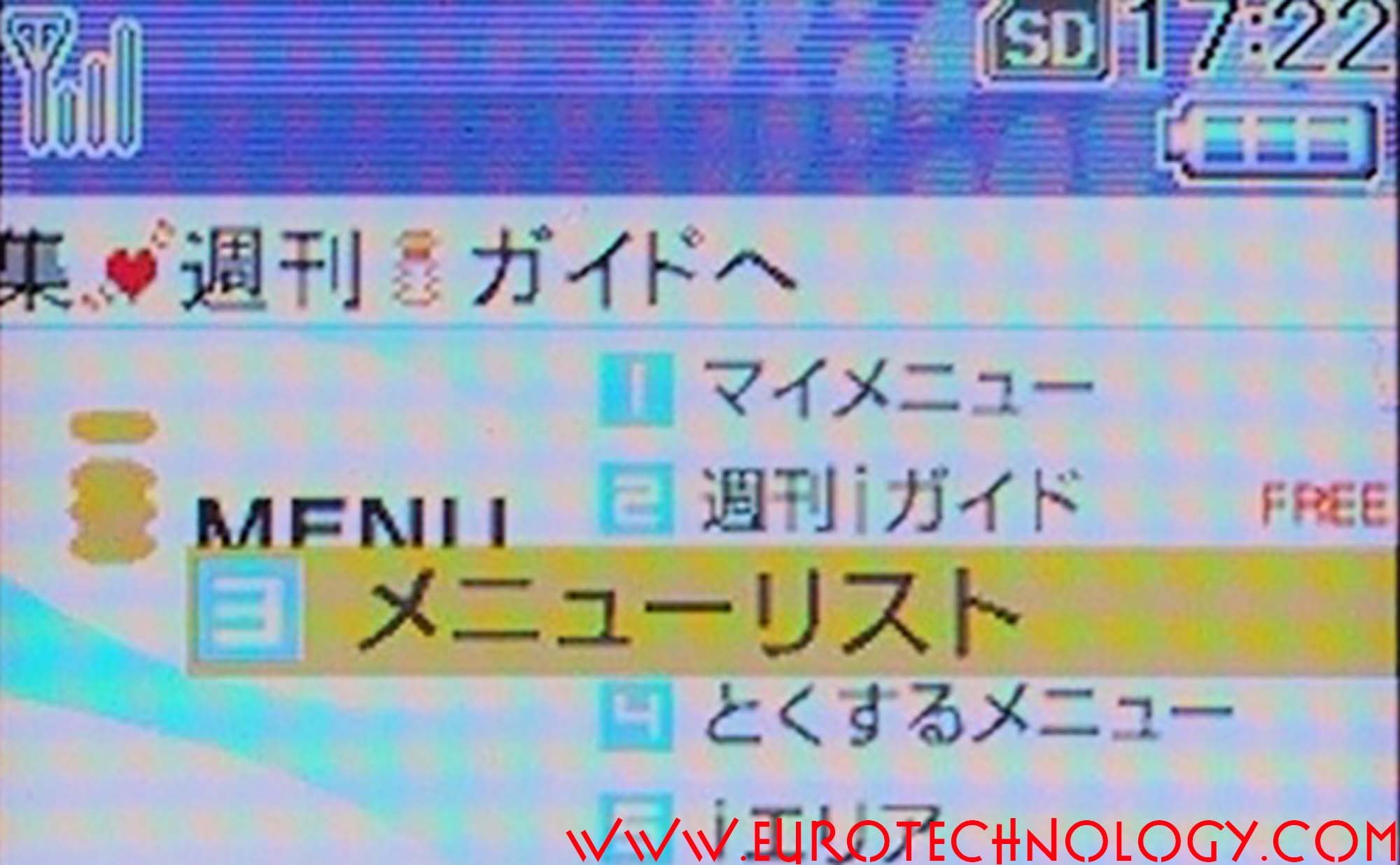

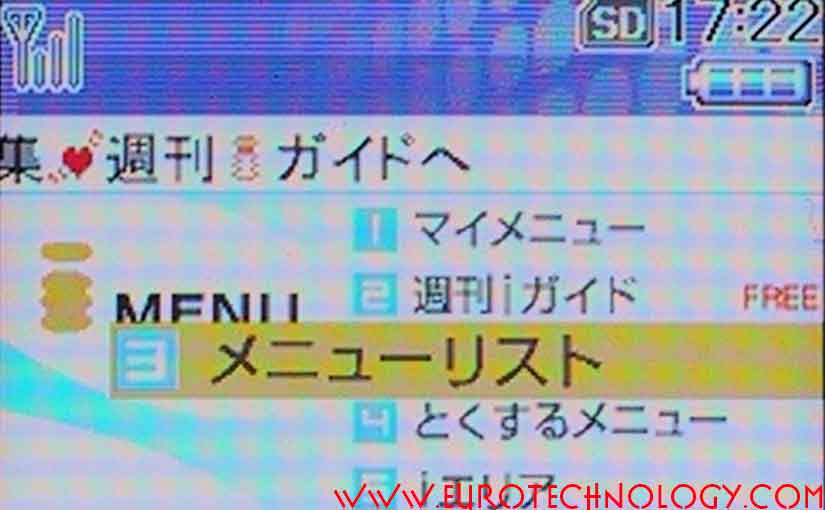

i-Mode was launched February 22, 1999 in Tokyo – birth of mobile internet

The mobile internet was born 16 years ago in Japan Galapagos-Syndrome: NTT Docomo failed to capture global value On February 22, 1999, the mobile internet was born when Mari Matsunaga, Takeshi Natsuno and Keiichi Enoki launched Docomo’s i-Mode to a handful of people who had made the effort to the Press Conference introducing Docomo’s new…

-

Murata cheerleader robots: stability, sensing, synchronized dance – waiting for open innovation and APIs?

Murata and its robots Murata introduced their newest Cheerleader robots in a press event on September 25, 2014 in Tokyo.Purpose of the robots is brand building and advertising of the company’s components and capabilities. Watch the Cheerleader robots dance synchronously here: Murata Manufacturing (村田製作所) While Japan’s eight electronics conglomerates stagnate in both revenues and income…

-

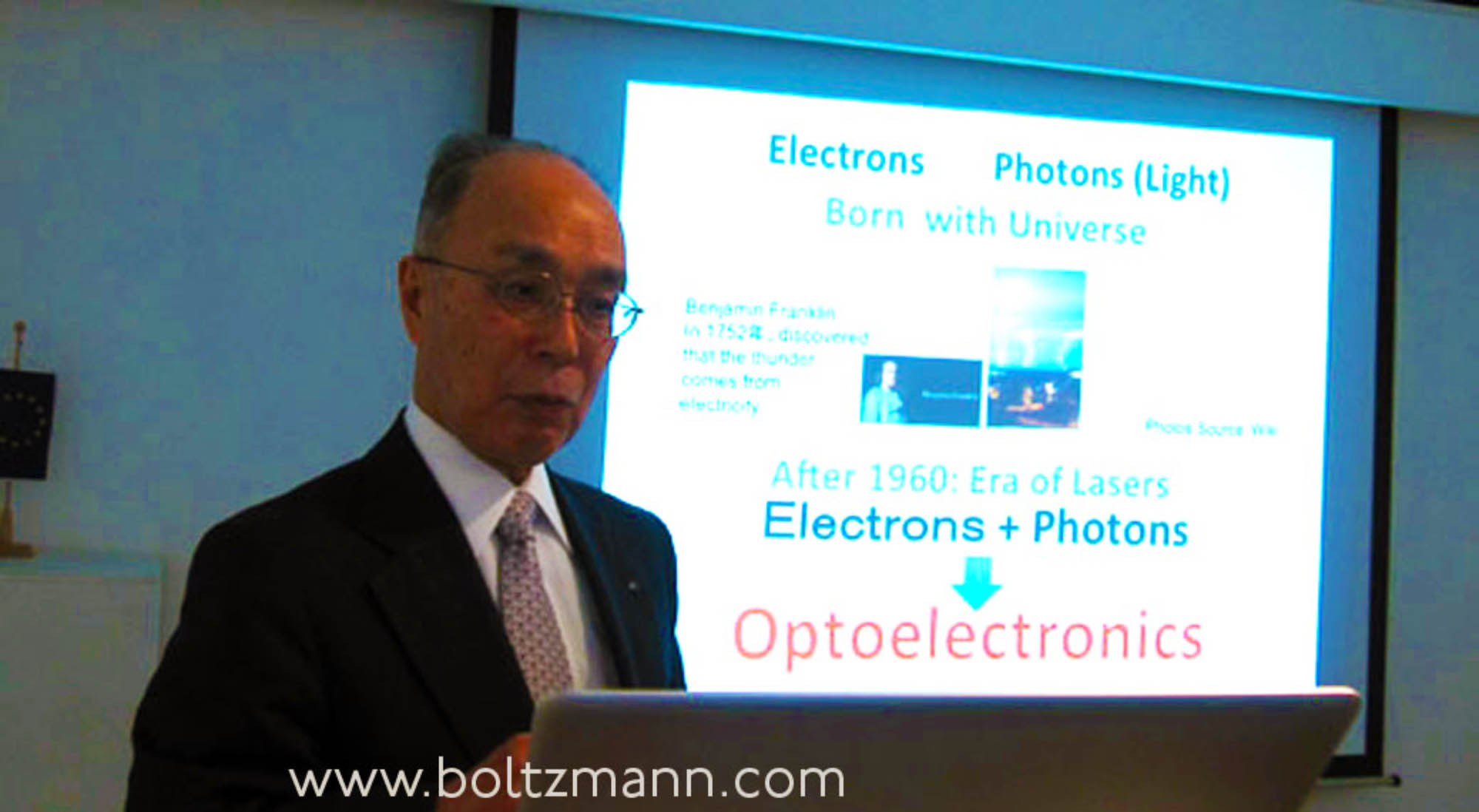

VCSEL – Vertical cavity surface emitting lasers by their inventor, Kenichi Iga (6th Ludwig Boltzmann Symposium)

VCSEL inventor Kenichi Iga: hv vs kT – Optoelectronics and Energy (Former President and Emeritus Professor of Tokyo Institute of Technology. Inventor of VCSEL (vertical cavity surface emitting lasers), widely used in photonics systems) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. VCSEL: how…

-

Japan electronics industry seen by Freescale-Japan President & “Asian Le Mans Race” at Fuji Speedway

David Uze, President for Japan & Korea of Freescale on Japan electronics industry Perspectives for electronics industries in Japan 【日本語版こちらへ】 In this newsletter David Uze, President for Japan & Korea of the global semiconductor electronics company Freescale, shares his success story in Japan, and his perspectives on Japan’s electronics industry sector…. note: compare also with…

-

NEC revenues shrink from YEN 5000 billion in 1998 to YEN 3000 billion in 2012

NEC is one of NTT’s traditional four equipment suppliers NEC is one of NTT’s traditional suppliers of telecom equipment, and one of Japan’s flagship electronics companies. In the early days of the PC age, NEC dominated Japan’s PC market with the 98 series of PC, which had a NEC-proprietary variation of MicroSoft’s MS-DOS operating system.…

-

Sony earnings boosted by weak yen – BBC interview about SONY earning results

Helped BBC with the article “Sony earnings boosted by weak yen and smartphone sales“ https://www.bbc.com/news/business-23527714 for detailed analysis of Japan’s electronics industry sector including SONY, see: Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

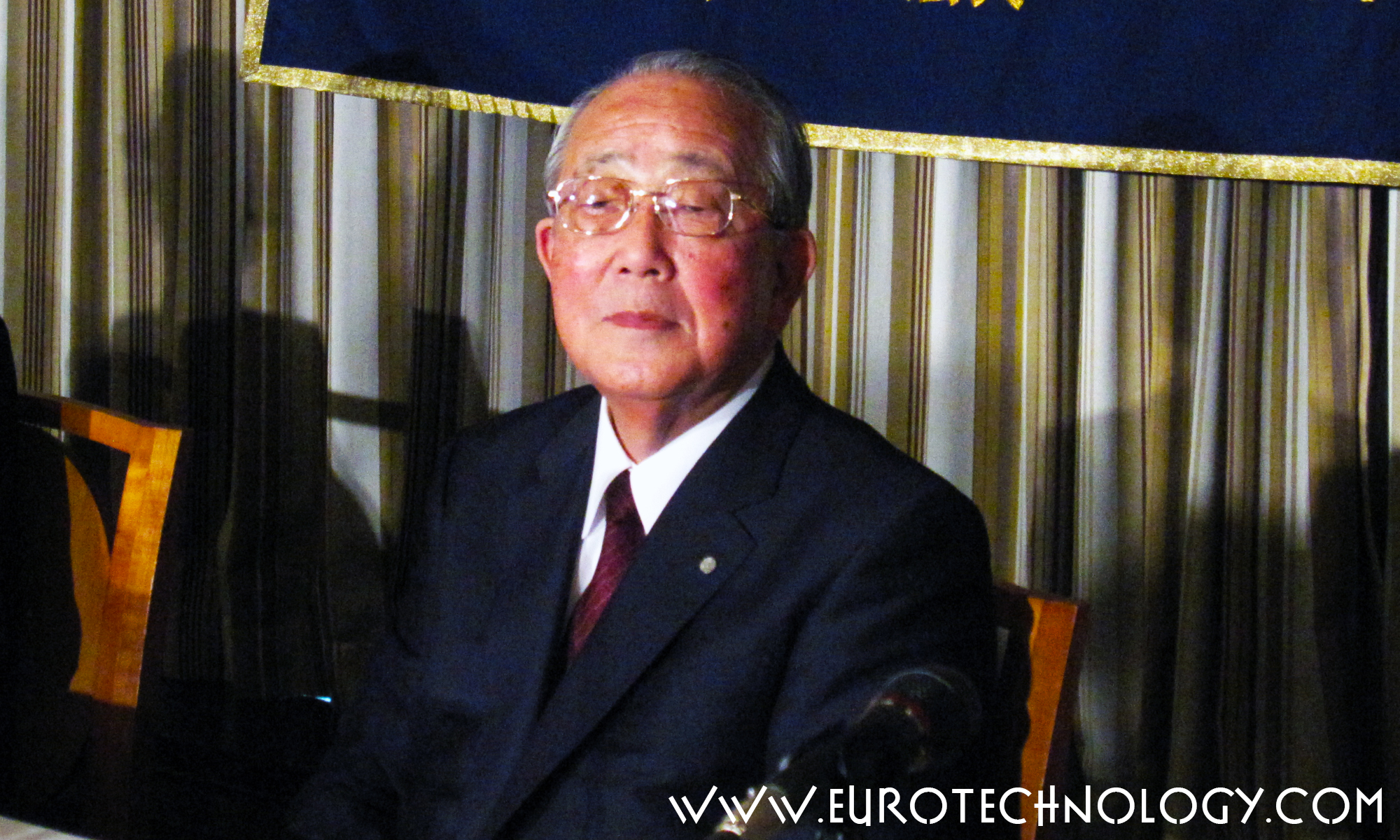

Kazuo Inamori, founder of Kyocera and DDI (KDDI), rebuilds Japan Airlines using Amoeba Management (アメーバ経営)

Kazuo Inamori (稲盛 和夫) one of Japan’s legendary serial entrepreneurs Japan Airlines (日本航空株式会社) turnaround from bankruptcy Bad news from Japan’s electronics industry sector makes global headlines this week (I was interviewed on BBC, US National Public Radio etc) – in this newsletter, lets look at some good news from Japan. Kazuo Inamori (80 years old,…

-

Japanese electronics groups need new business models (BBC-interview: Yen ‘not the cause of woes of Japan’s electronics firms’)

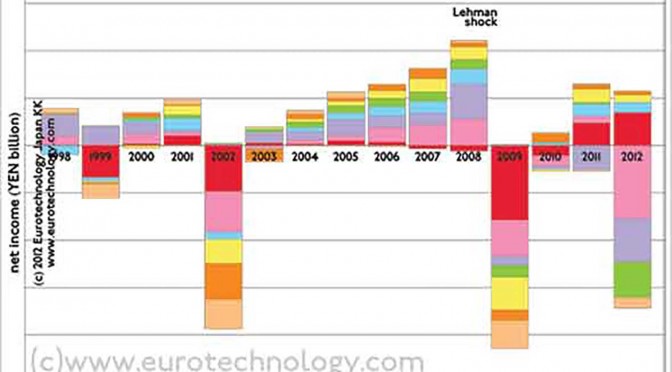

Japanese electronics groups combined as of similar size as the economy of the Netherlands Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands. Over…

-

Japan’s tech companies need to restructure – CNBC March 27, 2012

https://www.cnbc.com/video/2012/03/27/japans-tech-companies-need-to-restructure.html Japan’s electronics industries – research report

-

Upbeat on Intel (CNBC TV interview) (Airtime: Tues. Apr. 14 2009)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Kyocera expands in Europe via acquisition of TA Triumph-Adler

Kyocera is one of Japan’s powerful electronics companies, which together are about as large economically as the whole of the Netherlands. Taking advantage of low EURO exchange rates and the high YEN, and low valuations during the current economic crisis, Kyocera acquired 93.84% of TA Triumph-Adler AG for a total purchase price on the order…

-

72.5% of all digital mobile TV on this planet earth is in Japan

About 50 million mobile phones equipped with digital terrestrial mobile TV (“oneseg”) have been delivered up until today – not counting “oneseg” tuners for PCs, car navigation units and stand-alone units. Comparing this number with reports of mobile TV roll-out in other countries around the world, we conclude that 72.5% of todays mobile phones with…

-

Wild differences in operating margins for mobile, TV media groups and electricals

We analyze the effect of the crisis on operating margins in three different sectors in Japan: (1) electronics,(2) mobile communications(3) TV media groups. In sector (1), Nintendo‘s margins are above 30% and increasing despite the crisis, while traditional electronics companies’ margins are evaporating. (2) for mobile operators DoCoMo, KDDI and SoftBank margins are 10%-20% and…

-

ICT trends for Japan for 2009

Smartphones, European exits from Japan, and M&A ICT trends for Japan: Ericsson and Nokia Siemens Networks (NSN) remain engaged in Japan’s ICT sector by Gerhard Fasol One of the Embassies here in Tokyo asked me to write a report about ICT trends for Japan… ICT trends for Japan: Mobile phone sector Pushed by the Government…

-

Japan electronics industry: Outlook for the Chip Industry (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

L.G. Philips Post Strong Q3 Profits (CNBC TV Interview)

More in our J-ELECTRIC Report Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Briefing about Japan’s high-technology business world for Mme Nicole Fontaine

Briefing about Japan’s high-technology business sector for Mme Nicole Fontaine, Vice-Minister for Industry of France Tokyo, Friday, September 20, 2002, at the French Chamber of Commerce and Industry in Japan. Copyright·©1997-2013 ·Eurotechnology Japan KK·All Rights Reserved·