Category: telecommunications

-

Apple-Samsung Patent War and Impact on Japans Industries (talk at Foreign Correspondents Club Tokyo on Oct 2, 2012)

PROFESSIONAL LUNCHEON “Apple-Samsung Patent War and Impact on Japans Industries” Speaker: Gerhard Fasol Tuesday, October 2, 2012 12:00-13:30 Foreign Correspondents Club Japan (FCCJ), Yurakucho Outline: In a global war to dominate the smartphone market, Samsung and Apple have been at each other’s throats, playing out the war in courts around the world and accusing each…

-

Mobile payments: 10 years to reinvent the wheel?

Mobile payments for train travel was demonstrated in Tokyo in 2003, but has not reached London yet Mobile payments: Tokyo (mobile SUICA) vs. London (OYSTER) Mobile payments are big: Reuters estimates that the mobile payment market will be about US$ 1000 Billion by 2016, and in Japan just a single railway line achieves already now…

-

How to turn Galapagos into a competitive advantage in both directions

Positive and negative aspects of Japan’s Galapagos issues European Institute of Japanese Studies Academy Seminars presents Speaker: Dr. Gerhard Fasol, President, Eurotechnology Japan K.K. Wednesday, June 13, 2012, 18:30 – 21:00 Embassy of Sweden, Alfred Nobel Auditorium Stockholm School of Economics, European Institute of Japanese Studies About the talk: In the last 20 years, several…

-

Disaster communication. Lessons from the Tohoku disaster

Communications save lives during disasters Disaster communication: keynote at the 7th KCC Korea Communications Conference, Seoul Communications save lives during disasters, and are essential for survival, for “situational awareness” (= to know what is going on), for decision making, and business continuity. Nobody likes to experience a disaster, but when disaster strikes there is no…

-

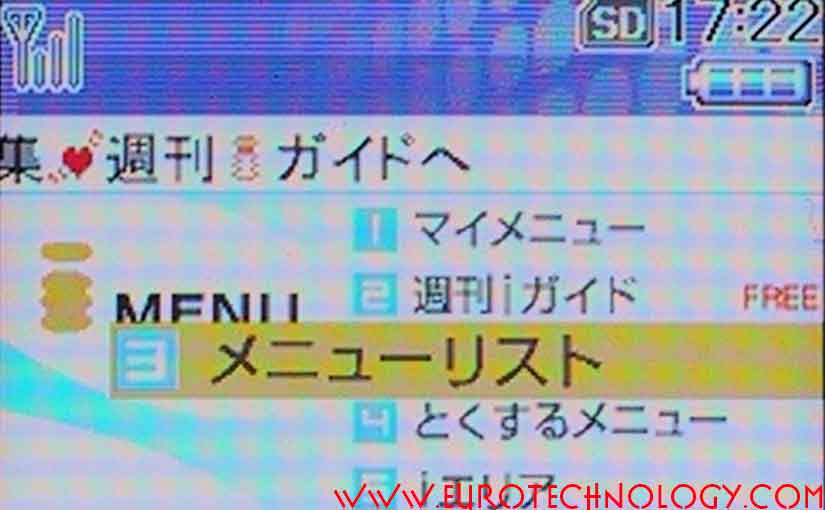

Post-Galapagos Japan? – globalizing Japan’s fantastic technologies…

Japan Galapagos effect: “Why do Japanese companies make so beautiful mobile phones with fantastic functions, and have almost no global market share?” I asked this question back in 2003 to NTT-DoCoMo’s CEO Dr. Tachikawa (see my article “Leadership questions of the week” in Wallstreet Journal of June 12, 2006, page 31), and offered several proposals…

-

Will cash become obsolete?

Gave presentation to the Telecommunications Committee of the American Chamber of Commerce in Japan (ACCJ) on October 7, 2009, entitled “Will cash become obsolete? E-money, mobile payments and mobile commerce”. Talk was attended by about 30-40 executives from major global telecom operators, global banks, new-age payment companies, and from major internet companies. Outline: What is…

-

When did qr-codes start on mobile phones? (in August 2002)

qr-codes were developed by Toyota subsidiary denso-wave When did qr-codes start on mobile phones: First mobile phone with qr-code reader was the J-SH09 by SHARP for Japanese mobile operator J-Phone When did qr-codes for mobile phones start in Japan? Here is the answer: the first mobile phone with qr-code reader was the J-SH09 produced by…

-

M-payments and e-money grow exponentially

1 Billion e-money transactions/month around 2014 Exponential growth: The number of e-cash payments per month increases by a factor of 10 about every 4 years E-money transactions (including mobile e-cash) grow exponentially in Japan, and we expect to see 1 Billion e-money transactions/month around 2014 (this figure would be much bigger if contactless train travel…

-

10 years e-cash and mobile payments

Mobile phone payments with RFID start in Japan in 2003 i-Mode mobile payments started in Japan in 1999 10 years ago – 1999 – the global mobile payment revolution started in Japan: with i-mode introducing an essentially Japan-only highly successful micropayment system for online content and brick-and-mortar based m-commerce, and SONY’s Edy starting e-cash experiments…

-

Mobile 2.0 at the Korean Communications Conference, Seoul, June 18, 2009

Chairing and keynoting Track 3-3 “Mobile 2.0” at the Korean Communications Conference in Seoul on Thursday June 18, 2009 at the COEX Conference Center. What will Mobile 2.0 be and how do we get there? Korea and Japan can be like a time-machine: if we look at Korea and Japan today, we can get a…

-

New opportunities versus old mistakes – foreign companies in Japan’s high-tech markets (presentation at Stanford University)

About 10 years ago, on October 28th, 1999, I was invited to give a talk about this topic at Stanford University’s US-Japan Technology Management Center for Stanford Faculty, alumni and Silicon Valley entrepreneurs. 10 years is a good period to check out how much of that is still valid today, and how much Japan has…

-

beeTV – DoCoMo’s new mobile TV

Japan leads mobile phone experimentation Japan introduces and tests a large range of experimental and innovative mobile services On May 1, 2009, DoCoMo in cooperation with media firm Avex started the mobile TV beeTV which brings 8 channels including a MOOLOG Channel (MOOLOG = MOOvie-bLOG) beeTV is an indicator how Mobile TV may impact Japan’s…

-

Potential Flu Pandemic Positive for Telcos

Potential Flu Pandemic Positive for Telcos (Airtime: Tuesday, April 28, 2009) Read more about Japan’s telecom sector: http://www.eurotechnology.com/store/jcomm/ Read more about DoCoMo: http://www.eurotechnology.com/store/imode/ Read more about KDDI: http://www.eurotechnology.com/store/kddi/ Read more about Softbank: http://www.eurotechnology.com/store/softbank/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Does the "not-invented-here" syndrome slow down the development of mobile internet and mobile content outside Japan?

It is well known that mobile internet, mobile payments and mobile content business and many other areas of mobile broadband are much more developed in Japan and South Korea than in other countries. NOKIA and Vodafone and some other western mobile phone companies had the opportunity to take part in Japan’s mobile payment systems, mobile…

-

"Mobile Internet Device will replace Cell Phone! Do you agree?" [from a LinkedIn discussion]

[My answer to a recent LinkedIn discussion group question: “Mobile Internet Device will replace Cell Phone!”] This is too narrow a view. I would say: today’s state of the art cell phones already include the role of internet device + many other functions, mobile internet devices cannot do. 1. For several years practically all Japanese…

-

iida – a new brand for KDDI’s design series

KDDI created a new brand: “iida” for the long running best selling AU design series mobile phones. KDDI introduced some of the most recent iida design series models at the KDDI Designing Center. In addition to the earlier Yamaha musical instruments phones, KDDI introduced a spectacular phone created by Yayoi Kusama. Fun is the green…

-

72.5% of all digital mobile TV on this planet earth is in Japan

About 50 million mobile phones equipped with digital terrestrial mobile TV (“oneseg”) have been delivered up until today – not counting “oneseg” tuners for PCs, car navigation units and stand-alone units. Comparing this number with reports of mobile TV roll-out in other countries around the world, we conclude that 72.5% of todays mobile phones with…

-

Top 10 mobile trends for 2009

Answering the question “Top 10 mobile trends for 2009: what would you choose?” We answer from our perspective here in Tokyo: Mobile payments and wallet phonessee our mobile payment report GPS and location based services (LBS) such as navigation and mapping see our location based services (LBS) report Mobile search including location related search QR…

-

Wild differences in operating margins for mobile, TV media groups and electricals

We analyze the effect of the crisis on operating margins in three different sectors in Japan: (1) electronics, (2) mobile communications (3) TV media groups. In sector (1), Nintendo‘s margins are above 30% and increasing despite the crisis, while traditional electronics companies’ margins are evaporating. (2) for mobile operators DoCoMo, KDDI and SoftBank margins are…

-

8 years since commercial start of location based services (LBS) in Japan in July 2001

It will soon be 8 years since DoCoMo started commercial location based services (LBS) for mobile phones in Japan in July 2001. During these 8 years, Japan’s mobile LBS industry has grown and a range of differentiated mobile LBS services has emerged – indicative of how the LBS industry might develop in other countries in…

-

+ 49% y-o-y net profit increase for KDDI

Japan’s telecom operators are a very bright spots in a dismal economic crisis. I think that’s not a coincidence. Why? The deeper purpose of Japan’s location based services, QR-codes, mobile music, e-moji, wallet phones and keitai credit etc. has always been to make mobile phones inseparable from people’s daily lives, so that people would use…

-

3G mobile diversity in China

China’s Ministry MIIT granted three different 3G cellphone licenses on January 7, 2009: a TD-SCDMA license to China Mobile (457 million GSM subscribers) a wCDMA license to China Unicom (133 million GSM subscribers) a CDMA2000 license to China Telecom (43 million CDMA subscribers acquired in 2008 from China Unicom, 216 million fixnet phone subscribers, 38…

-

Mobile marketing with QR-code

If your business requires interacting with lots of people in Japan, if you are offering services to consumers, or just as a convenience offered on your business cards – think about QR codes: Eurotechnology Japan blog: Mobile marketing with QR-code Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

5 top tips for mobile marketing?

Answering the question: “What are the 5 top tips for mobile marketing” Our company worked for several of the world’s largest consumer companies on mobile marketing here in Tokyo/Japan.- Many of Japan’s mobile trends usually move to Europe and US within about 3-5 years. So here are some tips from our work on mobile marketing…

-

Japan trends 2008/2009

One of our clients in the financial industry asked me several trend questions: Q1: Biggest surprises in Japan in 2008? Collapse of Japan’s mobile phone handset market (read our blog). In this context the Japanese telecom equipment makers association invited me to give a presentation, which was booked out 2-3 weeks ahead – about 100…

-

ICT trends for Japan for 2009

Smartphones, European exits from Japan, and M&A ICT trends for Japan: Ericsson and Nokia Siemens Networks (NSN) remain engaged in Japan’s ICT sector by Gerhard Fasol One of the Embassies here in Tokyo asked me to write a report about ICT trends for Japan… ICT trends for Japan: Mobile phone sector Pushed by the Government…

-

NOKIA quits Japan – for now…

NOKIA’s Japan subsidiary was founded on April 3, 1989 – almost 20 years ago. On November 27, 2008 NOKIA announced to terminate selling mobile phones to Japan’s mobile operators, effectively withdrawing from Japan (except for purchasing, R&D and VERTU). NOKIA’s sales figures in Japan were a well kept secret until last week when several Japanese…

-

Japan’s mobile phone disaster

Japan’s mobile phone sector is admired the world over, and Japanese mobile phones are years ahead the rest of the world regarding functionality. However, Japan’s mobile phone industry may be heading for a disaster, similar to the European 3G spectrum license fee disaster which almost bankrupted Europe’s mobile phone operators – unless changes are made…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

presentation by Gerhard Fasol, at the Industry Association of Japanese telecom and networking equipment makers, Friday November 27, 2008, 15:00-16:30 Presentation was fully booked several weeks before the talk, attended by about 100 managers and executives of Japan’s telecom equipment makers, and included also the Vice-Minister/Secretary of State of Japan’s General Affairs Ministry, which is…