Category: telecommunications

-

New Japan vs old Japan: Japan’s two worlds

Japan’s two worlds New Japan vs Old Japan A few days ago the New Context Conference was held here in Tokyo, mainly about social network systems (SNS), top executives including CEO of LinkedIn, Facebook, and some exciting new photo, video conference and e-learning companies discussed market entry to Japan. Japan’s two markets Takeshi Natsuno, one…

-

Yamaha Mobile Orchestra – mobile phones musical instruments

Using the motion, acceleration and position sensors to convert smart phones into musical instruments Yamaha Mobile Orchestra uses mobile phones equipped with motion and acceleration sensors as musical instruments Copyright (c) 2008-2013 Eurotechnology Japan KK All Rights Reserved

-

eMobile – interview with CEO and founder Dr Sachio Semmoto by Dr. Gerhard Fasol

New entrant challenging Japan’s mobile incumbents Docomo and KDDI and SoftBank. A discussion between Dr Sachio Semmoto and Dr. Gerhard Fasol Dr Sachio Semmoto: one of Japan’s most successful serial entrepreneurs eMobile is Japan’s newest & fastest growing mobile operator, focused on mobile broadband – currently at HSDPA speeds up to 7.2 Mbps and HSUPA/EUL…

-

Nokia & Sony Ericsson Results Likely to Disappoint (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

eMobile: "New age" mobile operator innovates

“New Age” mobile operator eMobile started with a “green field” nationwide HSDPA 3G network offering commercial services since March 31, 2007. By August 2008, eMobile has attracted more than 750,000 subscribers. eMobile‘s network covers about 85% of Japan at this time. At an investors conference, eMobile‘s CEO recently explained, how his company could reduce the…

-

iPhone in Japan – in the press

Here some articles about the panel discussion at the Foreign Correspondents’ Club of Japan on the topic “Will The iPhone Trigger A Turning Point In Japan’s Mobile Phone Industry?” Apple iPhone is having success in Japan against local internet mobiles (The Australian) The iPhone’s impact in Japan (BusinessWeek) Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

75% of mobile phones in Japan ship with digital mobile TV

Digital mobile TV started in Japan in 2005 – about 3 years ago: KDDI/AU sold the first phones with digital mobile TV starting in October 2005, at the same time mobile TV was available for public testing. The official commercial service of mobile TV started on April 1, 2006. Today more than 75% ship with…

-

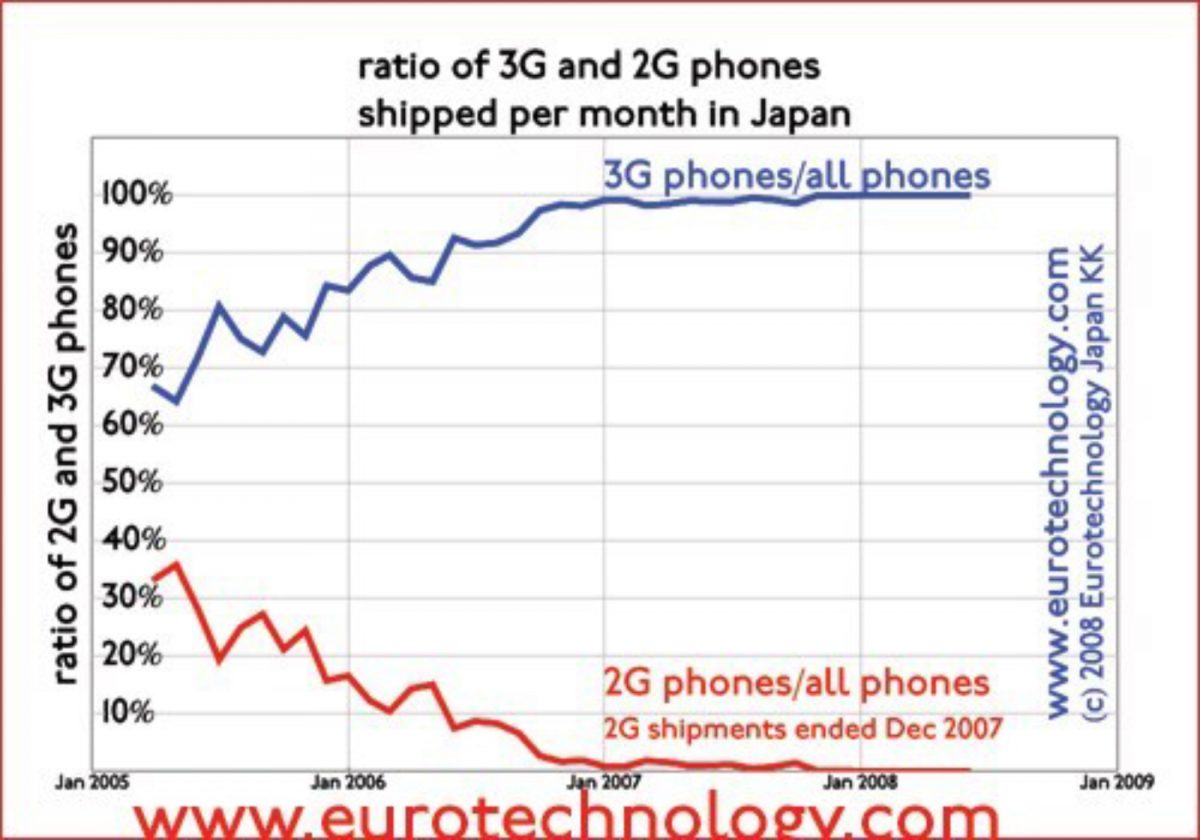

Last 2G phone shipped 8 months ago in Japan, 2G networks are switched off

KDDI/AU switched off 2G radio network in March 2008, Docomo and SoftBank to switch off 2G networks in 2009 Second generation (2G) phones silently bowed out of Japan’s market 8 months ago: the last 2G phones in Japan were shipped in December 2007. KDDI/AU switched off their 2G radio network in March 2008, this year,…

-

Will the iPhone trigger a turning point in Japan’s mobile phone industry?

Tetsuzo Matsumoto (Senior Executive Vice-President and Board Member of SOFTBANK MOBILE Corporation), Gerhard Fasol (CEO, Eurotechnology Japan KK)and Dennis Normile (Japan Correspondent of SCIENCE Magazine, and FCCJ) discuss about the future of Japan’s mobile phone market. “Will the iPhone trigger a turning point in Japan’s mobile phone industry?”(Foreign Correspondents’ Club of Japan, Tokyo Wednesday, August…

-

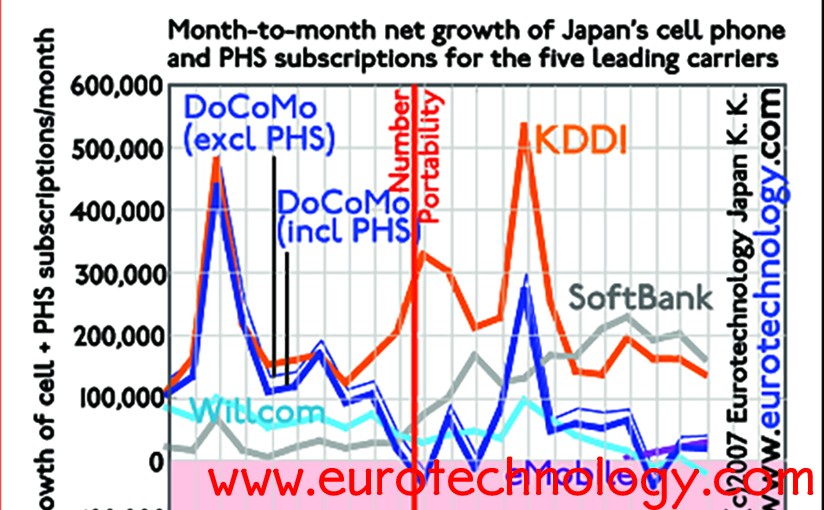

How many iPhones were sold in July 2008 in Japan?

How many iPhones did SoftBank sell in Japan during July? Our estimate: between 75,000 – 125,000. Read on about how we arrived at this estimate. Net growth of mobile subscription numbers in Japan (Japan’s mobile market grows by about 5.5 million per year – for more analysis read our JCOMM-Report). How did we arrive at…

-

NTT-Data expands to Europe: Acquisition of Cirquent GmbH

NTT Data and BMW agreed today, that NTT Data will acquire 72.9% of outstanding shares of Cirquent GmbH NTT Data thus gains BMW as largest customer in Europe Today, August 1, 2008, NTT Data and BMW agreed, that NTT Data will acquire 72.9% of the outstanding shares of Cirquent GmbH in order to globalize. Cirquent…

-

It’s an entirely different story for the iPhone in Japan than anywhere else…

In a terse one-line press announcement “SoftBank today announced it has signed an agreement with Apple to bring the iPhone to Japan later this year”. (Of course we are talking about the 3G i-Phone, because Japan has almost switched off the 2G networks, and has essentially stopped selling 2G phones for a couple of years…

-

Japan’s Mobile Space Not Saturated

More in our J-COMM report: http://www.eurotechnology.com/store/jcomm/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Yahoo Japan – Yahoo! Complication

There are two YAHOO!s – YAHOO! Inc and YAHOO! KK. (ヤフー株式会社) Yahoo! KK, ヤフー株式会社 is a Japanese corporation listed on the Tokyo Stock Exchange Yahoo! KK (ヤフー株式会社) is not a full/100% subsidiary of Yahoo Inc, but Yahoo! KK is a publicly traded company, listed on the Tokyo Stock Exchange. Ownership of Yahoo! KK (ヤフー株式会社) 35.45%…

-

Mobile Industry Resilient to the downturn (CNBC TV interview)

More in our report on Japan’s telecom and mobile sector Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

iPhone Dials into Japan (CNBC TV interview)

More about SoftBank and SoftBank’s iPhone business in Japan Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Market caps of companies in mobile: global vs local

Google, Apple, Nokia, HTC, Vodafone and are winning the driver’s seat of the global internet revolution. DoCoMo, KDDI and SoftBank essentially stay inside Japan for now – limiting their growth prospects and leaving global opportunities to others. GOOGLE with Android and APPLE with iPhone are reaching for the driver’s seat of the global mobile data…

-

SoftBank and KDDI win market share, Docomo loses

SoftBank from 4th to 1st position within less than 12 months… SoftBank‘s turn-round of x-Vodafone-Japan, went faster than many expected. Within less than 12 months SoftBank went from last place to first place in customer sign-ups, overtaking even KDDI‘s super-popular AU. Willcom recently suffers from SoftBank‘s revival, as well as from eMobile‘s flat rate data…

-

First half FY2008 results: SoftBank and KDDI profits increase, DoCoMo’s trends is downward

In the last few days NTT, NTT-DoCoMo, KDDI and SoftBank announced their first half financial results. SoftBank and KDDI are the winners both for market share and for profits, while DoCoMo‘s results and market shares are sinking, and pulling the NTT-Group down at this time. Extrapolation indicates that DoCoMo‘s net profits may fall into the…

-

KDDI Set To Post Record H1 Profit (CNBC TV interview)

Need to know more about KDDI? Read our Report on KDDI Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

SuiPo – linking posters to mobile phones and IC cards

JR-East introduced SuiPo (Suica Poster). People who want to participate need to register and link their plastic SUICA card, or their mobile SUICA (wallet phone with installed SUICA application) with a registered mobile or PC email address. Whenever a registered participants touches the SUICA reader/writer on the side of a poster, links to a campaign…

-

Nanaco – e-cash and m-cash for Seven-Eleven

Seven-Eleven rolls out national electronic money and mobile payment system Retail chain AEON follows with WAON e-cash and mobile money This week two of Japan’s largest retail chains roll out electronic and mobile cash: Monday April 23rd, 2007 the Seven & I Holdings Group started “nanaco” and tomorrow, Friday April 27th, 2007, the AEON retail…

-

eMobile – mobile disruption in Japan

On March 31, 2007 eMobile will start high-speed (3.6 Mbps, HSDPA) mobile data services in Tokyo, Osaka and Nagoya, bringing disruption into the mobile data market in Japan. While Willcom offers a flat data rate of YEN 9000 (US$ 77) per month for unlimited data transmission at 128kbps, eMobile will offer 30 times higher speed…

-

PASMO: IC cards for transport

On Sunday, March 18, 2007, about 100 transportation companies in the Tokyo region switched to the near-field electronic money and payment system PASMO. Electronic money is a new battle field which JR-East pioneered with SUICA. Seven & I is still to throw it’s weight into the battle – read about today’s status of the electronic…

-

“Help – my mobile phone does not work!” – Why Japan’s mobile phone sector is so different from Europe’s

Presentation at the Lunch meeting of the Finnish Chamber of Commerce in Japan (FCCJ) on March 16, 2007 at the Westin Hotel, Tokyo. Summary of the event and photographs here: https://web.archive.org/web/20160815232148/http://www.fcc.or.jp/lunch160307.html The presentation is not available any longer on the FCCJ website however you can download our report about Japan’s telecom sector. An abbreviated version…

-

Mobile payment and the future of money (presentation at CLSA Japan Forum)

Can e-money and mobile payment replace cash? Example: mobile payment for the world’s busiest train line CLSA – Asia-Pacific Markets – last week organized the “CLSA Japan Forum” here in Tokyo. About 800-1000 investment bankers, portfolio managers, investors, analysts came together. Since last year interest of global investors in Japan has increased a lot. Eurotechnology…

-

Mickey mouse and Disneychannel use QR-Codes

Disneychannel places advertisements with huge QR-code on Tokyo’s roofs. People passing by point their mobile phones at Mickey’s QR-code, and the mobile phone takes them to Disneychannel’s mobile site. QR codes were developed in the 1990s by Toyota affiliate Denso-Wave to manage car parts – today they are by far the best way to link…

-

European Central Bank (ECB) uses QR-codes

QR codes were developed in the 1990s to manage car parts – today they are by far the best way to link mobile phones to almost anything. In many applications QR codes are cheaper, easier, more flexible and more secure than RFID and NFC. The European Central Bank (based in Frankfurt) manages the EURO, is…

-

3G Summit and Mobile Payment workshop

Mobile Payment workshop and Global 3G Evolution Forum in Tokyo – Makuhari 3GPP, UMTS-Forum, Verizon and Docomo and others 22-25 January 2007 MarcusEvans organized the “Global 3G Evolution Forum” in Makuhari near Tokyo. Speakers included: Takanori Utano, Executive Vice-President and CTO of DoCoMo, Takehiro Nakamura of NTT and Vice-Chairman of 3GPP Jean-Pierre Bienaime, Chairman of…

-

Mobile subscriptions grow by 5 million in Japan during 2006

Japan’s mobile subscriber numbers grew by about 5 million in 2006. Because of the much higher ARPU, Japan’s mobile market again grew by a couple of Finlands during 2006. A growing number of people have more than one mobile phone, to take advantage of the best rates, eg for mail, voice and data. We expect…