Tag: docomo

-

Mobile internet coming of age: i-Mode’s 18th birthday

The global mobile internet was born today 18 years ago, on February 22, 1999 by Gerhard Fasol NTT Docomo announced the start of i-Mode on February 22, 1999 at a press conference in Tokyo Today, 18 years ago, on February 22, 1999, Mari Matsunaga, Takeshi Natsuno, and Keiichi Enoki announced the start of the world’s…

-

Mobile internet’s 17th birthday

The global mobile internet revolution started with Docomo’s i-Mode on February 22, 1999 i-Mode, Happy Birthday! Today, exactly 17 years ago, on February 22, 1999, NTT-Docomo launched the world’s first mobile internet service, i-Mode, at a press conference attended only by a handful of people. NTT-Docomo created the foundation of the global mobile internet revolution,…

-

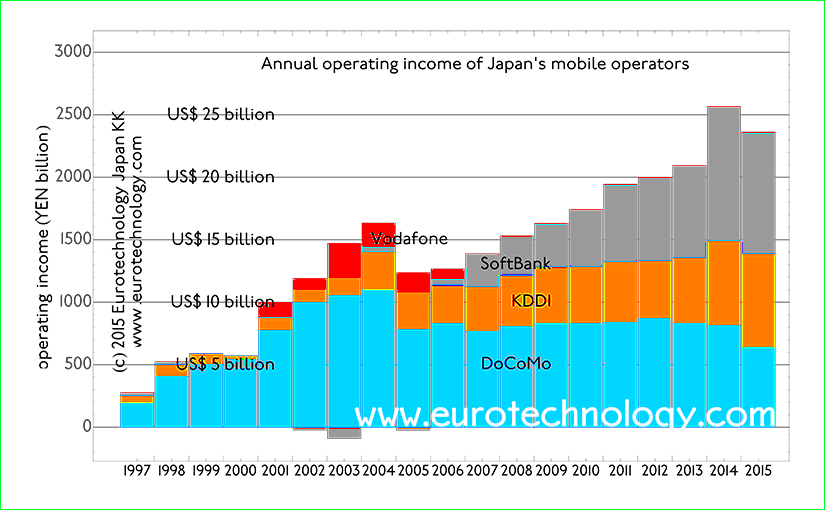

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

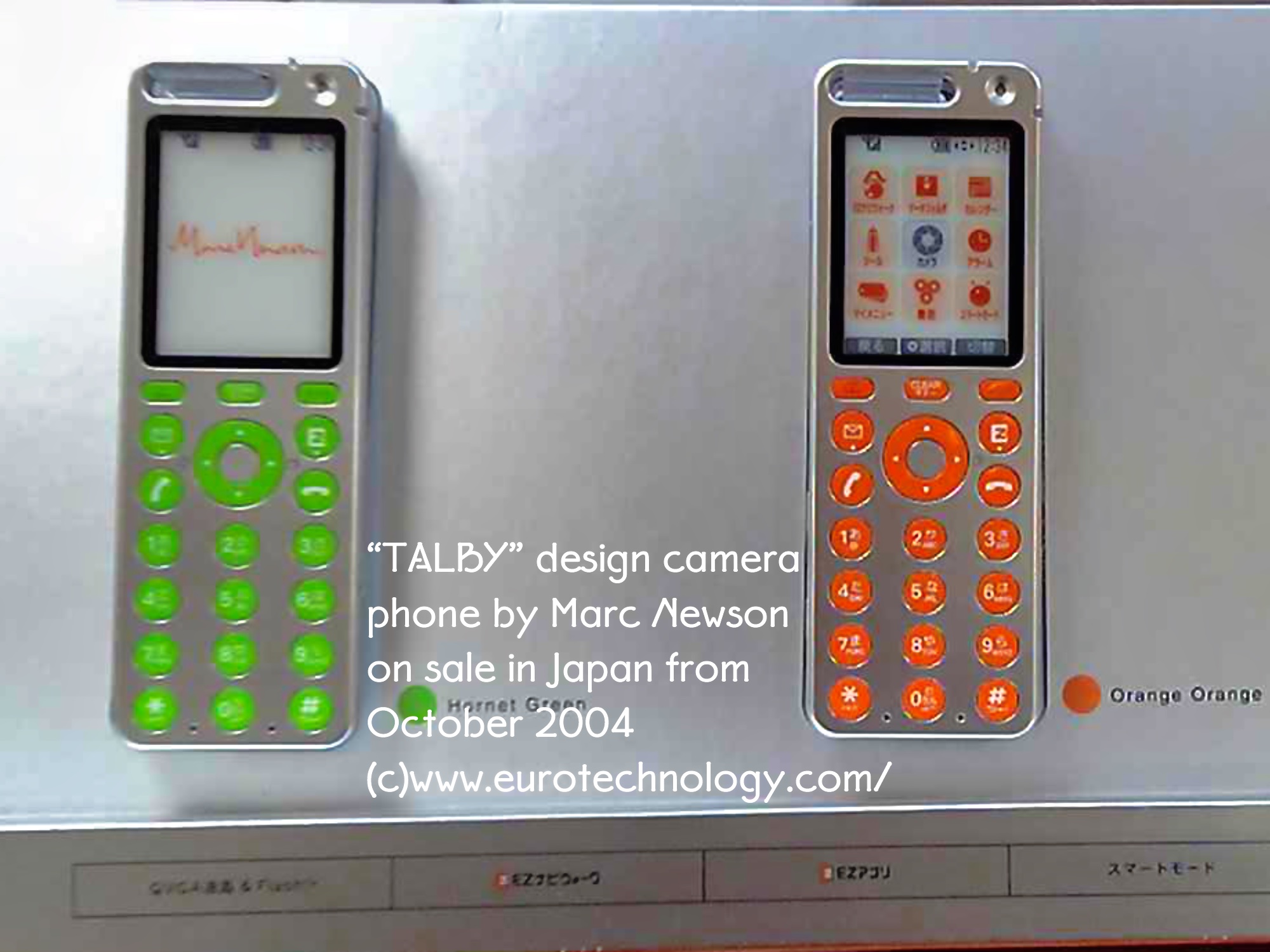

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

i-Mode was launched February 22, 1999 in Tokyo – birth of mobile internet

The mobile internet was born 16 years ago in Japan Galapagos-Syndrome: NTT Docomo failed to capture global value On February 22, 1999, the mobile internet was born when Mari Matsunaga, Takeshi Natsuno and Keiichi Enoki launched Docomo’s i-Mode to a handful of people who had made the effort to the Press Conference introducing Docomo’s new…

-

ApplePay vs Osaifu-Keitai – CNBC interview

ApplePay is expected to start in October 2014 – Docomo’s Osaifu-keitai wallet phones started on July 10, 2004. https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html Mobile payments Japan, e-money and mobile credit (200 pages, pdf file) In business the first-comer does not always win the game Japan’s NTT-Docomo tested two types of wallet phones, manufactured by Panasonic and SONY with 5000…

-

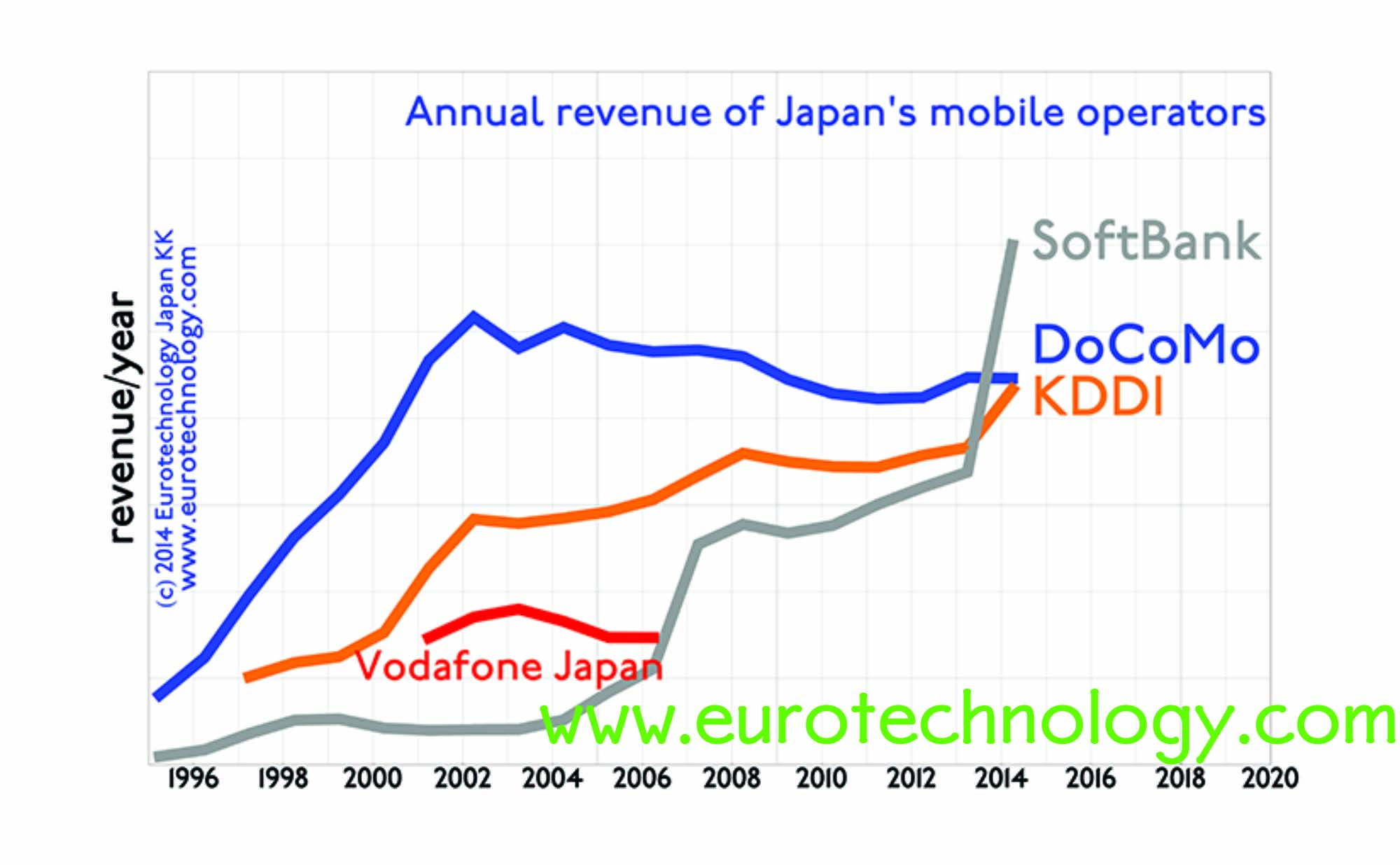

SoftBank overtakes Docomo and KDDI in revenues and income and market cap

SoftBank overtakes Docomo and KDDI in all major KPIs SoftBank presents annual results for the Financial Year which ended March 31, 2014 today, NTT-Docomo and KDDI presented their results a few days ago. Using projections published by SoftBank and using data found in the Japanese business press over the recent days, we have compared SoftBank,…

-

Docomo financial report for FY2013: operating income of YEN 819 billion (US$ 8.2 billion)

Docomo financial report for FY2013: US$8.2 billion operating profits but withdraws from India by Gerhard Fasol On April 25, 2014 NTT-Docomo announced annual results for FY2013 (April 1, 2013 – March 31, 2014) and explained the way forward. Annual revenues are YEN 4461.2 billion (US$ 33.6 billion), operating income is YEN 819.2 billion (US$ 8.19…

-

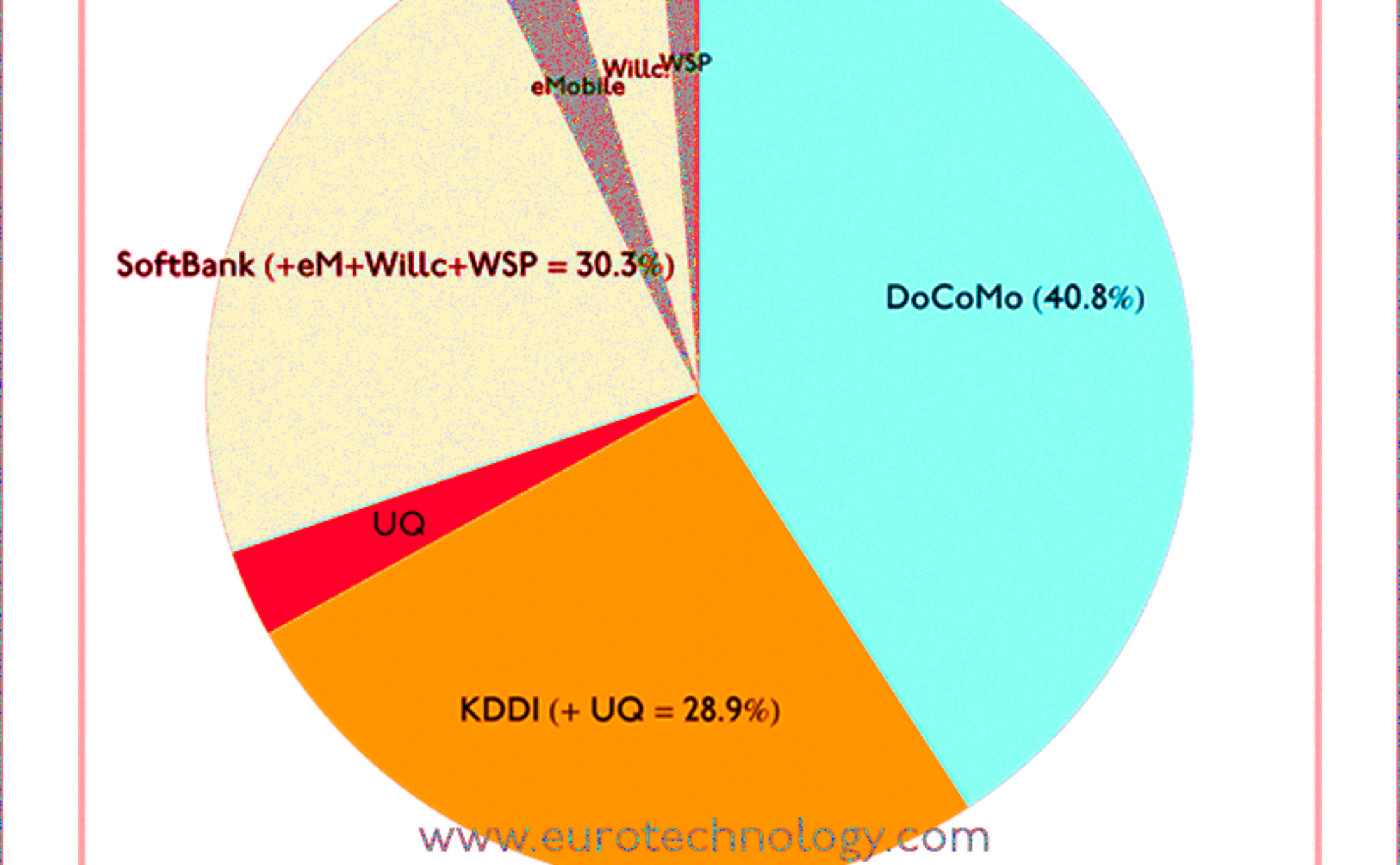

SoftBank market share in Japan – many articles get it wrong. What is SoftBank’s true market share in Japan?

by Gerhard Fasol Many press articles get SoftBank market share in Japan wrong With SoftBank‘s acquisition of US No. 3 mobile operators Sprint and the possibility that Softbank/Sprint will also acquire No. 4 T-Mobile-USA, SoftBank and Masayoshi Son are catching global headlines. SoftBank market share in Japan: Many media articles report wrong data, because they…

-

Docomo postpones Tizen OS mobile handsets for the second time

Below are notes for an interview for the French newspaper LesEchos. The full article can be found here. On Thursday January 16th, 2014, NTT Docomo announced the postponement of mobile phone handsets based on the TIZEN operating system. This is actually the second time that NTT Docomo has postponed the planned introduction of TIZEN handsets,…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

Growth in Japan: the SoftBank group

SoftBank gaining market share in Japan SoftBank market cap catching up with Docomo Mobile subscription data released last week show, that the SoftBank group continues to gain market share while incumbent NTT-docomo continues to lose market share – an upward trend for SoftBank, and a downward trend for NTT-docomo essentially unbroken since SoftBank acquired Vodafone-Japan…

-

Japan telecom sector financial results and the Softbank-Sprint take-over battle

SoftBank seeks to win, where Docomo failed – taking Japan’s telecoms know-how global Japan telecom sector financial results: very very healthy With SoftBank and DISH battling for US mobile operator SPRINT, the eyes are on Japan’s very healthy mobile phone sector, which a few days ago announced financial results for FY 2012. Japan’s mobile operators…

-

Post-Galapagos Japan? – globalizing Japan’s fantastic technologies…

Japan Galapagos effect: “Why do Japanese companies make so beautiful mobile phones with fantastic functions, and have almost no global market share?” I asked this question back in 2003 to NTT-DoCoMo’s CEO Dr. Tachikawa (see my article “Leadership questions of the week” in Wallstreet Journal of June 12, 2006, page 31), and offered several proposals…

-

Do mobile app-stores and online games disrupt Nintendo’s blue ocean?

Japan introduced the mobile internet with i-Mode in 1999, while i-Phone and friends are now getting the rest of the world hooked onto the mobile internet. Games used to be played in game parlors, and some of Japan’s game giants were originally and still are game parlor machine makers – a round of Dance-Dance-Revolution anyone?…

-

beeTV – DoCoMo’s new mobile TV

Japan leads mobile phone experimentation Japan introduces and tests a large range of experimental and innovative mobile services On May 1, 2009, DoCoMo in cooperation with media firm Avex started the mobile TV beeTV which brings 8 channels including a MOOLOG Channel (MOOLOG = MOOvie-bLOG) beeTV is an indicator how Mobile TV may impact Japan’s…

-

Potential Flu Pandemic Positive for Telcos

Potential Flu Pandemic Positive for Telcos (Airtime: Tuesday, April 28, 2009) Read more about Japan’s telecom sector: http://www.eurotechnology.com/store/jcomm/ Read more about DoCoMo: http://www.eurotechnology.com/store/imode/ Read more about KDDI: http://www.eurotechnology.com/store/kddi/ Read more about Softbank: http://www.eurotechnology.com/store/softbank/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Wild differences in operating margins for mobile, TV media groups and electricals

We analyze the effect of the crisis on operating margins in three different sectors in Japan: (1) electronics, (2) mobile communications (3) TV media groups. In sector (1), Nintendo‘s margins are above 30% and increasing despite the crisis, while traditional electronics companies’ margins are evaporating. (2) for mobile operators DoCoMo, KDDI and SoftBank margins are…

-

New Japan vs old Japan: Japan’s two worlds

Japan’s two worlds New Japan vs Old Japan A few days ago the New Context Conference was held here in Tokyo, mainly about social network systems (SNS), top executives including CEO of LinkedIn, Facebook, and some exciting new photo, video conference and e-learning companies discussed market entry to Japan. Japan’s two markets Takeshi Natsuno, one…

-

Tech Sector Outlook (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

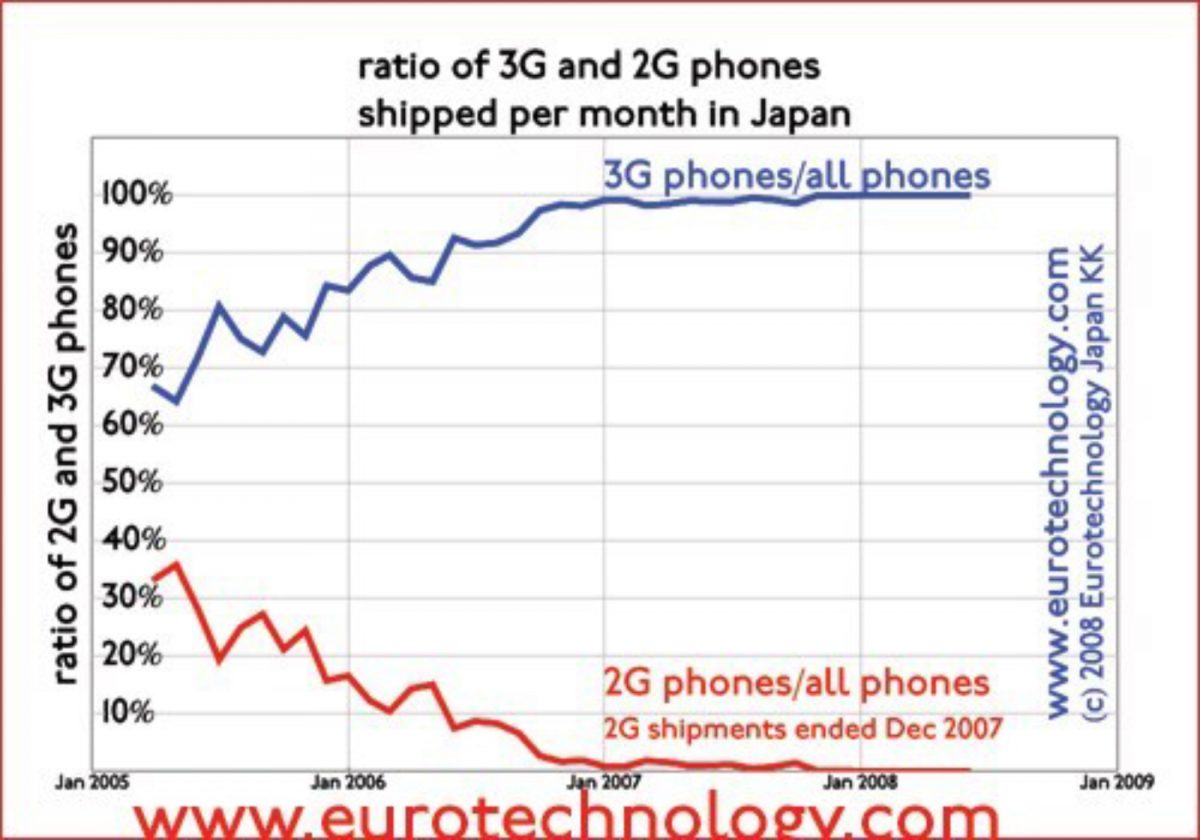

Last 2G phone shipped 8 months ago in Japan, 2G networks are switched off

KDDI/AU switched off 2G radio network in March 2008, Docomo and SoftBank to switch off 2G networks in 2009 Second generation (2G) phones silently bowed out of Japan’s market 8 months ago: the last 2G phones in Japan were shipped in December 2007. KDDI/AU switched off their 2G radio network in March 2008, this year,…

-

Japan’s Mobile Space Not Saturated

More in our J-COMM report: http://www.eurotechnology.com/store/jcomm/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Mobile Industry Resilient to the downturn (CNBC TV interview)

More in our report on Japan’s telecom and mobile sector Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Market caps of companies in mobile: global vs local

Google, Apple, Nokia, HTC, Vodafone and are winning the driver’s seat of the global internet revolution. DoCoMo, KDDI and SoftBank essentially stay inside Japan for now – limiting their growth prospects and leaving global opportunities to others. GOOGLE with Android and APPLE with iPhone are reaching for the driver’s seat of the global mobile data…

-

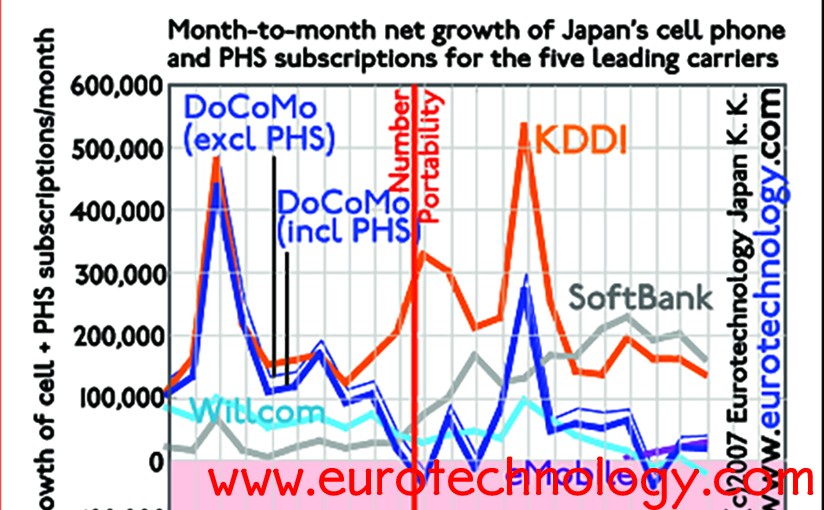

SoftBank and KDDI win market share, Docomo loses

SoftBank from 4th to 1st position within less than 12 months… SoftBank‘s turn-round of x-Vodafone-Japan, went faster than many expected. Within less than 12 months SoftBank went from last place to first place in customer sign-ups, overtaking even KDDI‘s super-popular AU. Willcom recently suffers from SoftBank‘s revival, as well as from eMobile‘s flat rate data…

-

First half FY2008 results: SoftBank and KDDI profits increase, DoCoMo’s trends is downward

In the last few days NTT, NTT-DoCoMo, KDDI and SoftBank announced their first half financial results. SoftBank and KDDI are the winners both for market share and for profits, while DoCoMo‘s results and market shares are sinking, and pulling the NTT-Group down at this time. Extrapolation indicates that DoCoMo‘s net profits may fall into the…

-

“Help – my mobile phone does not work!” – Why Japan’s mobile phone sector is so different from Europe’s

Presentation at the Lunch meeting of the Finnish Chamber of Commerce in Japan (FCCJ) on March 16, 2007 at the Westin Hotel, Tokyo. Summary of the event and photographs here: https://web.archive.org/web/20160815232148/http://www.fcc.or.jp/lunch160307.html The presentation is not available any longer on the FCCJ website however you can download our report about Japan’s telecom sector. An abbreviated version…

-

Mobile payment and the future of money (presentation at CLSA Japan Forum)

Can e-money and mobile payment replace cash? Example: mobile payment for the world’s busiest train line CLSA – Asia-Pacific Markets – last week organized the “CLSA Japan Forum” here in Tokyo. About 800-1000 investment bankers, portfolio managers, investors, analysts came together. Since last year interest of global investors in Japan has increased a lot. Eurotechnology…

-

Mobile subscriptions grow by 5 million in Japan during 2006

Japan’s mobile subscriber numbers grew by about 5 million in 2006. Because of the much higher ARPU, Japan’s mobile market again grew by a couple of Finlands during 2006. A growing number of people have more than one mobile phone, to take advantage of the best rates, eg for mail, voice and data. We expect…

-

Mobile Number Portability (MNP) in Japan

Mobile number portability created winners and losers in only two months – the main business challenge for Japanese operators is to avoid a price war. KDDI is the clear winner in the first round, DoCoMo suffers a setback, and SoftBank (which acquired Vodafone-Japan) did better than expected. Today we released the 23rd edition of our…

-

NEW YEAR on i-Mode and EZ-web

Both docomo’s i-Mode and KDDI’s EZweb top menu pages display Season Greetings and reflect Japan’s seasonal mood: autumn sports days in schools, skiing in winter, Halloween and New Year. Here are this year’s New Year greetings for the Year of the boar on i-mode and EZweb which were displayed from January 1, 2007 for a…