Tag: sony

-

SONY 70th Birthday: Happy Birthday SONY!

Today: by far the strongest profits are not from electronics or Playstation, but from the subsidiary SONY Financial Holdings Inc within Japan SONY 70th Birthday: Tokyo Tsushin Kogyo (Totsuko) was founded on May 7, 1946 SONY celebrates 70th Birthday today – SONY’s predecessor Tokyo Tsushin Kogyo (東京通信工業株式会社), Totsuko (東通工) was founded on May 7, 1946…

-

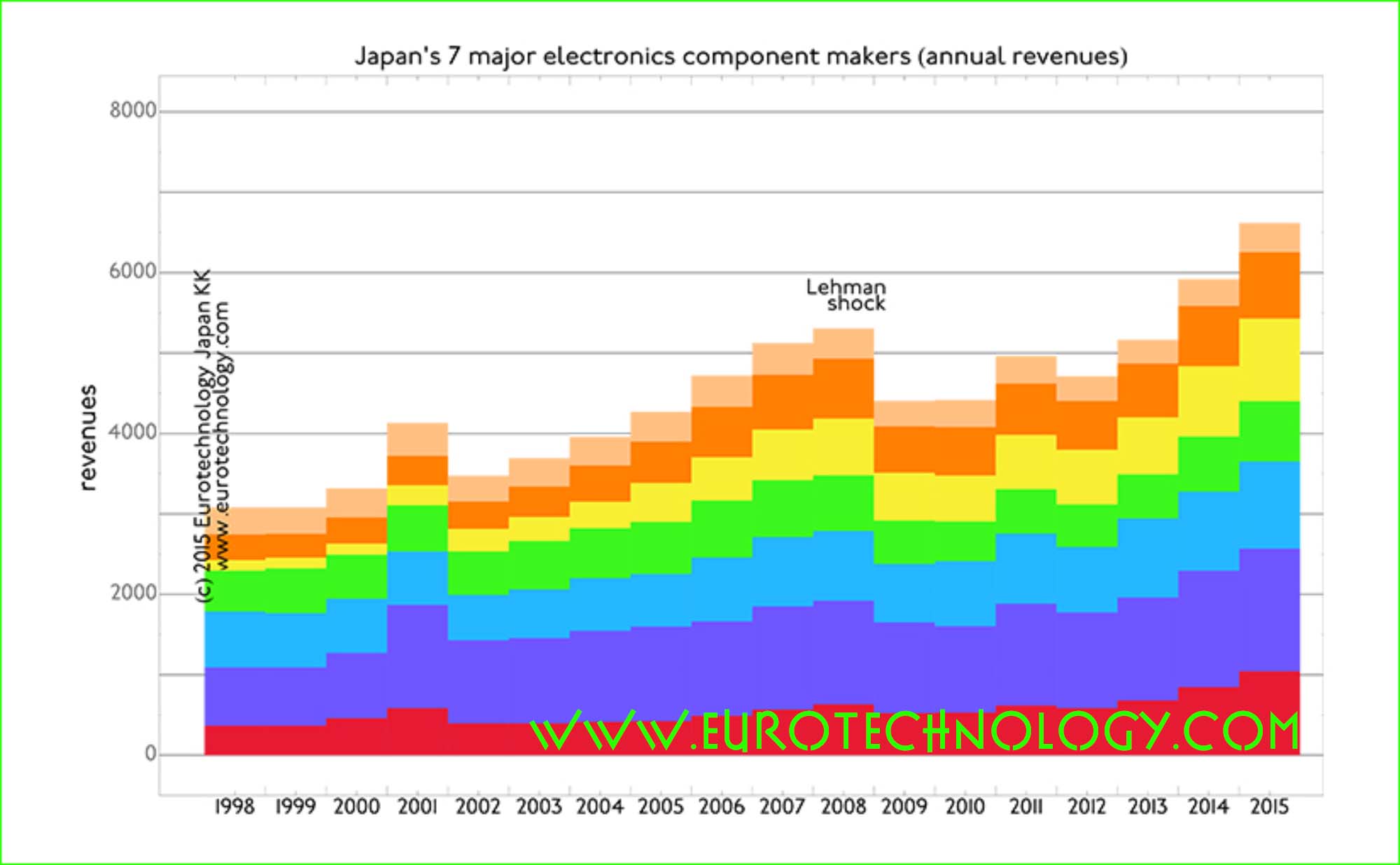

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

JVC KENWOOD Chairman: “Speed is like fresh food” – Revitalization of Japanese industry by JVC KENWOOD Chairman Haruo Kawahara (6th Ludwig Boltzmann Symposium)

JVC Kenwood Chairman Haruo Kawahara: Revitalization of Japanese Industry (Representative Director and Chairman of the Board of JVC KENWOOD Corporation) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. Background reading: JVC KENWOOD Corporation was incorporated on October 1, 2008, and has 20,033 employees as…

-

Steve Jobs and SONY: why do Steven Jobs and SONY reach opposite answers to the same question: what to do with history?

Steve Jobs and SONY: why 180 degrees opposite decisions? Steve Jobs donates history to Stanford University in order to focus on the future Steve Jobs and SONY – when Steve Jobs when returned to Apple in 1996, and now SONY are faced with the same question: what to do about corporate archives and the corporate…

-

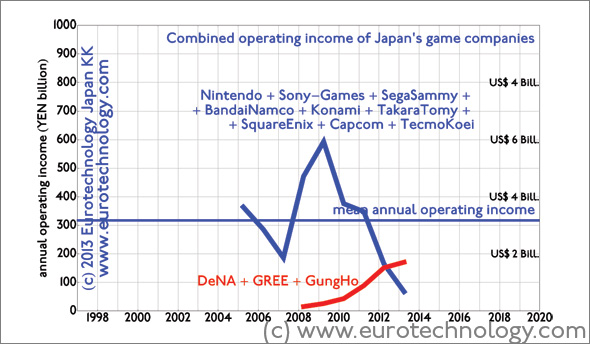

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…

-

Sony earnings boosted by weak yen – BBC interview about SONY earning results

Helped BBC with the article “Sony earnings boosted by weak yen and smartphone sales“ https://www.bbc.com/news/business-23527714 for detailed analysis of Japan’s electronics industry sector including SONY, see: Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

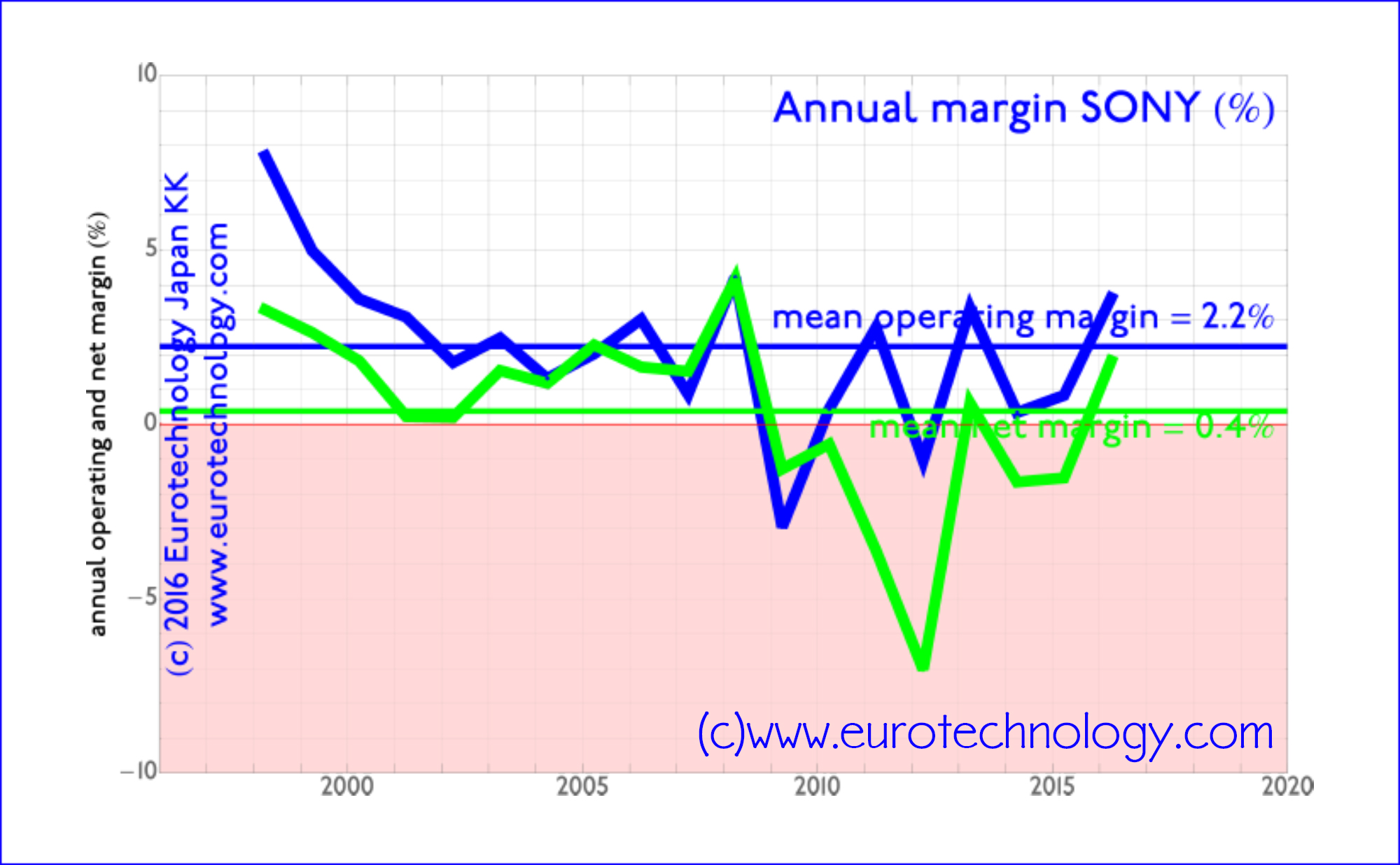

Japan’s electronics giants – FY2012 results announced. 17 years of no growth and no profits.

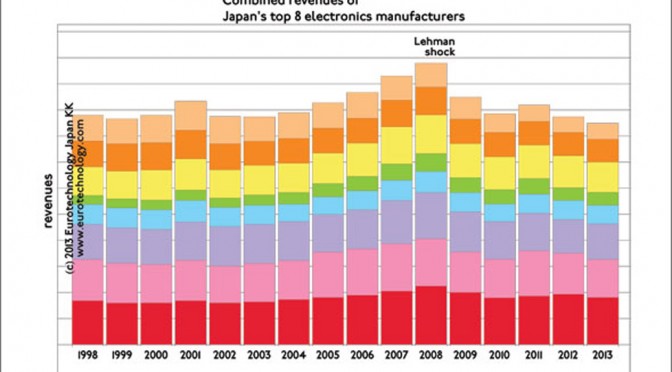

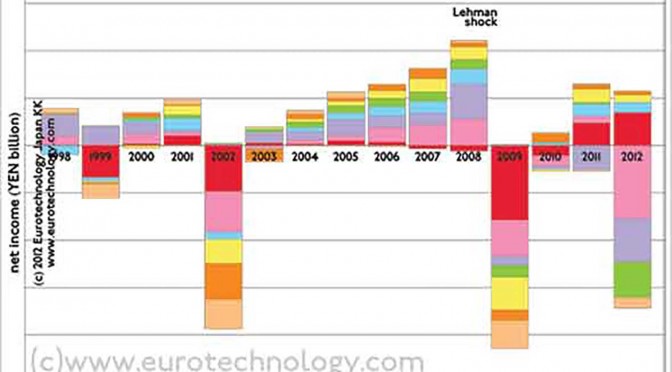

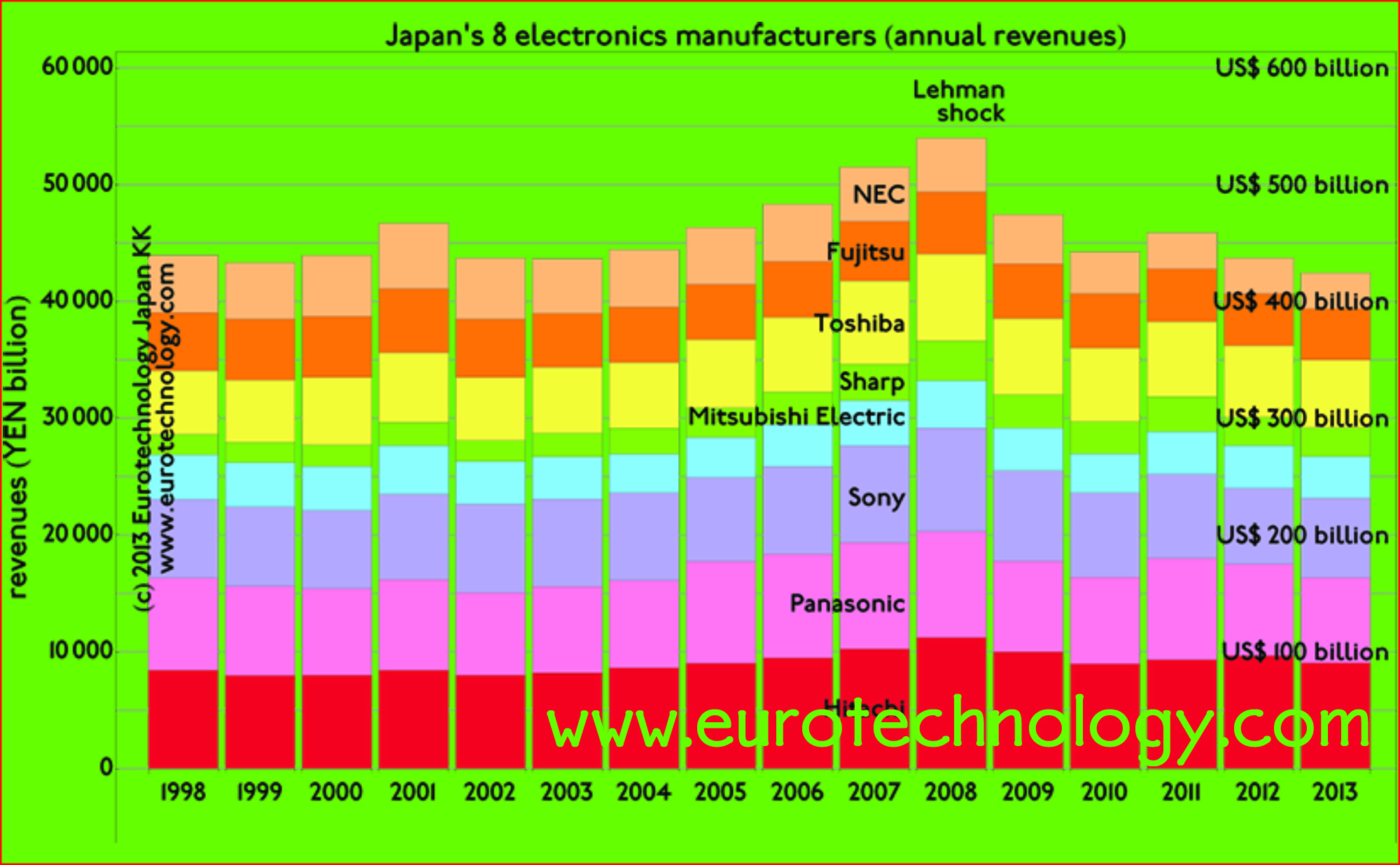

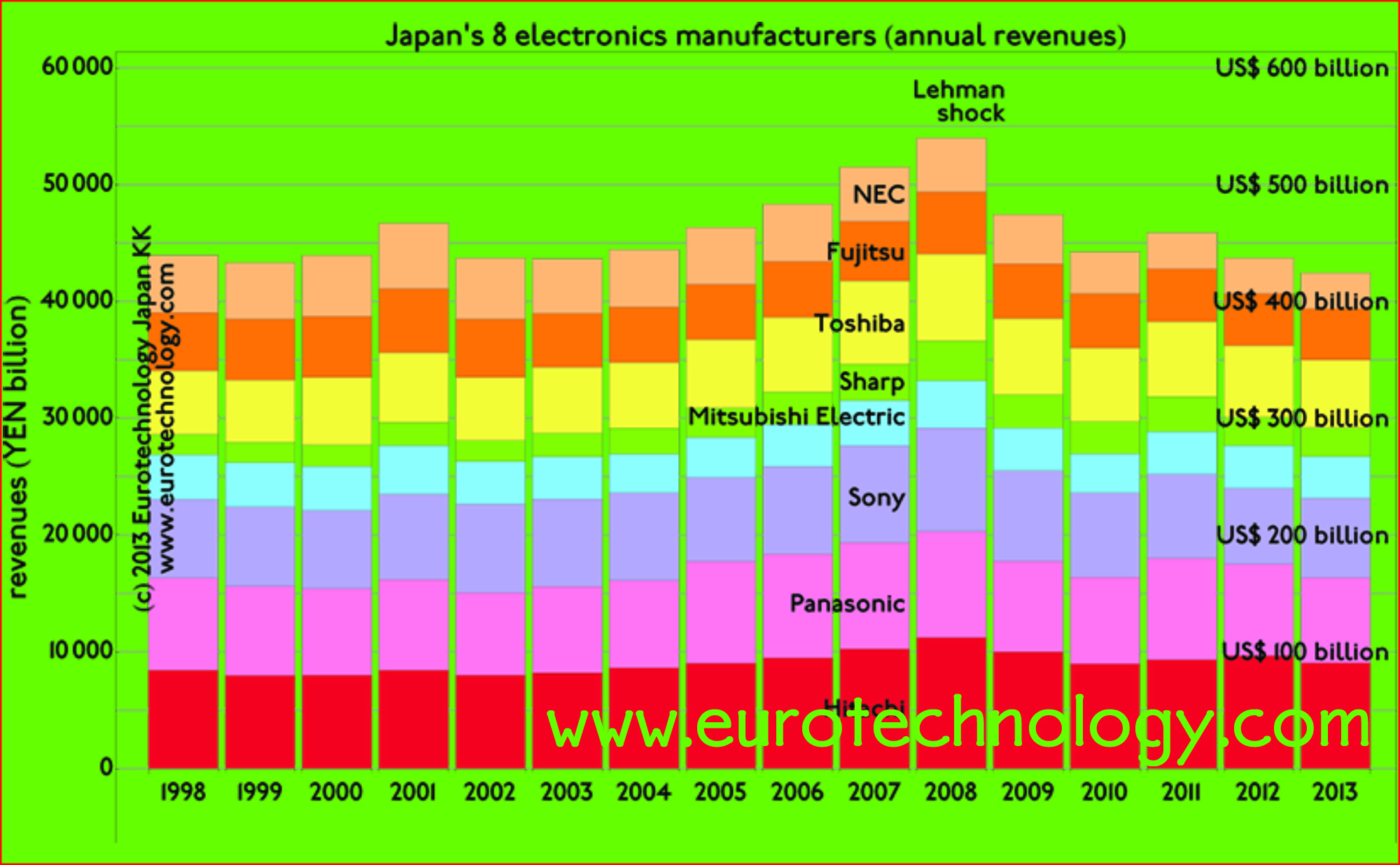

Japan’s electronics giants: as large as the economy of Holland, but 17 years of stagnation. No growth & no profits. Daniel Loeb: SONY’s uninvited guest gives Japan’s business culture a jolt Japan’s electronics giants combined are as large as the economy of Holland, but did not grow for about 17 years, and on average lost…

-

SONY results for FY2012 (ended March 31, 2013)

SONY’s first profits in 4 years come from selling assets and buildings SONY results for FY2012- BBC interview SONY announced annual financial results today, and BBC interviewed me twice to comment on the results (read comments here on the BBC website). After 4 years of net losses, it is comforting to see SONY report profits…

-

Intellectual Japan – BBC: “Japan has to become a brain country” – from mono zukuri to brain country

Intellectual Japan: Japan’s electronics companies need new business models – interview for the BBC The BBC recently examined why Japan’s electronics sector has to create new business models, and quotes “Japan has to become a brain country”. Japan’s top 8 electronics companies combined are as large as the Netherlands economically, but have shown zero growth…

-

SONY profits: 56% of profits are from selling life insurance and financial products (manuscript invited by BBC)

Games are 11% of SONY’s sales SONY profits: Currently 56% of SONY’s profits come from selling life insurance and financial products Games are 11% of SONY‘s sales – and currently 56% of SONY profits come from selling life insurance, consumer loans and financial products in Japan. Games are important, but are not going to make…

-

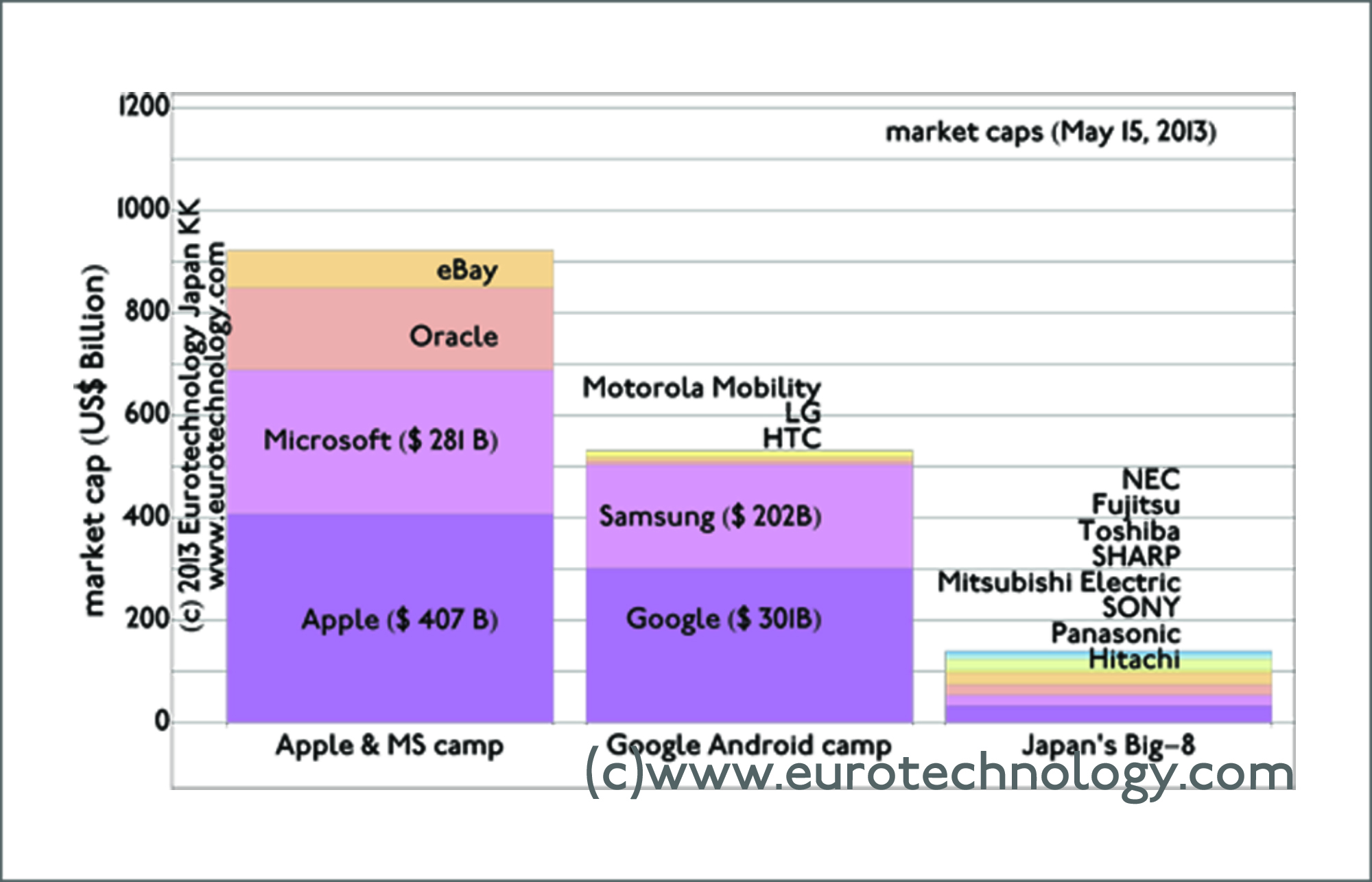

Japanese electronics groups need new business models (BBC-interview: Yen ‘not the cause of woes of Japan’s electronics firms’)

Japanese electronics groups combined as of similar size as the economy of the Netherlands Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands. Over…

-

SONY revival prospects and shareholder meeting (BBC interview)

SONY needs to leave 1990 structures behind and more more than commodities SONY revival from record YEN 455 billion loss for FY2010 SONY (6758) announced a record YEN 455 Billion (US$ 5.7 Billion) loss for financial year 2011, which ended March 31, 2012, and held the annual shareholder meeting on Wednesday. SONY revival: My points…

-

Future of Video Game Sector (CNBC Airtime: Thurs. Jul. 30 2009)

Read more about Nintendo and the games sector: http://www.eurotechnology.com/store/jgames/ Read more about Japan’s electrical industry sector in our Japan’s electronics industry report (pdf file) Subscribe to our newsletters: technology newsletters from Japan

-

Japan’s games sector overtakes electrical sector in income

Japan’s games sector is booming – and net annual income of Japan’s top 9 game companies combined has now overtaken the combined net income of all Japan’s top 19 electronics giants (including Hitachi, Panasonic, SONY, Fujitsu, Toshiba, SHARP… at the top, and ROHM, Omron… further down the ranking list). Why does it make sense to…

-

Japan electronics groups: global benchmarking

Japan electronics groups have far lower income/profits than EU or US comparable corporations Ripe for drastic reform and transformation: 18 years no growth and almost no profits Lets look at global benchmarking of Japan’s top electrical groups Panasonic and Hitachi (representative of Japan’s top ten electrical giants) – in our previous blog we suggested that…

-

Japan’s electronics companies & the crisis

Japan’s top 20 electronics companies combined are about as large as The Netherlands economically, and have big impact on the world economy. Our analysis shows how dramatically Japan’s electronics companies have been hit by the current crisis (except for Nintendo). We suggest that full recovery to 2008 (FY2007) levels may take until 2016 – about…

-

More Drastic Changes Needed at Sony (CNBC TV interview)

SONY needs drastic changes: from commodities to networks and communities More Drastic Changes Needed at Sony (CNBC Airtime: Thursday, May 14, 2009) Read more about SONY and Japan’s electrical industry sector Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Foggy Outlook for Global Tech Sector (CNBC TV interview)

Foggy Outlook for Global Tech Sector (Airtime: Tues. Feb. 10 2009) Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Wild differences in operating margins for mobile, TV media groups and electricals

We analyze the effect of the crisis on operating margins in three different sectors in Japan: (1) electronics,(2) mobile communications(3) TV media groups. In sector (1), Nintendo‘s margins are above 30% and increasing despite the crisis, while traditional electronics companies’ margins are evaporating. (2) for mobile operators DoCoMo, KDDI and SoftBank margins are 10%-20% and…

-

Japan trends 2008/2009

One of our clients in the financial industry asked me several trend questions: Q1: Biggest surprises in Japan in 2008? Collapse of Japan’s mobile phone handset market (read our blog). In this context the Japanese telecom equipment makers association invited me to give a presentation, which was booked out 2-3 weeks ahead – about 100…

-

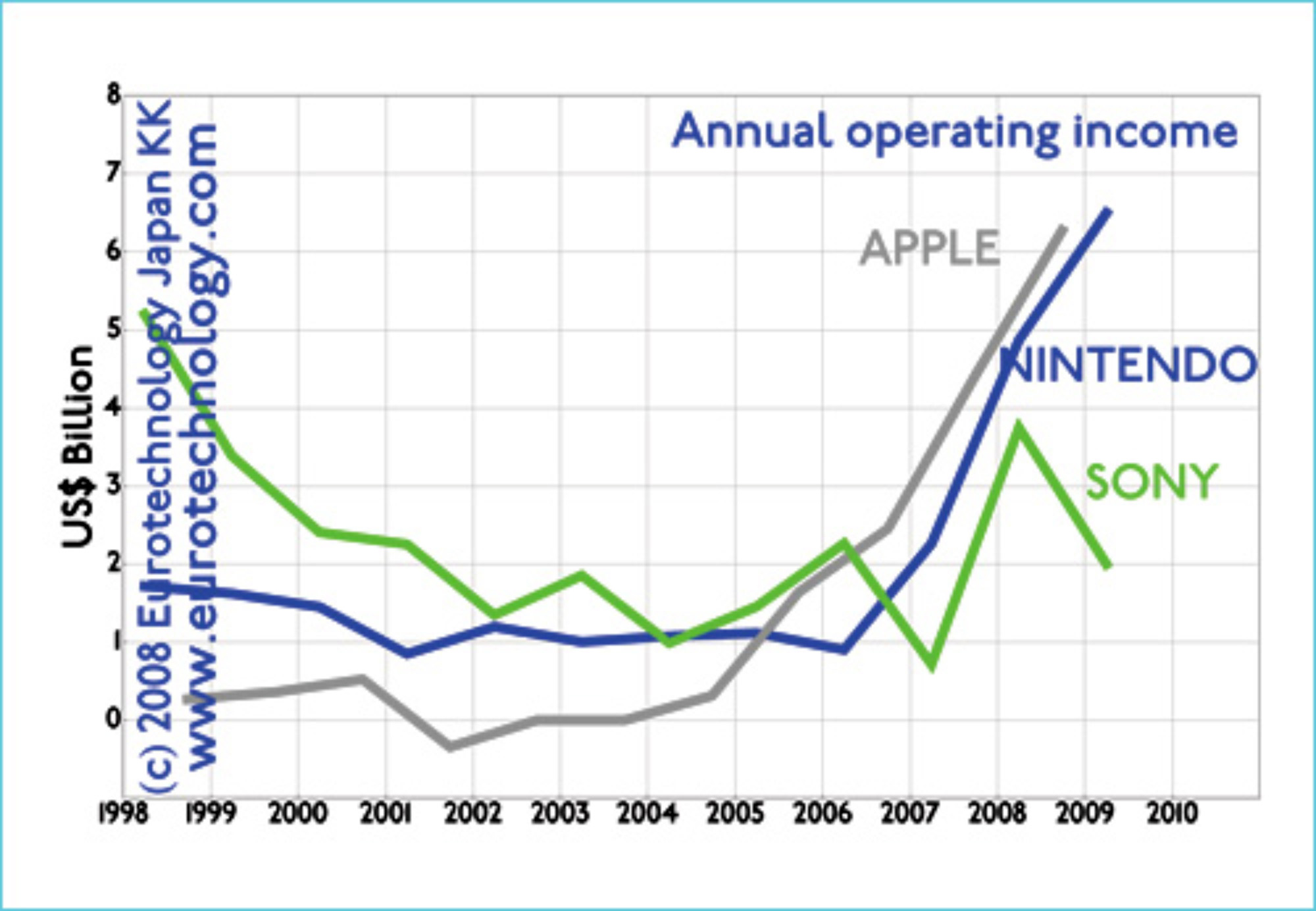

Apple Nintendo Sony: The power of focus

Lets benchmark three iconic companies: Apple Nintendo Sony Apple Nintendo Sony: three iconic companies evolving along very different paths. Apple’s current physical products famously all fit onto a single mid-sized table. Nintendo’s current physical products as well, for SONY you’d need a warehouse. Apple Nintendo Sony – Lets look at today’s market caps: Apple Nintendo…

-

Tech Sector Outlook (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Nokia & Sony Ericsson Results Likely to Disappoint (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

XBOX Japan entry

XBOX still faces difficulties in Japan XBOX Japan entry: Microsoft reduces prices by 30% Microsoft announced to reduce prices for Xbox-360 by 30% in Japan. We believe that this price reduction will not be enough to bring the breakthrough for Xbox in Japan. Nintendo has reinvented the game industry, created a completely new paradigm. Nintendo…

-

XBOX Japan strategy – Microsoft still struggling

Microsoft XBOX introduced XBOX to Japan on February 22, 2002 XBOX Japan Strategy – CNBC interview Microsoft introduced the original XBOX game console in the USA on November 15, 2001, in Japan on February 22, 2002, and in Europe on March 14, 2002. During the period January-June 2005, three years after introduction of the XBOX…

-

Assessing Japan’s Gaming Sector (CNBC TV interview)

More in our J-GAMES report: http://www.eurotechnology.com/store/jgames/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Sony Plans LCD TV Expansion

Read our report on Japan’s electronics industry sector: Copyright 2013 Eurotechnology Japan KK All Rights Reserved·

-

Sony Needs a Hit Product – TV interview

Read our report on Japan’s electronics industry sector: Copyright 2013 Eurotechnology Japan KK All Rights Reserved