Today: by far the strongest profits are not from electronics or Playstation, but from the subsidiary SONY Financial Holdings Inc within Japan

SONY 70th Birthday: Tokyo Tsushin Kogyo (Totsuko) was founded on May 7, 1946

SONY celebrates 70th Birthday today – SONY’s predecessor Tokyo Tsushin Kogyo (東京通信工業株式会社), Totsuko (東通工) was founded on May 7, 1946 by:

- Masaru Ibuka (井深大), and

- Akio Morita (盛田昭夫)

following preparations going back to 1945.

Outside Japan there is a tendency to focus on one of the two co-founders, Akio Morita, however, as an engineer Masaru Ibuka was as least as important a co-founder.

Masaru Ibuka (井深大), co-founder

Masaru Ibuka (井深大) was a passionate engineer, and drove much of the technical product development, recruiting and leading some of the best engineers.

Read Masaru Ibuka’s obituary in NATURE here: “Obituary: Masaru Ibuka (1908-97). Electrical engineer and co-founder of SONY” by Gerhard Fasol.

Read also: Masaru Ibuka, Founder of SONY, Obituary for NATURE

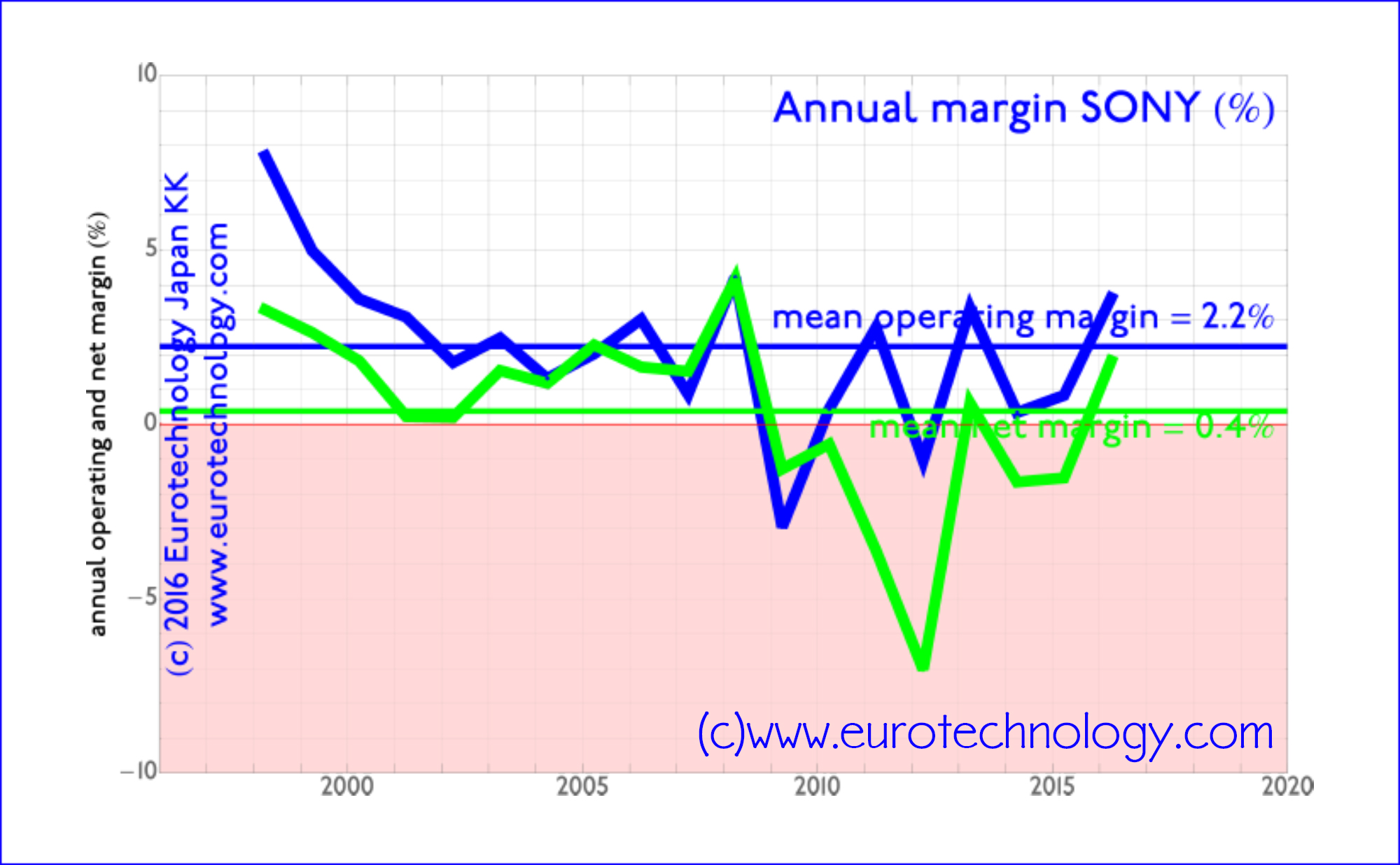

SONY over the most recent 18 years (1998-2016)

compound annual growth rate (CAGR) = 1.0% over the last 18 years

Essentially, over the last 18 years (FY ending March 31, 1998 – FY ending March 31, 2016), SONY’s revenues=sales have been stable, growing on average 1% per year.

net income/profit margin = 0.4% over the last 18 years

Net income/profits have been 0.4% (approximately zero) averaged over these 18 years – as is characteristic for Japan’s top 8 electronics multinationals.

Back in the days of Trinitron vacuum tube TVs and mechanical Walkman tape recorders, SONY’s products could command relatively high profit margins, the falling edge can be seen in the Figure below: gross profit margins were as high as 8% back in 1998, and net profit margins as high as 3% of sales. However, averaged over the last 18 years, net profit margins average about 0.4%.

SONY’s subsidiary “SONY Financial Holdings Inc” (60% owned by SONY) is by far the most profitable division of SONY

SONY publishes detailed reports of operating profits for its different divisions, showing that by far the most profitable division are Financial Services, which are not an integral part of the SONY Corporation (ソニー株式会社), but a partly (60%) owned and separately managed subsidiary SONY Financial Holdings Inc (ソニーフィナンシャルホールディングス株式会社).

In the latest financial report for the Financial Year ending March 31, 2016, SONY Finance has twice as much income/profit as the next most profitable divisions – SONY’s Financial Services (mainly offering credit card and banking services inside Japan) are and have been by far the most profitable division of SONY for many years.

SONY Financial Holdings Inc (ソニーフィナンシャルホールディングス株式会社) is a subsidiary of SONY, and is independently listed on the Tokyo Stock Exchange [TSE Code 8729], was founded on April 1, 2004, and IPO was on Oct 11, 2007. SONY owns 60% of SONY Financial Holdings Inc’s shares.

Our report: “Japan electronics industries – mono zukuri”

Register and receive an email with a link to a free trial version of our report on “Japan electronics industries” and our newsletters.

Purchase a copy of the report online here.

Copyright 2016 Eurotechnology Japan KK All Rights Reserved

Comments and discussions