Tag: nec

-

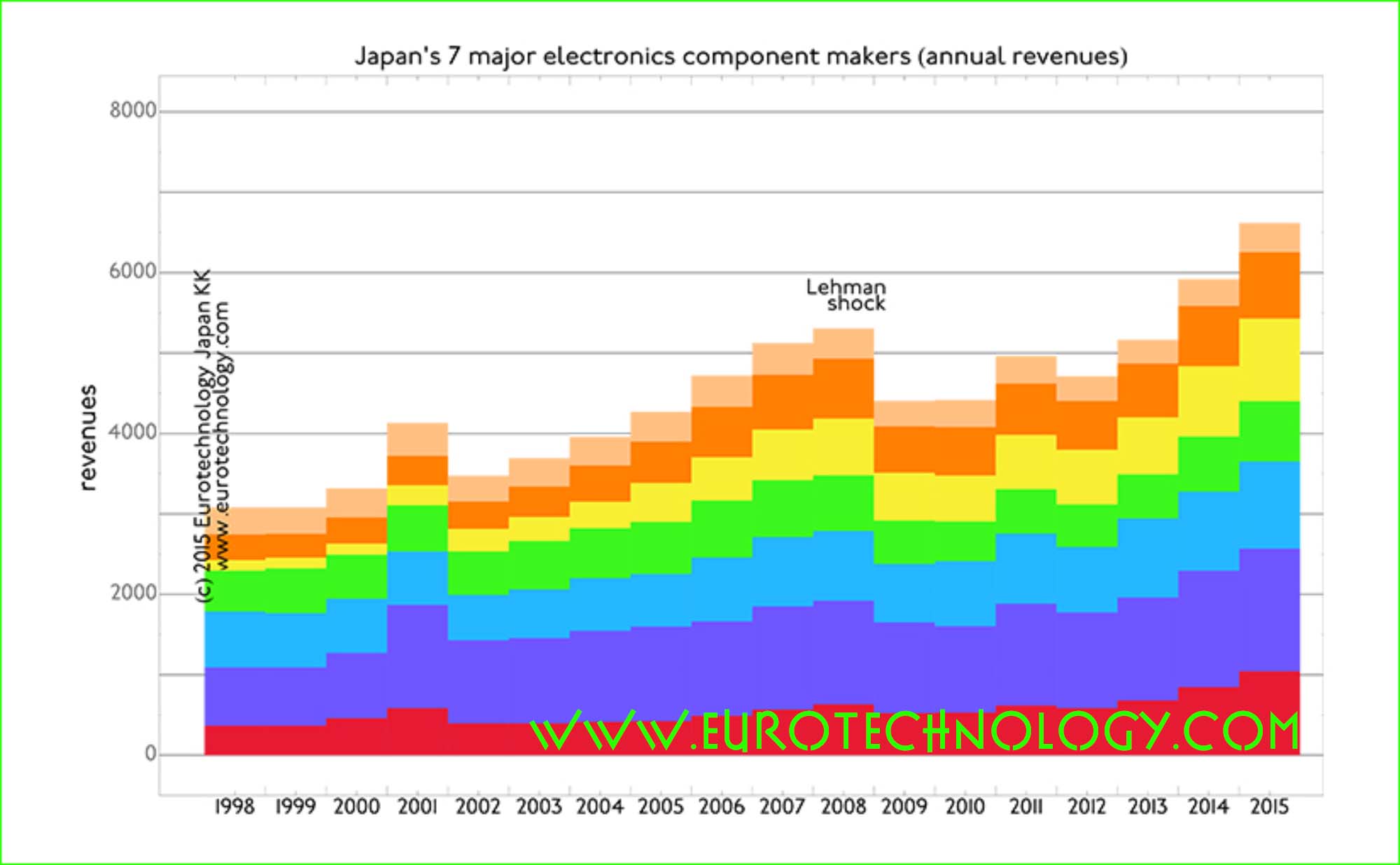

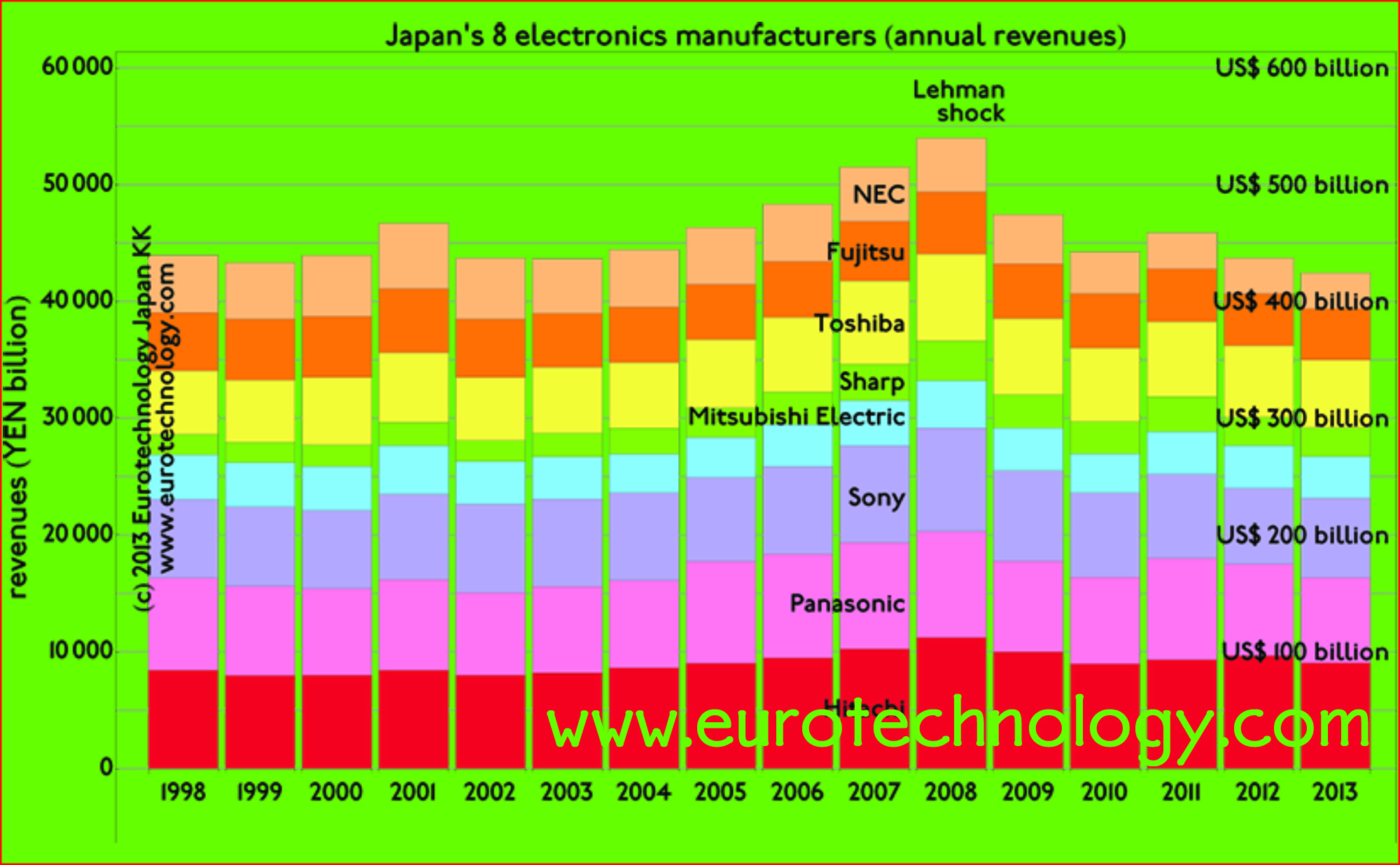

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

NEC revenues shrink from YEN 5000 billion in 1998 to YEN 3000 billion in 2012

NEC is one of NTT’s traditional four equipment suppliers NEC is one of NTT’s traditional suppliers of telecom equipment, and one of Japan’s flagship electronics companies. In the early days of the PC age, NEC dominated Japan’s PC market with the 98 series of PC, which had a NEC-proprietary variation of MicroSoft’s MS-DOS operating system.…

-

NEC smartphone termination, discussions with Lenovo failed

NEC smartphone – admits losing against competition from Apple and Samsung NEC smartphone – NEC used to be No. 1 in Japan’s “Galapagos keitai” market Just a few years ago, NEC was No. 1 in market share of Japanese pre-smart phone “Galake” (Galapagos-keitai, for a review of Japan’s Galapagos effect click here) super-feature phones. Recently…

-

Japan’s electronics giants – FY2012 results announced. 17 years of no growth and no profits.

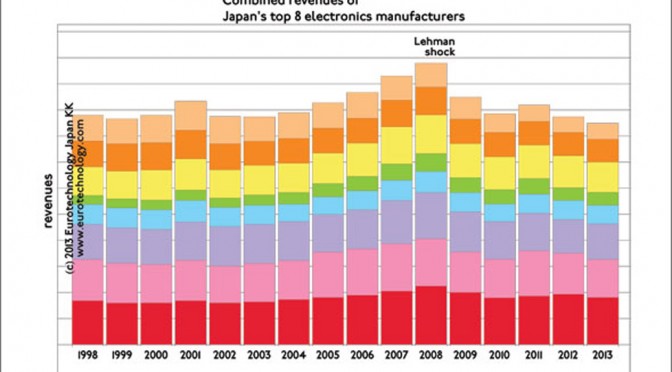

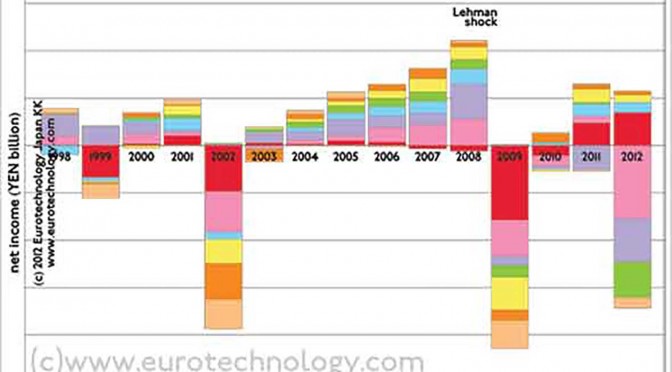

Japan’s electronics giants: as large as the economy of Holland, but 17 years of stagnation. No growth & no profits. Daniel Loeb: SONY’s uninvited guest gives Japan’s business culture a jolt Japan’s electronics giants combined are as large as the economy of Holland, but did not grow for about 17 years, and on average lost…

-

Intellectual Japan – BBC: “Japan has to become a brain country” – from mono zukuri to brain country

Intellectual Japan: Japan’s electronics companies need new business models – interview for the BBC The BBC recently examined why Japan’s electronics sector has to create new business models, and quotes “Japan has to become a brain country”. Japan’s top 8 electronics companies combined are as large as the Netherlands economically, but have shown zero growth…

-

Japanese electronics groups need new business models (BBC-interview: Yen ‘not the cause of woes of Japan’s electronics firms’)

Japanese electronics groups combined as of similar size as the economy of the Netherlands Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands. Over…

-

Post-Galapagos Japan? – globalizing Japan’s fantastic technologies…

Japan Galapagos effect: “Why do Japanese companies make so beautiful mobile phones with fantastic functions, and have almost no global market share?” I asked this question back in 2003 to NTT-DoCoMo’s CEO Dr. Tachikawa (see my article “Leadership questions of the week” in Wallstreet Journal of June 12, 2006, page 31), and offered several proposals…

-

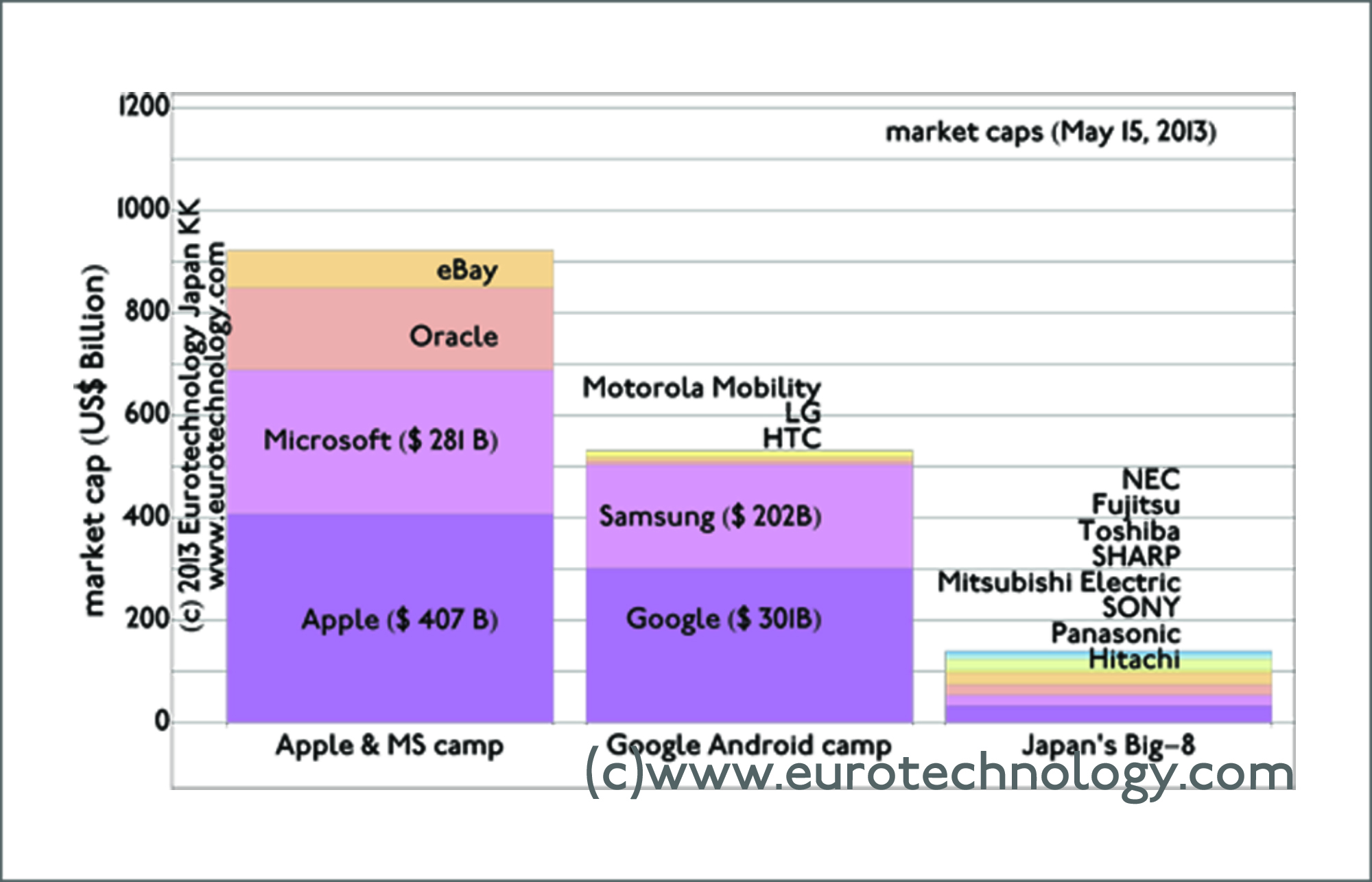

Japan electronics groups: global benchmarking

Japan electronics groups have far lower income/profits than EU or US comparable corporations Ripe for drastic reform and transformation: 18 years no growth and almost no profits Lets look at global benchmarking of Japan’s top electrical groups Panasonic and Hitachi (representative of Japan’s top ten electrical giants) – in our previous blog we suggested that…