Tag: BBC

-

Japan GDP growth and losses at Japan Post – Gerhard Fasol interviewed by Rico Hizon on BBC TV

Japan’s economy grows five quarters in a row, and Japan Post books losses of YEN 400.33 billion (US$ 3.6 billion) for an acquisition in Australia Japan GDP growth, growth of 2%/year. Still, Japan’s economy is the same size as in 2000, while countries like France, Germany, UK today are double the size as in the…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

Sony earnings boosted by weak yen – BBC interview about SONY earning results

Helped BBC with the article “Sony earnings boosted by weak yen and smartphone sales“ https://www.bbc.com/news/business-23527714 for detailed analysis of Japan’s electronics industry sector including SONY, see: Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

Intellectual Japan – BBC: “Japan has to become a brain country” – from mono zukuri to brain country

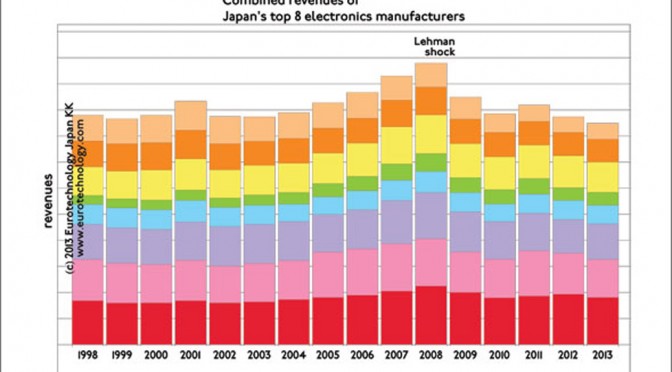

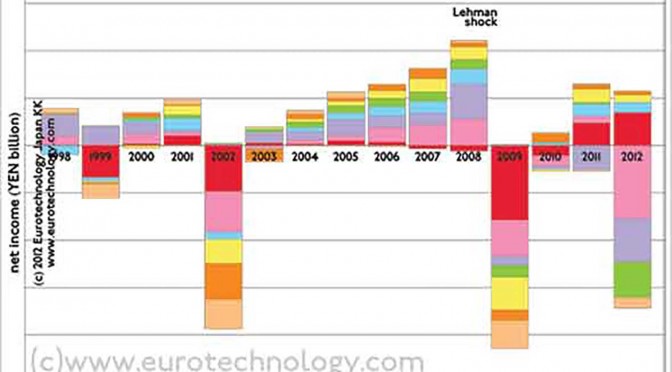

Intellectual Japan: Japan’s electronics companies need new business models – interview for the BBC The BBC recently examined why Japan’s electronics sector has to create new business models, and quotes “Japan has to become a brain country”. Japan’s top 8 electronics companies combined are as large as the Netherlands economically, but have shown zero growth…

-

SONY profits: 56% of profits are from selling life insurance and financial products (manuscript invited by BBC)

Games are 11% of SONY’s sales SONY profits: Currently 56% of SONY’s profits come from selling life insurance and financial products Games are 11% of SONY‘s sales – and currently 56% of SONY profits come from selling life insurance, consumer loans and financial products in Japan. Games are important, but are not going to make…

-

Japanese electronics groups need new business models (BBC-interview: Yen ‘not the cause of woes of Japan’s electronics firms’)

Japanese electronics groups combined as of similar size as the economy of the Netherlands Over the last 15 years combined annual sales growth was zero, and combined annual loss was US$ 0.6 billion/year Japan’s “Big-8” electrical groups (Hitachi, Panasonic, Sony, Mitsubishi-Electric, Sharp, Toshiba, Fujitsu, NEC) combined are of similar economic size as the Netherlands. Over…