Author: g_fasol

-

Hiroshi Mikitani about the Japan Association of New Economy (JANE)

Hiroshi Mikitani about how Japan should become more competitive Hiroshi Mikitani: presentation of his new book = Competitiveness Today Hiroshi Mikitani, Founder and Chairman of Rakuten, gave a talk at the Foreign Correspondents Club about his Japan Association of New Economy (JANE) and about his new book authored with his father entitled Competitiveness. Mikitani is…

-

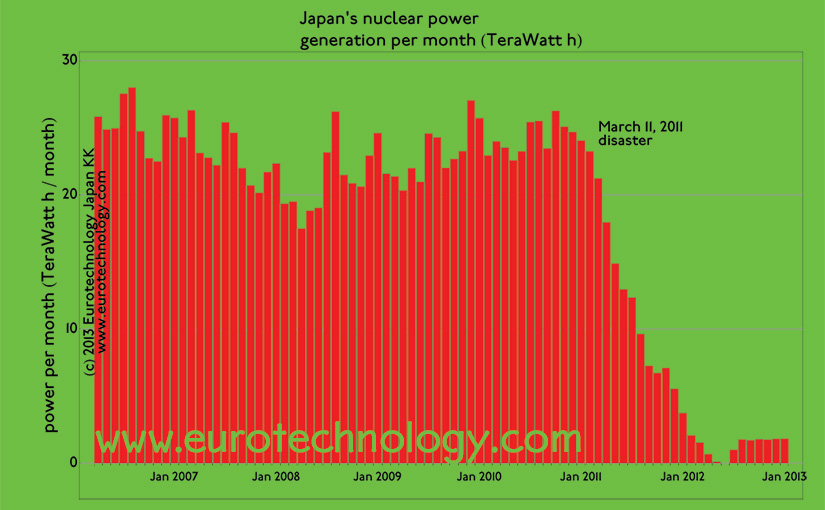

Japan nuclear free since Monday, Sept. 16, 2013, when the last reaction was switched off. Restart unclear.

Japan went 100% nuclear free since Monday, Sept. 16, 2013. When nuclear reactors will be restarted is totally unclear. Kansai Electric Power (KEPCO) on Sunday Sept 15, 2013 at 16:40 started to reduce power output of Japan’s last remaining active nuclear power reactor (Oi No. 4 reactor), and stopped operations of this reactor on Monday…

-

Japan electronics industry seen by Freescale-Japan President & “Asian Le Mans Race” at Fuji Speedway

David Uze, President for Japan & Korea of Freescale on Japan electronics industry Perspectives for electronics industries in Japan 【日本語版こちらへ】 In this newsletter David Uze, President for Japan & Korea of the global semiconductor electronics company Freescale, shares his success story in Japan, and his perspectives on Japan’s electronics industry sector…. note: compare also with…

-

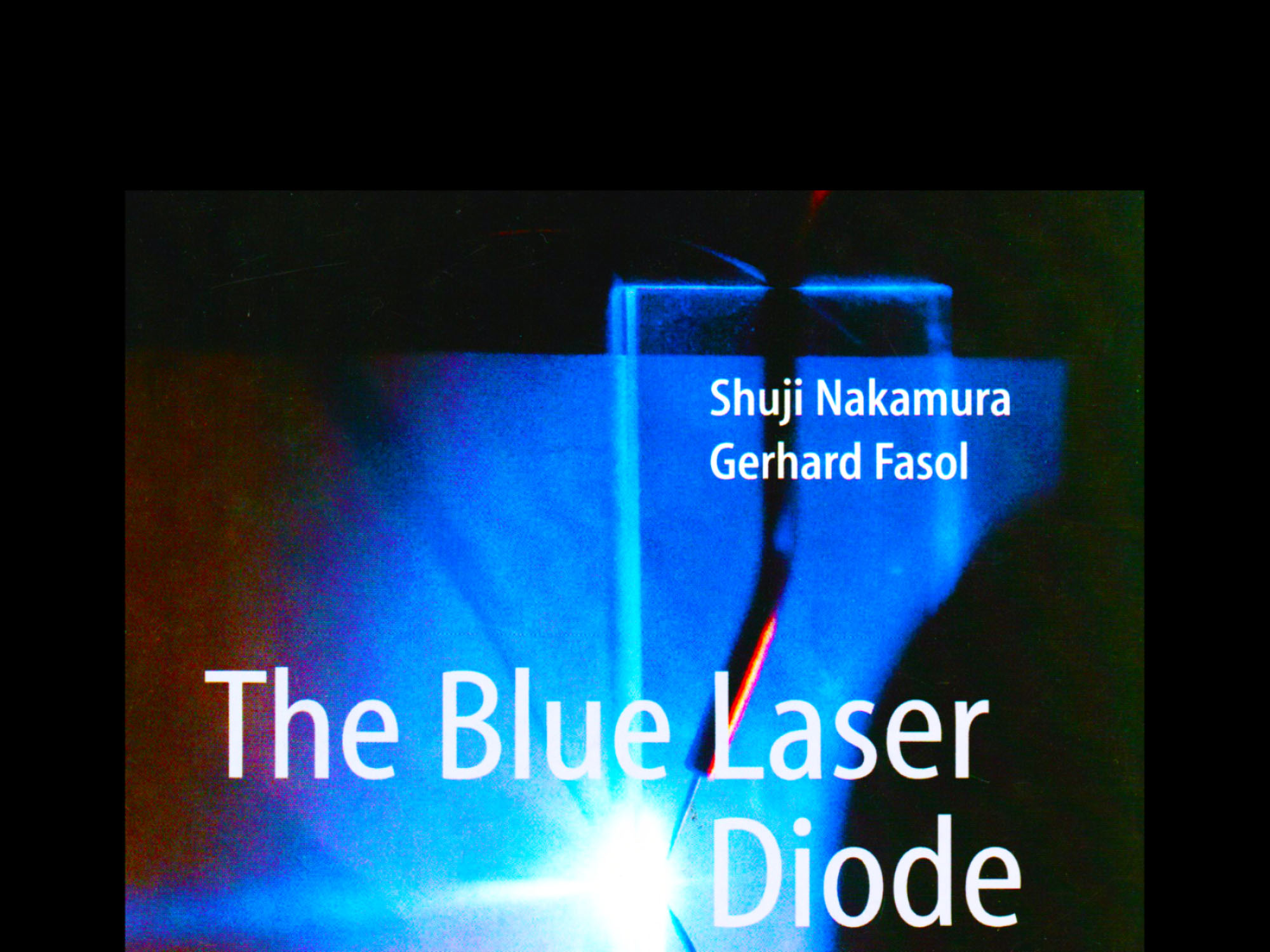

Blue laser book with Shuji Nakamura – how this book came about

The Blue Laser Diode, by Shuji Nakamura and Gerhard Fasol, Springer Verlag The story and physics background of the discovery and development of the GaN LEDs and lasers Since I have been working for many years on GaAs research, as soon as I heard Shuji Nakamura’s talk at one of Japan’s applied physics conferences, I…

-

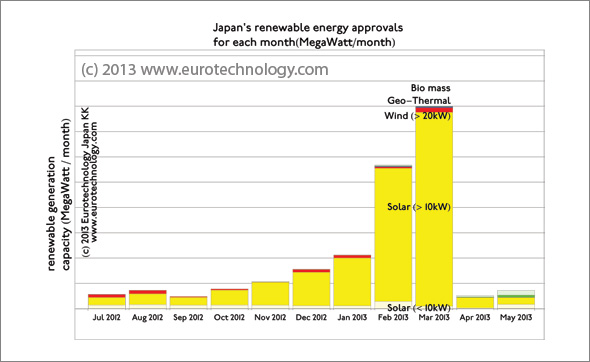

Feed in tariff Japan for renewable energy: approvals drying up?

Feed in tariff Japan for renewable energy are about three times higher than in Germany Approvals peaked just before the latest feed in tariff reduction The figures below show an overview of renewable energy sources currently installed and operational in Japan (the majority of which is water power), and also renewable energy projects approved by…

-

Masayoshi Son threatened to set himself on fire in Japan’s Postal Ministry?!

Masayoshi Son threatened to set himself on fire in Japan’s Post and Telecommunications Ministry? Is it really true? by Gerhard Fasol Masayoshi Son is known for his unbreakable will to achieve his and his companies’ business goals, and the will to take risks. Masayoshi Son threatened to set himself on fire in the Ministry?!? Spectrum…

-

Cloud computing trends

Keynote article about Cloud computing impact and trends in the RENESAS ELECTRONICS customer magazine and website “Renesas Edge Global Watch” Gerhard Fasol: “Cloud computing impact & trends” (English language)Gerhard Fasol: “Cloud computing impact & trends” (Chinese language)Gerhard Fasol: “Cloud computing impact & trends” – 世界のクラウド・コンピューティング事情(1):クラウド・コンピューティングとは? (Japanese language) Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

How many banks are there in Japan? and financial industry trends

Japan’s banking system: Tokyo Banks, Trust Banks, Foreign Banks, Regional Banks – and The Bank of Japan by Gerhard Fasol Japan banks need to register with the Ministry of Finance, so we know exactly how many banks there are in Japan, and we know address and all details about each one (contact us if you…

-

Japan Galapagos effect (Galapagos syndrome)

Japan Galapagos effect Autor: Gerhard Fasol Globalizing Japan On the Galapagos islands, Charles Darwin noticed a number of species which were extremely beautiful, had evolved on the Galapagos islands locally, and were not able to live anywhere else. Similarly, due to language, culture, comparatively small interchange between Japan’s markets and foreign markets, some technologies and…

-

NEC revenues shrink from YEN 5000 billion in 1998 to YEN 3000 billion in 2012

NEC is one of NTT’s traditional four equipment suppliers NEC is one of NTT’s traditional suppliers of telecom equipment, and one of Japan’s flagship electronics companies. In the early days of the PC age, NEC dominated Japan’s PC market with the 98 series of PC, which had a NEC-proprietary variation of MicroSoft’s MS-DOS operating system.…

-

NEC smartphone termination, discussions with Lenovo failed

NEC smartphone – admits losing against competition from Apple and Samsung NEC smartphone – NEC used to be No. 1 in Japan’s “Galapagos keitai” market Just a few years ago, NEC was No. 1 in market share of Japanese pre-smart phone “Galake” (Galapagos-keitai, for a review of Japan’s Galapagos effect click here) super-feature phones. Recently…

-

Sony earnings boosted by weak yen – BBC interview about SONY earning results

Helped BBC with the article “Sony earnings boosted by weak yen and smartphone sales“ https://www.bbc.com/news/business-23527714 for detailed analysis of Japan’s electronics industry sector including SONY, see: Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

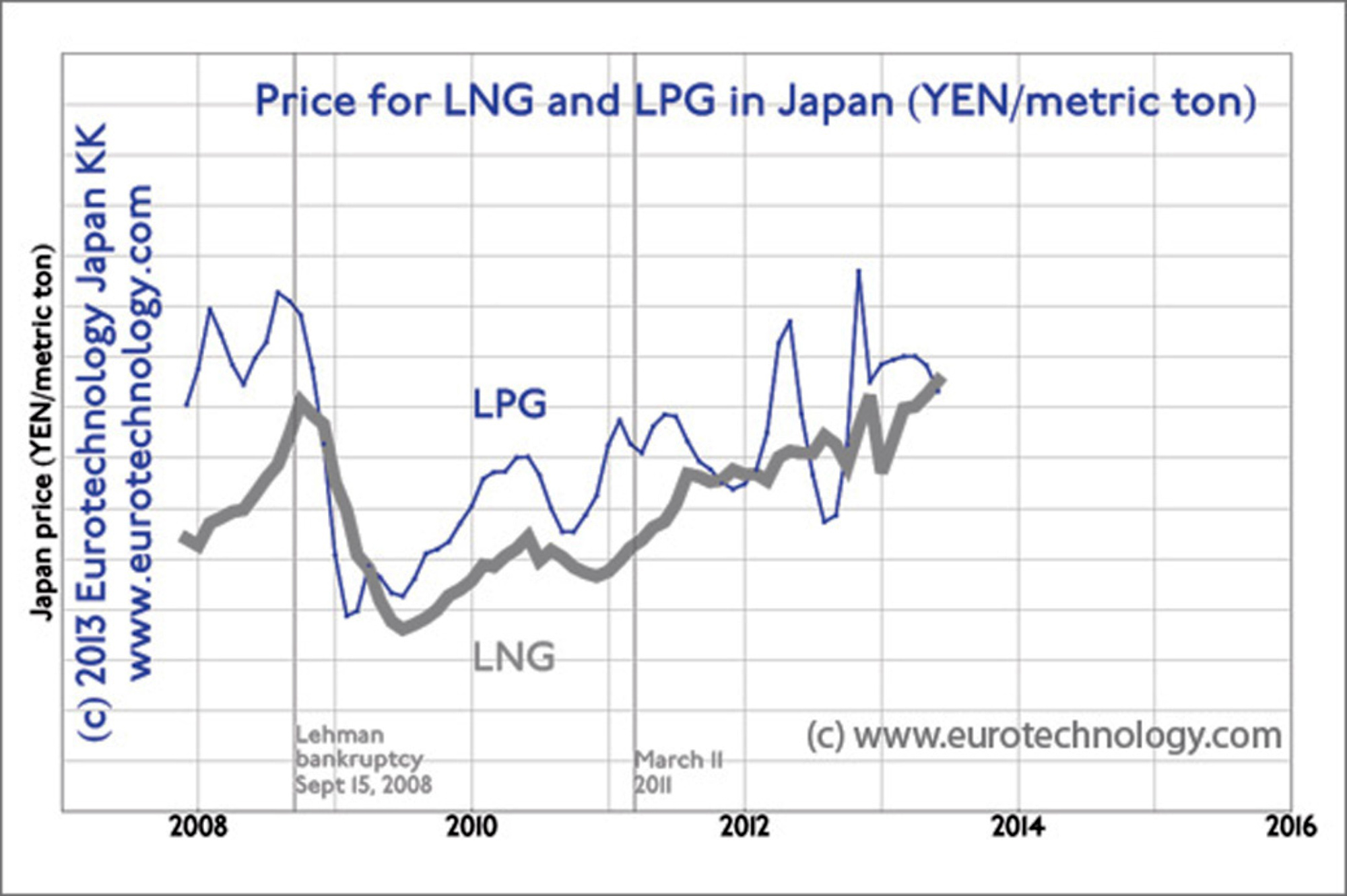

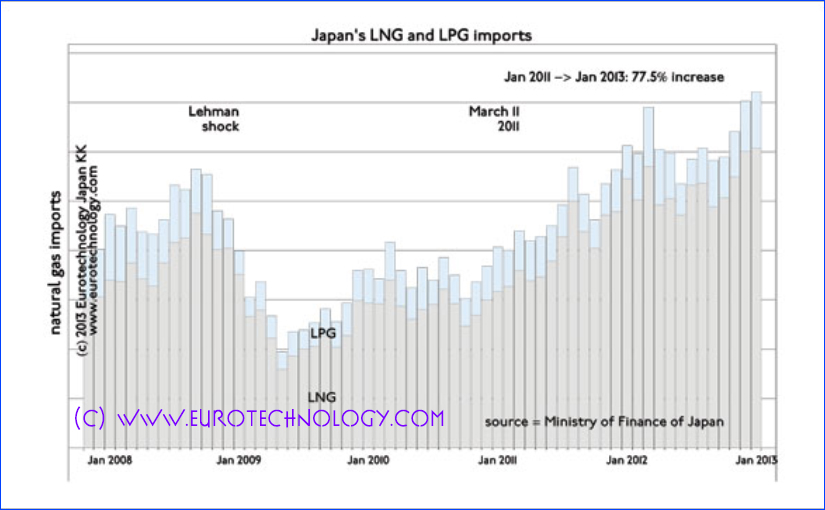

Japan LNG import costs increase 77.5% from 2011-2013

Japan LNG import costs – we analyze Japan’s official LNG import data Japan LNG import costs increase 77.5% from 2011-2013 Here we analyze Japan’s liquid natural gas (LNG) costs, which have been driven to record heights – mainly by the very high LNG prices Japan has to pay, and driven even higher by the low…

-

Japan energy – myths versus reality, mantra versus smart

A lecture a the Embassy of Sweden for the Stockholm School of Economics European Institute for Japanese Studies EIJS Outline of the lecture: Thank you to all those who attended the event “Japan’s energy – myths vs reality” at the Embassy of Sweden – an event organized by the European Institute for Japanese Studies of…

-

Japan’s Energy – Myths vs Reality

European Institute of Japanese Studies Academy Seminars presents: Japan’s Energy – Myths vs Reality” Speaker: Dr. Gerhard Fasol, President, Eurotechnology Japan K.K. Wednesday, June 19th, 2013 18:30 – 21:00 Embassy of Sweden, Alfred Nobel Auditorium Stockholm School of Economics, European Institute of Japanese Studies for details and registration click here Announcement on the webpage of…

-

94% of renewable energy projects approved under Japan’s feed-in-tariff programs are for solar energy generation

Japan’s feed in tariff for renewable energy Almost all projects are for solar energy Feed-in-tariffs for renewable energy where introduced in two stages in Japan. Large scale introduction of feed-in-tariffs (FIT) started with the Law entitled “Special measures concerning renewable energy electric power procurement by operators of electrical utilities law” which came into force on…

-

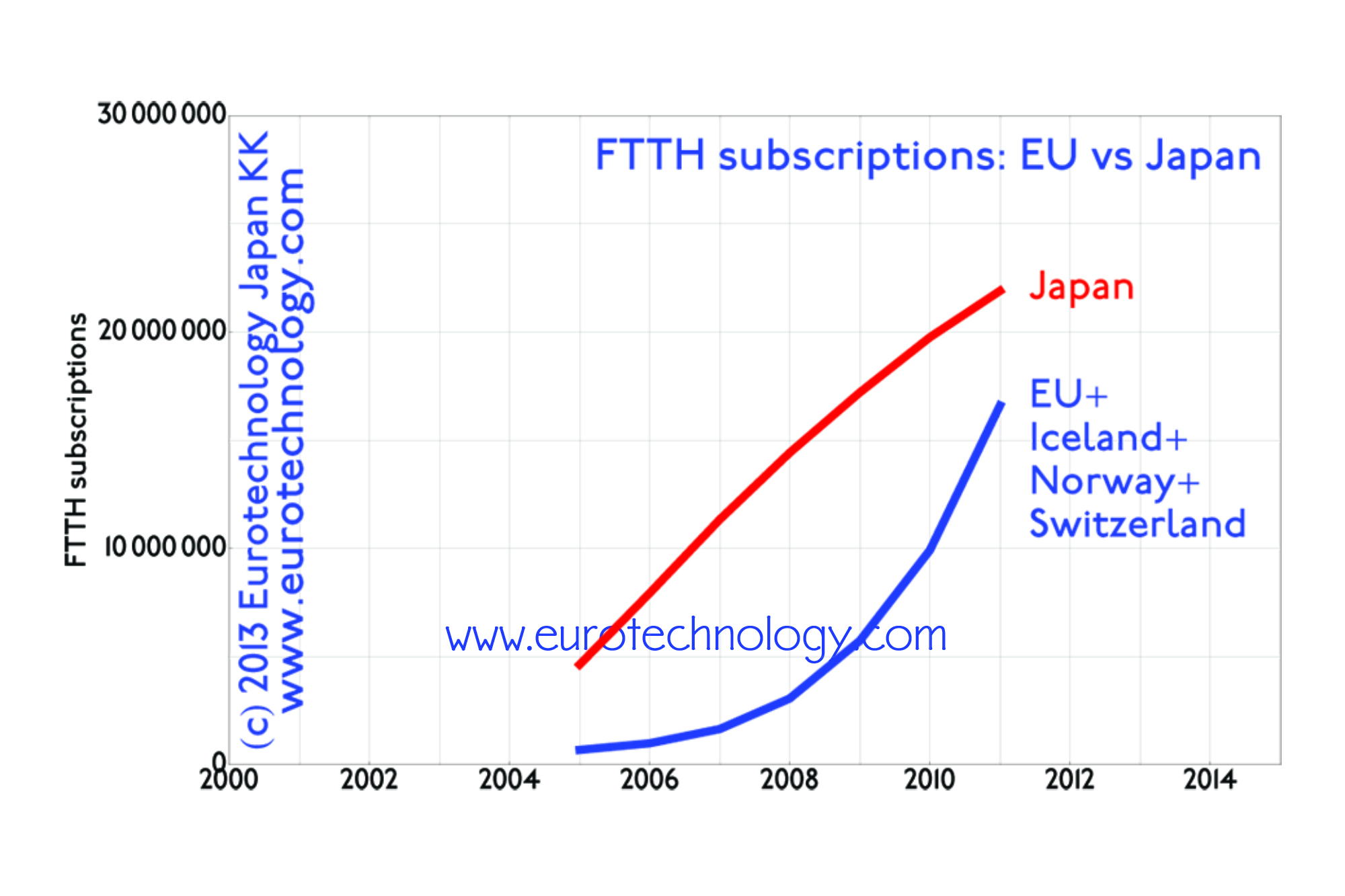

FTTH Japan Europe: more FTTH broadband subscriptions in Japan than in all of EU + Norway + Switzerland + Iceland

by Gerhard Fasol Japan has more broadband fixed internet subscriptions than all of the European Union + Switzerland + Norway + Iceland FTTH Japan Europe: While Japan initially was late in waking up to the commercial introduction of the Internet – Japan was fast to catch up and overtake Japan alone currently has about 30%…

-

Overview of Japan’s Data Center Landscape (opening keynote)

“Overview of Japan’s Data Center Landscape” (Opening keynote)Speaker: Gerhard FasolMay 22, 20139:15-9:45Tokyo Convention Hall, Great Hall on 5th Floor, TOKYO SQUARE GARDEN, 3-1-1 Kyobashi, Chuo-ku, TokyoData Center Summit TokyoData Center Summit Tokyo (Japanese text only)

-

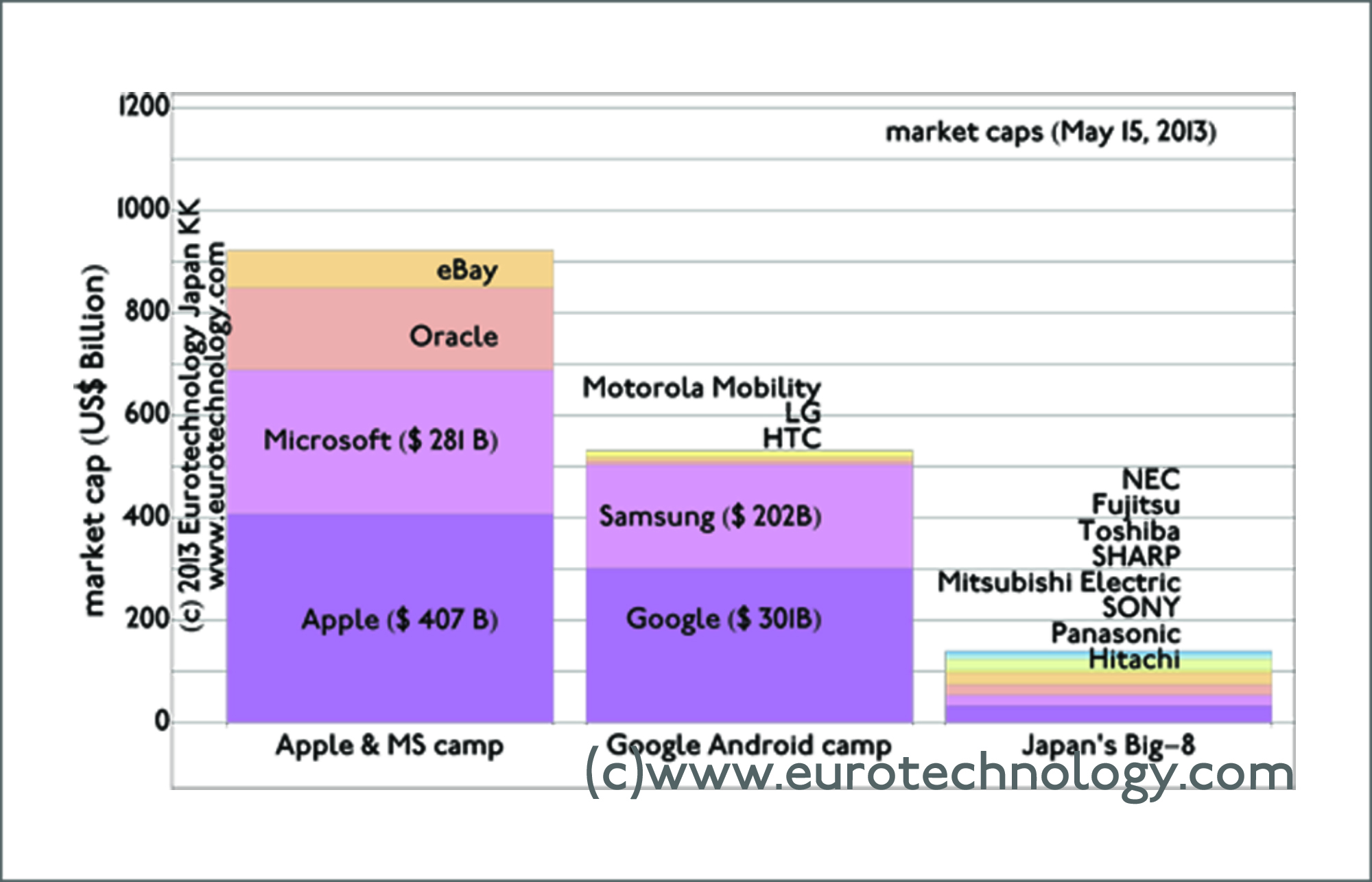

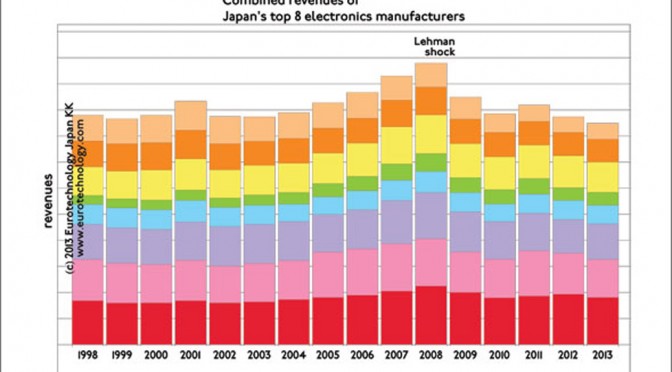

Japan’s electronics giants – FY2012 results announced. 17 years of no growth and no profits.

Japan’s electronics giants: as large as the economy of Holland, but 17 years of stagnation. No growth & no profits. Daniel Loeb: SONY’s uninvited guest gives Japan’s business culture a jolt Japan’s electronics giants combined are as large as the economy of Holland, but did not grow for about 17 years, and on average lost…

-

Growth in Japan: the SoftBank group

SoftBank gaining market share in Japan SoftBank market cap catching up with Docomo Mobile subscription data released last week show, that the SoftBank group continues to gain market share while incumbent NTT-docomo continues to lose market share – an upward trend for SoftBank, and a downward trend for NTT-docomo essentially unbroken since SoftBank acquired Vodafone-Japan…

-

SONY results for FY2012 (ended March 31, 2013)

SONY’s first profits in 4 years come from selling assets and buildings SONY results for FY2012- BBC interview SONY announced annual financial results today, and BBC interviewed me twice to comment on the results (read comments here on the BBC website). After 4 years of net losses, it is comforting to see SONY report profits…

-

Masayoshi Son: “I am a man – and I want to be Number 1”

SoftBank aims for global No. 1 position…acquiring SPRINT on the way to the top SoftBank: towards global No. 1 with a 300 year vision To understand SoftBank, and the planned SPRINT acquisition, you need to understand Masayoshi Son – and Masayoshi Son says: “I am a man – and I want to be Number 1”.…

-

Japan telecom sector financial results and the Softbank-Sprint take-over battle

SoftBank seeks to win, where Docomo failed – taking Japan’s telecoms know-how global Japan telecom sector financial results: very very healthy With SoftBank and DISH battling for US mobile operator SPRINT, the eyes are on Japan’s very healthy mobile phone sector, which a few days ago announced financial results for FY 2012. Japan’s mobile operators…

-

US$ 15 billion losses for Japan’s electricity sector continue

On April 30 Japan’s electricity operators announced their financial results for the financial year that ended on March 31. Japan’s ten regional electricity operators again announced combined net losses in excess of US$ 15 billion for the Financial Year ending March 31, 2013, similar in size as the previous year: energy remains one of Japan’s…

-

Intellectual Japan – BBC: “Japan has to become a brain country” – from mono zukuri to brain country

Intellectual Japan: Japan’s electronics companies need new business models – interview for the BBC The BBC recently examined why Japan’s electronics sector has to create new business models, and quotes “Japan has to become a brain country”. Japan’s top 8 electronics companies combined are as large as the Netherlands economically, but have shown zero growth…

-

Japan ought to be heaven for renewable energy (The Economist)

Industry Ministry METI announces renewable energy sources admitted to the feed-in-tariff program Reversing the decline of renewable energy in Japan A few days ago Japan’s industry ministry METI announced the most recent data on renewable energy sources in Japan admitted under the feed-in-tariff (FIT) regulations introduced on July 1, 2012. We have updated our report…

-

Japan to reverse decline of renewable energy – Renewables declined from 25% to 10%

Japan’s renewable energy generation is overwhelmingly water power Japan to reverse decline of renewable energy. The ratio of renewable power generation has decreased from 25% of total electricity generation in 1970 to 10% today. Extremely aggressive feed-in tariffs (FIT) for renewable energy introduced in July 2012 are showing first modest results to reverse this trend…

-

Japan gas imports: +77.5% from Jan ’11 to Jan ’13 – all-out efforts to reduce energy costs

Japan replaced almost all nuclear energy with liquid natural gas imports Increased LNG import costs due to declining yen Japan gas imports: Japan replaced almost all nuclear energy with liquid natural gas imports at very short notice. Japan pays far higher costs for liquid natural gas imports than most other regions in the world (find…

-

Energy – 5th Ludwig Boltzmann Symposium, Tokyo, Feb 20, 2013

Energy 5th Ludwig Boltzmann Symposium – speakers: Robert Geller, Gerhard Fasol, Kiyoshi Kurokawa, Shuji Nakamura Wednesday, 20th February 2013, Embassy of Austria, Tokyo 14:00 Welcome by Dr. Bernhard Zimburg, Ambassador of Austria to Japan 14:10 Gerhard Fasol, “today’s agenda” 14:20 – 14:40 Robert GellerProfessor of Geophysics University of Tokyo, seismologist. First ever tenured non-Japanese faculty…

-

SONY profits: 56% of profits are from selling life insurance and financial products (manuscript invited by BBC)

Games are 11% of SONY’s sales SONY profits: Currently 56% of SONY’s profits come from selling life insurance and financial products Games are 11% of SONY‘s sales – and currently 56% of SONY profits come from selling life insurance, consumer loans and financial products in Japan. Games are important, but are not going to make…