The Deal seals Vodafone’s exit from Japan

Softbank acquires Vodafone Japan in an approx. US$ 15 billion deal – worth an estimated US$ 83 billion ten years later

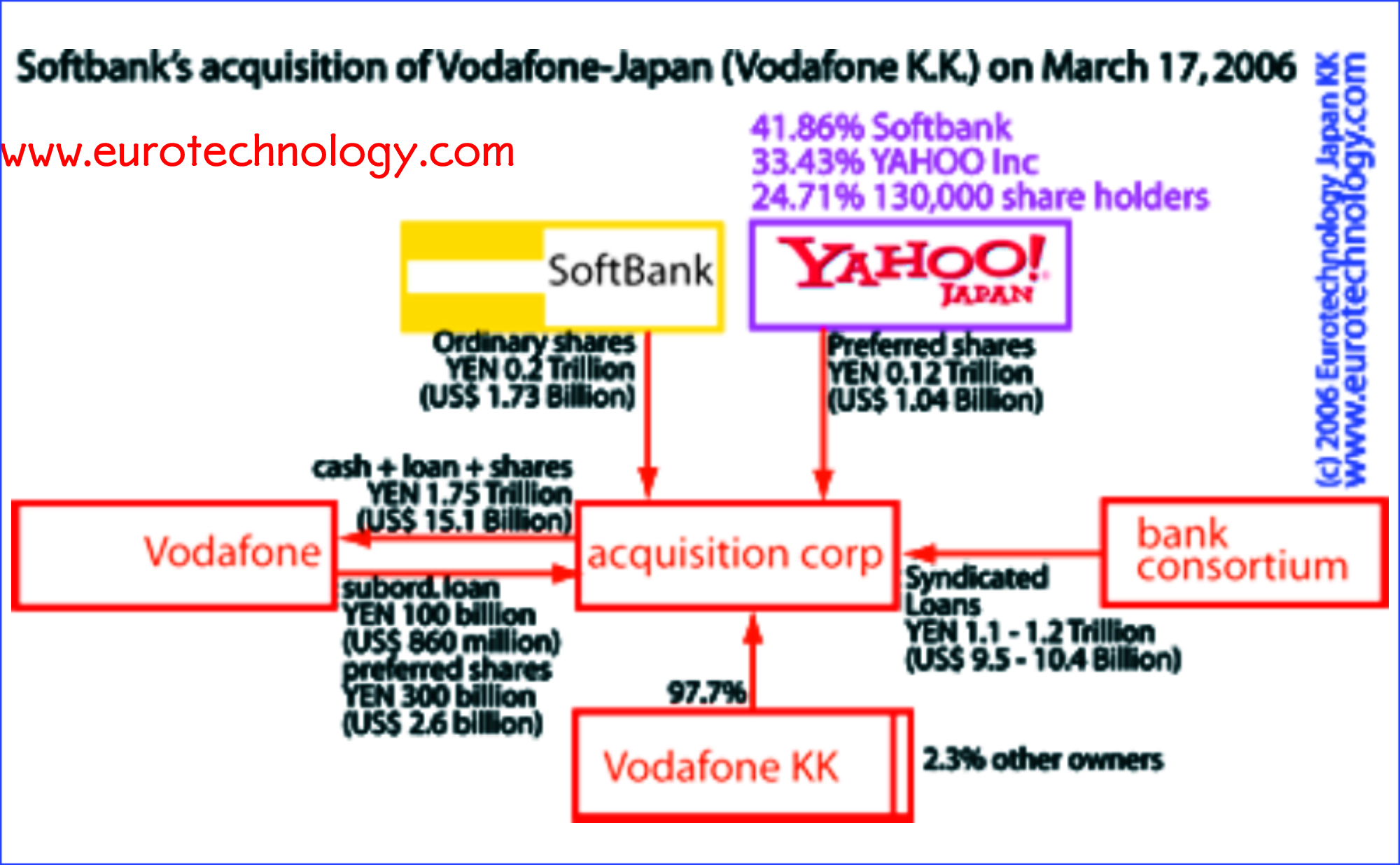

SoftBank and Yahoo-Japan acquired 97.7% of outstanding shares of Vodafone Japan (Vodafone KK) in Japan’s largest M&A transaction (the remaining 2.3% are owned by other investors). In a Leveraged Buy-Out (LBO) a consortium of banks extended US$ 9.5 to 10.4 Billion in loans.

Citibank was the lead in this transaction on SoftBank side, but because of the size of this transaction, essentially all major players in Japan’s financial industry were involved – including our company, which advised one of the loan risk assurance companies on aspects of the risks of this transaction.

Ten Years later (2016) we estimate that Vodafone-Japan would have been worth approx. US$ 83 billion

We estimate that ten years later, had Vodafone-Japan been successful, would have been worth an estimated US$ 83 billion, a value lost to Vodafone as opportunity cost, and the reward to SoftBank fur the successful turnaround.

For details of our analysis of the value of this company ten years later read:

SoftBank’s aim: grow to 26 million mobile subscribers and become No. 2 in Japan

SoftBank announced the plan to return to J-Phone’s growth curve and to aim for 26 million subscribers, which would place the resulting mobile operator on place 2 in Japan.

Japan’s new telecom landscape

Three major players emerge after a sequence of consolidation and restructuring: NTT, KDDI and Softbank/YAHOO. The following figure outlines Japan’s telecom sector in 2006:

Understand Japan’s telecom sector

Understand Softbank: our report: “SoftBank today and 300 year vision”

pdf file, approx 120 pages, 47 figures 18 photos, 7 tables

Copyright (c) 1997-2013 Eurotechnology Japan KK All Rights Reserved

Comments and discussions