Author: g_fasol

-

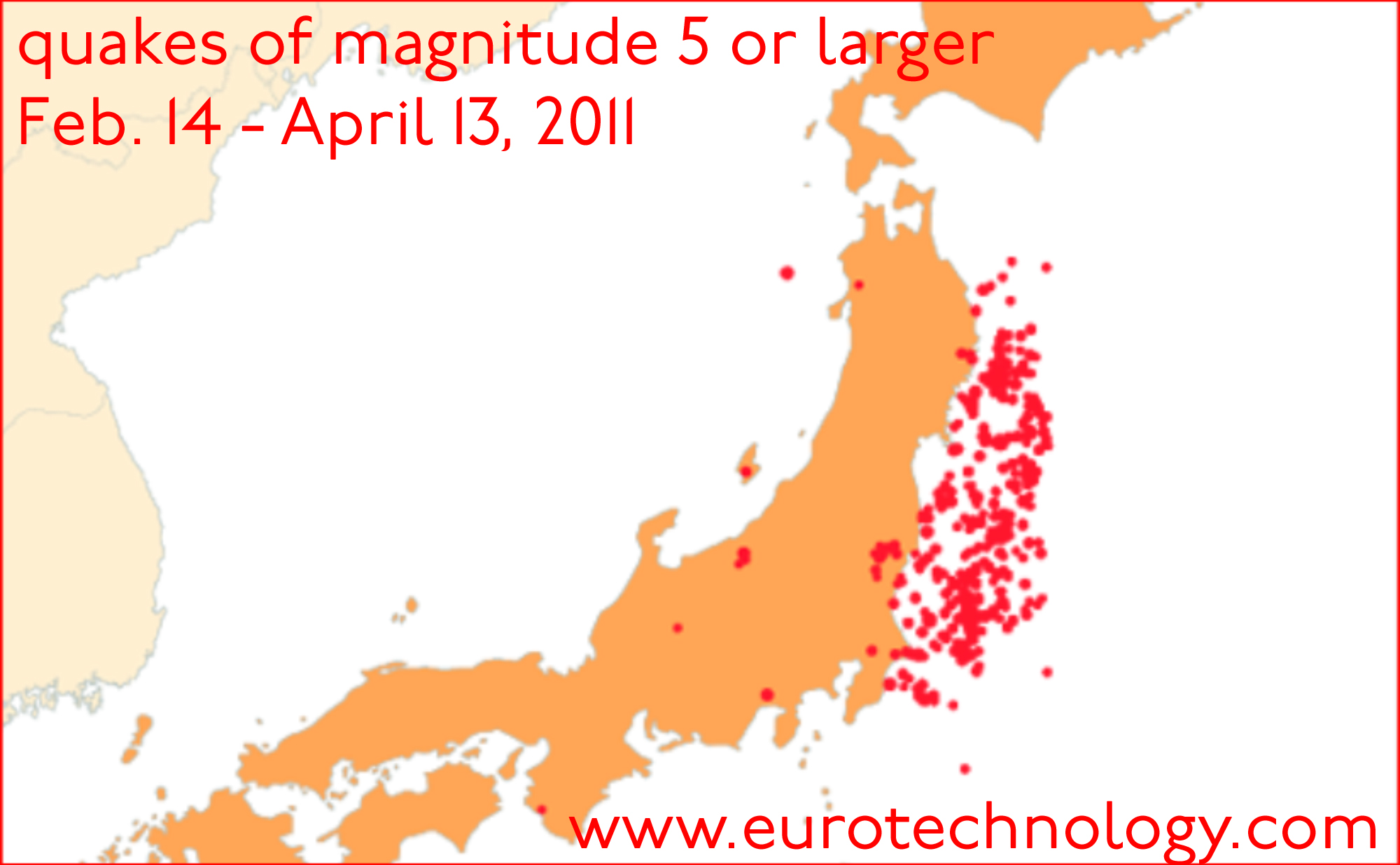

Fukushima nuclear disaster: 5 years since the Tohoku earthquake and tsunami on 2011/3/11 at 14:46:24

5 years and many lessons learnt since the Tohoku and Fukushima disasters Tohoku disaster and Fukushima nuclear disaster lead to Japan’s energy market liberalization Tohoku disaster: On Friday March 11, 2011 at 14:46:24, the magnitude 9.0 “Great East Japan earthquake” caused a tsunami, reaching up to 40.4 meters high inland in Tohoku. Japan’s National Police…

-

Mobile internet’s 17th birthday

The global mobile internet revolution started with Docomo’s i-Mode on February 22, 1999 i-Mode, Happy Birthday! Today, exactly 17 years ago, on February 22, 1999, NTT-Docomo launched the world’s first mobile internet service, i-Mode, at a press conference attended only by a handful of people. NTT-Docomo created the foundation of the global mobile internet revolution,…

-

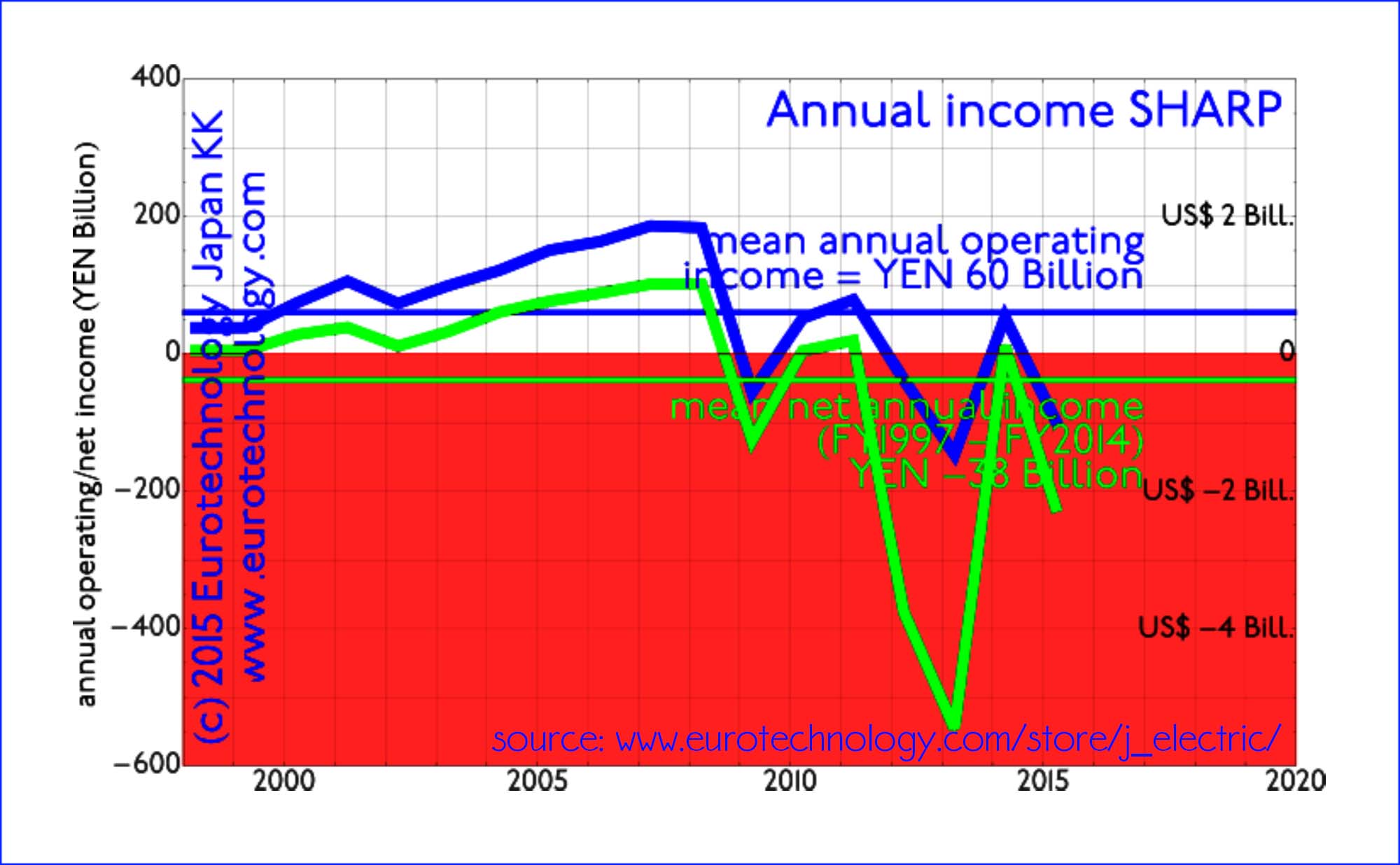

SHARP and the future of Japan’s electronics

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

Economic growth for Japan? A New Year 2016 preview

Economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood Chairman Kawahara), and adjusting…

-

Corporate governance reforms in Japan – practical views of a Board Director

A Board Director’s view Corporate governance reforms in Japan progress faster than even one of their key promoters expected, and cost almost no tax payers money Author: Gerhard Fasol Corporate governance reforms in Japan are one component of “Abenomics” to bring back economic growth to Japan. Corporate governance reforms in Japan are driven at least…

-

Was Osamu Suzuki first to understand Volkswagen’s Diesel issues?

Osamu Suzuki: “we looked at Wagen’s technologies, and could not find anything we need” (Nikkei, 1 July 2011) by Gerhard Fasol Did Volkswagen underestimate Mr Suzuki? Over the last 18 years myself and our company have worked on many foreign-Japanese company partnerships, therefore we always have great interest in business partnerships involving Japanese companies, and…

-

Mr. Suzuki didn’t want to be a Volkswagen employee, and that’s understandable (Prof. Dudenhoeffer via Bloomberg)

Mr Suzuki (Chairman of Suzuki Motors), wrote in his Japanese blog, that “ending the partnership with Volkswagen (Wagen-san as he calls VW) was like the relieve I feel after having a fishbone stuck in my throat removed” No partnership works without meeting of minds, with opposite agendas and colliding expectations by Gerhard Fasol, All Rights…

-

Quarterly financial reports to go away: UK and EU remove requirements for quarterly financial reports

Voluntary quarterly reporting? Quarterly financial reports: can they be the trees which obscure long term growth of the forrest? As a Board Director of a Japanese company traded on the Tokyo Stock Exchange I have to study and approve monthly, quarterly and annual financial reports, and I share responsibility for the future success of the…

-

Burberry Japan: breaking up is hard to do

Burberry Japan pivots from successful partnership to direct business by Gerhard Fasol, All Rights Reserved. many of the underlying issues also apply in all other business areas, such as electronics, and technology. Sanyo Shokai pivots from Burberry to Mackintosh and other brands Burberry Japan pivots to direct business to solve Burberry’s “Japan Problem”: for the…

-

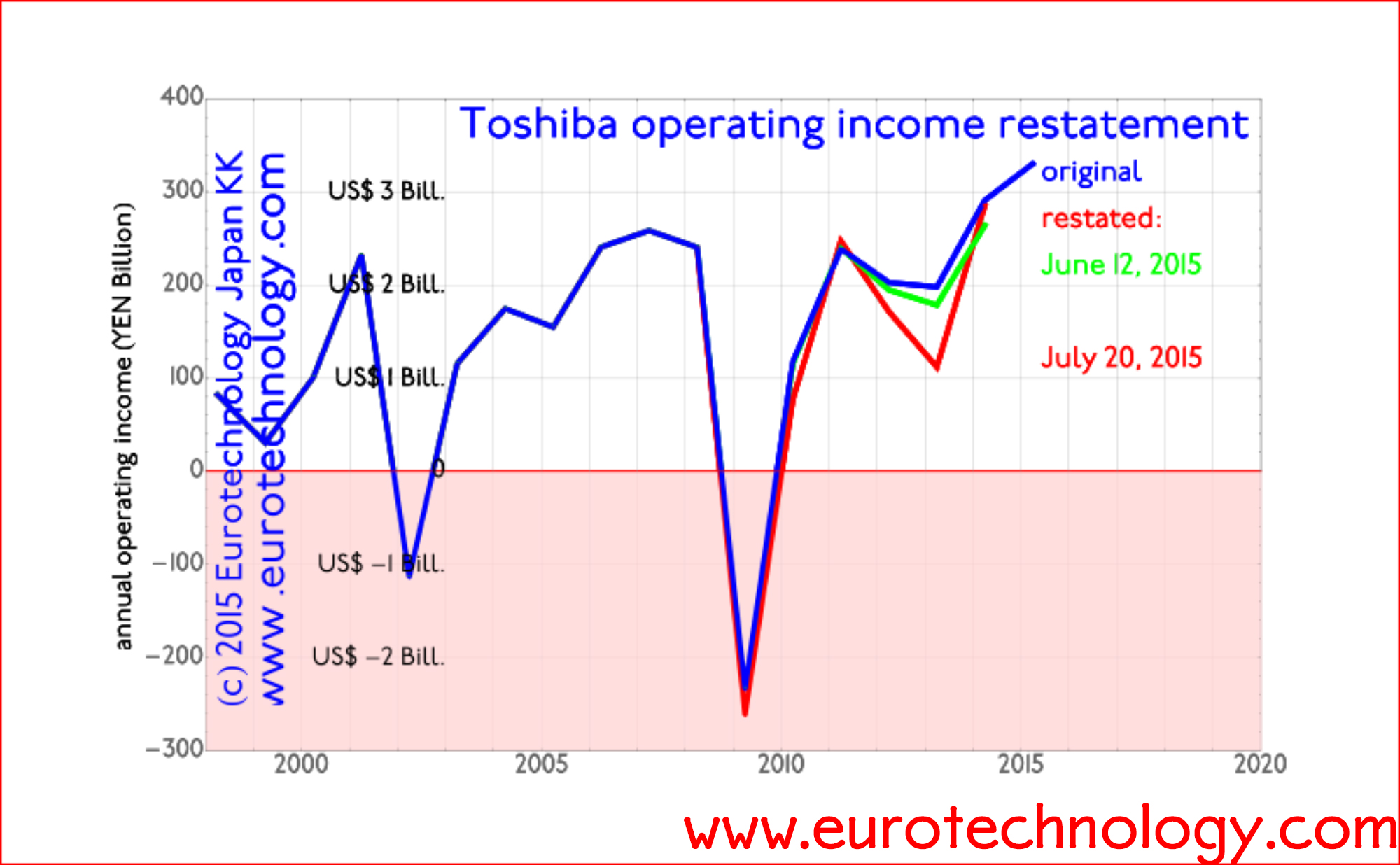

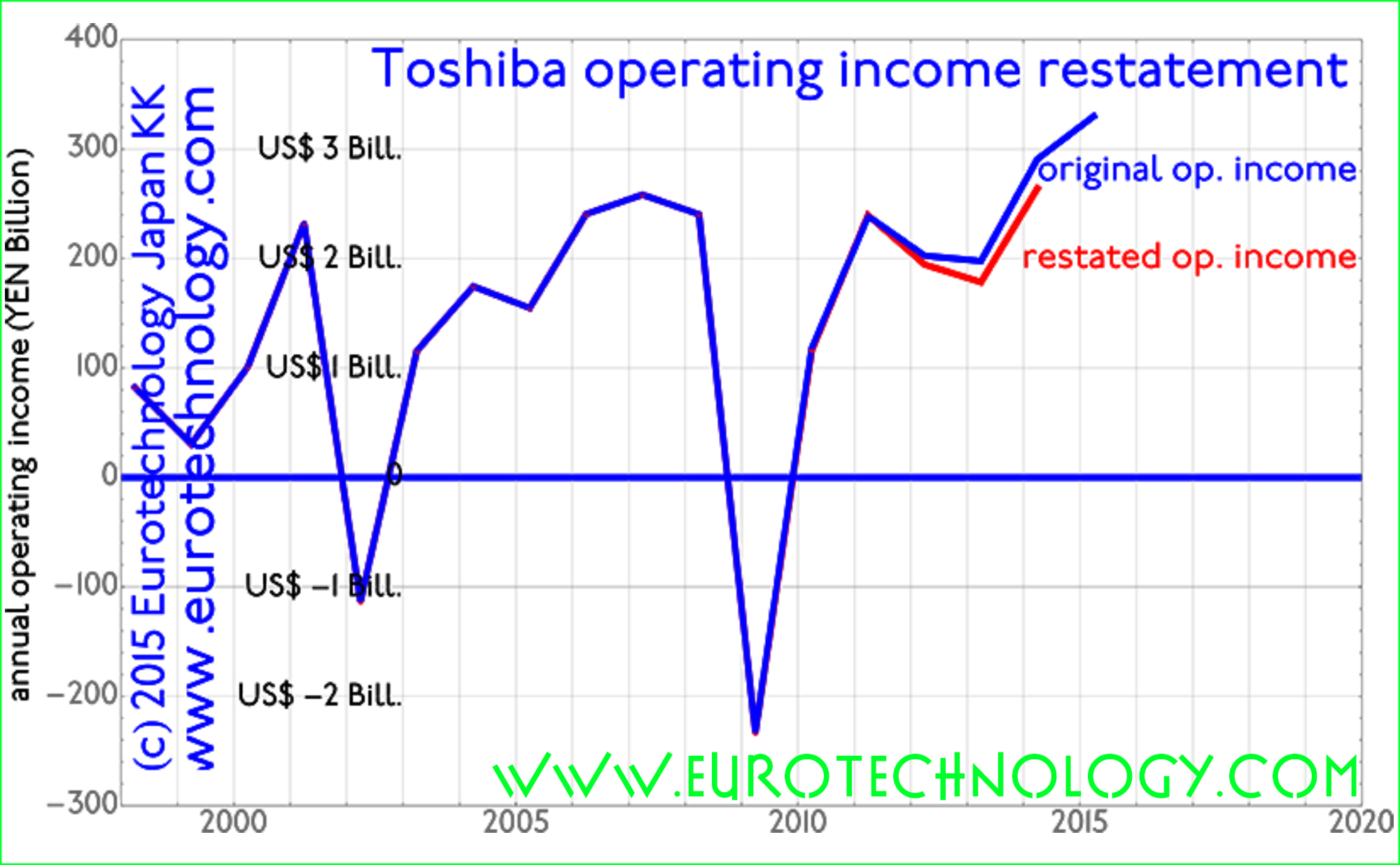

Toshiba income restatement: corresponds to one full year of average operating income

Toshiba’s income restatement announced by the independent 3rd party committee by Gerhard Fasol Independent 3rd party committee chaired by former Chief Prosecutor of Tokyo High Court On 12 June, 2015, Toshiba announced corrections to income reports, and at the same time engaged an independent 3rd party investigation committee headed by former Chief Prosecutor at the…

-

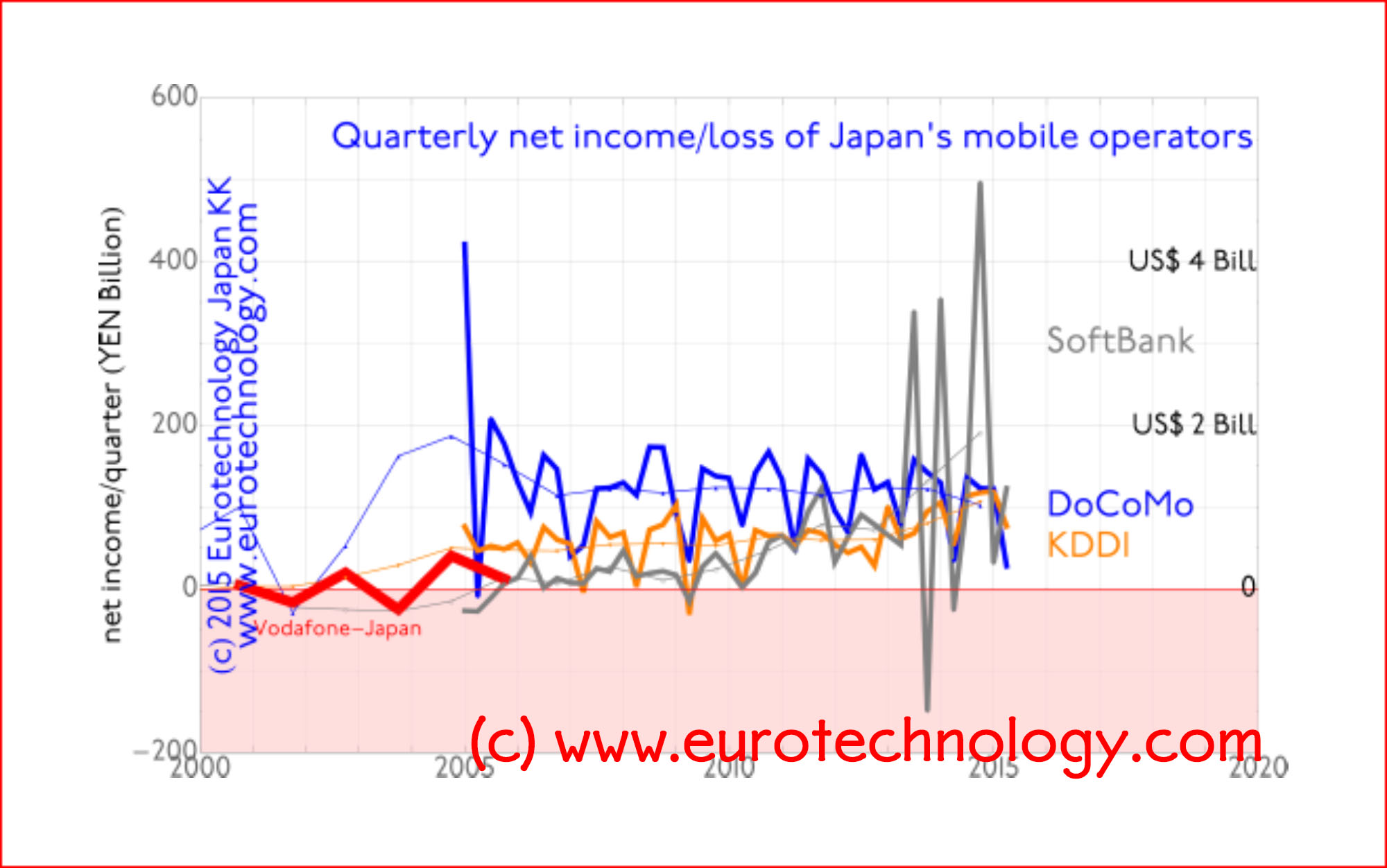

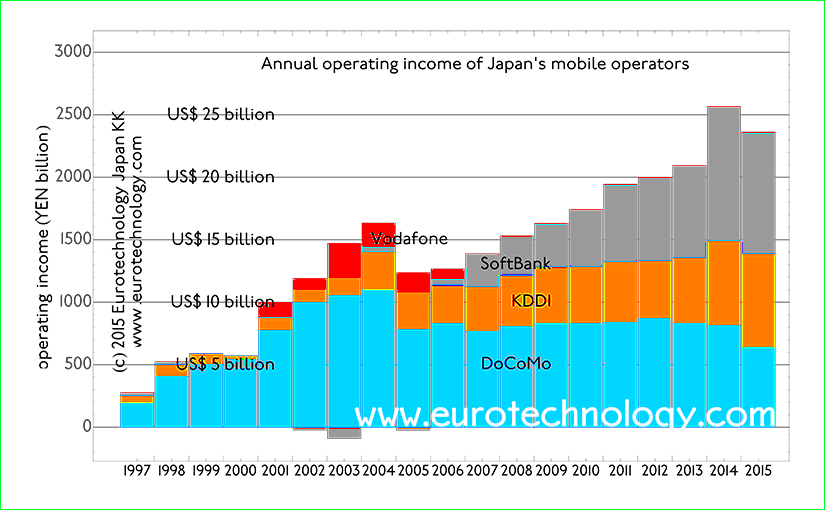

Japan mobile operators grow to US$ 25 billion in operating profits for FY2014 (ended March 31, 2015)

Annual revenues exceed US$ 170 billion in FY2014 Japan’s mobile telecommunications sector continues to grow The global mobile internet and smartphone revolution started in Japan in 1999, and Japan’s mobile telecommunications market is the world’s most advanced and most vibrant. Much mobile innovation and inventions, such as camera phones, color screens for mobile phones, mobile…

-

Masahiro Morimoto, entrepreneur, CEO and Chairman of the Board, UBIC Inc. (today: Fronteo) A discussion with Dr. Gerhard Fasol

UBIC Inc (today: Fronteo): founded to curb huge losses of Japanese corporations due to litigation abroad A discussion between UBIC (today: Fronteo) CEO Masahiro Morimoto and Dr. Gerhard Fasol From Japanese/Chinese/Korean (CJK) e-discovery, to data forensics, virtual data scientist and predictive coding Masahiro Morimoto founded UBIC Inc. on August 8, 2003 to stem the huge…

-

Toshiba accounting restatements in context

July 21, 2015: Update – report of the independent 3rd party committee chaired by former Chief Prosecutor of the Tokyo High Court. Corrections amount to 2 1/2 years (31.5 months) of average annual net profits by Gerhard Fasol Sales stagnation combined with almost zero net profit of Japan’s top 8 electronics companies creates increasing pressure…

-

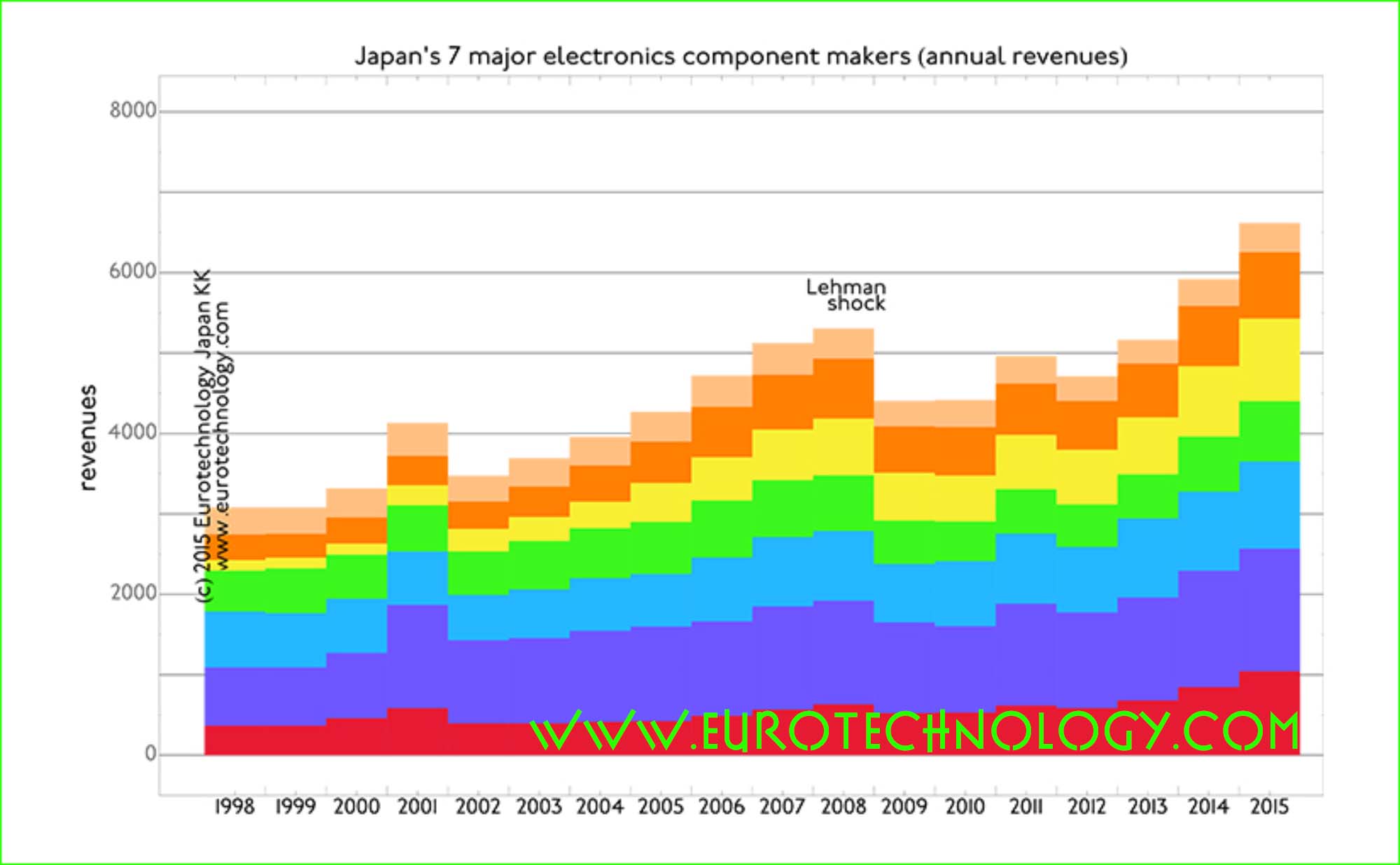

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

Japan Exchange Group CEO Atsushi Saito: proud of Corporate Governance achievements, but ashamed of Toshiba

New Dimensions of Japanese Financial Market Only with freedom and democracy, the values of open society and professionalism can the investment chain function effectively The iconic leader of the Tokyo Stock Exchange since 2007, now Group CEO of the Japan Exchange Group gave a Press Conference at the Foreign Correspondents Club of Japan on June…

-

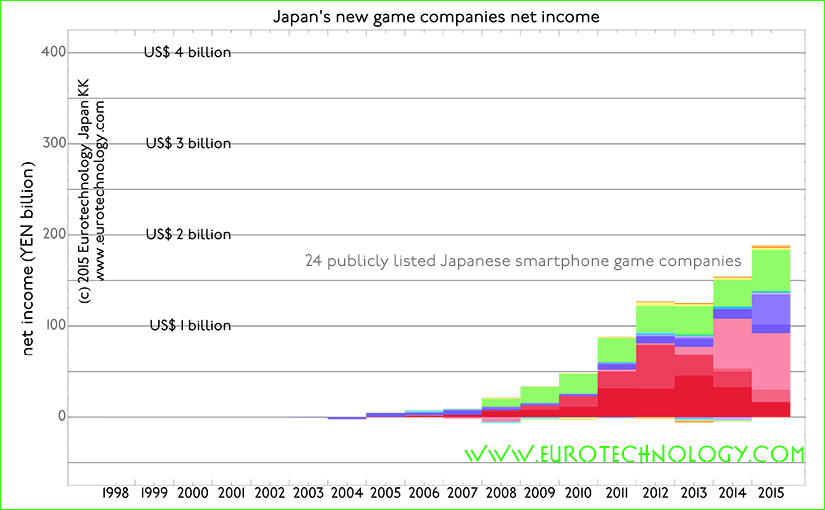

Japan top grossing smartphone apps

5 top listed smartphone app companies have combined market cap of US$ 14 billion (excluding LINE) LINE is currently a private company and LINE’s company value is generally estimated in the US$ 10-15 billion range, so if we include LINE, the combined market value of Japan’s top 5 smartphone game companies is on the order…

-

Japan Google Play top grossing Android apps

25 Japan Google Play top grossing Android Apps of June 6, 2015 (All Categories) Japan game market report (398 pages, pdf-file) No. 1 Monster strike (by Mixi) No. 2 Puzzle & Dragons by GungHo No. 3「LINE: ディズニーツムツム」LINE Disney tsumu tsumu (by LINE Corporation & Disney) No. 4「白猫プロジェクト」”White Cat project” by COLOPL Inc. No. 5 「剣と魔法のログレスいにしえの女神・人気の本格オンラインRPG」Sword…

-

Japan iOS App store 25 top grossing

25 Top Grossing iPhone Apps of June 6, 2015 (All Categories) Japan game market report (398 pages, pdf-file) Copyright 2015 -2019 Eurotechnology Japan KK All Rights Reserved

-

Smartphone games disrupt Japanese video game industry

24 new listed smartphone game companies achieve net income twice as high as all top 8 traditional video game companies combined Its not just Nintendo being disrupted, its the whole Japanese video games industry In the most recent version of our report on Japan’s game industry, we added 24 publicly listed new smartphone game companies…

-

Nintendo smartphone pivot?!

Nintendo partners with DeNA Taking Nintendo intellectual property and characters to smartphones Nintendo was founded on September 23, 1889 by Fujasiro Yamauchi in Kyoto for the production of handmade “hanafuda” cards. Nintendo Headquarters are still located in Kyoto (you can see the Nintendo headquarters building from the Kyoto railway station). The Chinese characters used to…

-

Sir Stephen Gomersall: Globalization and the art of tea

by Hitachi Chief Executive for Europe and subsequently Hitachi Board Director (2004-2014) Sir Stephen Gomersall: Princess Chichibu Memorial Lecture to the Japan British Society at Ueno Gakuen, Tokyo, 5 March 2015 Sir Stephen Gomersall: It is a great honour to be giving this lecture this evening. HIH Princess Chichibu was a charming and broad-minded Patron…

-

Crisis leadership post-Fukushima: Dr. Chuck Casto

Global leadership in the extreme Dr Chuck Casto: Leader of the US Integrated Government and NRC efforts in Japan during the Fukushima nuclear accident in 2011 I don’t think that there is anyone with deeper insight into the Fukushima-Dai-Ichi nuclear disaster, its management, causes and consequences, than Dr. Chuck Casto. Dr Casto arrived in Japan…

-

Angela Merkel in Japan to discuss renewable energy

German Federal Chancellor Angela Merkel in Japan March 9-10, 2015 Hopes for Japan and Germany share at least part of the path to renewable energy Germany’s Federal Chancellor Angela Merkel, Physicist with a PhD (Chancellor Angela Merkel’s PhD thesis is available here) and several scientific publications to her credit, visits Tokyo today Monday 9 March…

-

Japanese acquisitions in Europe total € 6 billion in 2015

Overcoming Japan’s “Galapagos syndrome” Globalizing Japan’s high-tech industries At the Bank of Kyoto’s New Year celebration meeting, Japan’s stagnation and need for globalization were center of discussion – despite focus on globalization, the present author was more or less the only non-Japanese invited and attending(!). The Chairman of Japan’s Industry Federation KEIDANREN, Mr Sakakibara (Chairman…

-

i-Mode was launched February 22, 1999 in Tokyo – birth of mobile internet

The mobile internet was born 16 years ago in Japan Galapagos-Syndrome: NTT Docomo failed to capture global value On February 22, 1999, the mobile internet was born when Mari Matsunaga, Takeshi Natsuno and Keiichi Enoki launched Docomo’s i-Mode to a handful of people who had made the effort to the Press Conference introducing Docomo’s new…

-

Google Play Japan – top grossing Android Apps ranking

Android smart phone apps ranking in Japan by gross revenues (Feb. 18, 2015) Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is No. 1 globally, spending more than the USA. Therefore Japan is naturally the No. 1 target globally for many mobile…

-

Japan smartphone app rankings by cash revenue (iOS)

Top grossing app ranking (Feb. 10, 2015) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is No. 1 globally, spending more than the USA. Therefore Japan is naturally the No. 1 target globally for many mobile game companies, and quite a few of the top grossing apps in Japan…

-

Japan in 2015 – analysis

Thoughts and analysis for 2015 Abenomics?! The trick of course is the third arrow, the reforms. Read what Professor Takeo Hoshi has to say about Abenomics, Japanese economist, who has worked his way up US Universities, and has now reached the position of Professor of Economics at Stanford University. By the way, here is my…

-

EU Japan FTA

Free Trade Agreement (FTA) and Economic Partnership Agreement (EPA) Preparations: EU Japan FTA trade negotiations initiated: At the 20th EU-Japan Summit of May 2011 the EU and Japan decided to start preparations for both a Free Trade Agreement (FTA) and a political framework agreement (Economic Partnership Agreement, EPA). For updates and further details see: http://eu-japan.com/eu-japan-agreements/eu-japan-trade-negotiations/…