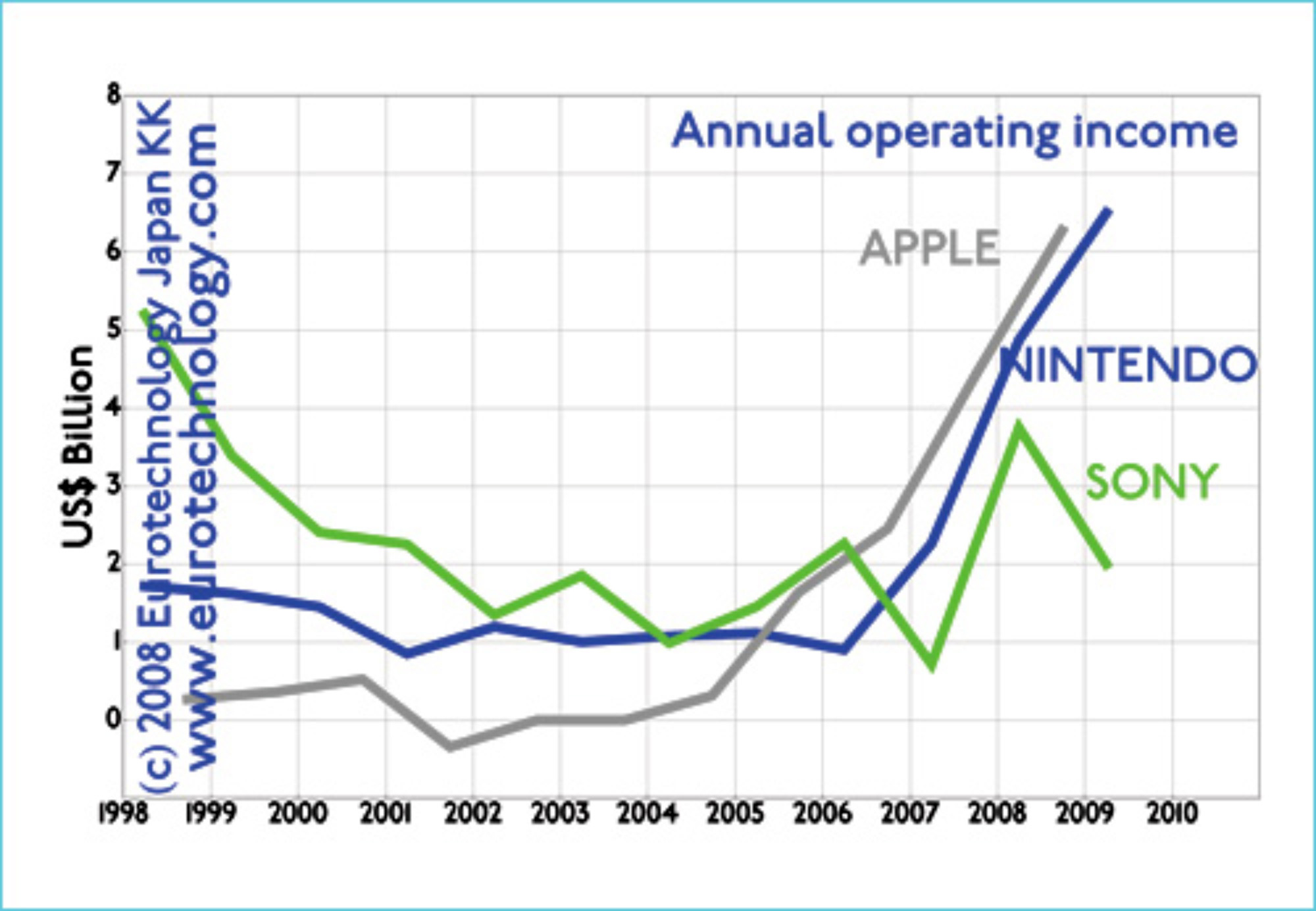

Lets benchmark three iconic companies:

Apple Nintendo Sony

Apple Nintendo Sony: three iconic companies evolving along very different paths. Apple’s current physical products famously all fit onto a single mid-sized table. Nintendo’s current physical products as well, for SONY you’d need a warehouse.

- APPLE: Wednesday October 22 APPLE announced spectacular full-year results with a year-on-year net income increase of 38%. The results are even better than they look, because iPhone sales and income are spread forward over 2 years due to accounting rules. (See our comments on CNBC here)

- NINTENDO: on August 29, 2008 Nintendo revised the forecast for full-year net income upward by +26.2% (See our comments on CNBC here)

- SONY: in contrast, on October 23, 2008, SONY said that full-year net income (for the financial year ending March 2009) is expected to be 37.5% lower than previously predicted (see our comments on SONY’s 1Q results here on CNBC)

Apple Nintendo Sony – Lets look at today’s market caps:

- APPLE market cap = US$ 85.6 Billion (about 4 x SONY)

- NINTENDO market cap = US$ 37.2 Billion (about 2 x SONY)

- SONY market cap = US$ 19.9 Billion

Apple Nintendo Sony – Why this dramatic difference in market caps? We believe its focus.

Apple and Nintendo are companies with clear focus. Lets look at the details below:

Comparing revenues (sales):

SONY = 3 x APPLE

SONY = 4 x NINTENDO

Comparing annual operating income:

APPLE = 3 x SONY

NINTENDO = 3 x SONY

Comparing operating margin:

APPLE = 9 x SONY

NINTENDO = 15 x SONY

Read our report on Japan’s electronics industry sector

Japan electronics industries – mono zukuri

Copyright (c) 2008-2013 Eurotechnology Japan KK All Rights Reserved