Seen in a fashion store in San Francisco:

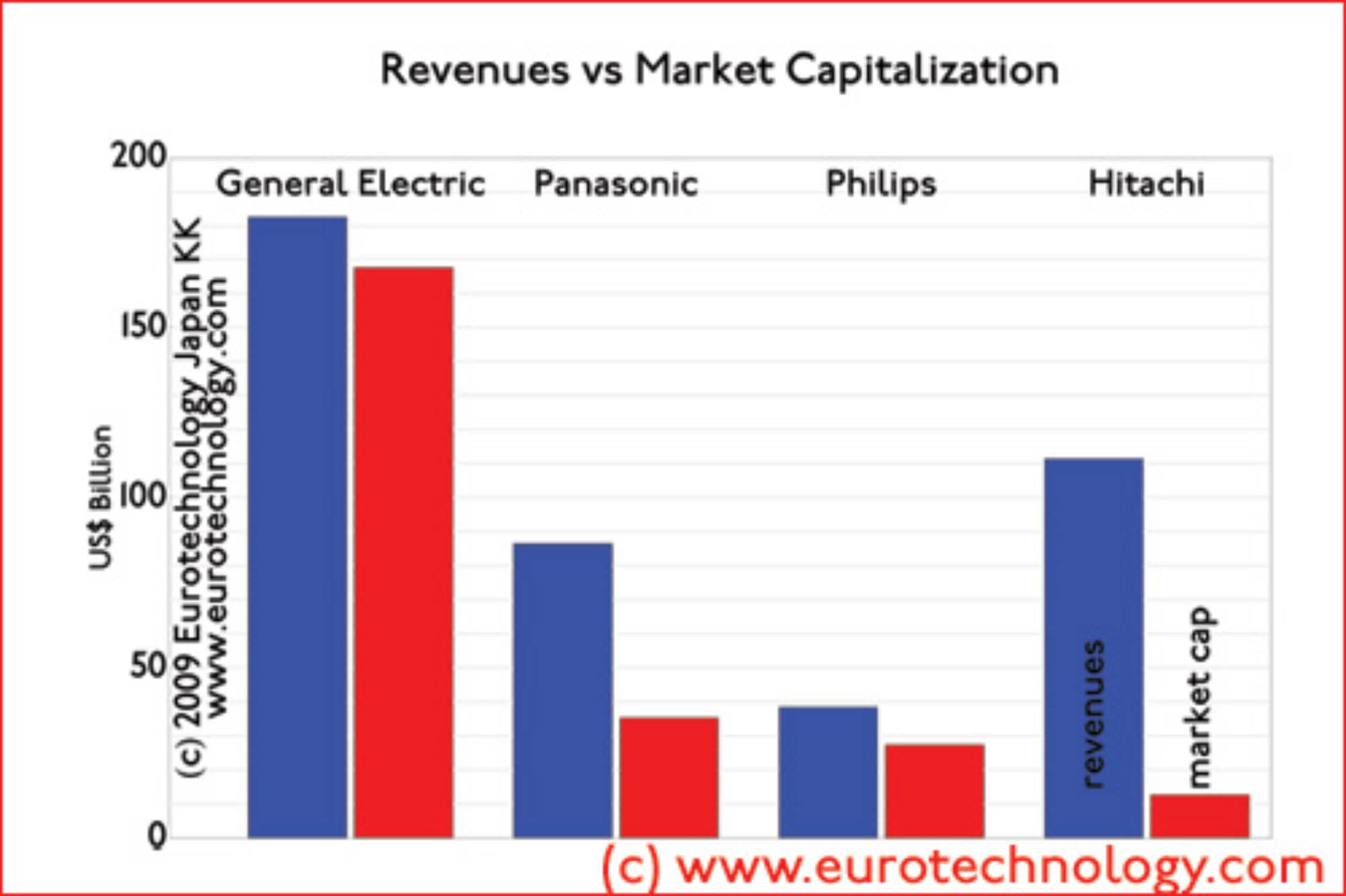

Some of Japan’s electrical corporations have remarkably low market capitalizations: General Electric has 1.6 x more sales than Hitachi, but has 13.3 x the market capitalization. Philips has 1/3 x Hitachi’s sales, but has 2.2 times higher market cap.

Low market values do not help big recent public share offerings:

Hitachi raising YEN 250.7 Billion (US$ 2.8 Billion),

Toshiba raising YEN 298.7 Billion (US$ 3.3 Billion), and

NEC raising YEN 115.5 Billion (US$ 1.3 Billion).

Low valuations increase the pressure for change in Japan’s electrical sector, and the SANYO-Panasonic merger is an indication of changes to come.

In the “post-Galapagos committee” we are working with some of Japan’s brightest leaders on understanding the reasons and on how to drive this change.

Benchmarking Japan’s electrical companies – Philips= 1/3 x Hitachi’s sales and 2.2 x Hitachi’s market cap:

More in our report on Japan’s electrical industries.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

I asked this question back in 2003 to NTT-DoCoMo’s CEO Dr. Tachikawa (see my article “Leadership questions of the week” in Wallstreet Journal of June 12, 2006, page 31), and offered several proposals to Dr. Tachikawa, of which he accepted one.

A related question is: “why can Samsung, LG and Apple beat Japan’s initially far more advanced mobile phone makers, and why have Japan’s phone makers taken no effective action to build global business in order to avoid extinction?”

Now six years after my initial presentation to DoCoMo’s CEO, I have been invited as the only non-Japanese to work on Japan’s “Post-Galapagos Committee”. For most of this year our small group of industry CEOs, academics, government officials and other leaders have been working on understanding the reasons for Japan’s “Galapagos effect” and how to overcome it.

Read about this work here in the New York Times, about my (Japanese language) presentation to the committee on the IT-Media website here (in Japanese)

The “Galapagos effect” has not been created by a single factor. Instead a collection of choices by the management teams of Japan’s electrical conglomerates have prevented leverage of their domestic success stories into global success stories. These choices can be overcome. In our “Post-Galapagos committee” we have worked all-year on how to overcome these choices.

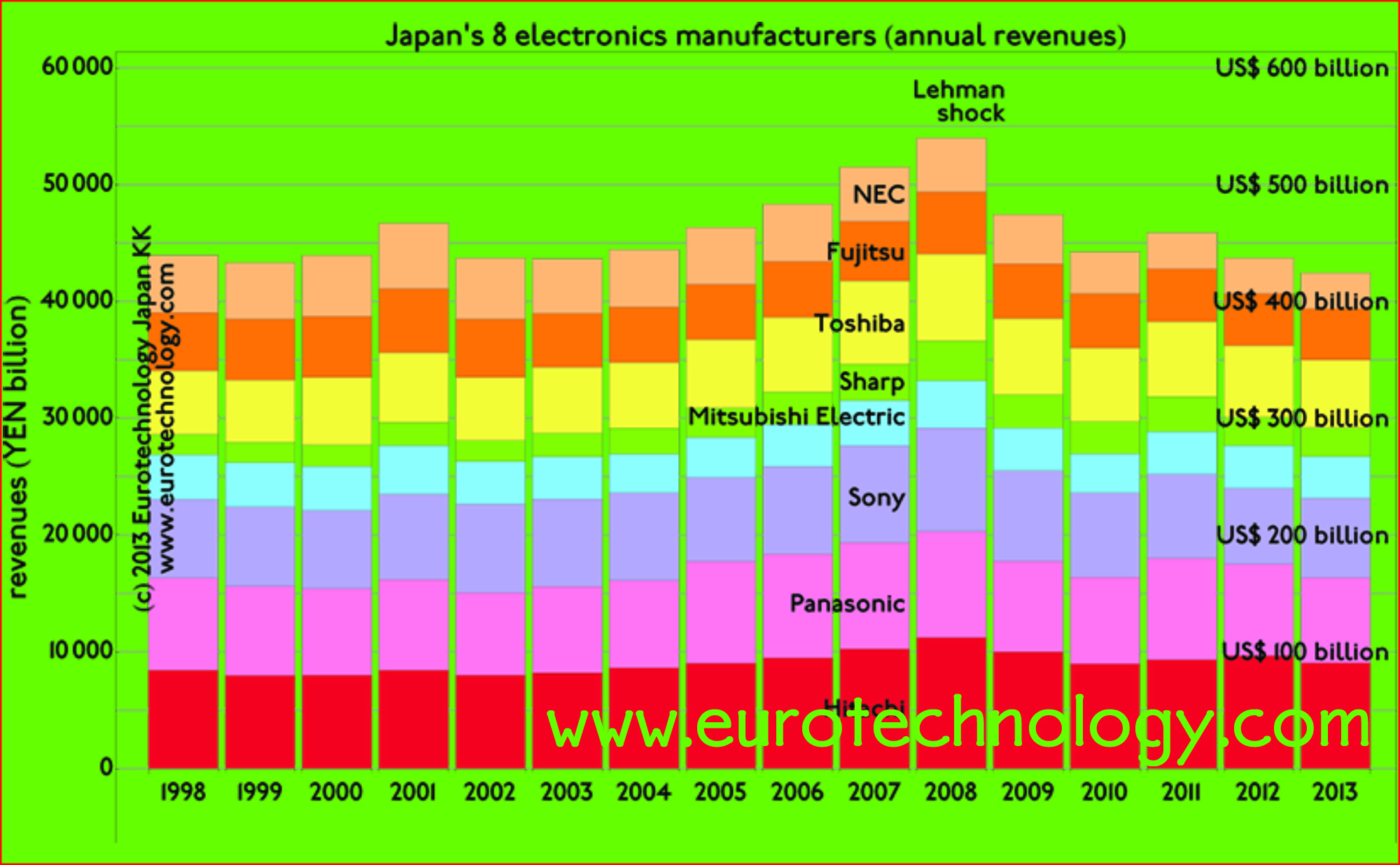

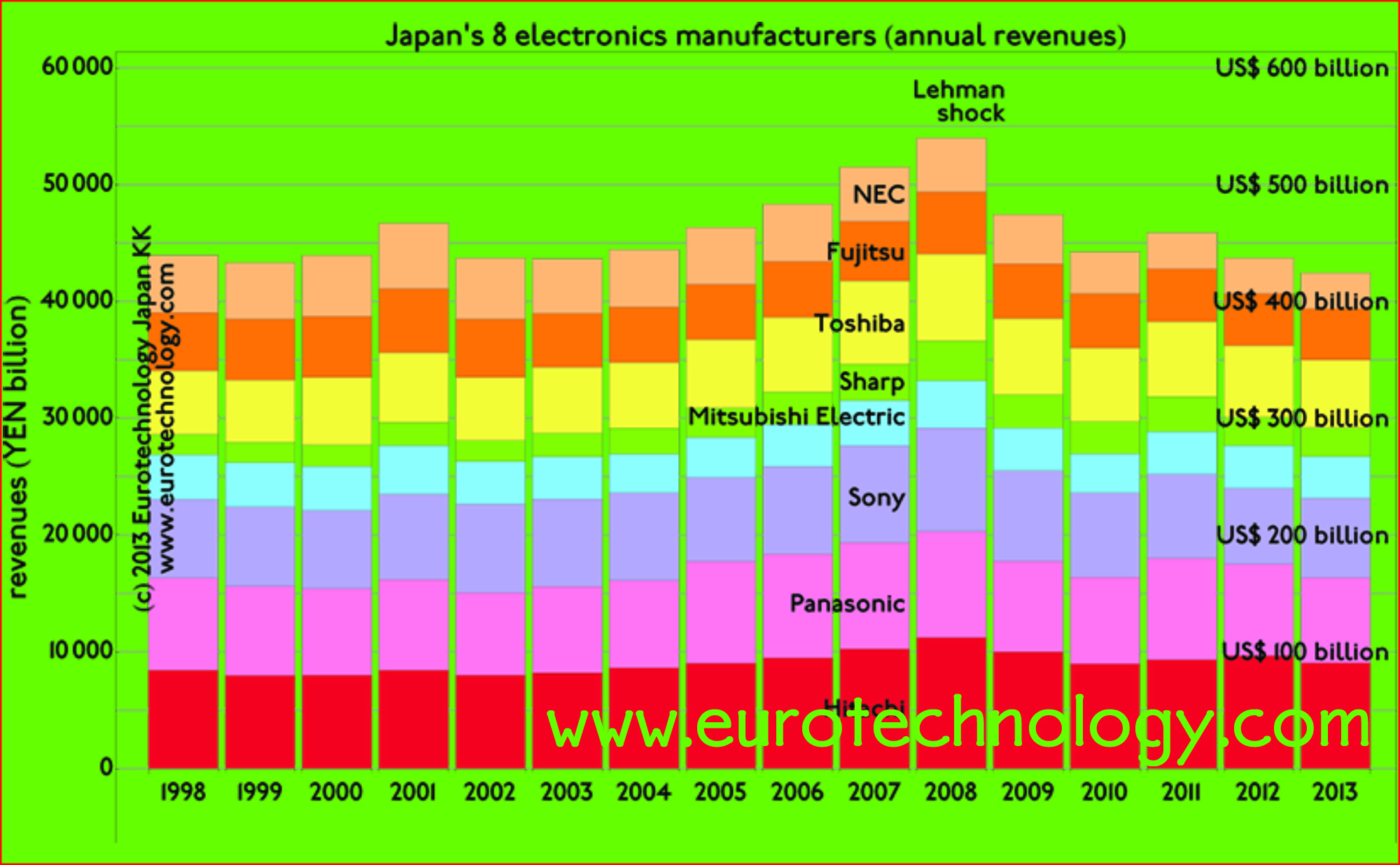

Unfortunately the “Galapagos effect” is only one symptom of the crisis of Japan’s electrical giants: most have shown little or no growth in sales over the last 10 years, while at the same time margins tend to be small or negative. Over the same period, General Electric has increased sales by a factor of about three, while at the same time earning healthy margins.

Overcoming this crisis will create many opportunities. If at least some of the conclusions of our “Post Galapagos Committee” can be realized, then our committee’s hard and totally voluntary work during most of this year and many late nights will not be wasted.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Gave presentation to the Telecommunications Committee of the American Chamber of Commerce in Japan (ACCJ) on October 7, 2009, entitled “Will cash become obsolete? E-money, mobile payments and mobile commerce”.

Talk was attended by about 30-40 executives from major global telecom operators, global banks, new-age payment companies, and from major internet companies.

Outline:

What is money?

e-Cash value to society:

Why should be care? (Summary)

More information in our reports:

Mobile payments, e-money and mobile credit in Japan

SUICA and NFC payment for transport

QR codes are also used for payment

Read more about Nintendo and the games sector: http://www.eurotechnology.com/store/jgames/

Read more about Japan’s electrical industry sector in our Japan’s electronics industry report (pdf file)

Subscribe to our newsletters:

technology newsletters from Japan

When did qr-codes for mobile phones start in Japan?

Here is the answer: the first mobile phone with qr-code reader was the J-SH09 produced by SHARP for Japan’s J-Phone mobile operator (today’s Softbank) and came on sale in August 2002 – seven years ago.

More details and more than 100 case studies of qr-code applications in our QR-Code report

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

The total solar eclipse could be seen clearly today around 11:13am in Tokyo – however in Tokyo the coverage was not total. Here is a picture taken with a standard Canon digital camera:

Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

Japan introduced the mobile internet with i-Mode in 1999, while i-Phone and friends are now getting the rest of the world hooked onto the mobile internet.

Games used to be played in game parlors, and some of Japan’s game giants were originally and still are game parlor machine makers – a round of Dance-Dance-Revolution anyone? Next came consoles, cassettes and handhelds, taking the growth momentum out of game parlors, and establishing a pattern of growth by generations (today we are in the 7th Generation). Nintendo broke the cozy generation pattern where pixels and MHz increased in predictable ways from Generation to Generation without much other fundamental change. Nintendo took games sideways into the blue oceans of motion sensors and to the silver generation, women and other previously non-gaming majorities, while Xbox and SONY kept slugging out the generation game.

We have been analyzing the Tokyo Game Show for many years – at the 2004 Tokyo Game Show, when SONY gave previews of the PSP – actually, I was personally much more interested in DoCoMo’s huge exhibition village setting a stage for about 15 mobile phone gaming partners.

Since i-Mode started mobile phone games in 1999, online and mobile phone games combined have essentially outgrown the video game software sector in 2009, and are certain to grow much more in coming years – the iPhone is not slowing mobile phone based gaming down…. Those who only count video game cassettes and consoles, certainly don’t see the rapid mobile and online growth – and complain about shrinking markets.

Is Nintendo now being blind-sided by mobile phones and app-stores?

I don’t think so: not blind-sided – but strongly affected. Actually, Nintendo’s CEO and games developer Shigeru Miyamoto tell us they want to make their DSi’s central to everybody’s lives – with built in cameras, payments, app-stores, navigation. Essentially everyone on planet earth has a mobile phone, or will soon have one, or two. Many of todays phones in people’s hands can’t yet play games nicely – but DoCoMo’s phones do – and iPhones do also. Thats why we already see a lot of mobile gaming in Japan. Imagine the day when most mobile phones on planet earth can play games nicely? Will that day come?

Will people upgrade to a DSi? or to a PSP? or to a better mobile phone? Apple and DoCoMo are both proof that people do pay for downloading games from i-Mode or i-Tunes app-stores – and that’s exactly the growth we see in the Figure – you don’t see that growth if you count only the number of game cassettes and consoles sold. In any case we may not see an 8th generation console – people might upgrade their phones instead – or use Skype on their PSP.

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

E-money transactions (including mobile e-cash) grow exponentially in Japan, and we expect to see 1 Billion e-money transactions/month around 2014 (this figure would be much bigger if contactless train travel tickets were included). e-Money now represents about 2% of all cash (banknotes + coins) in circulation in Japan, a recent examination of e-money by the Bank of Japan shows. More below, and a detailed analysis in our mobile payment and e-money report, where we combine the newest data from the Bank of Japan with our own research data.

We expect 1 billion e-money transactions per month around 2014. Green curve shows payments with Suica, Pasmo and Edy (not including train travel). The blue curve shows data for all e-money transactions researched by the Bank of Japan.

Research by the Bank of Japan shows that e-money has reached the level of 2% of all cash in circulation (bank notes and coins).

To know more – and to find detailed statistical data: read our mobile payment reports

https://www.cnbc.com/video/2014/09/16/why-apple-pay-isnt-as-revolutionary-as-it-seems.html

Copyright 2013 -2019 Eurotechnology Japan KK All Rights Reserved

Japan’s games sector is booming – and net annual income of Japan’s top 9 game companies combined has now overtaken the combined net income of all Japan’s top 19 electronics giants (including Hitachi, Panasonic, SONY, Fujitsu, Toshiba, SHARP… at the top, and ROHM, Omron… further down the ranking list).

Why does it make sense to compare electronics giants with game companies? In many areas, especially home electronics and personal portable devices these two sectors compete for exactly the same consumer spending budgets and mind share.

Pressure on Japan’s electrical giants for much more fundamental restructuring is increasing. More details below and find our calculations and analysis explained in our reports: Report on Japan’s electrical industry sector and our Report on Japan’s game industries.

Figure compares the added total net income of Japan’s top 18 electrical companies (Hitachi, Panasonic, SONY…) with the combined total net income of Japan’s top 9 games companies (Nintendo, Bandai Namco…, not including SONY Computer Entertainment, because net income is not available).

The games sector – lead by Nintendo – shows stable net income all through the current crisis years. While pressure on the electrical giants for more fundamental restructuring is increasing.

Combined total net annual income of Japan’s games sector. (SONY Computer Entertainment is not included, since net income is not available)

Detailed analysis in our report on Japan’s games sector.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

10 years ago – 1999 – the global mobile payment revolution started in Japan: with i-mode introducing an essentially Japan-only highly successful micropayment system for online content and brick-and-mortar based m-commerce, and SONY’s Edy starting e-cash experiments in Tokyo’s Osaki district. In 2003 SONY’s Felica IC semiconductor chips were combined with mobile phones to introduce the first “wallet phones” (“saifu keitai”). Today the majority of mobile phones in Japan are wallet phones.

For the last 10 years, Japan has been a laboratory for mobile payments and e-cash, conducting a test on 125 million population on which mobile payment and e-cash models work and which don’t. -> We can all learn from Japan’s 10 years of experimentation which mobile payment business models are likely to work, and which might fail!

Edy stands for Euro, Dollar, Yen… expressing the hope for global success – Intel Capital believes in this success and has invested in the company that runs Edy: BitWallet (initially backed by SONY and now acquired by Rakuten).

While SONY has distributed the largest number of cards, in our view the world’s largest (by payment volume) and most effective e-cash and mobile payment system is operated by the world’s largest railway company: SUICA and mobile SUICA.

the world’s most effective railway company in our view also operates the world’s most effective mobile commerce system: The Express Card / EX-IC system.

Although we only have official figures for FY2008, we estimate that in 2009 about US$ 3 billion worth of train tickets are sold via JR-Tokai’s Express card system for a single train line – and much of this by m-commerce via mobile phone. JR-Tokai’s Express card system is an entirely different system than the i-Phone – but an equally friendly and efficient design solution. (For a case study of JR-Tokai’s Express card system download our report).

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

Lets look at global benchmarking of Japan’s top electrical groups Panasonic and Hitachi (representative of Japan’s top ten electrical giants) – in our previous blog we suggested that full recovery to 2008 (FY2007) levels may take until 2016 – about seven years in terms of income, and about 3-4 years in terms of revenues – UNLESS major restructuring happens. Will it be done?

We also take a look at specialist ROHM, which used to have outstanding margins because of the focus on highly specialized electrical and electronic components. ROHM’s shareholder proposals recently made headlines.

Comparing Japan’s top electrical groups Panasonic and Hitachi with GE and SIEMENS clearly shows the different philosophies in US, EU and Japan:

Germany based Siemens and Japanese giants Panasonic and Hitachi in the 1990s all had net margins close to zero. However, while Panasonic and Hitachi maintained their margins close to zero since the 1990s, Siemens clearly aims for US level margins – and achieved a slow and steady upward trend.

Very dramatic restructuring would be necessary to bring Japan’s electric giants onto such a path. I think it is quite obvious exactly which restructuring is necessary. I also believe that if carried out it will actually create more employment in Japan than maintaining the existing structure of Japan’s electrical industry sector. However, actually carrying such restructuring will require superhuman effort… will this happen?

Rohm is another interesting story – and a fascinating Kyoto-culture company (with headquarters not so far from superstar Nintendo). Rohm was founded in 1958 by today’s CEO Sato Kenichiro to make resistors, and he later changed the name to R.ohm and then ROHM – today 80% of products are semiconductors. With increasing competition ROHM’s initially very high margins melted away. To counter the trend towards commoditization, ROHM invests heavily in R&D with technology centers around the world. Last week ROHM made global headlines: US fund Brandes had proposed a US$ 157 million share buy back, which was rejected at the shareholder meeting. Looking at ROHM’s margin over the years, its clear that action is required to bring margins again from today’s zero to the previous 20% level. I can sympathize with shareholders who think that a Shuji Nakamura / Nichia-type R&D breakthrough would be more likely to deliver such a comeback rather than a share buy back.

Note that not all shareholder proposals by US or European funds are rejected summarily at Japanese company shareholder meetings… some well prepared proposals have actually been accepted successfully.

Starting from similar positions in the 1990s:

Today, GE is about twice the size as Hitachi or Siemens, and about 2.5 the size of Panasonic. It seems that successful globalization is a necessary factor to achieve GE-style growth – necessary, but not sufficient… (see: our analysis of dramatic differences in globalization of Japan’s electric groups). The current crisis is a big opportunity for further growth by strong companies.

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

Japan’s top 20 electronics companies combined are about as large as The Netherlands economically, and have big impact on the world economy. Our analysis shows how dramatically Japan’s electronics companies have been hit by the current crisis (except for Nintendo). We suggest that full recovery to 2008 (FY2007) levels may take until 2016 – about seven years in terms of income, and about 3-4 years in terms of revenues.

The crisis has thrown Japan’s electrical companies back to 2002 in terms of combined annual net incomes. It has taken Japanese electricals 7 years to climb from the 2002 crisis to the 2008 (FY2007) boom. Since Japan’s electrical companies have made relatively soft adjustments, but not a full fundamental industry restructuring yet, we think that it is likely that developments will proceed along a similar path as in the past: following such an analysis we think that it will take about 7 years from 2009 (ie. until 2016) for Japan’s electrical companies to work their way back up to 2008 net income levels. (Find detailed financial data and analysis in our report on Japan’s electronics industries)

Back to FY2003:

Combined annual sales for the financial year ending March 31, 2010, are at a similar level as in FY 2003, ie Japan’s electrical industry has been taken back 6 years in terms of revenue growth. Again, since a dramatic and fundamental industry restructuring has not yet taken place, we believe that we can expect it will take about 4 years for Japan’s electronics industry to grow again to 2008 (FY2007) size in terms of annual revenues.

The crisis spreads the field…

During the “good” years of FY1997 – FY2007 the differences between top and bottom performing electrical companies became steadily smaller: the field narrowed.

This figure shows that during the current crisis the spread between best and worst performing companies became more than twice as wide. The crisis clearly differentiates winners (Nintendo) from losers in terms of operating margins.

Read more details in our report about Japan’s electrical industries:

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

Korea and Japan can be like a time-machine: if we look at Korea and Japan today, we can get a good idea of how Mobile 2.0 could evolve in Europe and US and other advanced markets 5-8 years down the road. Is this a perfect time-machine? No. i-Mode and Japan’s mobile phones never made it onto the world stage, but Korean mobile phones did.

This keynote will set the stage for the Mobile 2.0 panel discussion. I will introduce some of the most outstanding new services which have cultural and society impact: mobile social networks, and literature created on mobile phones for mobile phones, as well as mobile payments, which have the potential to replace money as we know it.

Will Korea, Japan, China and the rest of the world arrive at the same Mobile 2.0 and what will the timing be?

Which are the critical issues? We identify four critical issues for the rapid development of Mobile 2.0, and will discuss these issues with the following panel:

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

About 10 years ago, on October 28th, 1999, I was invited to give a talk about this topic at Stanford University’s US-Japan Technology Management Center for Stanford Faculty, alumni and Silicon Valley entrepreneurs. 10 years is a good period to check out how much of that is still valid today, and how much Japan has changed during the last 10 years.-

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

On May 1, 2009, DoCoMo in cooperation with media firm Avex started the mobile TV beeTV which brings 8 channels including a MOOLOG Channel (MOOLOG = MOOvie-bLOG)

beeTV is an indicator how Mobile TV may impact Japan’s Media Sector.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Read more about SONY and Japan’s electrical industry sector

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Read more about Japan’s telecom sector: http://www.eurotechnology.com/store/jcomm/

Read more about DoCoMo: http://www.eurotechnology.com/store/imode/

Read more about KDDI: http://www.eurotechnology.com/store/kddi/

Read more about Softbank: http://www.eurotechnology.com/store/softbank/

Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

David E Kuhl and Dennis L Meadows, the winners of the 2009 Japan Prize gave a presentation in Tokyo on April 22, 2009.

Professor David E Kuhl was given the Japan Prize for tomographic imaging in nuclear medecine, he has been called the “father of emission tomography”, having developed tomographic imaging in nuclear medicine.

Dennis Meadows is famous for his book “The Limits of Growth” (1972), which was written by three MIT scientists including Meadows as a project funded by the Club of Rome. Meadows has shown that current economic and human activity has become unsustainable.

Asked about the current economic crisis, Meadows explains the current economic crisis as the bottom of the Kondratiev cycle, which has a period of 45-60 years (about 50 years). According to Meadows the reason for the Kondratiev cycles is overinvestments in production resources. Excessive production resources need to be adjusted to actual needs periodically, and this period is about 50 years. The last Kondriatiev-type elimination of production overcapacity was caused by the damages of the 2nd World War. Currently this down-adjustment of production resources occurs in peace-time.

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/

Copyright· (c) 2013 Eurotechnology Japan KK All Rights Reserved

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Diseno Textile SA (ZARA) entered Japan’s market earlier than H&M and can now collect some fruits from timing advantage: Diseno succeeded to obtain a license for Sanrio’s Hello Kitty character, and plans to market Hello Kitty branded goods.

Will be interesting to see if H&M will do quid-pro-quo and seek to license other famous Japanese characters?

Copyright (c) 2013 Eurotechnology Japan KK·All Rights Reserved

European Central Bank (ECB) President Jean-Claude Trichet gave a presentation here in Tokyo on April 18, 2009 about the current financial and economic crisis.

Trichet blamed the crisis on an underpricing of the unit of risk. He also emphasized that its not a general crisis affecting all companies and financial institutions, but that some badly managed companies and banks are in bad shape, while well managed companies and financial institutions are in good shape and doing fine.

Trichet praised excellent international cooperation in taking measures to improve economic and financial stability and he also mentioned that unconventional steps will be announced at future meetings.

Overall his words were very carefully chosen and defensive, well aware of the impact of his words on the capital markets

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

It is well known that mobile internet, mobile payments and mobile content business and many other areas of mobile broadband are much more developed in Japan and South Korea than in other countries.

NOKIA and Vodafone and some other western mobile phone companies had the opportunity to take part in Japan’s mobile payment systems, mobile TV solutions and many other mobile businesses – instead they preferred not to do so and to withdraw from Japan’s mobile market.

Similarly it seems that mobile payments, mobile TV developments outside Japan are being developed from scratch without much regard to what has been learnt in Japan in debugging such mobile businesses both from the technology viewpoint as well as the usability, security, convenience etc viewpoints.

Lets discuss if the “not invented here syndrome” could be a factor.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

[My answer to a recent LinkedIn discussion group question: “Mobile Internet Device will replace Cell Phone!”]

This is too narrow a view.

I would say: today’s state of the art cell phones already include the role of internet device + many other functions, mobile internet devices cannot do.

1. For several years practically all Japanese cell phones have been “mobile internet devices” + camera + barcode reader + digital & analog TV + GPS navigator + movie camera + wallet + cash + train ticket + appartement key + comic book + e-book reader + alarm clock + etc. read the details in our reports:

http://www.eurotechnology.com/store/

2. have you read Karl Popper? – he is a philosopher. He says it makes no sense to discuss terminology. He would object to this discussion topic – because he would say that this is just mincing definitions and has no substance.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Nintendo’s CEO Satoru Iwata and games developer superstar Shigeru Miyamoto presented in Tokyo on April 9, 2009 about Nintendo’s situation and future plans.

Iwata emphasized plans to move from one DS per household to one DS per person, by personalizing the DS, and by seeing that DS enriches everyday life. As examples he mentioned applications in hospitals and schools (which provoked a question from the audience what he plans to do about children who’s parents cannot afford to purchase a DS for their children), and in museums, where explanations on exhibits are given via the DS.

Nintendo plans a “My DS” experience, by including two cameras in the new DSi, and with online downloads of small non-cartridge games and other applications from a new online store to enrich owners’ daily lives.

Asked about Nintendo’s plans for the recession, Iwata answered, that key is to keep Nintendo’s products at the top of consumers’ wish lists.

Read more about this presentation and analysis of Nintendo and Japan’s games sector in our J-GAMES report.

Asked how Iwata plans to respond to the success of mobile phones, iMode and Appli games, and whether Nintendo plans to create own mobile phones or add phone functions to DS, Iwata explained his thinking under which conditions he would consider entering the mobile phone space.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

KDDI created a new brand: “iida” for the long running best selling AU design series mobile phones. KDDI introduced some of the most recent iida design series models at the KDDI Designing Center. In addition to the earlier Yamaha musical instruments phones, KDDI introduced a spectacular phone created by Yayoi Kusama.

Fun is the green leaved charger….

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

It’s not all doom and gloom here in Japan. Nintendo’s sales and operating profits are rising 8.8% year-on-year. KDDI saw its net profits increasing 59% year on year. Yahoo Japan increases dividends by 22%-25% for 2008. Who are today’s winners in Japan’s IT industry? Gerhard Fasol will show us how and why some great Japanese companies excel in today’s crisis.

The talk reviews today’s status of Japan’s electrical companies, the telecommunications sector and the internet sector, and introduces seven different companies, which show rapid growth of revenues, operating income and net income despite the crisis. These seven companies we introduce turn the crisis into an opportunity.

Mr Fasol is one of the best specialists of Japan’s IT industry. After 12 years in Japan working for the most prestigious Japanese institutions and companies (the University of Tokyo, NTT, Hitachi…), he founded the strategy and M&A firm Eurotechnology Japan KK in 1996. Mr Fasol has advised some of the greatest companies, including NTT, SIEMENS, Deutsche Telekom, Cubic, Unaxis and about 100 fund managers on strategy for Japan, as well as the President of Germany. He helped a French pharmaceutical company acquire a factory in Japan.

He comments regularly on CNBC on Japan’s tech sector.

Schedule: March 24th, 2009 (Tuesday) from 18:30

The conference will be followed by a light cocktail.

Place: French Chamber of Commerce and Industry in Japan, meeting room

Iida bldg 1F, 5-5 Rokubancho, Chiyoda-ku, Tokyo 102-0085

Tel.: 03-3288-9624

Access map: www.ccifj.or.jp

Language: English

Fees: 5.000 yens (to pay in cash at the door)

Payment will be required for cancellations or no-show after this deadline.

Announcement on the website of the French Chamber of Commerce

read a report on the talk here in the monthly newsletter of the French Chamber of Commerce in Japan (in French)

Background reading: our J-ELECTRIC report about Japan’s electric companies

and our Eurotechnology Japan Blog

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved