More in our report on Japan’s telecom and mobile sector

Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

More in our report on Japan’s telecom and mobile sector

Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

More about SoftBank and SoftBank’s iPhone business in Japan

Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

Japan Post (JP), the world’s largest bank & insurer by assets became a group of private companies on October 1, 2007. Japan Post manages about US$ 3.3 Trillion in assets, about 40% more than Citigroup or HSBC and about 12 times more than the banking arm of Germany’s Deutsche Post.

Privatization of Japan Post would not have happened without former Prime Minister Koizumi in the driver’s seat, and the overwhelming mandate he obtained from the electorate in the spectacular September 11, 2005 election.

Japan Post is a “sleeping giant” about to be woken up by private sector CEOs: Japan Post holds about 1/4 of Japan’s US$ 13 billion in household assets, is the largest Japanese insurer, has one of the largest retail shop networks, and is a formidable transporter and deliverer. We expect the new CEOs of JP’s four new group companies to dramatically improve management of JP’s assets.

We believe that JP’s privatization has a very good chance to be successful – given the success stories of postal privatization in other countries, and the very successful privatization of Japan’s former national railways JNR.

JP Services

on second place in Japan’s parcel delivery industry, transports about 2/3 as many parcels as No. 1 Yamato. With about US$ 17 Billion in sales almost twice as large as Yamato and 1/2 as large as FedEx. International footprint is almost non-existent at this stage in contrast to much larger Deutsche Post/DHL.

JP Network with 24,700 Post Offices all over Japan, could challenge convenience store giant Seven & I Holdings (11,853 Seven-Eleven stores, and 33,000 stores in total).

JP Bank

manages YEN 231.6 Trillion (US$ 2.15 Trillion) in assets. 80% of these assets are postal saving accounts, of which about 79% are invested in Japanese Government bonds. By assets of similar size as Citigroup and HSBC and almost twice the size as Japan’s largest commercial bank Mitsubishi-Tokyo-UFJ, and almost four times the size by assets as Mizuho-Bank.

JP Insurance

with YEN 126 Trillion (US$ 1.17 Trillion) Japan’s largest insurer by assets held, more than twice the size of Nihon Seimei – Japan’s largest commercial insurer. JP Bank and JP Insurance combined hold about 1/4 of Japan’s US$ 13 Trillion of household assets.

Since October 1, 2007, each of the four JP group companies is headed by a new CEO from the private sector. We expect the new private sector CEOs to dramatically change the way JP assets are managed and allocated.

Citi, HSBC and UBS react to JP privatization

Citi is in the process of acquiring retail broker Nikko Cordial. Citi as the first foreign bank in Japan acquired a full banking license, mended the relationship with Japan’s Banking regulator FSA and is on expansion course in Japan.

HSBC has announced plans to open retail branches in urban centres such as Tokyo, Kobe and others to provide asset management services to private customers in Japan.

UBS has also been reported to plan expansion of private banking and asset management services to private customers.

Figure 1: Japan Post was privatized and split into four groups on Oct 1, 2007

Japan Post Bank and Japan Post Insurance together hold about US$ 3.3 Trillion in assets. Each of the four Japan Post operating companies is headed by a new CEO from the private sector

Figure 2: The world’s largest bank by assets…

JP Service is among the world’s largest delivery companies in terms of sales, JP Network has twice as many stores in Japan as Seven – Eleven, JP Bank is among the world’s biggest banks, and JP Insurance is twice as large in assets as Japan’s largest commercial insurer.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Google, Apple, Nokia, HTC, Vodafone and are winning the driver’s seat of the global internet revolution. DoCoMo, KDDI and SoftBank essentially stay inside Japan for now – limiting their growth prospects and leaving global opportunities to others.

GOOGLE with Android and APPLE with iPhone are reaching for the driver’s seat of the global mobile data revolution. Global companies including GOOGLE, Vodafone, Apple and NOKIA grow to US$ 100s Billion valuations, while local companies NTT, DoCoMo, KDDI and SoftBank remain essentially limited to Japan’s market for now. Smartphone maker HTC increases impact – including in Japan.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

SoftBank from 4th to 1st position within less than 12 months… SoftBank‘s turn-round of x-Vodafone-Japan, went faster than many expected. Within less than 12 months SoftBank went from last place to first place in customer sign-ups, overtaking even KDDI‘s super-popular AU.

Willcom recently suffers from SoftBank‘s revival, as well as from eMobile‘s flat rate data services.

Find latest market share data in our report on Japan’s telecom industry.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

In the last few days NTT, NTT-DoCoMo, KDDI and SoftBank announced their first half financial results. SoftBank and KDDI are the winners both for market share and for profits, while DoCoMo‘s results and market shares are sinking, and pulling the NTT-Group down at this time. Extrapolation indicates that DoCoMo‘s net profits may fall into the red about one year from now, drastic action is taken soon.

The thin lines show linear interpolations of quarterly net profit data. Our extrapolation seems to indicate that DoCoMo‘s net profit might fall into the red towards then end of calender year 2008 unless drastic action is taken. If current trends continue, SoftBank‘s net profits might exceed DoCoMo‘s mid-2008. We expect DoCoMo to take dramatic action before this happens.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Need to know more about KDDI? Read our Report on KDDI

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

More in our J-ELECTRIC Report

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

JR-East introduced SuiPo (Suica Poster).

People who want to participate need to register and link their plastic SUICA card, or their mobile SUICA (wallet phone with installed SUICA application) with a registered mobile or PC email address.

Whenever a registered participants touches the SUICA reader/writer on the side of a poster, links to a campaign homepage, coupons, event announcements or other information is sent to the registered PC or mobile phone email address.

The SuiPo system puts interactivity into posters and allows the advertiser to build an opt-in data base of interested people and to interact with them.

More about SUICA: Download our SUICA report

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

This week two of Japan’s largest retail chains roll out electronic and mobile cash: Monday April 23rd, 2007 the Seven & I Holdings Group started “nanaco” and tomorrow, Friday April 27th, 2007, the AEON retail group will start “WAON”.

For detailed documentation and analysis of Japan’s highly developed e-money and mobile payment sector, download and read our report “Mobile payments, e-money and mobile credit in Japan”.

At first sight the massive roll-out of electronic cash and mobile payments systems during March and April this year here in Japan has been smooth and without problems (except for PASMO underestimating the success and running out of cards). However, when we look below the surface, clouds of a competitive storm are brewing. This storm might be followed by consolidation. Here are some examples:

PASMO cards were sold out within the first three weeks, and PASMO is now losing market share (and commission payments) to SUICA day-by-day – PASMO became a victim of it’s own success.

7-11’s “nanaco” offers twice as much discount as AEON Group’s “WAON”. Clearly “nanaco” is on a more aggressive course than “WAON”. We expect competition to heat up.

By the way- on Wednesday April 25th, 2007, two days after Seven-Eleven’s national roll-out of their e-money and mobile payment system, our company Eurotechnology Japan KK arranged a meeting between Seven-Eleven’s Chief e-Money architect and manager with the top-management of one of Europe’s most important mobile operators to enable the European operator to almost live experience an important global mile-stone in the development of e-money and mobile payments. To this day, to our knowledge, there is nothing like Seven-Eleven’s nanaco e-money and mobile payments system in Europe.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Today was the 50th anniversary of the treaty of Rome which was at the beginning of the European Union. In Tokyo we had a big party at the top of Roppongi Hills – 52nd floor. Here are some pictures…

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

On March 31, 2007 eMobile will start high-speed (3.6 Mbps, HSDPA) mobile data services in Tokyo, Osaka and Nagoya, bringing disruption into the mobile data market in Japan.

While Willcom offers a flat data rate of YEN 9000 (US$ 77) per month for unlimited data transmission at 128kbps, eMobile will offer 30 times higher speed at about 1/2 the price:

3.6Mbps for PDAs, laptops and PCs for YEN 4980 (US$ 43, EURO 32) per month flat rate without any data limit (and n.b. no “fair use limit” as many European operators impose in the fine-print). …. and yes- you can probably also do wireless VOIP or Skype if you set this up yourself.

The established mobile operators (DoCoMo, KDDI/AU and SoftBank) do not offer any flat data rate to connecting PCs and laptops at this time.

eMobile offers the EM-ONE terminal:

(By the way- did you ever wonder why new entrants love flat rates? it’s because telecom billing systems are so expensive and complex. Flat rates are one of many competitive weapons new entrants have over incumbents…)

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

On Sunday, March 18, 2007, about 100 transportation companies in the Tokyo region switched to the near-field electronic money and payment system PASMO. Electronic money is a new battle field which JR-East pioneered with SUICA. Seven & I is still to throw it’s weight into the battle – read about today’s status of the electronic money marketplace in our “Mobile Payment and Keitai Credit” report.

A new multi-billion dollar power? Here is the character for PASMO: with an antenna on the hat, a pocket on the chest to store PASMO away, and wheels on the shoes, and in cherry-blossom pink… Does this cherry-blossom-pink guy look like he represents a new US$ multi-billion economic power?

Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

Tokyo Tower was illuminated in green color on St Patrick’s Day – (when I took these photographs a Japanese policeman guarding the Russian Embassy nearby asked me if Tokyo Tower from now on will always be green – so I explained St. Patrick’s Day to the Japanese policeman):

I took these photographs standing close to the perimeter of the Russian Embassy in Tokyo, which is heavily guarded by Japanese police. When I took the photographs of the green Tokyo Tower, a police officer standing guard asked me, if Tokyo Tower from now on will always be green. I told him that its only today for St. Patrick’s Day. The Japanese police officer did not know about St. Patrick’s Day, so I explained St. Patrick’s Day to him….

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Presentation at the Lunch meeting of the Finnish Chamber of Commerce in Japan (FCCJ) on March 16, 2007 at the Westin Hotel, Tokyo.

Summary of the event and photographs here:

https://web.archive.org/web/20160815232148/http://www.fcc.or.jp/lunch160307.html

or here

https://web.archive.org/web/20111022052713/http://www.fcc.or.jp/lunch160307.html

Dowload the presentation here

https://web.archive.org/web/20070709231130/http://www.fcc.or.jp/pdf/FCCJ_160302.pdf

From the Announcement:

In his presentation, Dr. Fasol will explain the essentials of Japan’s mobile phone market, why and how it is so different to Europe’s. He will also talk about some of the reasons why it is so difficult for European companies to succeed and uncover opportunities and the keys to success for European companies in this important market.

More in our report about Japan’s telecom sector.

Copyright 2007-2013 Eurotechnology Japan KK All Rights Reserved·

CLSA – Asia-Pacific Markets – last week organized the “CLSA Japan Forum” here in Tokyo. About 800-1000 investment bankers, portfolio managers, investors, analysts came together. Since last year interest of global investors in Japan has increased a lot.

Eurotechnology Japan KK participated actively, and on Friday March 2, 2007, gave a presentation on:

“Impact of mobile payment and the future of money”

The presentation covers the following agenda:

More information:

“Mobile payment and keitai credit” (download here)

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

On February 1, 2007, LENOVO announced excellent 3rd Quarter results. I commented live on CNBC-TV. Read comments on LENOVO’s results below.

Comments on LENOVO’s 3Q results

LENOVO (traded on the the Hong Kong stock exchange) for 3Q announced 23% higher profits compared to 3Q one year ago. Revenue increased slightly to US$ 4 billion, making LENOVO a US$ 12 billion/year company. LENOVO is very successful in it’s home market China, where it controls more than 35% of the PC market. While shipments in China rose 17% during the quarter ending Dec 31, 2007, global sales only increased 0.4%, held back mainly by performance problems and falling sales in the Americas. Globally, LENOVO is squeezed between ACER below, which grows much more rapidly (ACER’s growth was 32.4% in 3Q2006 compared to one year ago while LENOVO’s growth was only 10.1%) and Hewlett-Packard and Dell above. While Dell was struggling recently, Michael Dell came back as CEO of Dell, and I expect Dell to improve and become a much more difficult competitor for LENOVO. LENOVO’s challenge is to turn around the US operations, where it is losing ground. To do so, LENOVO will need to strengthen sales to consumer markets, maybe by learning attractive product design by watching APPLE, since competing on price will further hit profits. LENOVO risks to be overtaken globally by ACER.

Comments on LENOVO

LENOVO is more important than it’s size of US$ 12 billion in sales suggests for the following reasons. LENOVO is one of the first Chinese companies developing a global brand and a global business. With China’s growing economic importance on the world stage, if LENOVO manages to turn-round US operations and becomes globally successful, it’s management structure and methods may become a model for other Chinese companies to globalize. It is interesting to compare LENOVO’s relative success after the acquisition of IBM’s PC business with BENQ’s acquisition of SIEMENS-Mobile phones. If LENOVO succeeds to turn-round US operations, LENOVO may become a model case for futher take-overs of Western companies by Chinese companies. LENOVO is owned 27.3% by the Chinese Academy of Science. If LENOVO succeeds and continues to expand it’s success story, financial benefits will flow back to the Chinese Academy of Science, strengthening China’s science base and contributing to China’s further development. LENOVO is also China’s largest domestic mobile phone maker, after recently overtaking Ningbo-Bird. LENOVO sold 2.1 million mobile phone handsets in 3Q2006, a market share of 6.2%, and annual sales on the order of 8 million phones. This number is far below NOKIA’s sales on the order of 350 million phones/year globally, and recently global phone makers have been gaining ground over local makers in China. However, LENOVO does have a chance sometime in the future to become a global mobile phone player in the way SAMSUNG has succeeded.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Disneychannel places advertisements with huge QR-code on Tokyo’s roofs. People passing by point their mobile phones at Mickey’s QR-code, and the mobile phone takes them to Disneychannel’s mobile site.

QR codes were developed in the 1990s by Toyota affiliate Denso-Wave to manage car parts – today they are by far the best way to link mobile phones to almost anything. In many applications QR codes are cheaper, easier, more flexible and more secure than RFID and NFC.

If you need more information about QR-codes and their business applications, download our report here (pdf-file) or

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

QR codes were developed in the 1990s to manage car parts – today they are by far the best way to link mobile phones to almost anything. In many applications QR codes are cheaper, easier, more flexible and more secure than RFID and NFC.

The European Central Bank (based in Frankfurt) manages the EURO, is one of the world’s most important central banks, and uses QR-codes to link traditional PC-webpages to mobile pages.

If you need more information about qr-codes and their business applications, download our report here (pdf-file) or

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

22-25 January 2007 MarcusEvans organized the “Global 3G Evolution Forum” in Makuhari near Tokyo.

Speakers included:

and many other leading mobile communications managers from all over the world.

Jointly with Jan Larsson, General Strategy Manager of TeliaSonera International Carrier division, I chaired all sessions all day on Wednesday January 24, 2007.

On Monday, January 22, 2007, I held a three hour workshop about “Mobile Payment”.

Copyright 2013 Eurotechnology Japan KK All Rights Reserved

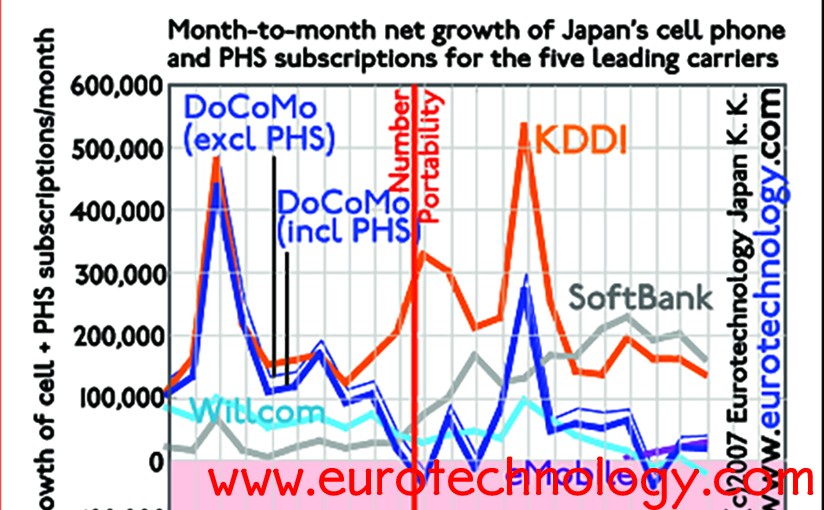

Japan’s mobile subscriber numbers grew by about 5 million in 2006. Because of the much higher ARPU, Japan’s mobile market again grew by a couple of Finlands during 2006. A growing number of people have more than one mobile phone, to take advantage of the best rates, eg for mail, voice and data. We expect growth to continue. Our analysis below shows that KDDI’s and AU’s gains are a lot larger than a superficial view of the statistics reveals – see our Figure below. Find a detailed review in the latest edition of our JCOMM-Report.

KDDI‘s subscriber gains during 2006 are much bigger than a superficial analysis reveals (see figure above):

KDDI’s AU mobile service gained about 4.2 million new subscribers during 2006 – more than twice as many than DoCoMo’s cellular service, which gained about 1.8 million new subscriptions.

Currently, KDDI is shutting down it’s TuKa 2G service, and DoCoMo is shutting down it’s PHS service. Both services together lost more than 2 million subscribers during 2006 – this is a much larger movement than due to number portability introduced on Oct 24, 2006.

KDDI offers both number portability and mobile email portability, and reports surprise that many former low-end TuKa users moved to top-end high-speed WIN (2.4 Mbps) data services.

For KDDI, enticing TuKa subscribers to move to high-end/high-speed AU services was an excellent preparation for number portability, and helped KDDI win in the first stage.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Every year Nikkei Marketing Journal publishes a ranking list of the most successful products of the past year in the form Sumo wrestling results are traditionally displayed: there is a Western side and an Eastern side, winners at the top are displayed in much larger print than also rans at the bottom as in Sumo rankings.

IC tickets are the “Ooseki” (second place) winners on the Eastern side of the Sumo ranking of hit products for 2006.

On March 18, 2007, more than 100 transportation companies of the Tokyo region including 25 train operators which serve a population of around 30 million will introduce PASMO IC-Tickets. Introduction of PASMO will increase market share for IC-tickets and ecash in Japan – and globally.

Read more in the latest edition of our Suica and RFID-Ticket report.

Mobile payments Japan, e-money and mobile credit (200 pages, pdf file):

Copyright 2006-2013 Eurotechnology Japan KK All Rights Reserved

Shibuya Hachiko square (in Japan usually called “scramble”) is certainly among one of the world’s most busy street crossing, and therefore also one of the places in the world with the highest density of advertising and marketing efforts, certainly on a par or exceeding Times Square in New York. It is not trivial to catch attention for particular promotions within this environment of information overload.

Shibuya Hachiko and surrounding areas challenge the creativity of creative agencies, and many new concepts have been tested out first here, e.g. many different types of using QR-codes for advertising and marketing.

While Coca-Cola promotes Cmode vending machines with mixed success for wallet-phones and mobile payments, a promoter used the opposite extreme at the most visible spot on Shibuya’s Hachiko square recently: a human vending machine with a built-in charming human operator for the human touch (there is an upper window to serve adults and a special lower window to serve children):

Read our report on Japan’s Media Landscape (approx. 200 pages, pdf file)

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

QR codes have been developed around 1994 by Toyota subsidiary Denso Wave – about 20 years ago- for car parts management at Toyota’s factories, and the first applications of QR codes for mobile phones came to market back in August 2002 – about 11 years ago here in Japan.

Thus there have been over 10 years of development and testing of many different types of applications of QR codes here in Japan, ranging from immigration control and visa, to mobile payments, ticketing and of course marketing and advertising. We have collected about 105 applications of QR codes, mainly in Japan in our QR code report.

QR-codes turn out to be the killer-app for camera phones – not MMS.

QR-codes have become ubiquitous in Japan since their first introduction to mobile phones in Japan in August 2002, and link mobile phones to life in many ways. QR-codes are usually the quickest, most efficient and cheapest way to link mobile phones to information in daily life, and to provide feedback in both directions, and even for user-to-user interactions.

QR-codes do not have to be in boring black-and-white:

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

On March 18, 2007, more than 100 transportation companies (26 railway companies and 75 bus companies) – moving 30 million people of the Tokyo region – will switch to the IC card ticketing and e-cash system named “PASMO”. PASMO will interoperate and partially compete with SUICA.

Preparations go back more than 20 years, when Japan’s national railways started research on IC cards for ticketing. SUICA IC-card tickets were introduced commercially in November 2001 at 424 JR-EAST rail stations in the Tokyo region.

Tokyo’s PASMO combined with SUICA is likely to develop into one of the world’s biggest electronic payment and e-cash systems.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Mobile number portability created winners and losers in only two months – the main business challenge for Japanese operators is to avoid a price war.

KDDI is the clear winner in the first round, DoCoMo suffers a setback, and SoftBank (which acquired Vodafone-Japan) did better than expected.

Today we released the 23rd edition of our JCOMM-Report – about 250 pages of overview and analysis of Japan’s telecom sector.

KDDI gains 524,000 subscribers in Oct & Nov 2006. DoCoMo for the first time ever since it was founded experienced a net loss of subscriptions.

KDDI gains 600,000 new EZweb subscribers, Japanese operators earn much from mobile internet – subscription data show even better results for KDDI‘s EZweb.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Both docomo’s i-Mode and KDDI’s EZweb top menu pages display Season Greetings and reflect Japan’s seasonal mood: autumn sports days in schools, skiing in winter, Halloween and New Year.

Here are this year’s New Year greetings for the Year of the boar on i-mode and EZweb which were displayed from January 1, 2007 for a few days during Japan’s New Year vacation:

More about Japan’s mobile internet:

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

Paying with the mobile phone in shops and trains, unlocking doors, security check in offices, paying the air ticket and checking in, all just by waving the wallet phone close to a reader/writer unit is addictive – and daily life in Japan today.

SUICA in Tokyo, Octopus in Hong Kong and Oyster in London are great success stories but they use different and incompatible technologies and software.

For mobile payments to take off globally, global interoperability is a must.

NXP (Philips’ former semiconductor division) and SONY on November 20, 2006 announced a cooperation, which will bring global interoperability to wallet phones and mobile payment.

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

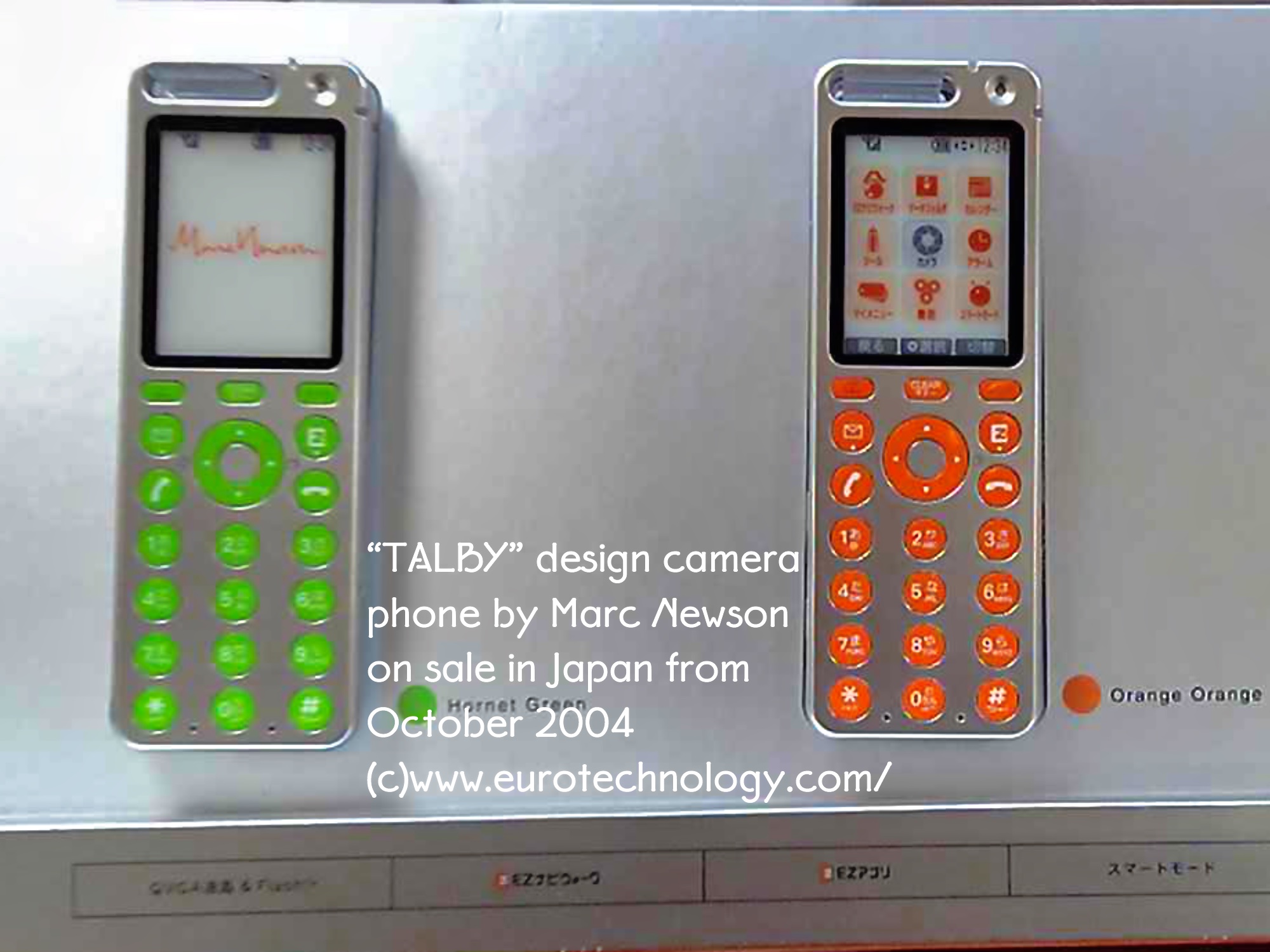

KDDI is unique among mobile operators in creating value from design for phones with the “au design project”. Creating value for which consumers are willing to pay premium prices is a key to success in the rapidly growing global US$ 150 Billion mobile phone business.

au design project 2006:

The KDDI Designing Center showed the exhibition “TRILOGY”, displaying some results of the “au design project 2006”. The three concept phones are (from left to right):

Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved