Category: Japan’s energy sector

-

Japan trends for 2013 (New Year post)

Japan replaced nuclear electricity generation by LNG, by imported gas Japan trends for 2013: Nuclear reactor restarts are on their way Japan trends for 2013 Japan’s energy sector: Japan has essentially replaced the 30% of its electricity energy supply which was from nuclear power plants, by electricity produced in aging thermal power plants from urgently…

-

Japan trends for 2013 (Christmas, Festive Season blog)

Japan trends for 2013: Energy crisis continues as a result of the Fukushima nuclear disaster Renewables: Japan’s feed in tariffs are among the world’s highest Japan trends for 2013: Japan’s energy sector: Prime-Minister Abe announced that he will review the Fukushima nuclear accident before taking decisions on nuclear power, essentially postponing the nuclear issue. Japan’s…

-

Japan’s successful and growing gas companies

Liberalization leads to increasing competition and partnerships between Japan’s regional electricity and gas companies Japan gas companies grow at an annual rate of 4.1% and show steady income Japan gas companies grow at an annual rate of 4.1% and show steady income, and have developed into serious competitors for Japan’s electricity operators, while also cooperating…

-

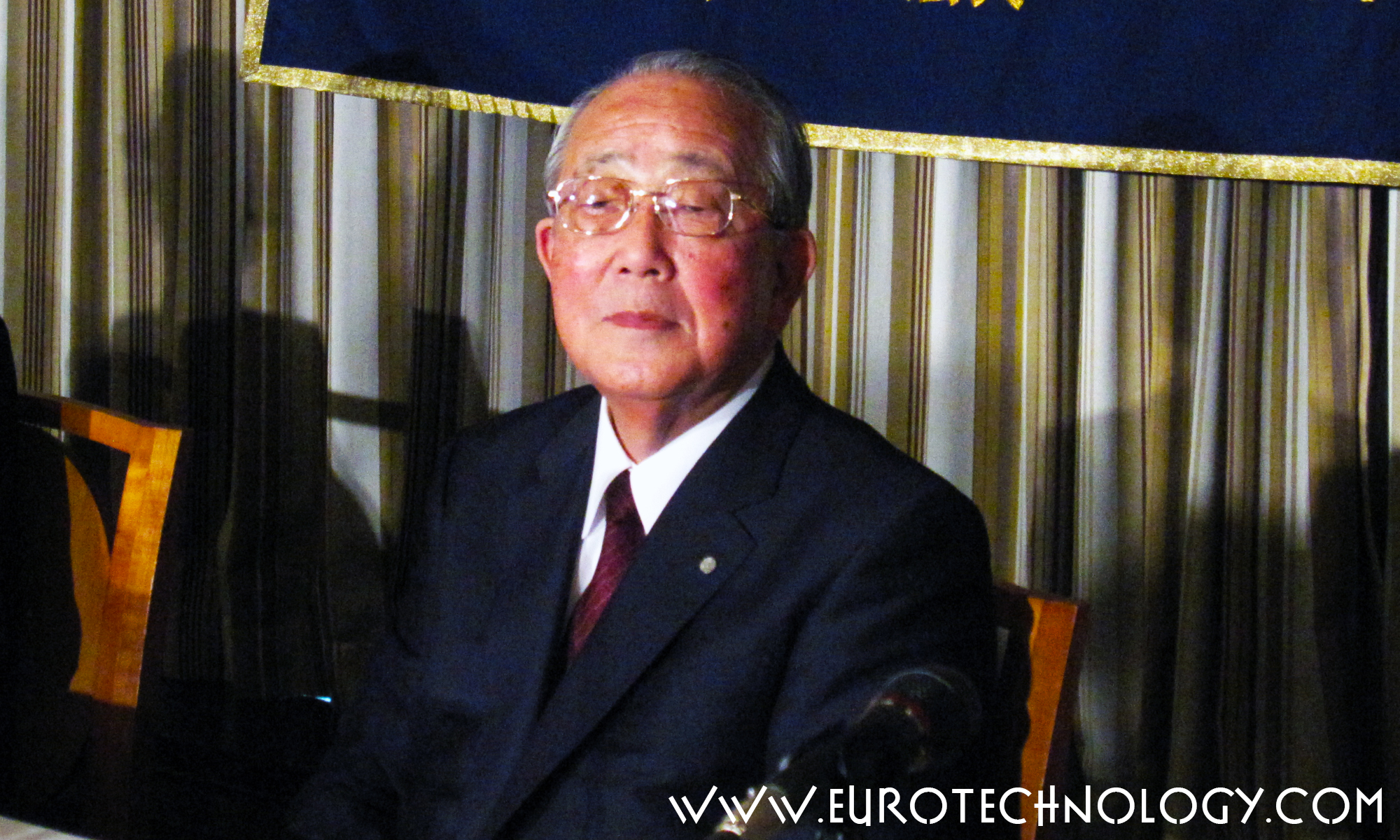

Kazuo Inamori, founder of Kyocera and DDI (KDDI), rebuilds Japan Airlines using Amoeba Management (アメーバ経営)

Kazuo Inamori (稲盛 和夫) one of Japan’s legendary serial entrepreneurs Japan Airlines (日本航空株式会社) turnaround from bankruptcy Bad news from Japan’s electronics industry sector makes global headlines this week (I was interviewed on BBC, US National Public Radio etc) – in this newsletter, lets look at some good news from Japan. Kazuo Inamori (80 years old,…

-

Financial instability of Japan’s electricity companies started in 2007

Financial instability of Japan’s electricity companies started long before the Fukushima nuclear accident Japan’s electricity companies ran into financial instability long before the March 11, 2011 disaster It is often assumed that the financial difficulties of Japan’s electricity companies are caused by the shut-down of almost all Japanese nuclear power stations within 13 months of…

-

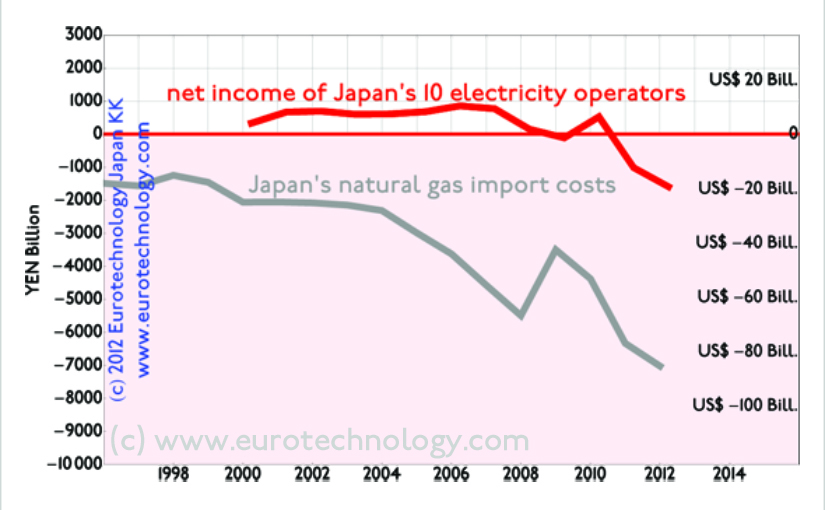

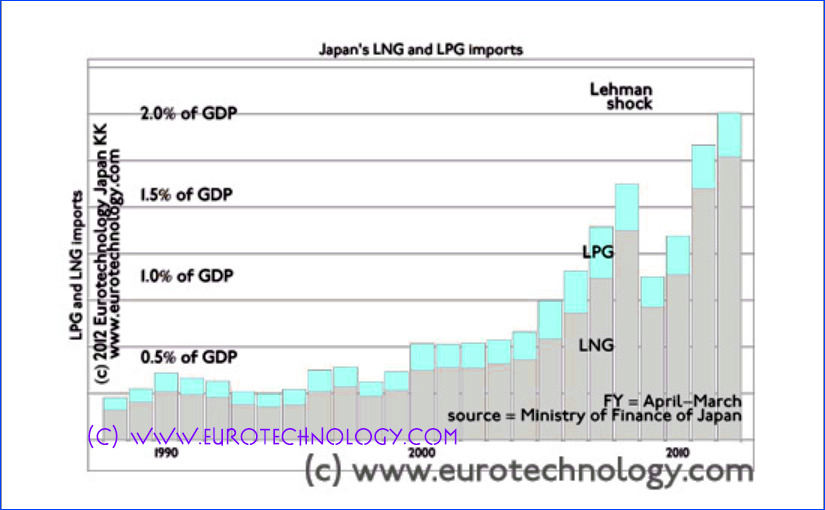

Japan natural gas import costs sky rocket

Japan switched 30% of total electricity generation from nuclear to LNG Japan natural gas import replaces all nuclear energy Japan switched about 30% of electricity capacity from nuclear to mainly natural gas powered thermal power stations within 13 months. We have analyzed Japan’s natural gas imports, which have skyrocketed to almost 2% of Japan’s GDP.…

-

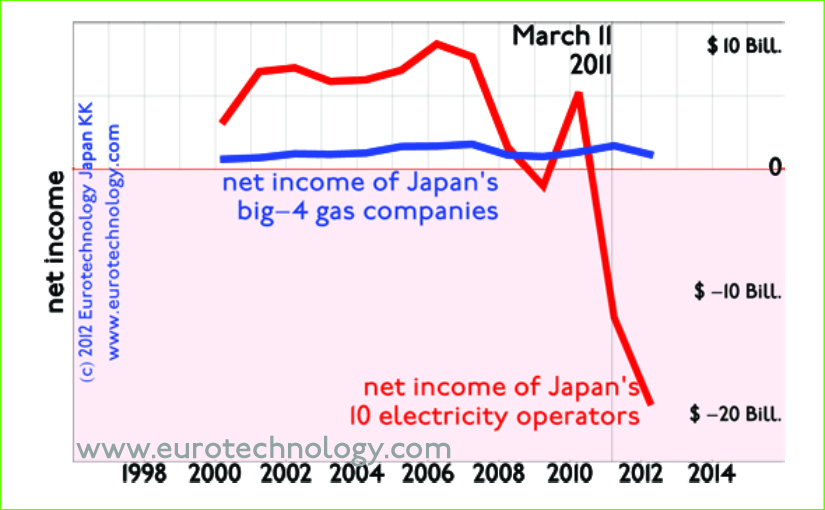

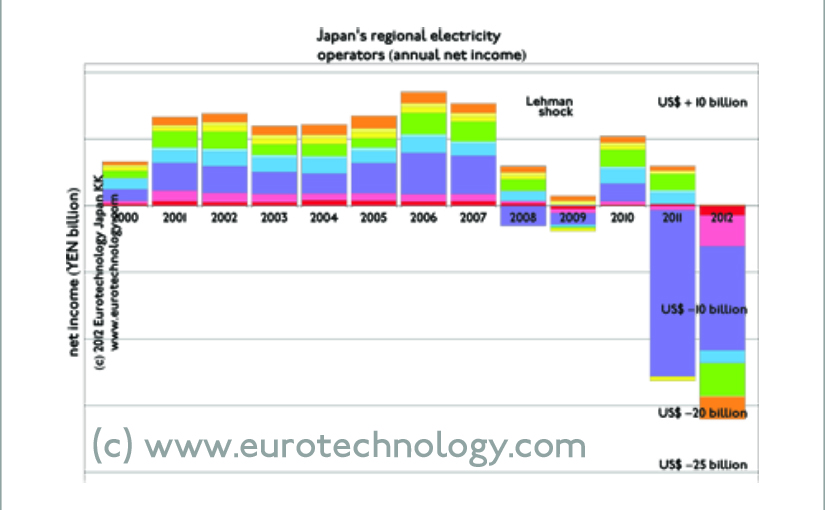

Japan’s electricity industry suffers huge losses from nuclear to fossil switch

What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry? Japan’s electricity operators switched from profits to huge losses What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry?Answer: Japan’s electricity operators switched from about US$ 10 billion/year combined net profits to US$…

-

Japan’s energy foxtrot: Two steps forward one step back

Two steps forward one step back: describes a frog struggling to climb out of a well, slipping back one step on the ladder for each two steps upwards out of the well Before the Fukushima disaster, Japan’s energy policy, strategy and execution were essentially decided behind closed doors by a small group of (about 100)…

-

Japan’s new energy strategy: much more than nuclear exit

Japan’s Cabinet released Japan’s new “Innovative Energy and Environmental Strategy” Japan’s new energy strategy Last Friday, September 14, 2012, Japan’s Cabinet released Japan’s new “Innovative Energy and Environmental Strategy”, which the Cabinet is required to produce by law, and which actually contains much more than the plan to work towards a future nuclear power free…

-

Joe Oliver: Briefing the Minister for Energy and Natural Resources of Canada

Joe Oliver, Minister for Energy and Natural Resources of Canada Was asked today to be one of a group of about 5 Japanese experts to brief the Minister for Energy and Natural Resources of Canada, Mr Joe Oliver. We were asked to keep the conversation off-the-record, so I can’t write about the meeting. Minister Oliver…

-

Japan’s PM Noda hints at new energy policy: Phasing out nuclear power by the 2030s

Develop as soon as possible a society which does not rely on nuclear power Eliminate nuclear power according to three principles By law Japan’s government must prepare a national energy strategy plan. The currently valid plan provides for an increase of nuclear power from 30% to 50% and is vehemently opposed by public opinion following…

-

Japan energy dilemma

Japanese law requires the government to have an energy strategy plan in place Keep nuclear power off – or restart nuclear? Japan’s current energy strategy plan provides for nuclear power to provide 30% of the electricity, rising to 50% in a few years by building additional nuclear power stations. However, contrary to the current strategy…

-

4th Ludwig Boltzmann Symposium Tokyo (Feb 20, 2012, Embassy of Austria)

Energy 4th Ludwig Boltzmann Symposium on Energy in Tokyo. Speakers: Tatsuo Masuda, Kiyoshi Kurokawa, Hideaki Watanabe, Robert Geller, Gerhard Fasol, Jonathan Dorfan Registration: latest 15 February 2011 Further information: Peter Storer, Minister for Cultural Affairs, Embassy of Austria Summary Tatsuo Masuda: “New energy architecture for Japan” Tatsuo Masuda described how Japan’s energy strategy and policy…

-

![Fukushima disaster impact on Tokyo [5]: Radiation risk situation for Tokyo, Business risk impact](https://www.eurotechnology.com/b/wp-content/uploads/2011/04/quakes_map_825_510.jpg)

Fukushima disaster impact on Tokyo [5]: Radiation risk situation for Tokyo, Business risk impact

5th update on the crisis in Tokyo, focusing on radiation and business impact Fukushima nuclear accident impact on Tokyo, 12 April 2011 This is our 5th update on the crisis in Tokyo, focusing mainly on the radiation and impact on business in Japan. The continuing quakes (as shown below) do present risk. To my knowledge,…

-

Outsourcing Japan market research and strategy consulting to India, Philippines?? – a recipe for business failure in Japan?

Business decisions unrelated to market realities are a prime reason for failure of foreign companies in Japan In a quest to reduce market research costs, Japan market research is often outsourced to India, Philippines, Indonesia etc With shock and surprise we recently found out that a very famous telecom and IT industry market research and…