Category: Natural Gas, LNG

-

Japan nuclear free since Monday, Sept. 16, 2013, when the last reaction was switched off. Restart unclear.

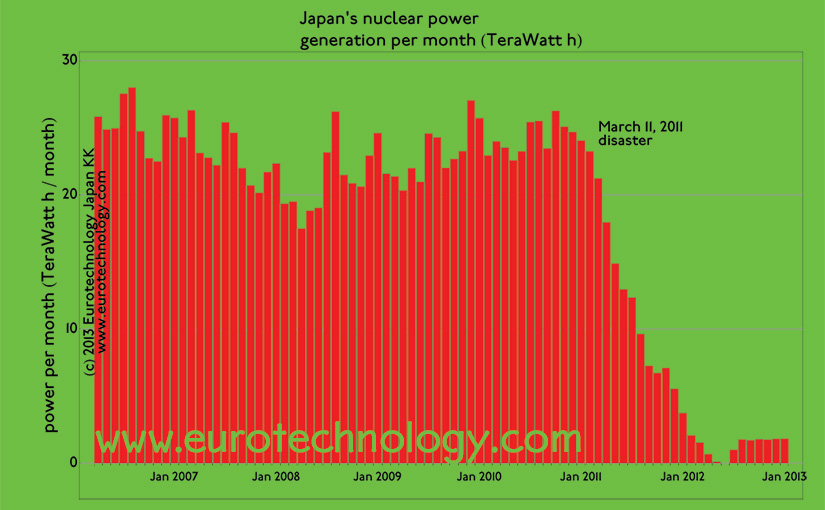

Japan went 100% nuclear free since Monday, Sept. 16, 2013. When nuclear reactors will be restarted is totally unclear. Kansai Electric Power (KEPCO) on Sunday Sept 15, 2013 at 16:40 started to reduce power output of Japan’s last remaining active nuclear power reactor (Oi No. 4 reactor), and stopped operations of this reactor on Monday…

-

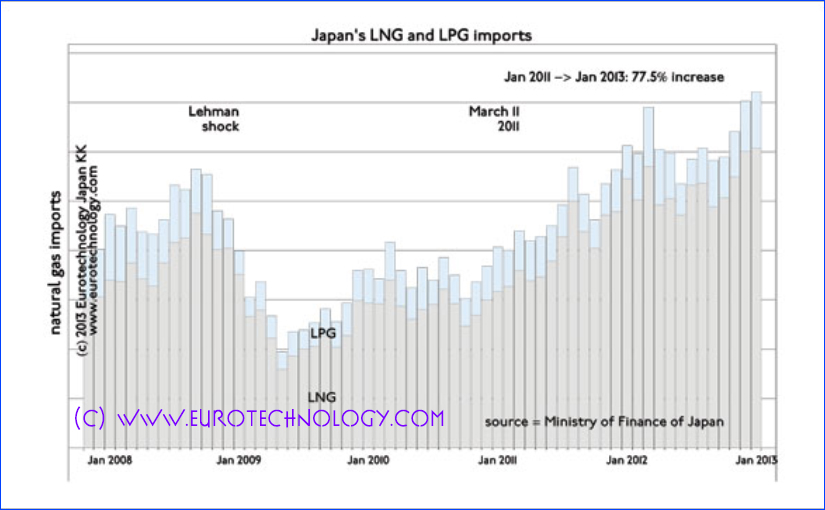

Japan LNG import costs increase 77.5% from 2011-2013

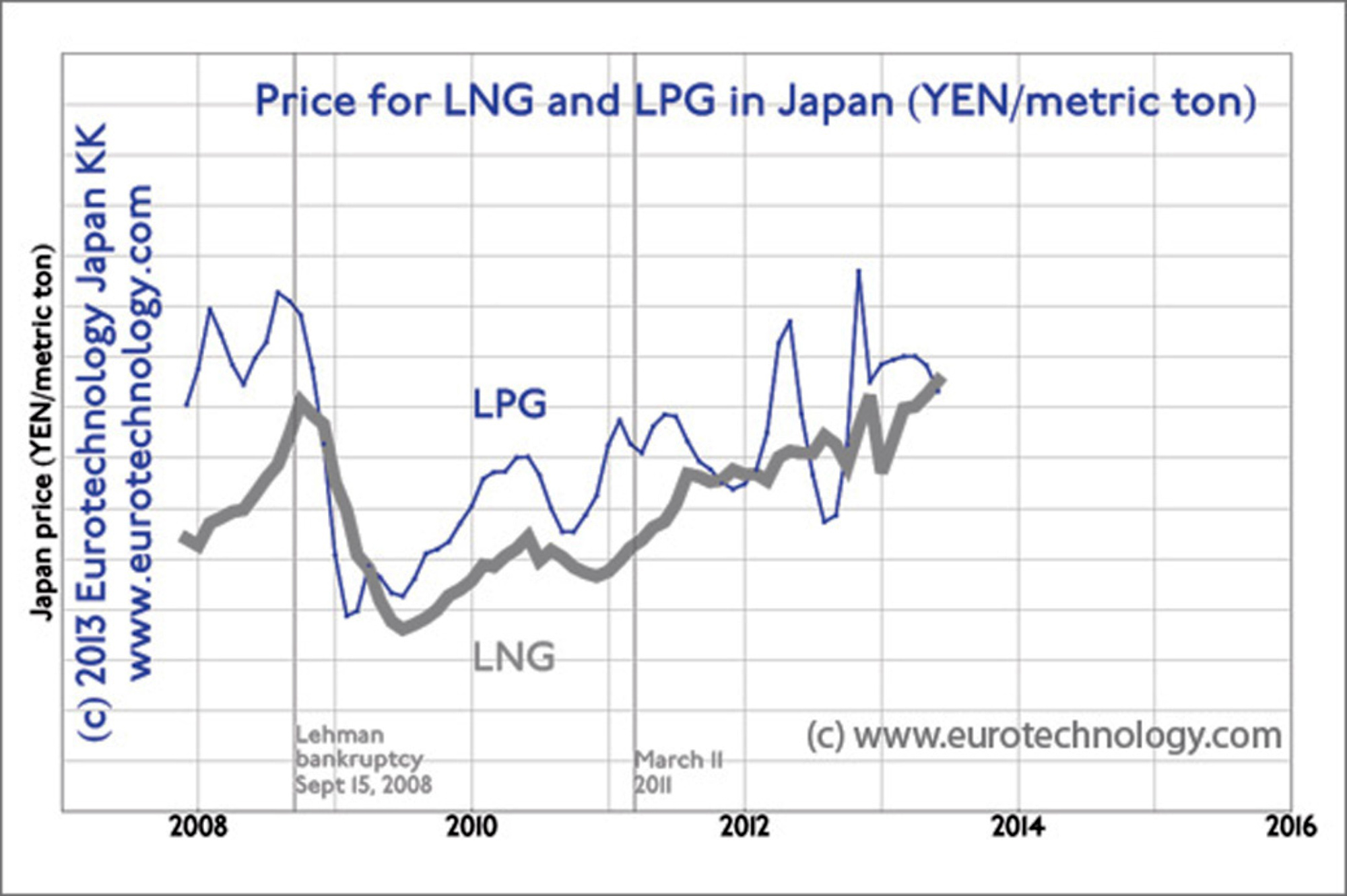

Japan LNG import costs – we analyze Japan’s official LNG import data Japan LNG import costs increase 77.5% from 2011-2013 Here we analyze Japan’s liquid natural gas (LNG) costs, which have been driven to record heights – mainly by the very high LNG prices Japan has to pay, and driven even higher by the low…

-

Japan energy – myths versus reality, mantra versus smart

A lecture a the Embassy of Sweden for the Stockholm School of Economics European Institute for Japanese Studies EIJS Outline of the lecture: Thank you to all those who attended the event “Japan’s energy – myths vs reality” at the Embassy of Sweden – an event organized by the European Institute for Japanese Studies of…

-

Japan gas imports: +77.5% from Jan ’11 to Jan ’13 – all-out efforts to reduce energy costs

Japan replaced almost all nuclear energy with liquid natural gas imports Increased LNG import costs due to declining yen Japan gas imports: Japan replaced almost all nuclear energy with liquid natural gas imports at very short notice. Japan pays far higher costs for liquid natural gas imports than most other regions in the world (find…

-

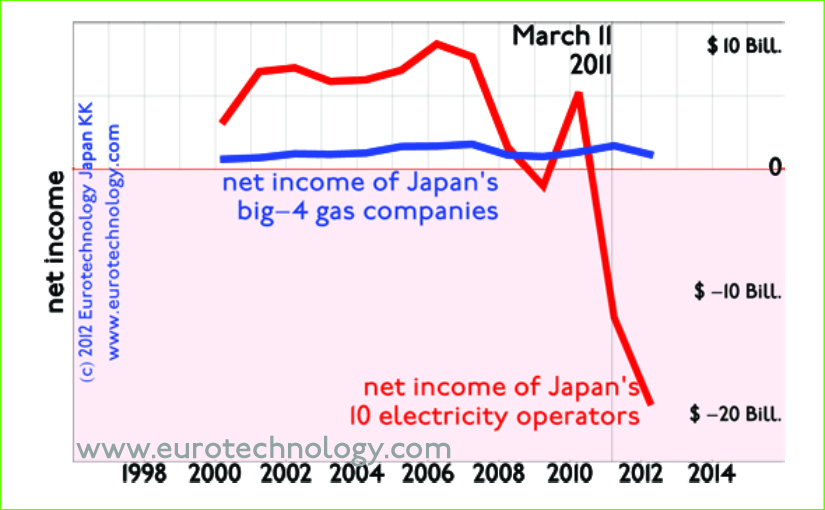

Japan’s successful and growing gas companies

Liberalization leads to increasing competition and partnerships between Japan’s regional electricity and gas companies Japan gas companies grow at an annual rate of 4.1% and show steady income Japan gas companies grow at an annual rate of 4.1% and show steady income, and have developed into serious competitors for Japan’s electricity operators, while also cooperating…

-

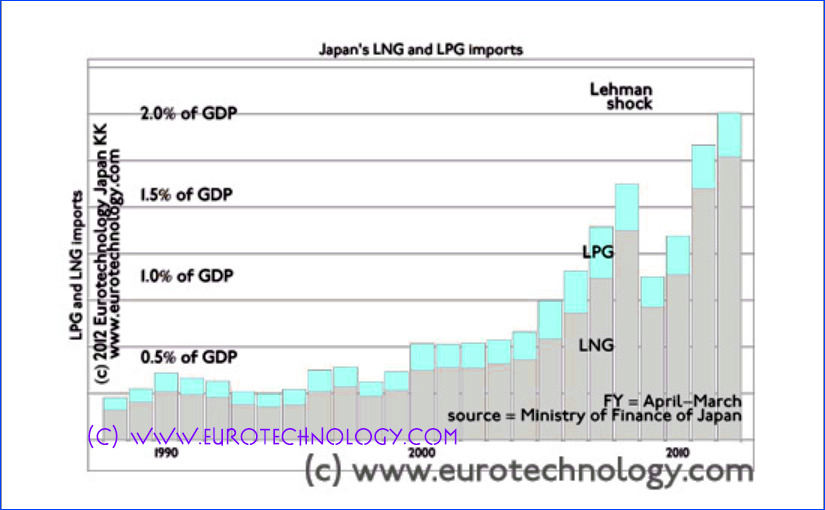

Japan natural gas import costs sky rocket

Japan switched 30% of total electricity generation from nuclear to LNG Japan natural gas import replaces all nuclear energy Japan switched about 30% of electricity capacity from nuclear to mainly natural gas powered thermal power stations within 13 months. We have analyzed Japan’s natural gas imports, which have skyrocketed to almost 2% of Japan’s GDP.…

-

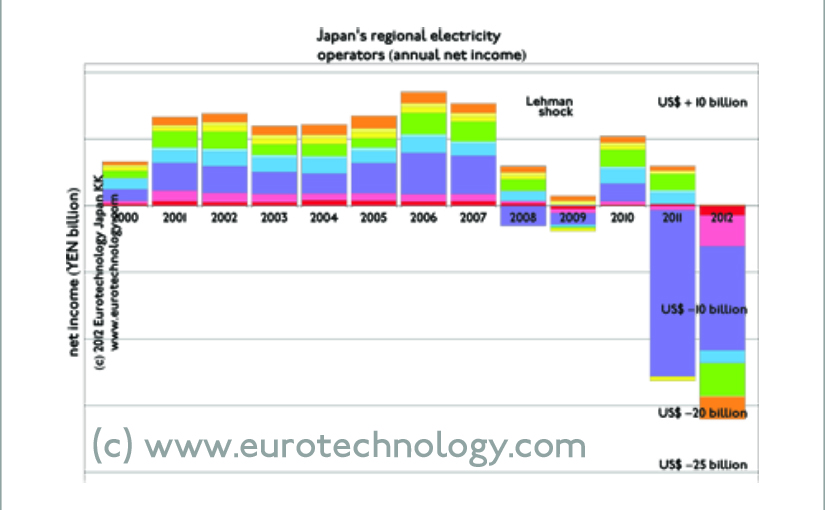

Japan’s electricity industry suffers huge losses from nuclear to fossil switch

What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry? Japan’s electricity operators switched from profits to huge losses What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry? Answer: Japan’s electricity operators switched from about US$ 10 billion/year combined net profits to…

-

Japan’s energy foxtrot: Two steps forward one step back

Two steps forward one step back: describes a frog struggling to climb out of a well, slipping back one step on the ladder for each two steps upwards out of the well Before the Fukushima disaster, Japan’s energy policy, strategy and execution were essentially decided behind closed doors by a small group of (about 100)…

-

Japan’s new energy strategy: much more than nuclear exit

Japan’s Cabinet released Japan’s new “Innovative Energy and Environmental Strategy” Japan’s new energy strategy Last Friday, September 14, 2012, Japan’s Cabinet released Japan’s new “Innovative Energy and Environmental Strategy”, which the Cabinet is required to produce by law, and which actually contains much more than the plan to work towards a future nuclear power free…

-

Joe Oliver: Briefing the Minister for Energy and Natural Resources of Canada

Joe Oliver, Minister for Energy and Natural Resources of Canada Was asked today to be one of a group of about 5 Japanese experts to brief the Minister for Energy and Natural Resources of Canada, Mr Joe Oliver. We were asked to keep the conversation off-the-record, so I can’t write about the meeting. Minister Oliver…

-

Japan energy dilemma

Japanese law requires the government to have an energy strategy plan in place Keep nuclear power off – or restart nuclear? Japan’s current energy strategy plan provides for nuclear power to provide 30% of the electricity, rising to 50% in a few years by building additional nuclear power stations. However, contrary to the current strategy…