Category: Japan’s electronics multinationals

-

Upbeat on Intel (CNBC TV interview) (Airtime: Tues. Apr. 14 2009)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Wild differences in operating margins for mobile, TV media groups and electricals

We analyze the effect of the crisis on operating margins in three different sectors in Japan: (1) electronics,(2) mobile communications(3) TV media groups. In sector (1), Nintendo‘s margins are above 30% and increasing despite the crisis, while traditional electronics companies’ margins are evaporating. (2) for mobile operators DoCoMo, KDDI and SoftBank margins are 10%-20% and…

-

Panasonic Warns on Loss (CNBC TV interview) (Airtime: Wed. Feb. 4 2009)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

ICT trends for Japan for 2009

Smartphones, European exits from Japan, and M&A ICT trends for Japan: Ericsson and Nokia Siemens Networks (NSN) remain engaged in Japan’s ICT sector by Gerhard Fasol One of the Embassies here in Tokyo asked me to write a report about ICT trends for Japan… ICT trends for Japan: Mobile phone sector Pushed by the Government…

-

Panasonic negotiates to acquire SANYO to form US$ 110 billion group

SANYO suffered from Niigata Chuetsu earthquake of Oct. 23, 2004 Panasonic attracted to SANYO’s battery and energy technologies On November 7, 2008 Panasonic (“Ideas for Life”) and Sanyo (slogan: “Think GAIA”) announced that they entered negotiations which can potentially lead to an acquisition of Sanyo by Panasonic to form one of the largest electronics groups…

-

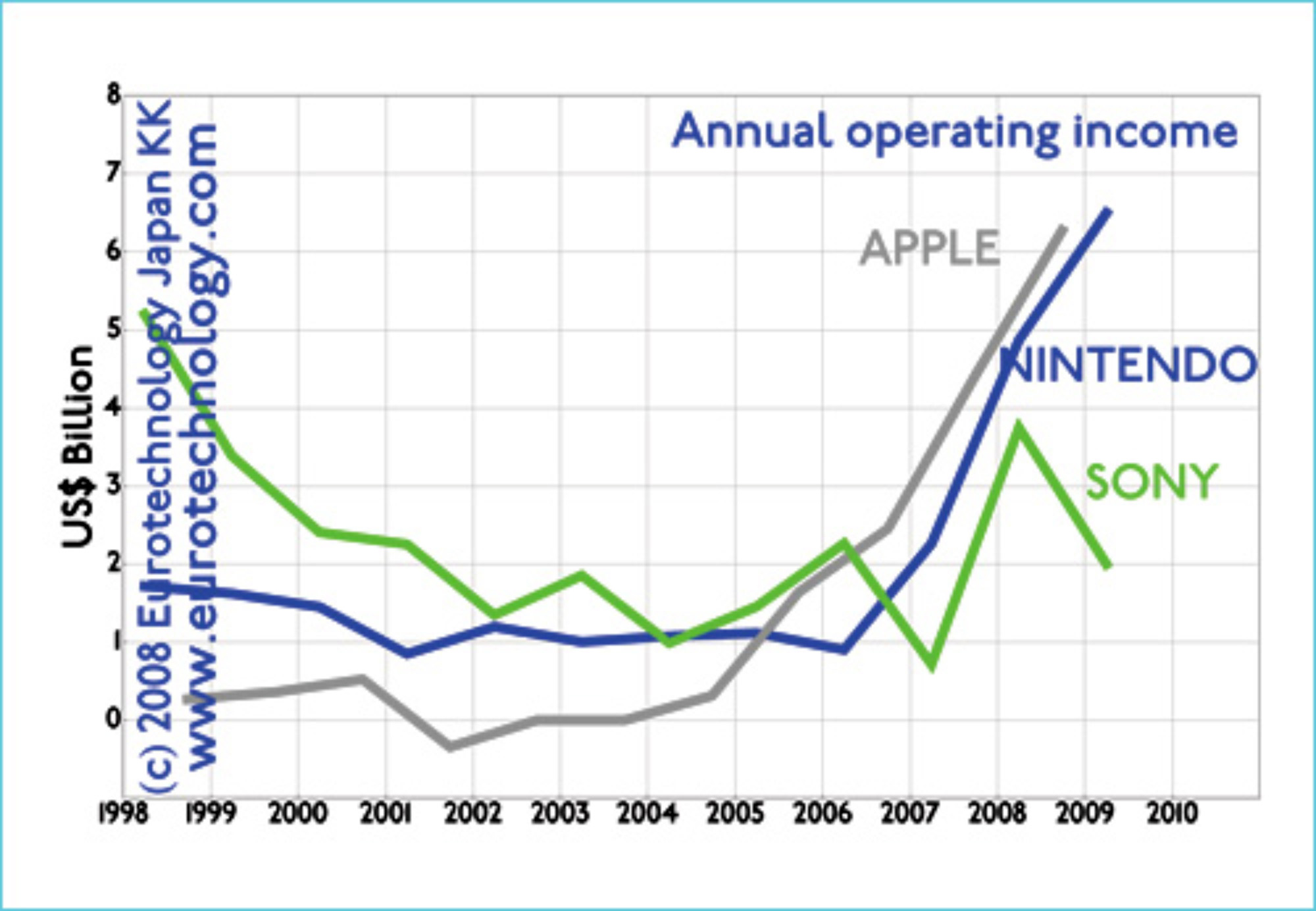

Apple Nintendo Sony: The power of focus

Lets benchmark three iconic companies: Apple Nintendo Sony Apple Nintendo Sony: three iconic companies evolving along very different paths. Apple’s current physical products famously all fit onto a single mid-sized table. Nintendo’s current physical products as well, for SONY you’d need a warehouse. Apple Nintendo Sony – Lets look at today’s market caps: Apple Nintendo…

-

Today’s APPLE 4th quarter results vs NINTENDO

A few hours ago (Oct 22, 2008, 6am Tokyo Time) APPLE announced 4th Quarter and Full Year results – we are here updating our comparison between APPLE and NINTENDO. With 6.9 million iPhones sold in APPLE’s 4th Quarter (July + August + September 2008), APPLE has achieved 2.76% market share of all mobile phones globally.…

-

Tech Sector Outlook (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Games: Nintendo – the winner takes it all

Game industries in total are MUCH bigger than music industries… in Japan game industries are about 10 times bigger business than music industries… Last weekend we had the Tokyo Game Show – read some key points below! From 2006 Japan’s game sector changed dramatically- Nintendo created several paradigm shifts, and “took off”. Read more about…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…

-

Japan electronics industry: Outlook for the Chip Industry (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Review of Japan Tech Earnings (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Sony Plans LCD TV Expansion

Read our report on Japan’s electronics industry sector: Copyright 2013 Eurotechnology Japan KK All Rights Reserved·

-

Sony Needs a Hit Product – TV interview

Read our report on Japan’s electronics industry sector: Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

Sony Spotlight (CNBC TV interview)

Read our report on Japan’s electronics industry sector: Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

Sony Needs to Change Its Game (CNBC TV interview)

Read our report on Japan’s electronics industry sector: Copyright 2013 Eurotechnology Japan KK All Rights Reserved

-

Samsung’s Earnings Beat Forecasts

Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

L.G. Philips Post Strong Q3 Profits (CNBC TV Interview)

More in our J-ELECTRIC Report Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Gerhard Fasol on CNBC about LENOVO 2007 3rd Quarter financial results

On February 1, 2007, LENOVO announced excellent 3rd Quarter results. I commented live on CNBC-TV. Read comments on LENOVO’s results below. Watch on youtube: Comments on LENOVO’s 3Q results LENOVO (traded on the the Hong Kong stock exchange) for 3Q announced 23% higher profits compared to 3Q one year ago. Revenue increased slightly to US$…

-

Ericsson Strategy & Technology Summit Tokyo

Eurotechnology’s CEO was invited to attend Ericsson’s Strategy & Technology Summit in Tokyo on November 15, 2006. Ericsson’s CEO, Carl-Henric Svanberg, Ericsson CSO – Chief of Strategy, Japan-CEO Rory Buckley and other Ericsson top management presented Ericsson’s strategy and vision. About 100 investors and investment bank analysts were invited to attend. I was given the…

-

SHARP pretax profit increases 26%

When BusinessWeek interviewed me for an article about SHARP in October 2004, the journalist interviewing me was very surprised that I was talking to him on a SHARP mobile phone. While NEC and Matsushita are merging their mobile phone development, SHARP has leveraged the power to make the best displays into market leadership in Japan’s…

-

SANYO – NOKIA CDMA2000 JV (Interview for CNBC)

Was interviewed today about the announced JV between SANYO and Nokia for CDMA2000 phone handsets (I added some corrections here): [Q1] How will SANYO benefit from this, since they are the ones who have the technology, what do they hope to gain from working with Nokia? Or is this merely a way to reduce costs…

-

About SANYO (CNBC and Wallstreet Journal)

CNBC interview on SANYO (Gerhard Fasol) Wednesday Nov 16, 2005, I was interviewed live on CBNC’s Asia Market Wrap with Christine Tan about SANYO’s plans to sell it’s financial division. Some of my friends asked me what I sad in this program – so here is my transcript from memory. Outline of Gerhard Fasol’s interview…

-

Eurotechnology Japan in the press: Bloomberg, BusinessWeek, Economist

Eurotechnology Japan KK in the press: Bloomberg: Vodafone K.K.’s Tsuda Seeks Growth in Japan, Not Sale BusinessWeek: How Sharp Stays On The Cutting Edge. More on SHARP in our report on Japan’s electronics industries BusinessWeek: Lasers Are About to Enter Their Blue Period BusinessWeek: Vodafone’s Bad Connection In Japan The Economist: Vodafone – not so…

-

PENCK (KDDI-AU Designer Series)

KDDI/AU Designer Series Model PENCK designed by Makoto Saito Design Office Inc. Today, February 18, KDDI-AU introduced PENCK – the latest model in the Designer Series, designed by Makoto Saito Design Office Inc.: Designer: Makoto Saito Design Office Inc. Data rate = 2.4 Mbps Music = Chaku-Uta-Full, stereo speakers Camera = 1.24 Megapixel, incl QR…

-

Briefing about Japan’s high-technology business world for Mme Nicole Fontaine

Briefing about Japan’s high-technology business sector for Mme Nicole Fontaine, Vice-Minister for Industry of France Tokyo, Friday, September 20, 2002, at the French Chamber of Commerce and Industry in Japan. Copyright·©1997-2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Masaru Ibuka, Founder of SONY, Obituary for NATURE

Masaru Ibuka obituary in NATURE by Gerhard Fasol After Masaru Ibuka (井深大) died on December 19, 1997, NATURE asked me to write an obituary about Masaru Ibuka, which was published in Nature on February 26, 1998, and you can download the article as a pdf-file here. The reference is: Gerhard Fasol, “Obituary: Masaru Ibuka (1908-97)”,…