Tag: nintendo

-

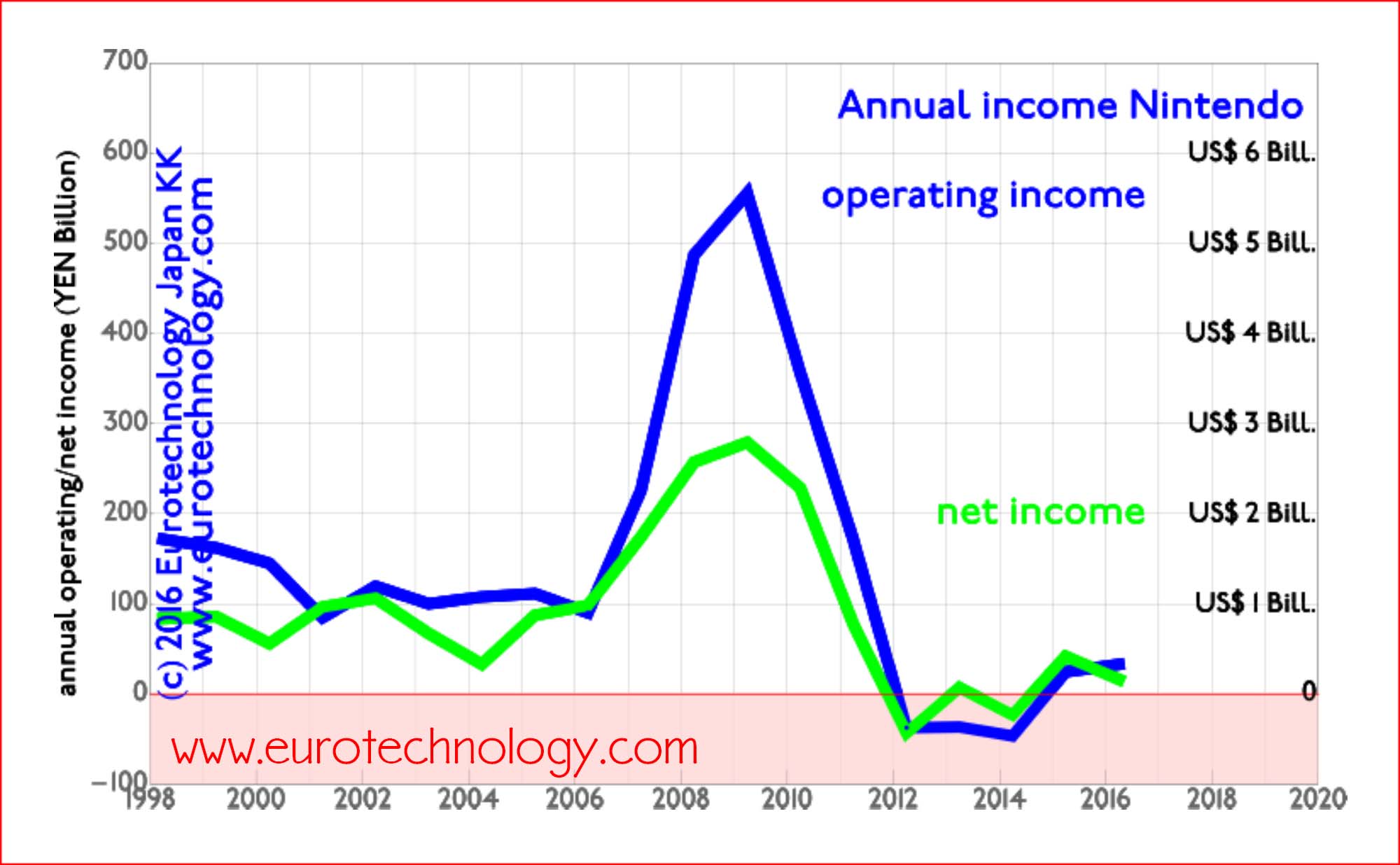

Pokemon Go – everybody loves Pikachu…

Pokemon Go is great – but will it bring another Nintendo boom as in 2009? or even exceed 2009? Google spin-out Niantic Labs’ augmented reality smartphone game booms to the top of charts Niantic Labs is specialized on augmented reality games. In a previous game, Ingress, players selected about 15 million memorable locations globally. Niantic…

-

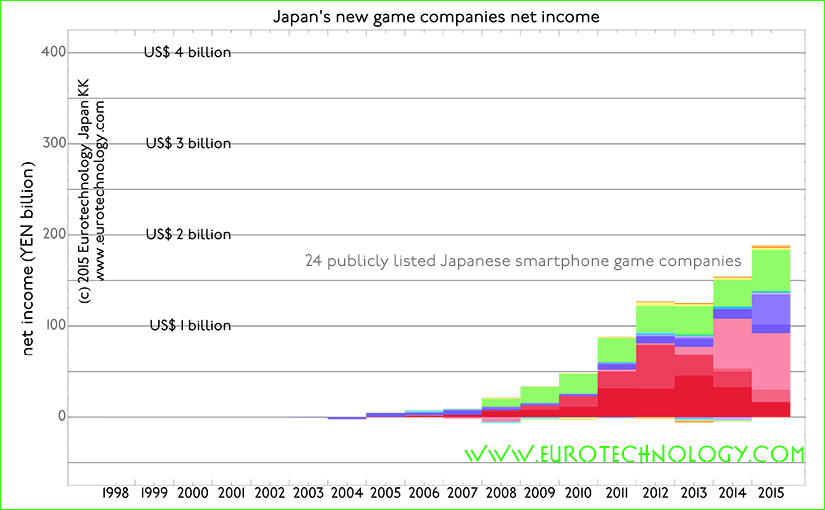

Smartphone games disrupt Japanese video game industry

24 new listed smartphone game companies achieve net income twice as high as all top 8 traditional video game companies combined Its not just Nintendo being disrupted, its the whole Japanese video games industry In the most recent version of our report on Japan’s game industry, we added 24 publicly listed new smartphone game companies…

-

Nintendo smartphone pivot?!

Nintendo partners with DeNA Taking Nintendo intellectual property and characters to smartphones Nintendo was founded on September 23, 1889 by Fujasiro Yamauchi in Kyoto for the production of handmade “hanafuda” cards. Nintendo Headquarters are still located in Kyoto (you can see the Nintendo headquarters building from the Kyoto railway station). The Chinese characters used to…

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

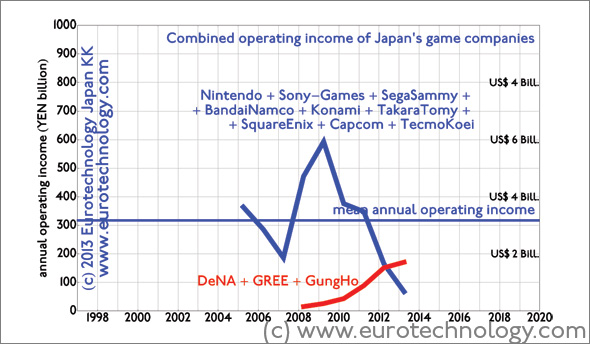

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…

-

Future of Video Game Sector (CNBC Airtime: Thurs. Jul. 30 2009)

Read more about Nintendo and the games sector: http://www.eurotechnology.com/store/jgames/ Read more about Japan’s electrical industry sector in our Japan’s electronics industry report (pdf file) Subscribe to our newsletters: technology newsletters from Japan

-

Do mobile app-stores and online games disrupt Nintendo’s blue ocean?

Japan introduced the mobile internet with i-Mode in 1999, while i-Phone and friends are now getting the rest of the world hooked onto the mobile internet. Games used to be played in game parlors, and some of Japan’s game giants were originally and still are game parlor machine makers – a round of Dance-Dance-Revolution anyone?…

-

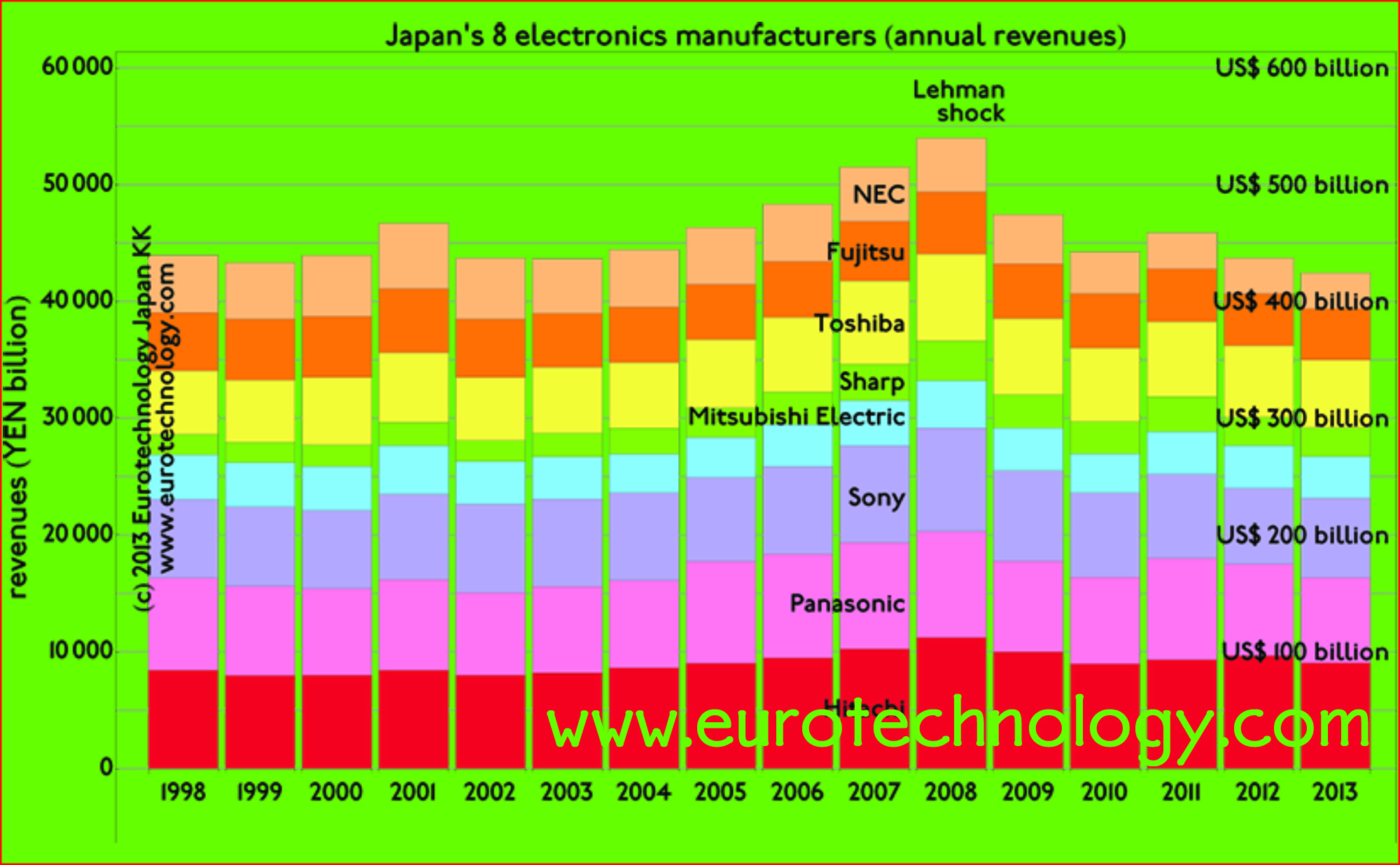

Japan’s games sector overtakes electrical sector in income

Japan’s games sector is booming – and net annual income of Japan’s top 9 game companies combined has now overtaken the combined net income of all Japan’s top 19 electronics giants (including Hitachi, Panasonic, SONY, Fujitsu, Toshiba, SHARP… at the top, and ROHM, Omron… further down the ranking list). Why does it make sense to…

-

Japan’s electronics companies & the crisis

Japan’s top 20 electronics companies combined are about as large as The Netherlands economically, and have big impact on the world economy. Our analysis shows how dramatically Japan’s electronics companies have been hit by the current crisis (except for Nintendo). We suggest that full recovery to 2008 (FY2007) levels may take until 2016 – about…

-

Nintendo’s CEO Satoru Iwata and Games Developer Superstar Shigeru Miyamoto

Nintendo’s CEO Satoru Iwata and games developer superstar Shigeru Miyamoto presented in Tokyo on April 9, 2009 about Nintendo’s situation and future plans. Iwata emphasized plans to move from one DS per household to one DS per person, by personalizing the DS, and by seeing that DS enriches everyday life. As examples he mentioned applications…

-

Investor Club: What crisis? Meet some booming Japanese companies

It’s not all doom and gloom here in Japan. Nintendo’s sales and operating profits are rising 8.8% year-on-year. KDDI saw its net profits increasing 59% year on year. Yahoo Japan increases dividends by 22%-25% for 2008. Who are today’s winners in Japan’s IT industry? Gerhard Fasol will show us how and why some great Japanese…

-

Wild differences in operating margins for mobile, TV media groups and electricals

We analyze the effect of the crisis on operating margins in three different sectors in Japan: (1) electronics, (2) mobile communications (3) TV media groups. In sector (1), Nintendo‘s margins are above 30% and increasing despite the crisis, while traditional electronics companies’ margins are evaporating. (2) for mobile operators DoCoMo, KDDI and SoftBank margins are…

-

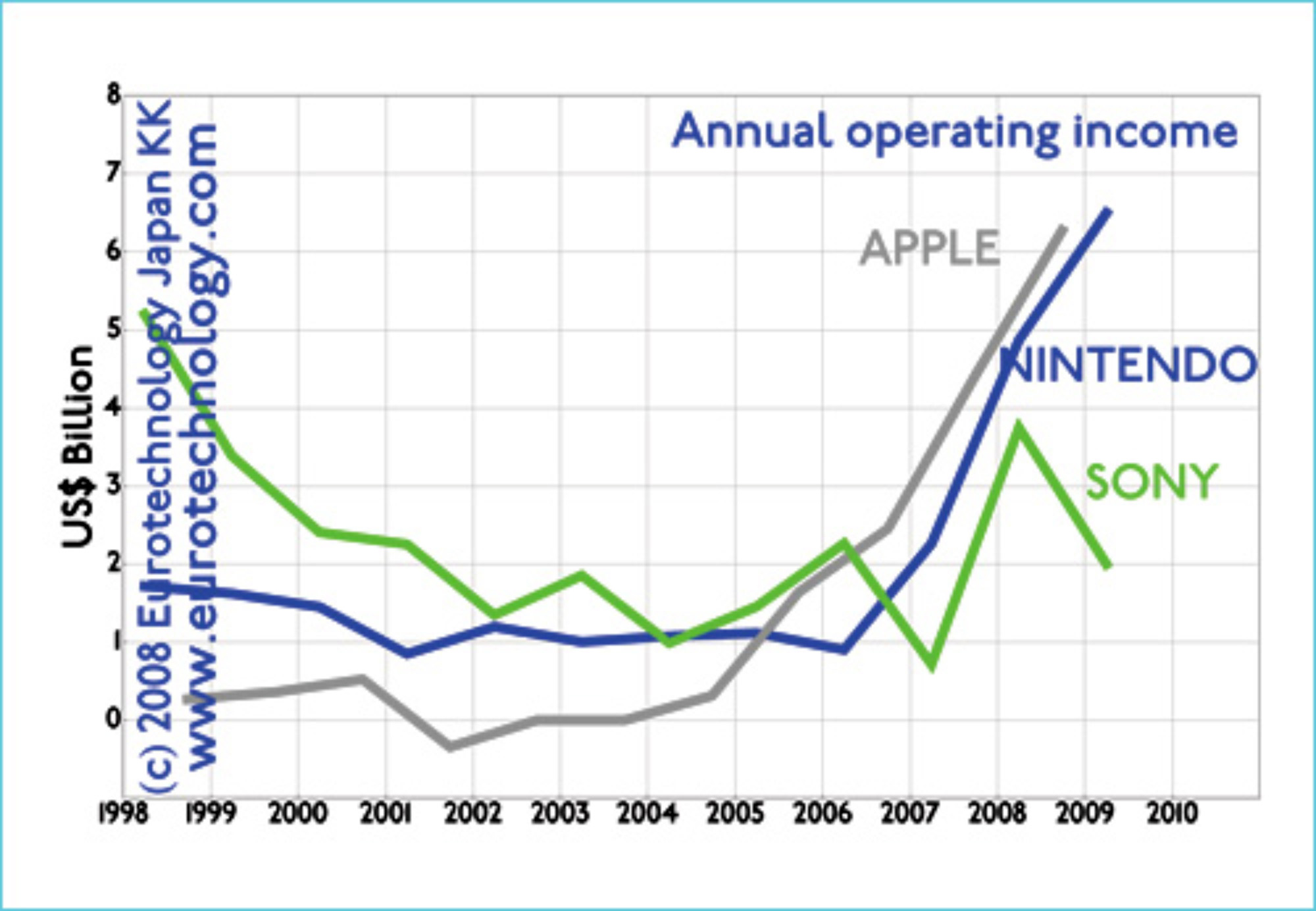

Apple Nintendo Sony: The power of focus

Lets benchmark three iconic companies: Apple Nintendo Sony Apple Nintendo Sony: three iconic companies evolving along very different paths. Apple’s current physical products famously all fit onto a single mid-sized table. Nintendo’s current physical products as well, for SONY you’d need a warehouse. APPLE: Wednesday October 22 APPLE announced spectacular full-year results with a year-on-year…

-

Today’s APPLE 4th quarter results vs NINTENDO

A few hours ago (Oct 22, 2008, 6am Tokyo Time) APPLE announced 4th Quarter and Full Year results – we are here updating our comparison between APPLE and NINTENDO. With 6.9 million iPhones sold in APPLE’s 4th Quarter (July + August + September 2008), APPLE has achieved 2.76% market share of all mobile phones globally.…

-

Games: Nintendo – the winner takes it all

Game industries in total are MUCH bigger than music industries… in Japan game industries are about 10 times bigger business than music industries… Last weekend we had the Tokyo Game Show – read some key points below! From 2006 Japan’s game sector changed dramatically- Nintendo created several paradigm shifts, and “took off”. Read more about…

-

XBOX Japan entry

XBOX still faces difficulties in Japan XBOX Japan entry: Microsoft reduces prices by 30% Microsoft announced to reduce prices for Xbox-360 by 30% in Japan. We believe that this price reduction will not be enough to bring the breakthrough for Xbox in Japan. Nintendo has reinvented the game industry, created a completely new paradigm. Nintendo…

-

XBOX Japan strategy – Microsoft still struggling

Microsoft XBOX introduced XBOX to Japan on February 22, 2002 XBOX Japan Strategy – CNBC interview Microsoft introduced the original XBOX game console in the USA on November 15, 2001, in Japan on February 22, 2002, and in Europe on March 14, 2002. During the period January-June 2005, three years after introduction of the XBOX…

-

Assessing Japan’s Gaming Sector (CNBC TV interview)

More in our J-GAMES report: http://www.eurotechnology.com/store/jgames/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Tokyo Game Show TGS2004 (Sept 24-26, 2004): breakthrough for native mobile games

Mobile phone games at the center of TGS2004 by Gerhard Fasol Docomo at the center of attention with JAVA native mobile games for i-Mode The annual “Tokyo Game Show” sets trends and is a must for game professionals and fans. More than 100 companies exhibit. This years highlight is the SONY “PlayStation Portable” – PSP…