Category: M&A

-

Chinese global brand – LENOVO

On February 1, 2007, LENOVO announced excellent 3rd Quarter results. I commented live on CNBC-TV. Read comments on LENOVO’s results below. Comments on LENOVO’s 3Q results LENOVO (traded on the the Hong Kong stock exchange) for 3Q announced 23% higher profits compared to 3Q one year ago. Revenue increased slightly to US$ 4 billion, making…

-

ACCESS CEO Toru Arakawa (Oct. 6, 2006)

Toru Arakawa, CEO and Founder of ACCESS, gave a keynote speech at this years CEATEC show in Makuhari on October 6, 2006, outlining ACCESS strategies. ACCESS is the maker of NetFront browsers and other software at the core of DoCoMo’s i-mode. ACCESS acquired PalmSource and is developing the Access Linux Platform (ALP) based on the…

-

Outsourcing Japan market research and strategy consulting to India, Philippines?? – a recipe for business failure in Japan?

Business decisions unrelated to market realities are a prime reason for failure of foreign companies in Japan In a quest to reduce market research costs, Japan market research is often outsourced to India, Philippines, Indonesia etc With shock and surprise we recently found out that a very famous telecom and IT industry market research and…

-

SoftBank accounting adjustments – a Red Herring interview

SoftBank accounting adjustments Vodafone Japan turn around under SoftBank – Interview for Red Herring Helped RedHerring with an interview on the recent SoftBank accounting adjustment. The article is entitled “Softbank Falls on Lehman Cut” and appeared on the RedHerring website on August 28, 2006. Our company also recently advised a major global financial institution on…

-

SoftBank rebrands Roppongi store from Vodafone red to SoftBank white/silver

SoftBank acquired Vodafone’s Japan operations and lost no time to rebrand the company Speed is one of SoftBank’s success factors On March 17, 2006 SoftBank announced the acquisition of Vodafone Japan with co-investment by Yahoo KK, sealing the end of Vodafone’s operations in Japan, and Vodafone’s exit from Japan. SoftBank did not lose a moment…

-

Vodafone Japan rebranding to SoftBank

SoftBank replaces Vodafone brand in Japan Vodafone quits business in Japan having sold all operations to SoftBank Photographs below show the world famous Vodafone board on Tokyo-Shibuya’s Hachiko-square being replaced by the SoftBank advertisement from June 14, 2006. Cheese phones anyone?… Vodafone “cheese phone” and “car tire phone” posters replaced by SoftBank posters on Tokyo’s…

-

Panel Discussion to 200 Japanese Executives at the Industrial Club of Japan

May 30, 2006: at the Industrial Club of Japan Panel discussion for about 200 Japanese CEOs and high level managers about the challenges of international business management. The five panelists were: James C AbbeglenAllen Miner (CEO of Sunbridge Venture Habitat, and founder of Oracle Japan) Kong Jian (China – Japan Economic Federation) Koshiro Kitazato (Chairman…

-

SoftBank rebrands Vodafone Japan

Speed of the essence: SoftBank loses no time to turn around Vodafone-Japan Vodafone’s withdrawal also shows, that the values of cross-cultural management skills are often underestimated by Gerhard Fasol SoftBank rebrands Vodafone Japan: Saturday June 10, 2006 was the first time we saw SoftBank replacing the Vodafone brand in Japan – bringing a formal end…

-

NTT Docomo acquisitions: Tower Records – No music, no life!

Docomo acquires music retail know-how and a laboratory for mobile payments at the point-of-sale NTT Docomo acquisitions: 32.34% of Tower Records a major share of Japan’s second largest Credit Card issuer Nikkei reports several NTT Docomo acquisitions: DoCoMo will use a total investment of around YEN 10 Billion (approx US$ 100 million) to acquire 32.24%…

-

Japan media landscape restructuring

Japan’s broadcasting is a US$ 40 billion/year industry There have been many attempts over the years for Japan media landscape restructuring by Gerhard Fasol Japan’s broadcasting markets (commercial TV + NHK + CATV + satellite + AM & FM radio) have annual combined revenues on the order of US$ 40 billion. The main players in…

-

Tokyo Game Show TGS2005: Playstation vs Microsoft XBOX vs absent Nintendo DS

Nintendo wins on mindshare despite traditional absence from TGS Tokyo Game Show TGS2005: Battle of the console and handheld platforms, while native mobile game applis on the path to disrupt by Gerhard Fasol Here some highlights of this year’s Tokyo Game Show TGS2005: SONY vs Microsoft. At last year’s TGS2004 Microsoft’s XBOX exhibit was pretty…

-

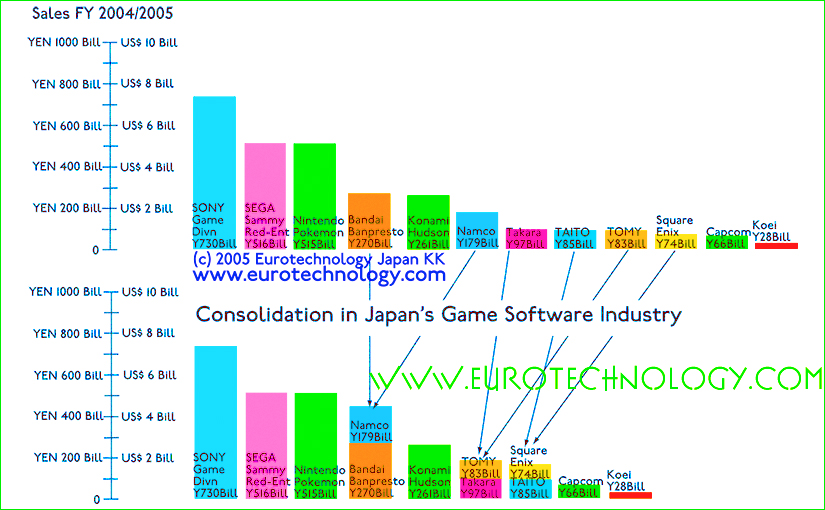

Japan game software industry consolidation

Japan’s historically grown game companies are global superpowers Shrinking traditional home video game software market and paradigm shift to online games, network games and mobile games forces consolidation by Gerhard Fasol Japan’s mobile game software companies are global superpowers. They are all historically grown and linked to other industry sectors, such as characters, arcade games,…

-

KDDI may partner with Poweredcom/TEPCO

Poweredcom has doubled investments in FTTH to YEN 44 Billion (US$ 0.4 Billion) for FY 2005/2006 from YEN 22 Billion in FY 2204/2005. (For details and analysis of Japan’s FTTH market read our report on Japan’s telecom sector). Partnership with KDDI‘s triple-play leverages Poweredcom’s present and future FTTH investments. Copyright·©1997-2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

KDDI absorbs TuKa

KDDI – Japan’s second largest telecom operator – streamlines the group KDDI’s AU with TuKa acquires 3.5 million additional subscribers KDDI announced to absorb the three TuKa companies into AU: with the stroke of a pen, AU will be stronger by 3.5 million subscribers. The three TuKa companies managed a successful turnround by focusing on…

-

Livedoor and Fuji TV take over battle via Japan Radio

New economy player Livedoor attempts takeover of “old economy” media conglomerate Fuji Television Group Livedoor and Fuji TV: Takafumi Horie “Horiemon” attempts to exploit an overlooked loophole in Fuji Televisions shareholder structure to gain control of the very much larger Fuji media group Livedoor and Fuji TV: New economy (Livedoor) is knocking at the door of…

-

Cable & Wireless Japan acquired by Softbank???!!

Cable & Wireless Japan staged what it said was one of the first “hostile” takeovers in Japan, but then proved to be unable to manage the company they had acquired by Gerhard Fasol On October 26, 2004, Softbank announced the acquisition of Cable & Wireless IDC for YEN 12.3 billion (= US$ 110 million) Cable…