Tag: mobile phone

-

iida – a new brand for KDDI’s design series by Yayoi Kusama

KDDI created a new brand: “iida” for the long running best selling AU design series mobile phones. KDDI introduced some of the most recent iida design series models at the KDDI Designing Center. In addition to the earlier Yamaha musical instruments phones, KDDI introduced a spectacular phone created by Yayoi Kusama. Fun is the green…

-

ICT trends for Japan for 2009

Smartphones, European exits from Japan, and M&A ICT trends for Japan: Ericsson and Nokia Siemens Networks (NSN) remain engaged in Japan’s ICT sector by Gerhard Fasol One of the Embassies here in Tokyo asked me to write a report about ICT trends for Japan… ICT trends for Japan: Mobile phone sector Pushed by the Government…

-

Japan’s mobile phone disaster

Japan’s mobile phone sector is admired the world over, and Japanese mobile phones are years ahead the rest of the world regarding functionality. However, Japan’s mobile phone industry may be heading for a disaster, similar to the European 3G spectrum license fee disaster which almost bankrupted Europe’s mobile phone operators – unless changes are made…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…

-

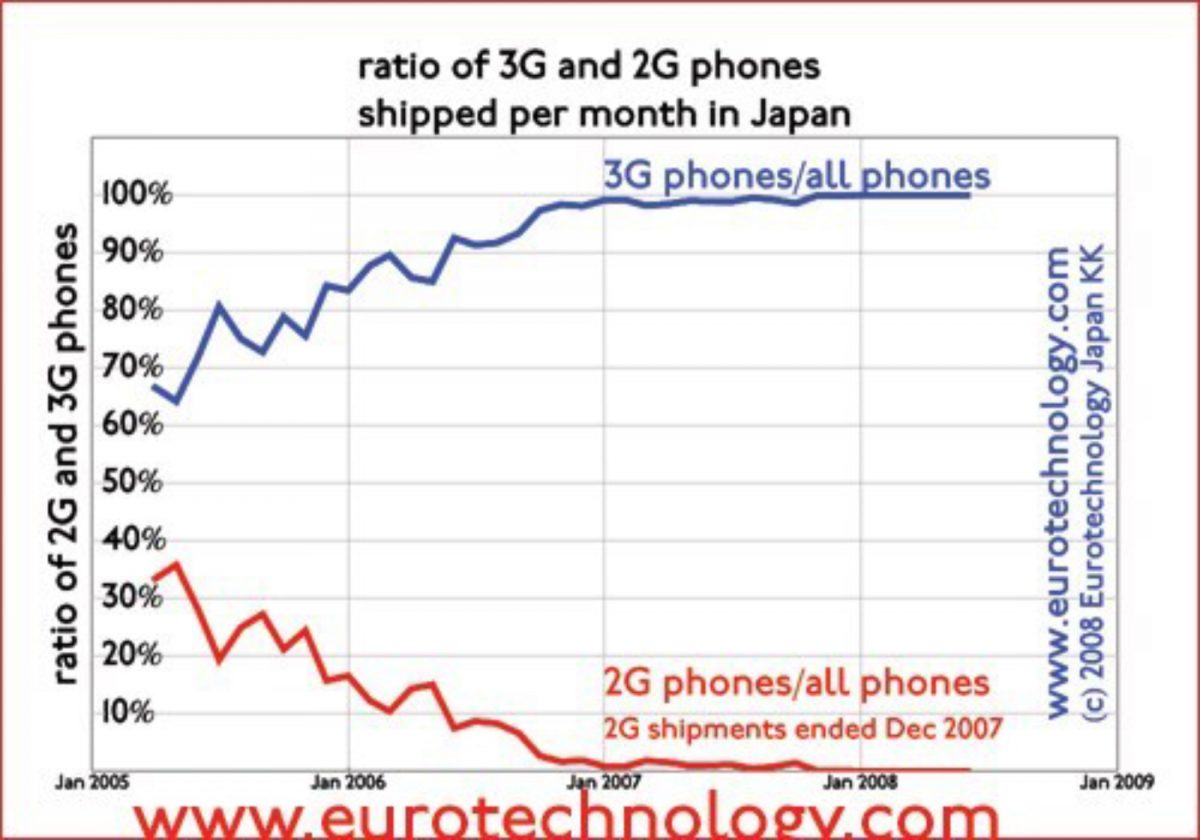

Last 2G phone shipped 8 months ago in Japan, 2G networks are switched off

KDDI/AU switched off 2G radio network in March 2008, Docomo and SoftBank to switch off 2G networks in 2009 Second generation (2G) phones silently bowed out of Japan’s market 8 months ago: the last 2G phones in Japan were shipped in December 2007. KDDI/AU switched off their 2G radio network in March 2008, this year,…

-

Will the iPhone trigger a turning point in Japan’s mobile phone industry?

Tetsuzo Matsumoto (Senior Executive Vice-President and Board Member of SOFTBANK MOBILE Corporation),Gerhard Fasol (CEO, Eurotechnology Japan KK)andDennis Normile (Japan Correspondent of SCIENCE Magazine, and FCCJ)discuss about the future of Japan’s mobile phone market. “Will the iPhone trigger a turning point in Japan’s mobile phone industry?”(Foreign Correspondents’ Club of Japan, Tokyo Wednesday, August 13, 2008, 12:00-14:00)…

-

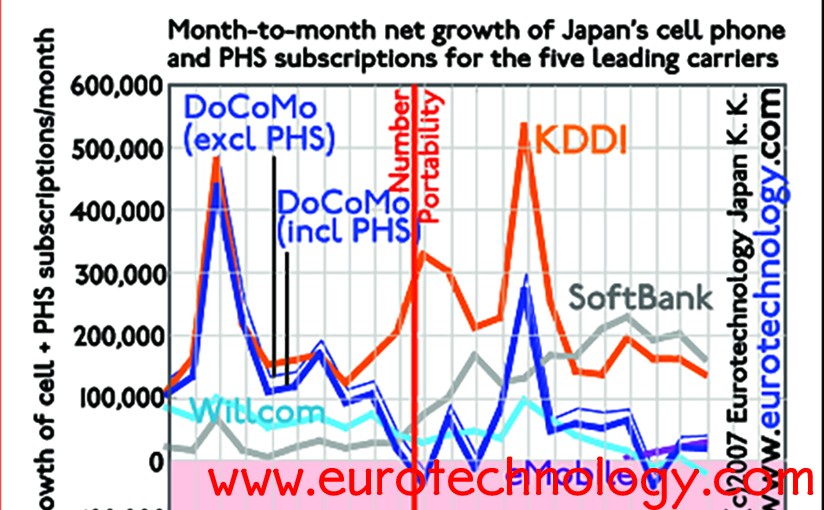

SoftBank and KDDI win market share, Docomo loses

SoftBank from 4th to 1st position within less than 12 months… SoftBank‘s turn-round of x-Vodafone-Japan, went faster than many expected. Within less than 12 months SoftBank went from last place to first place in customer sign-ups, overtaking even KDDI‘s super-popular AU. Willcom recently suffers from SoftBank‘s revival, as well as from eMobile‘s flat rate data…

-

First half FY2008 results: SoftBank and KDDI profits increase, DoCoMo’s trends is downward

In the last few days NTT, NTT-DoCoMo, KDDI and SoftBank announced their first half financial results. SoftBank and KDDI are the winners both for market share and for profits, while DoCoMo‘s results and market shares are sinking, and pulling the NTT-Group down at this time. Extrapolation indicates that DoCoMo‘s net profits may fall into the…

-

SuiPo – linking posters to mobile phones and IC cards

JR-East introduced SuiPo (Suica Poster). People who want to participate need to register and link their plastic SUICA card, or their mobile SUICA (wallet phone with installed SUICA application) with a registered mobile or PC email address. Whenever a registered participants touches the SUICA reader/writer on the side of a poster, links to a campaign…

-

“Help – my mobile phone does not work!” – Why Japan’s mobile phone sector is so different from Europe’s

Presentation at the Lunch meeting of the Finnish Chamber of Commerce in Japan (FCCJ) on March 16, 2007 at the Westin Hotel, Tokyo. Summary of the event and photographs here: https://web.archive.org/web/20160815232148/http://www.fcc.or.jp/lunch160307.html The presentation is not available any longer on the FCCJ website however you can download our report about Japan’s telecom sector. An abbreviated version…

-

u-Japan and Japan’s Mobile Phone Industry

u-Japan follows i-Japan and e-Japan to take Japan to the forefront of global IT developments Presentation at the EU-Japan Center for Industrial Cooperation, 12 October 2006 Title: “Japan’s Mobile Phone Industry and u-Japan” Date and Time: Thursday, 12th October 2006, 17:00-19:00 Location (tentative, please check closer to the date for changes): Main Conference Room 4F,…

-

Japan’s Mobile Communications Industry

Presentation at the German Embassy, Tokyo (12 June 2003, 18:30, Residence of HE The Ambassador of Germany, Tokyo) Copyright·©1997-2013 ·Eurotechnology Japan KK·All Rights Reserved·