Tag: softbank

-

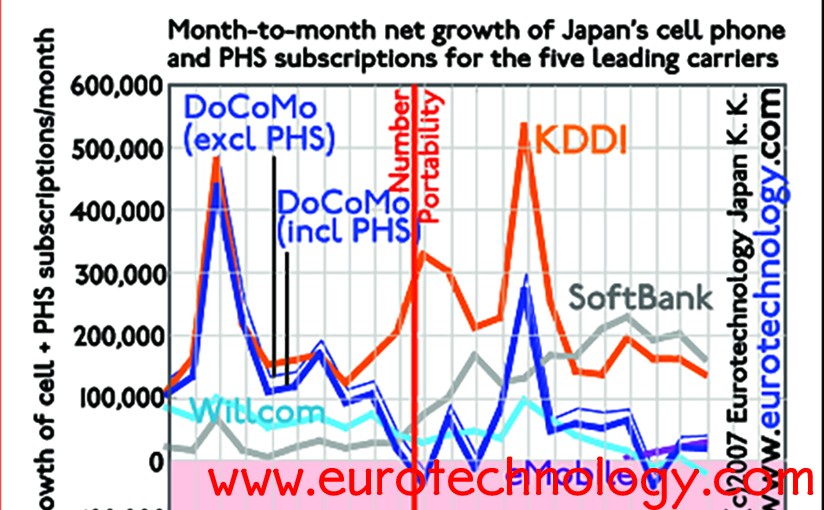

SoftBank and KDDI win market share, Docomo loses

SoftBank from 4th to 1st position within less than 12 months… SoftBank‘s turn-round of x-Vodafone-Japan, went faster than many expected. Within less than 12 months SoftBank went from last place to first place in customer sign-ups, overtaking even KDDI‘s super-popular AU. Willcom recently suffers from SoftBank‘s revival, as well as from eMobile‘s flat rate data…

-

First half FY2008 results: SoftBank and KDDI profits increase, DoCoMo’s trends is downward

In the last few days NTT, NTT-DoCoMo, KDDI and SoftBank announced their first half financial results. SoftBank and KDDI are the winners both for market share and for profits, while DoCoMo‘s results and market shares are sinking, and pulling the NTT-Group down at this time. Extrapolation indicates that DoCoMo‘s net profits may fall into the…

-

“Help – my mobile phone does not work!” – Why Japan’s mobile phone sector is so different from Europe’s

Presentation at the Lunch meeting of the Finnish Chamber of Commerce in Japan (FCCJ) on March 16, 2007 at the Westin Hotel, Tokyo. Summary of the event and photographs here: https://web.archive.org/web/20160815232148/http://www.fcc.or.jp/lunch160307.html The presentation is not available any longer on the FCCJ website however you can download our report about Japan’s telecom sector. An abbreviated version…

-

Mobile Number Portability (MNP) in Japan

Mobile number portability created winners and losers in only two months – the main business challenge for Japanese operators is to avoid a price war. KDDI is the clear winner in the first round, DoCoMo suffers a setback, and SoftBank (which acquired Vodafone-Japan) did better than expected. Today we released the 23rd edition of our…

-

Mobile number portability in Japan: SoftBank’s Zero YEN campaign

Mobile number portability was a major factor forcing Vodafone out of Japan MNP is the first challenge for SoftBank Mobile – read how SoftBank approaches the MNP battle Mobile number portability (MNP) was introduced in Japan on October 24, 2006. Mobile number portability means that Japanese cell-phone subscribers (excluding PHS subscribers) can move their subscriptions…

-

SoftBank’s Gold Plan – Zero Yen?

SoftBank acquired Vodafone KK for about US$ 15 billion, essentially with a very large loan. Thus SoftBank is under enormous pressure to succeed in Japan’s very competitive mobile phone market, where Number Portability was introduced on October 24, 2006. Recent subscriber number statistics and our observations indicate that SoftBank looks likely to succeed in turning…

-

Yahoo!-keitai replaces Vodafone-Live!

SoftBank replaced Vodafone-Live! by Yahoo!-Keitai. SoftBank phones have a “Y!”-button which links to Yahoo!-keitai. Yahoo-Keitai! offers a list of official sites, new services (e.g. a new communicator service), and also access to free mobile internet sites through the YAHOO directory, as well as access to YAHOO services, such as YAHOO-auctions. YAHOO!-keitai is a fresh start…

-

SoftBank Shibuya flagship store

On September 29, 2006, a few days before the official name change from Vodafone KK to SoftBank Mobile, SoftBank opened the rebranded Shibuya flagship store: Because of the crowded streets in Shibuya most of the building work was done during the night: More about SoftBank in our “SoftBank Report” Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

SoftBank accounting adjustments – a Red Herring interview

SoftBank accounting adjustments Vodafone Japan turn around under SoftBank – Interview for Red Herring Helped RedHerring with an interview on the recent SoftBank accounting adjustment. The article is entitled “Softbank Falls on Lehman Cut” and appeared on the RedHerring website on August 28, 2006. Our company also recently advised a major global financial institution on…

-

SoftBank rebrands Roppongi store from Vodafone red to SoftBank white/silver

SoftBank acquired Vodafone’s Japan operations and lost no time to rebrand the company Speed is one of SoftBank’s success factors On March 17, 2006 SoftBank announced the acquisition of Vodafone Japan with co-investment by Yahoo KK, sealing the end of Vodafone’s operations in Japan, and Vodafone’s exit from Japan. SoftBank did not lose a moment…

-

YAHOO and Google’s mobile strategies

Japan is a couple of years ahead of Europe and US in mobile communications by most measures What are GOOGLE and YAHOO doing in Japan’s mobile sector? GOOGLE started mobile operations in Japan by partnering with KDDI (Japan’s No. 2 mobile operator with about 25 million mobile subscribers) to develop mobile search. YAHOO-Japan made a…

-

SoftBank transforms former Vodafone Roppongi flagship store

Speed is one factor for SoftBank’s success Following the acquisition of Vodafone-Japan, SoftBank quickly turns round the company Today, August 26, 2006, SoftBank (read our report on SoftBank here) opened the remodeled and rebranded Roppongi flagship store. The SoftBank Roppongi store is designed in light colors using a color scheme including mainly white, silver and…

-

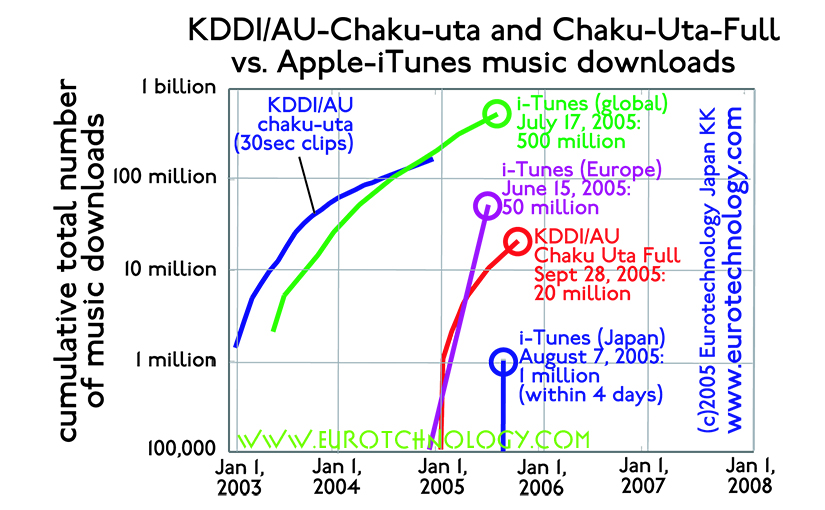

iPhone for Japan? iTunes/iPod phones?

There is a lot of discussions about whether Steve jobs is going to announce an iPhone or iPod-Phone at the Apple Computer Developer’s Conference in SF – according to the headline report on Saturday May 13th, 2006 in Nihon Keizai Shinbun ( the world’s largest business daily ) it’s already known since May this year…

-

SoftBank a small fry, writes BusinessWeek …. really??

Comparing Apple and SoftBank Is SoftBank really smaller than Apple Computer? In my 20 years of business and work between US/Japan and EU/Japan, I am often surprised how Western executives underestimate economic size and strength of Japan and it’s companies – here is another example:BusinessWeek writes about the SoftBank/iPod phone, and writes that former Apple…

-

Vodafone Japan rebranding to SoftBank

SoftBank replaces Vodafone brand in Japan Vodafone quits business in Japan having sold all operations to SoftBank Photographs below show the world famous Vodafone board on Tokyo-Shibuya’s Hachiko-square being replaced by the SoftBank advertisement from June 14, 2006. Cheese phones anyone?… Vodafone “cheese phone” and “car tire phone” posters replaced by SoftBank posters on Tokyo’s…

-

SoftBank rebrands Vodafone Japan

Speed of the essence: SoftBank loses no time to turn around Vodafone-Japan Vodafone’s withdrawal also shows, that the values of cross-cultural management skills are often underestimated by Gerhard Fasol SoftBank rebrands Vodafone Japan: Saturday June 10, 2006 was the first time we saw SoftBank replacing the Vodafone brand in Japan – bringing a formal end…

-

SoftBank turnaround program for Vodafone-Japan

SoftBank acquires Vodafone’s Japan operations, announces turnaround strategy SoftBank turnaround for Vodafone-Japan: Focus on customer service and increased investments by Gerhard Fasol SoftBank has acquired Vodafone-Japan (Vodafone KK) and will change the name to SoftBank Mobile. SoftBank‘s alliance with APPLE to develop iPod-mobile phones is the latest in a string of actions to take the…

-

iPod mobile phones for Japan?

According the headline report in Nihon Keizai Shinbun (the world’s largest business daily) on Saturday May 13th, Apple’s CEO Steve Jobs and SoftBank’s Chairman Masayoshi Son met recently, and are developing a joint mobile phone with iPod and iTunes functions. On March 17 SoftBank announced the full acquisition of Vodafone’s Japan subsidiary – the former…

-

Why Japan is several years ahead of Europe in telecoms and broadband?

Briefing at the European Union Embassy following Vodafone’s failure in Japan and what Europe can do to catch up? by Gerhard Fasol Today (March 23, 2006) I was invited to brief the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo about the topic “Why Japan is several years ahead…

-

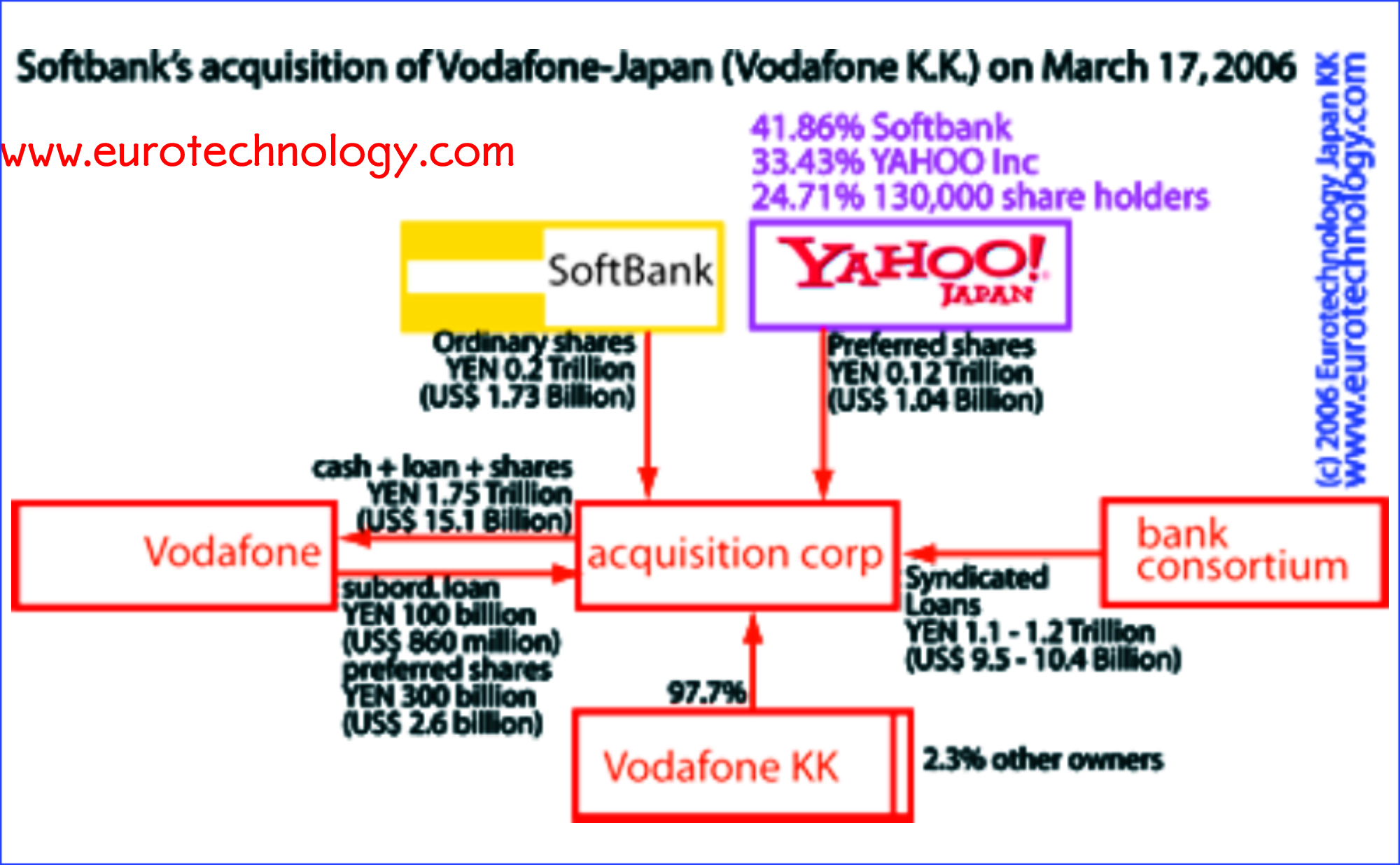

Softbank acquires Vodafone Japan with co-investment from Yahoo KK

The Deal seals Vodafone’s exit from Japan Softbank acquires Vodafone Japan in an approx. US$ 15 billion deal – worth an estimated US$ 83 billion ten years later SoftBank and Yahoo-Japan acquired 97.7% of outstanding shares of Vodafone Japan (Vodafone KK) in Japan’s largest M&A transaction (the remaining 2.3% are owned by other investors). In…

-

Vodafone Japan fail: Why did Vodafone lose the opportunity of US$ 83 billion value, and help jumpstart the growth of SoftBank

Vodafone’s opportunity cost of US$ 83 billion, asset write-down by £28bn (= approx. US$ 50 billion) in 2006, and kicking off SoftBank’s meteoric rise by Gerhard Fasol Vodafone Japan fail: learn from the missed US$ 83 billion opportunity in Japan Vodafone Japan fail: a painful lesson for the Vodafone group, and the jumpstart for SoftBank’s…

-

Vodafone in Japan? A dramatic change of Vodafone’s mind?

“Vodafone K.K.’s Tsuda, 津田志郎, seeks growth in Japan, not sale” However, sale to SoftBank may be the way forward About one year ago, in an interview with Bloomberg (“Vodafone KK’s Tsuda seeks growth in Japan, not sale“), I mentioned that a sale of Vodafone’s Japan operations to Softbank might be the way Vodafone will go…

-

Why are keitai so hot in Japan?

Innovations in Japan’s mobile phone sector Why is Japan’s telecommunications sector leading? Seminar announcement The European Institute of Japanese Studies (EIJS Academy in Tokyo) of the Stockholm School of Economics will hold a seminar in Tokyo-Marunochi on Thursday, February 16, 2006: Topic: “Why are Mobile Phones (Keitai) so hot in Japan? – and How European…

-

Japan’s mobile subscriber data for March 2005

March is the month when new subscriptions peak in Japan. During March 2005 around one million new subscribers signed up for mobile services in Japan, the net gain (new subscriptions minus cancellations) was 930,500. New subscribers were shared as follows between carriers: DoCoMo: + 480,200 (+ 51.6%) KDDI/AU: + 436,100 (+ 46.9%) WILLCOM: + 33,300…

-

Vodafone CEO Arun Sarin wants Vodafone to be in Japan for 10, 20, 30 years

Shiro Tsuda, 津田志郎, CEO of Vodafone Japan Vodafone CEO Arun Sarin wants to stay in Japan for the long term according to Bloomberg by Gerhard Fasol In February 2005 Shiro Tsuda (津田志郎, CEO of Vodafone KK for a few weeks) told Bloomberg that global “Vodafone CEO Arun Sarin wants Vodafone in Japan for 10, 20,…

-

NTT to invest US$ 45 Billion over 6 years

Softbank is rapidly becoming the third universal telco in Japan, targeting NTT’s most important income streams. KDDI of course is also targeting NTT’s fixed line income. On November 2, 2004, NTT announced plans to compete: NTT will invest 5 Chou YEN (YEN 5000 Billion = US$ 45 Billion) over 6 years (2005-2010), i.e. about US$…

-

Interview with Businessweek Editor David Rocks about Masayoshi Son and Japan’s telecom sector

Businessweek Editor David Rocks: “if you would meet Masayoshi Son, what would you ask him? by Gerhard Fasol Businessweek Editor David Rocks came three weeks to Japan to report on Japan’s telecommunications and technology sectors, arrived Friday and took me for dinner Friday night. A few days later David Rocks called me during my lunch…

-

21.6 million 3G subscribers in Japan (31 August 2004)

The mobile phone subscriber statistics for August 2004 in Japan came out: 3G subscribers: KDDI/AU: 15,511,800 subscribers, conversion rate to 3G: 86.1% DoCoMo: 5,900,200 subscribers, conversion rate to 3G: 12.6% Vodafone: 237,600 subscribers, conversion rate to 3G: 1.6% Copyright·©1997-2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

KDDI/AU has 80% of users on 3G

80% of KDDI/AU users are now converted to 3G, and KDDI/AU does not sell any 2G phones any more: only 3G and 3.5G (2.4Mbps data download). Here is KDDI/AU‘s newest 3.5G phone – the W21SA, for 2.4Mbps data download: More about Japan’s mobile telecom sector:Eurotechnology Japan report on Japan’s telecom industry Copyright·©1997-2013 ·Eurotechnology Japan KK·All…

-

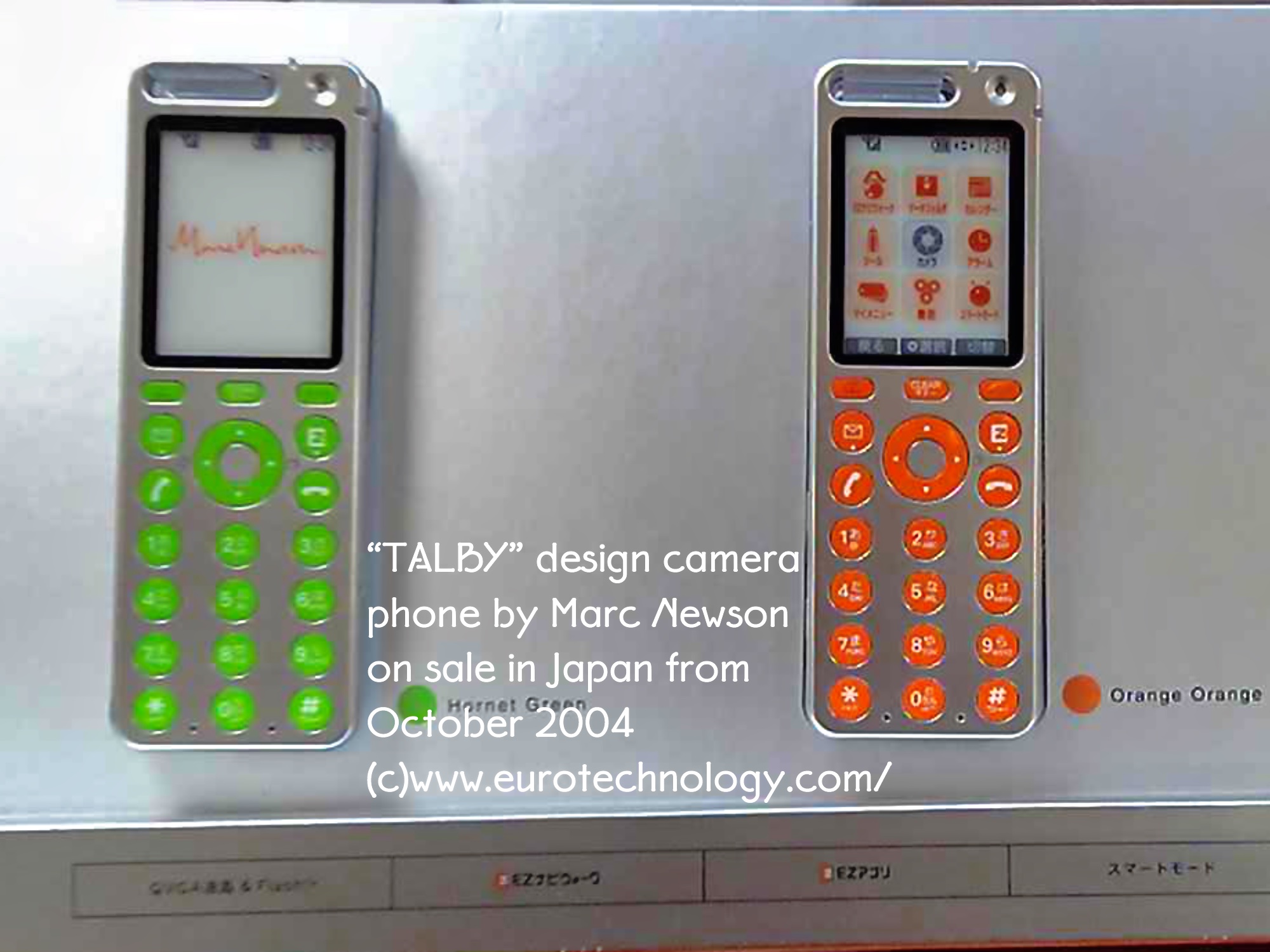

Wireless Japan 2004 exhibition (Tokyo, July 21-23, 2004)

FeliCa mobile payment wallet phones at the centre of attention by Gerhard Fasol Wireless, mobile phone industry trends years before they reach outside Japan Every year the Wireless Japan sets global trends in wireless communications and mobile phones. Mobile phone industry professionals cannot afford to miss this trend setting show. It is here that Japanese…