Tag: GungHo

-

Japan top grossing smartphone apps

5 top listed smartphone app companies have combined market cap of US$ 14 billion (excluding LINE) LINE is currently a private company and LINE’s company value is generally estimated in the US$ 10-15 billion range, so if we include LINE, the combined market value of Japan’s top 5 smartphone game companies is on the order…

-

Japan Google Play top grossing Android apps

25 Japan Google Play top grossing Android Apps of June 6, 2015 (All Categories) Japan game market report (398 pages, pdf-file) No. 1 Monster strike (by Mixi) No. 2 Puzzle & Dragons by GungHo No. 3「LINE: ディズニーツムツム」LINE Disney tsumu tsumu (by LINE Corporation & Disney) No. 4「白猫プロジェクト」”White Cat project” by COLOPL Inc. No. 5 「剣と魔法のログレスいにしえの女神・人気の本格オンラインRPG」Sword…

-

Japan iOS App store 25 top grossing

25 Top Grossing iPhone Apps of June 6, 2015 (All Categories) Japan game market report (398 pages, pdf-file) Copyright 2015 -2019 Eurotechnology Japan KK All Rights Reserved

-

Japan smartphone app rankings by cash revenue (iOS)

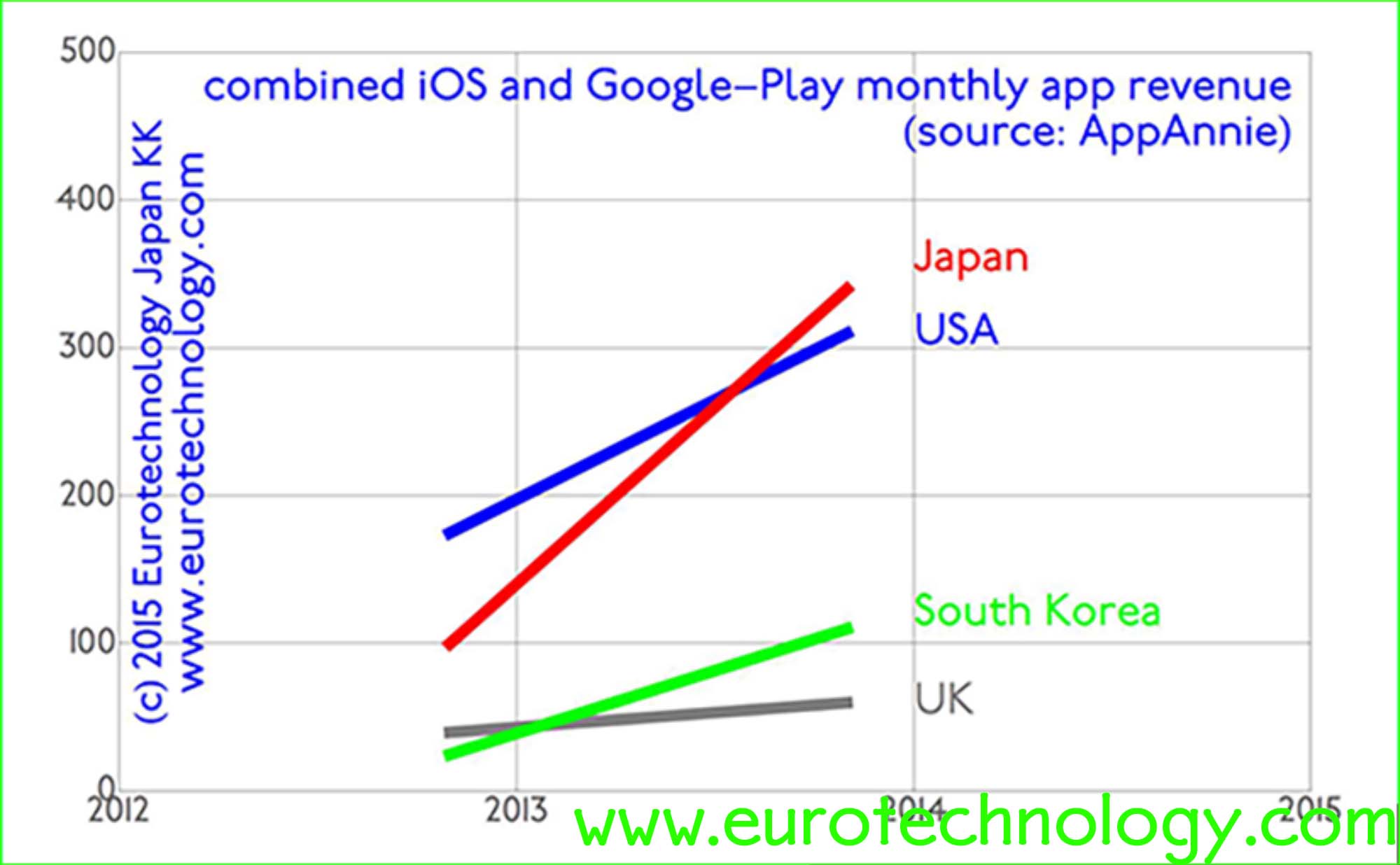

Top grossing app ranking (Feb. 10, 2015) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is No. 1 globally, spending more than the USA. Therefore Japan is naturally the No. 1 target globally for many mobile game companies, and quite a few of the top grossing apps in Japan…

-

Japan iPhone AppStore: world’s top grossing!

iPhone AppStore-Japan “Top Grossing” games ranking of July 13, 2014: iOS App Store ranking of June 6, 2015 here. Google Play Store ranking of June 6, 2015 here. Japan game market report (398 pages, pdf-file): Bold figures show rankings in February 2014 No. 1 Puzzle & Dragons by GungHo No. 2 Monster strike (by Mixi)…

-

Top Japanese game companies

25 listed top game companies listed on Tokyo Stock Exchange have total market cap of US$ 30 billion Japan game market report (398 pages, pdf-file): Japan is the cradle of many global games Japan created much of today’s global game market with icon’s such as Nintendo. However, today the moment has been taken over by…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…

-

Supercell wins SoftBank and GungHo investment

Supercell investment by SoftBank and GungHo Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets. SoftBank…

-

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

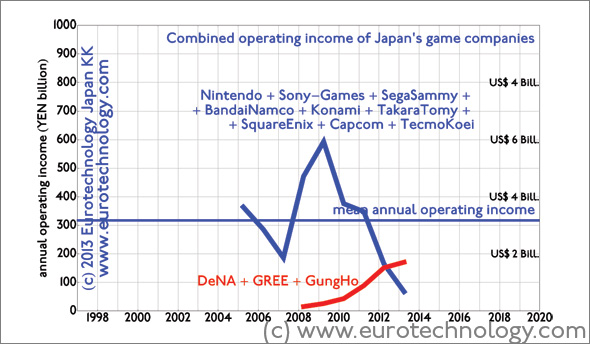

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…