Tag: u

-

Applied Materials and Tokyo Electron plan merger (BBC interview and comments)

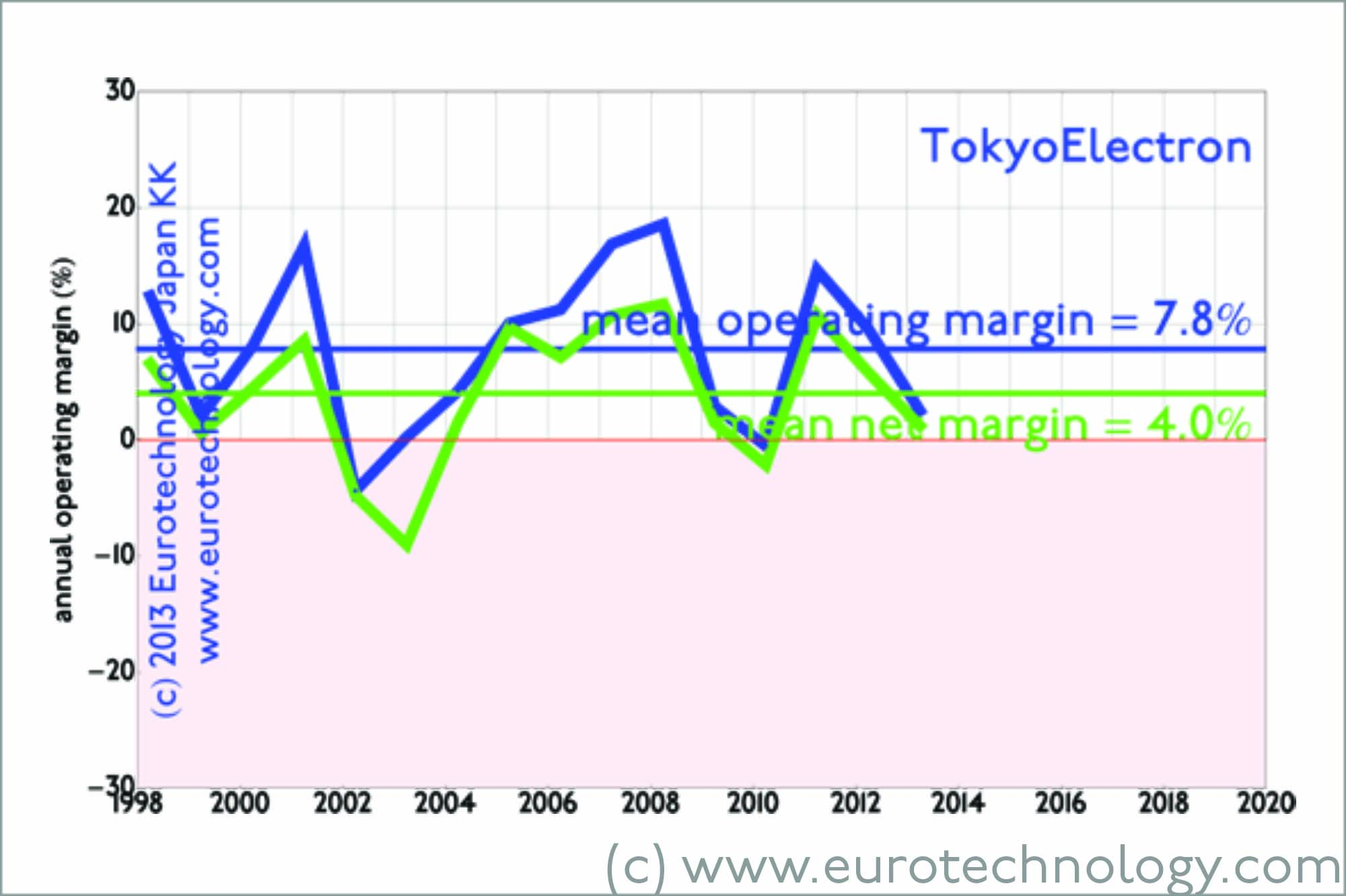

Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) plan merger Subject to regulatory approval in different jurisdictions Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) semiconductor manufacturing equipment makers on September 24, 2013 announced their “merger of equals” – creating a company with a nominal market capitalization of US$ 31.5 Billion,…

-

SoftBank rebrands Roppongi store from Vodafone red to SoftBank white/silver

SoftBank acquired Vodafone’s Japan operations and lost no time to rebrand the company Speed is one of SoftBank’s success factors On March 17, 2006 SoftBank announced the acquisition of Vodafone Japan with co-investment by Yahoo KK, sealing the end of Vodafone’s operations in Japan, and Vodafone’s exit from Japan. SoftBank did not lose a moment…