Tag: renewable energy

-

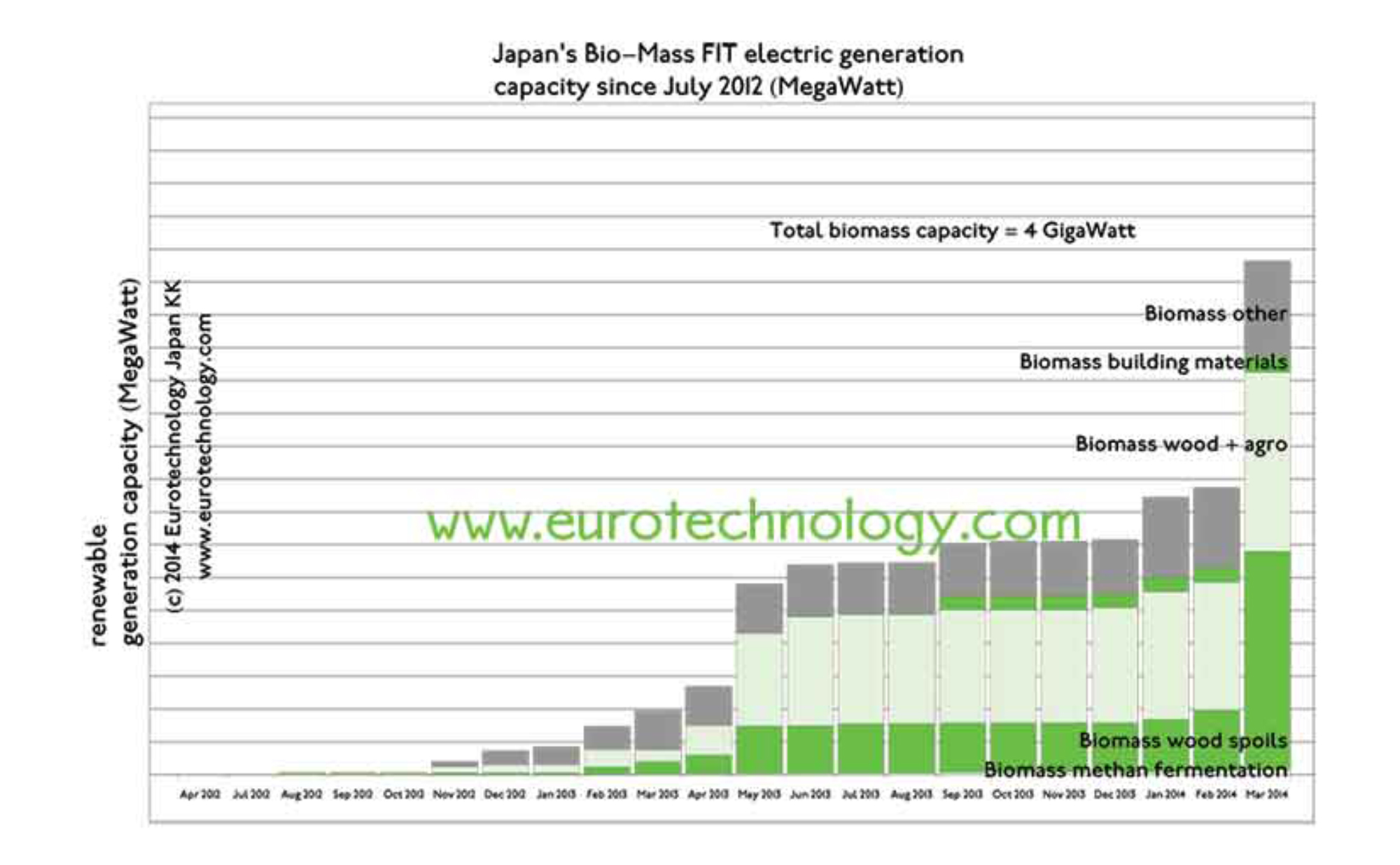

Japan biomass electricity generation booming

Japan biomass electricity generation approaches 4 GigaWatt Renewables in Japan is not just solar… Looking superficially at Japan’s renewable energy sector, its easy to overestimate geo-thermal energy, and to underestimate biomass. Biomass electricity generation capacity is about 5 times higher than geo-thermal Currently the installed biomass electricity generation capacity is about 5 times higher than…

-

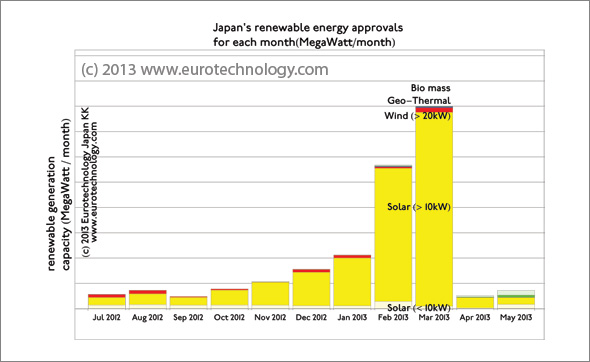

Feed in tariff Japan for renewable energy: approvals drying up?

Feed in tariff Japan for renewable energy are about three times higher than in Germany Approvals peaked just before the latest feed in tariff reduction The figures below show an overview of renewable energy sources currently installed and operational in Japan (the majority of which is water power), and also renewable energy projects approved by…

-

94% of renewable energy projects approved under Japan’s feed-in-tariff programs are for solar energy generation

Japan’s feed in tariff for renewable energy Almost all projects are for solar energy Feed-in-tariffs for renewable energy where introduced in two stages in Japan. Large scale introduction of feed-in-tariffs (FIT) started with the Law entitled “Special measures concerning renewable energy electric power procurement by operators of electrical utilities law” which came into force on…

-

Growth in Japan: the SoftBank group

SoftBank gaining market share in Japan SoftBank market cap catching up with Docomo Mobile subscription data released last week show, that the SoftBank group continues to gain market share while incumbent NTT-docomo continues to lose market share – an upward trend for SoftBank, and a downward trend for NTT-docomo essentially unbroken since SoftBank acquired Vodafone-Japan…

-

Japan ought to be heaven for renewable energy (The Economist)

Industry Ministry METI announces renewable energy sources admitted to the feed-in-tariff program Reversing the decline of renewable energy in Japan A few days ago Japan’s industry ministry METI announced the most recent data on renewable energy sources in Japan admitted under the feed-in-tariff (FIT) regulations introduced on July 1, 2012. We have updated our report…

-

Japan to reverse decline of renewable energy – Renewables declined from 25% to 10%

Japan’s renewable energy generation is overwhelmingly water power Japan to reverse decline of renewable energy. The ratio of renewable power generation has decreased from 25% of total electricity generation in 1970 to 10% today. Extremely aggressive feed-in tariffs (FIT) for renewable energy introduced in July 2012 are showing first modest results to reverse this trend…

-

Japan’s energy foxtrot: Two steps forward one step back

Two steps forward one step back: describes a frog struggling to climb out of a well, slipping back one step on the ladder for each two steps upwards out of the well Before the Fukushima disaster, Japan’s energy policy, strategy and execution were essentially decided behind closed doors by a small group of (about 100)…