Tag: Electricity

-

Japan electricity sector disruption – new business models and deregulation overdue

Japan electricity regional operators’ income peaked about 10 years ago Japanese electricity companies’ business models face massive disruption by technology innovation and the Fukushima nuclear accident With the annual general shareholder meetings completed and financial results published, we have analyzed the financial results of Japan’s 10 regional electric power companies (plus several other Japanese electricity…

-

Japan energy mix: Keeping the lights on in Japan – deregulation, new and renewable energy

Japan energy mix, smart grid, electricity deregulation – briefing by The Economist Corporate Network Economist Corporate Network held a breakfast briefing today April 24, 2014 for about 50 Japan-CEOs and executives. Shigeki (Sean) Miwa, General Manager of SoftBank’s CEO Office, and Representative Director & CEO of Bloom Energy Japan KK, and EVP of SB Energy…

-

Japan energy – myths versus reality, mantra versus smart

A lecture a the Embassy of Sweden for the Stockholm School of Economics European Institute for Japanese Studies EIJS Outline of the lecture: Thank you to all those who attended the event “Japan’s energy – myths vs reality” at the Embassy of Sweden – an event organized by the European Institute for Japanese Studies of…

-

Japan trends for 2013 (New Year post)

Japan replaced nuclear electricity generation by LNG, by imported gas Japan trends for 2013: Nuclear reactor restarts are on their way Japan trends for 2013 Japan’s energy sector: Japan has essentially replaced the 30% of its electricity energy supply which was from nuclear power plants, by electricity produced in aging thermal power plants from urgently…

-

Japan trends for 2013 (Christmas, Festive Season blog)

Japan trends for 2013: Energy crisis continues as a result of the Fukushima nuclear disaster Renewables: Japan’s feed in tariffs are among the world’s highest Japan trends for 2013: Japan’s energy sector: Prime-Minister Abe announced that he will review the Fukushima nuclear accident before taking decisions on nuclear power, essentially postponing the nuclear issue. Japan’s…

-

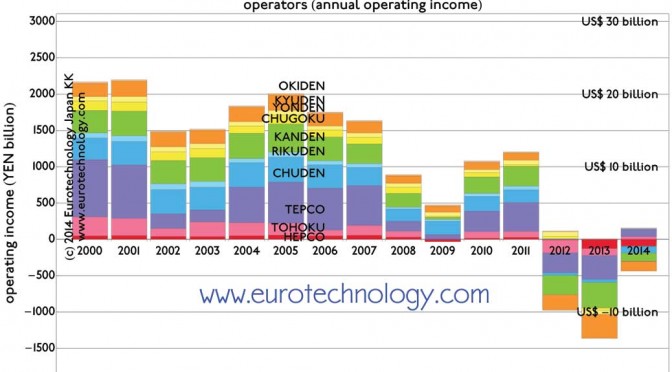

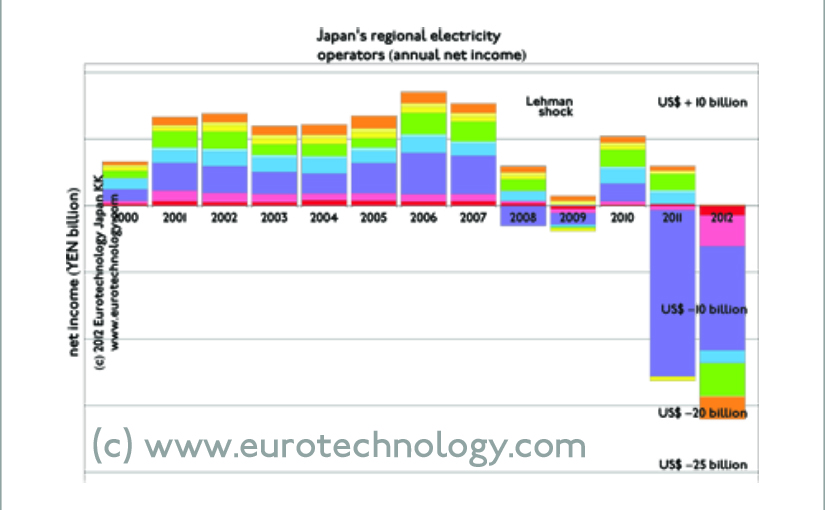

Japan’s electricity industry suffers huge losses from nuclear to fossil switch

What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry? Japan’s electricity operators switched from profits to huge losses What is the financial impact of Japan’s switch from nuclear to fossil on Japan’s electricity industry?Answer: Japan’s electricity operators switched from about US$ 10 billion/year combined net profits to US$…

-

Japan’s energy foxtrot: Two steps forward one step back

Two steps forward one step back: describes a frog struggling to climb out of a well, slipping back one step on the ladder for each two steps upwards out of the well Before the Fukushima disaster, Japan’s energy policy, strategy and execution were essentially decided behind closed doors by a small group of (about 100)…

-

Japan’s new energy strategy: much more than nuclear exit

Japan’s Cabinet released Japan’s new “Innovative Energy and Environmental Strategy” Japan’s new energy strategy Last Friday, September 14, 2012, Japan’s Cabinet released Japan’s new “Innovative Energy and Environmental Strategy”, which the Cabinet is required to produce by law, and which actually contains much more than the plan to work towards a future nuclear power free…

-

Japan’s PM Noda hints at new energy policy: Phasing out nuclear power by the 2030s

Develop as soon as possible a society which does not rely on nuclear power Eliminate nuclear power according to three principles By law Japan’s government must prepare a national energy strategy plan. The currently valid plan provides for an increase of nuclear power from 30% to 50% and is vehemently opposed by public opinion following…

-

Japan energy dilemma

Japanese law requires the government to have an energy strategy plan in place Keep nuclear power off – or restart nuclear? Japan’s current energy strategy plan provides for nuclear power to provide 30% of the electricity, rising to 50% in a few years by building additional nuclear power stations. However, contrary to the current strategy…