Tag: Vodafone KK

-

SoftBank Shibuya flagship store

On September 29, 2006, a few days before the official name change from Vodafone KK to SoftBank Mobile, SoftBank opened the rebranded Shibuya flagship store: Because of the crowded streets in Shibuya most of the building work was done during the night: More about SoftBank in our “SoftBank Report” Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Japan’s telecom sector briefing for the European Union Technology Attaches at the EU Embassy in Tokyo

Comparing EU and Japan in broadband Why did Vodafone quit Japan and sell Vodafone-Japan to Softbank? Following Vodafone’s decision to end business in Japan and the announcement of the sale of Vodafone-Japan to SoftBank, this author has been asked to brief the Technology Attaches of the 25 EU Embassies in Tokyo on Japan’s mobile phone…

-

SoftBank accounting adjustments – a Red Herring interview

SoftBank accounting adjustments Vodafone Japan turn around under SoftBank – Interview for Red Herring Helped RedHerring with an interview on the recent SoftBank accounting adjustment. The article is entitled “Softbank Falls on Lehman Cut” and appeared on the RedHerring website on August 28, 2006. Our company also recently advised a major global financial institution on…

-

SoftBank rebrands Roppongi store from Vodafone red to SoftBank white/silver

SoftBank acquired Vodafone’s Japan operations and lost no time to rebrand the company Speed is one of SoftBank’s success factors On March 17, 2006 SoftBank announced the acquisition of Vodafone Japan with co-investment by Yahoo KK, sealing the end of Vodafone’s operations in Japan, and Vodafone’s exit from Japan. SoftBank did not lose a moment…

-

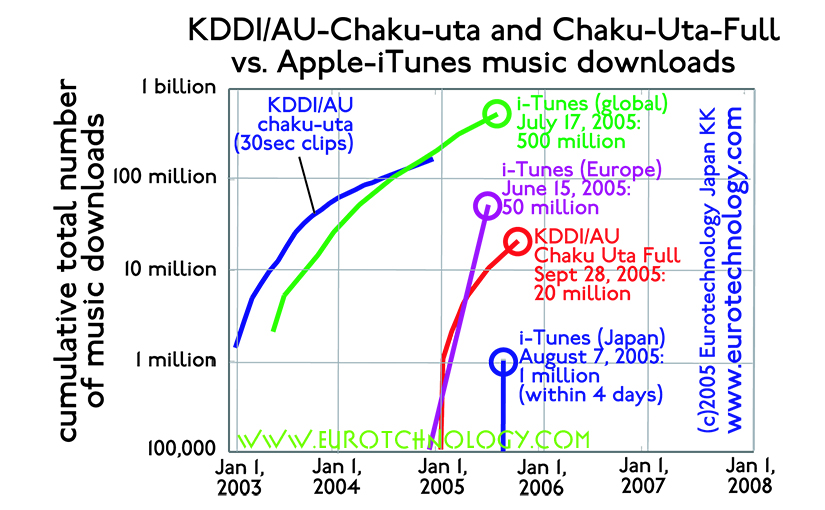

iPhone for Japan? iTunes/iPod phones?

There is a lot of discussions about whether Steve jobs is going to announce an iPhone or iPod-Phone at the Apple Computer Developer’s Conference in SF – according to the headline report on Saturday May 13th, 2006 in Nihon Keizai Shinbun ( the world’s largest business daily ) it’s already known since May this year…

-

SoftBank rebrands Vodafone Japan

Speed of the essence: SoftBank loses no time to turn around Vodafone-Japan Vodafone’s withdrawal also shows, that the values of cross-cultural management skills are often underestimated by Gerhard Fasol SoftBank rebrands Vodafone Japan: Saturday June 10, 2006 was the first time we saw SoftBank replacing the Vodafone brand in Japan – bringing a formal end…

-

SoftBank turnaround program for Vodafone-Japan

SoftBank acquires Vodafone’s Japan operations, announces turnaround strategy SoftBank turnaround for Vodafone-Japan: Focus on customer service and increased investments by Gerhard Fasol SoftBank has acquired Vodafone-Japan (Vodafone KK) and will change the name to SoftBank Mobile. SoftBank‘s alliance with APPLE to develop iPod-mobile phones is the latest in a string of actions to take the…

-

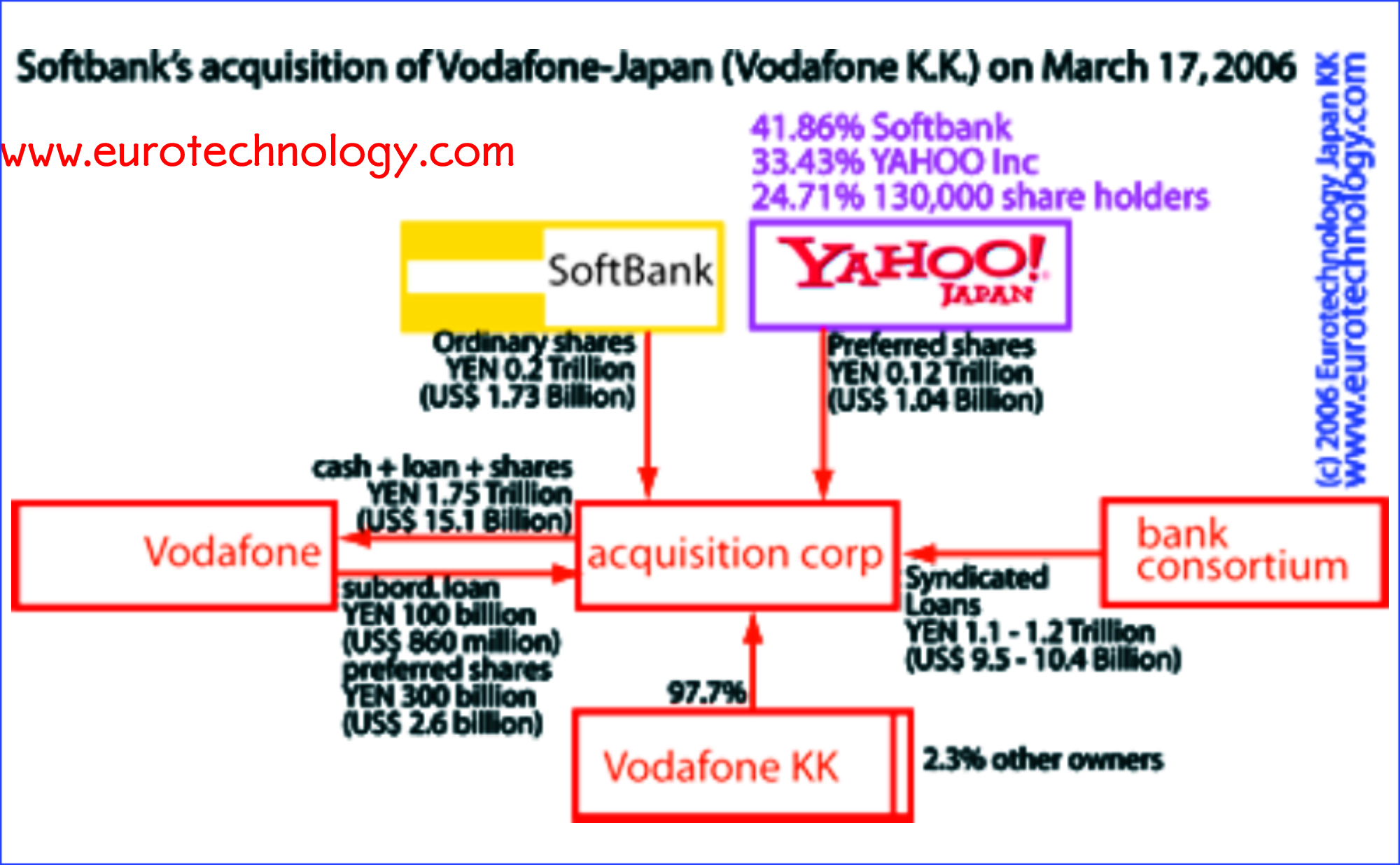

Softbank acquires Vodafone Japan with co-investment from Yahoo KK

The Deal seals Vodafone’s exit from Japan Softbank acquires Vodafone Japan in an approx. US$ 15 billion deal – worth an estimated US$ 83 billion ten years later SoftBank and Yahoo-Japan acquired 97.7% of outstanding shares of Vodafone Japan (Vodafone KK) in Japan’s largest M&A transaction (the remaining 2.3% are owned by other investors). In…

-

Vodafone in Japan? A dramatic change of Vodafone’s mind?

“Vodafone K.K.’s Tsuda, 津田志郎, seeks growth in Japan, not sale” However, sale to SoftBank may be the way forward About one year ago, in an interview with Bloomberg (“Vodafone KK’s Tsuda seeks growth in Japan, not sale“), I mentioned that a sale of Vodafone’s Japan operations to Softbank might be the way Vodafone will go…

-

Japan’s mobile operators’ profits

Overall Japanese mobile operators generate on the order of US$ 10 Billion/year in profits with a rising tendency. US$ 10 Billion/year profits attract three new entrants to Japan’s mobile markets (eMobile, YAHOO-BB and IP-mobile), mobile virtual operators, and attracted Vodafone to acquire J-Phone some time ago. DoCoMo’s domestic profits in particular have been continuously rising…

-

Japan’s full 2005 cellphone subscriber data

Japan’s 2005 cellphone subscriber data show: Japan’s cellphone market continues to grow by more than 4.5 million subscriptions/year DoCoMo and KDDI are continuing their head-to-head race Since June 2005 Vodafone is consistently gaining customers again (but losing market share) Willcom’s turn-round is continuing, and Willcom is consistently gaining market share. Willcom is outperforming Vodafone as…