Tag: Supercell

-

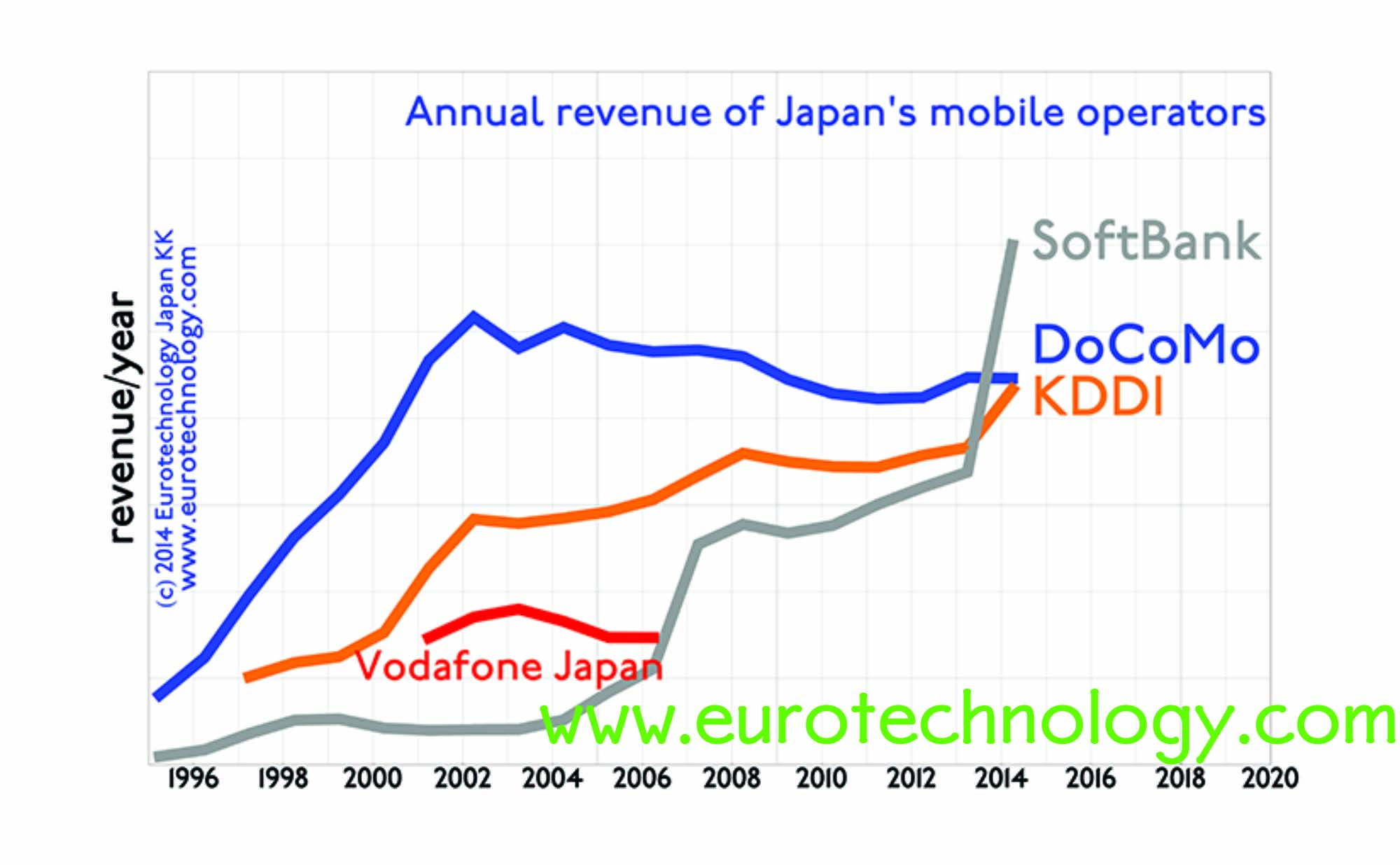

SoftBank overtakes Docomo and KDDI in revenues and income and market cap

SoftBank overtakes Docomo and KDDI in all major KPIs SoftBank presents annual results for the Financial Year which ended March 31, 2014 today, NTT-Docomo and KDDI presented their results a few days ago. Using projections published by SoftBank and using data found in the Japanese business press over the recent days, we have compared SoftBank,…

-

Supercell Japan advertises to improve today’s top-ten rank in Japan’s i-Phone/iOS App-Store

Supercell Japan is not satisfied with 10th rank for Clash of Clans in the Japanese iPhone app store… by Gerhard Fasol Report on Japan’s game makers and game markets Japan is the world’s No. 1 top grossing app market both for iOS apps and for Android apps, as we discussed before. Supercell Japan: investments by…

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

“Japanese superman Masayoshi Son” invests in Supercell (interview for Talouselämä, Finland’s largest business newspaper)

“Japanese superman Masayoshi Son” invests in SuperCell – interview with Finland’s largest business newspaper Talouselämä Talouselämä (Finland’s largest business newspaper)’s news editor Mirva Heiskanen interviewed me for their article entitled “Japanese superman Masayoshi Son invests in Supercell” (Supercellin ostaja Masayoshi Son on Japanin supermies). More interviews by Gerhard Fasol. To understand SoftBank better, read our…

-

Supercell wins SoftBank and GungHo investment

Supercell investment by SoftBank and GungHo Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets. SoftBank…