Tag: nokia

-

Nokia No. 1 in Japan! – Panasonic to sell mobile phone base station division to Nokia

Nokia strengthens No. 1 market position in Japan’s mobile phone base station market! Japan’s mobile phone base station market Japan’s mobile phone base station market is about US$ 2.6 billion/year and for European companies Ericsson and Nokia the most important market globally, although certainly also the most difficult one. Nokia is No. 1 with a…

-

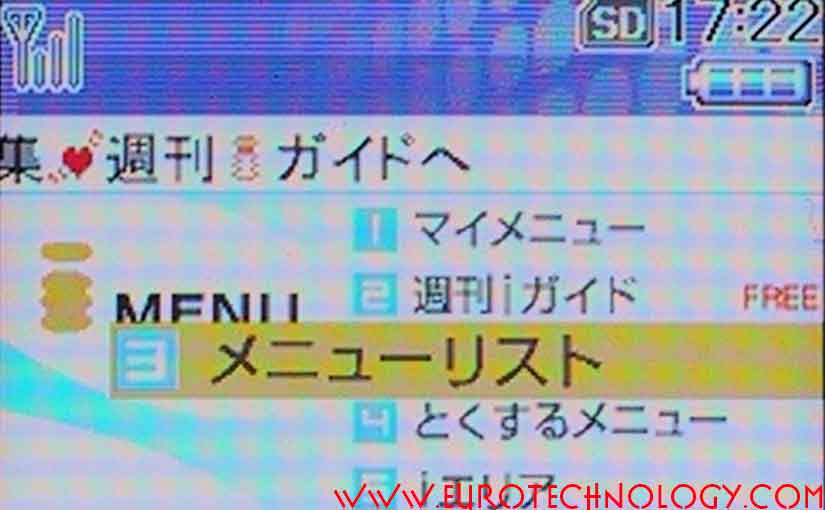

8 years since commercial start of location based services (LBS) in Japan in July 2001

It will soon be 8 years since DoCoMo started commercial location based services (LBS) for mobile phones in Japan in July 2001. During these 8 years, Japan’s mobile LBS industry has grown and a range of differentiated mobile LBS services has emerged – indicative of how the LBS industry might develop in other countries in…

-

ICT trends for Japan for 2009

Smartphones, European exits from Japan, and M&A ICT trends for Japan: Ericsson and Nokia Siemens Networks (NSN) remain engaged in Japan’s ICT sector by Gerhard Fasol One of the Embassies here in Tokyo asked me to write a report about ICT trends for Japan… ICT trends for Japan: Mobile phone sector Pushed by the Government…

-

NOKIA quits Japan – for now…

NOKIA’s Japan subsidiary was founded on April 3, 1989 – almost 20 years ago. On November 27, 2008 NOKIA announced to terminate selling mobile phones to Japan’s mobile operators, effectively withdrawing from Japan (except for purchasing, R&D and VERTU). NOKIA’s sales figures in Japan were a well kept secret until last week when several Japanese…

-

Nokia & Sony Ericsson Results Likely to Disappoint (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

Market caps of companies in mobile: global vs local

Google, Apple, Nokia, HTC, Vodafone and are winning the driver’s seat of the global internet revolution. DoCoMo, KDDI and SoftBank essentially stay inside Japan for now – limiting their growth prospects and leaving global opportunities to others. GOOGLE with Android and APPLE with iPhone are reaching for the driver’s seat of the global mobile data…

-

“Help – my mobile phone does not work!” – Why Japan’s mobile phone sector is so different from Europe’s

Presentation at the Lunch meeting of the Finnish Chamber of Commerce in Japan (FCCJ) on March 16, 2007 at the Westin Hotel, Tokyo. Summary of the event and photographs here: https://web.archive.org/web/20160815232148/http://www.fcc.or.jp/lunch160307.html The presentation is not available any longer on the FCCJ website however you can download our report about Japan’s telecom sector. An abbreviated version…

-

Finland-Japan Ubiquitous Society Conference

October 27, 2006 the Finland-Japan Ubiquitous Society Conference was held in Tokyo. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications, other speakers and panelists included Juho Lipsanen, Finland CEO of TeliaSonera, KDDI Chairman Murakami. The day before I briefed and had a long discussion with the top…

-

Briefing TeliaSonera top management

The day before the Finland-Japan Ubiquitous Society Conference in Tokyo, I briefed the top-management (CEO, CTO and other top managers) of TeliaSonera, on October 26, 2006. The next day, October 27, 2006, the Finland-Japan Ubiquitous Society Conference was held. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications,…

-

SANYO – NOKIA CDMA2000 JV (Interview for CNBC)

Was interviewed today about the announced JV between SANYO and Nokia for CDMA2000 phone handsets (I added some corrections here): [Q1] How will SANYO benefit from this, since they are the ones who have the technology, what do they hope to gain from working with Nokia? Or is this merely a way to reduce costs…

-

Tokyo Game Show TGS2004 (Sept 24-26, 2004): breakthrough for native mobile games

Mobile phone games at the center of TGS2004 by Gerhard Fasol Docomo at the center of attention with JAVA native mobile games for i-Mode The annual “Tokyo Game Show” sets trends and is a must for game professionals and fans. More than 100 companies exhibit. This years highlight is the SONY “PlayStation Portable” – PSP…