Tag: M&A

-

JVC KENWOOD Chairman: “Speed is like fresh food” – Revitalization of Japanese industry by JVC KENWOOD Chairman Haruo Kawahara (6th Ludwig Boltzmann Symposium)

JVC Kenwood Chairman Haruo Kawahara: Revitalization of Japanese Industry (Representative Director and Chairman of the Board of JVC KENWOOD Corporation) Keynote presented at the 6th Ludwig Boltzmann Symposium on February 20, 2014 at the Embassy of Austria in Tokyo. Background reading: JVC KENWOOD Corporation was incorporated on October 1, 2008, and has 20,033 employees as…

-

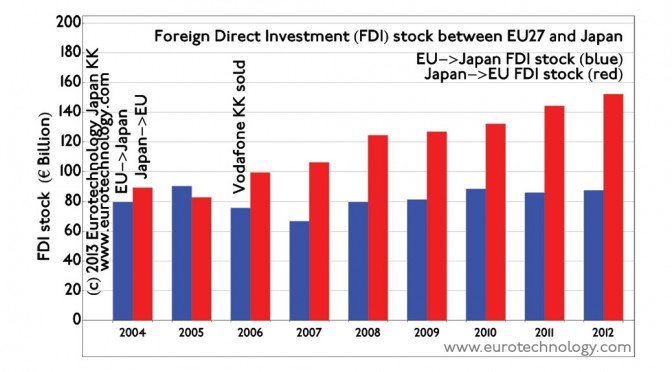

EU Japan investment stock totals about EURO 230 billion and is expected to increase

EU Japan investment stock is expected to increase with the future Economic Partnership Agreement European direct investments into Japan, European acquisitions in Japan EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from…

-

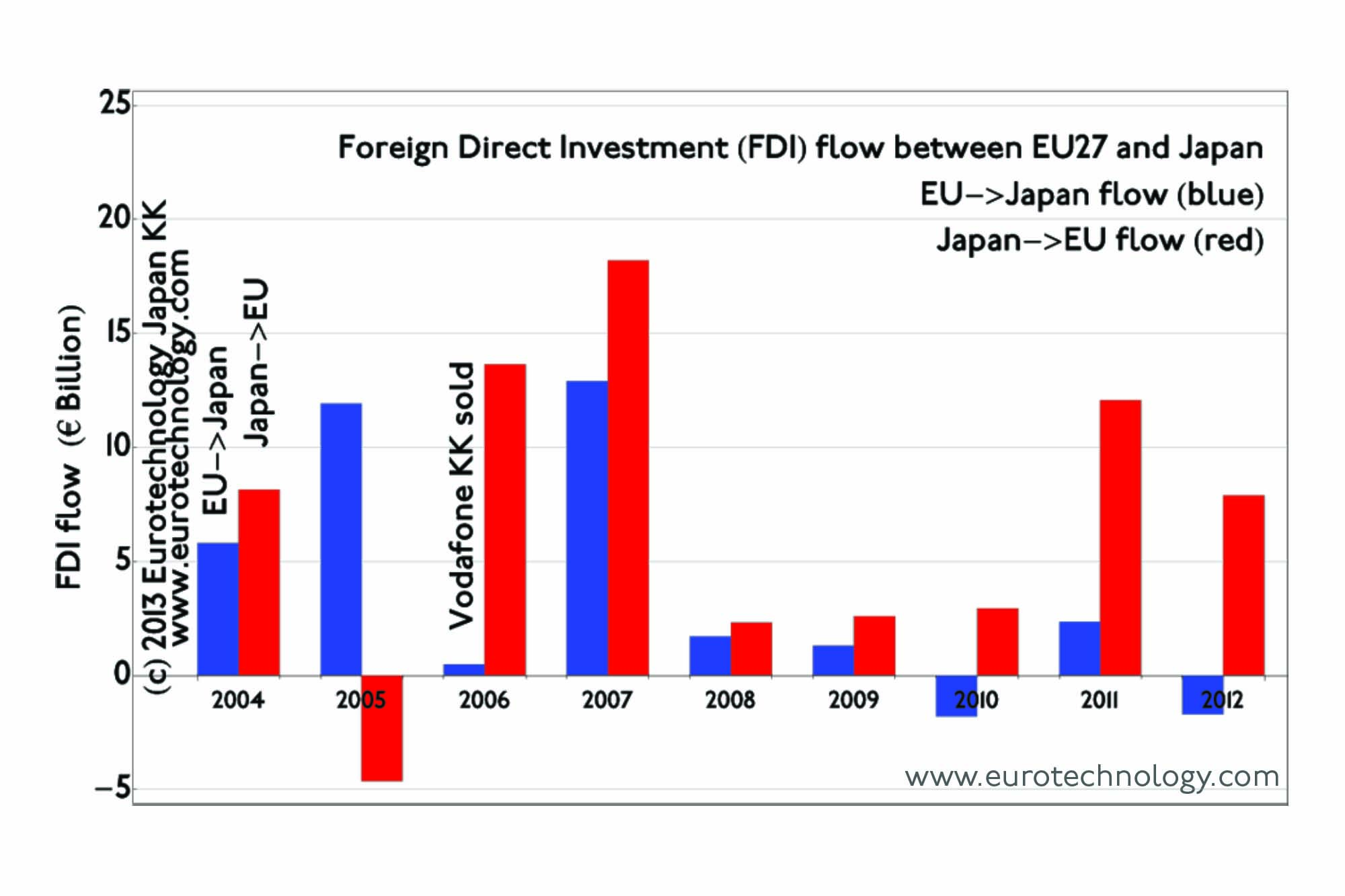

EU Japan investment and acquisition flow and M&A

EU Japan investment flow is mainly from Japan to Europe and totals about EURO 10 billion per year Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn, and was very quiet between 2008 and 2010. In recent years, mainly Japanese investments to Europe have picked up, and currently about…

-

TowerJazz to acquire three of Panasonic’s semiconductor fabs (Nikkei headline)

TowerJazz acquires three of Panasonic’s large written off wafer fabs for around US$ 100 million Massive market entry to Japan for TowerJazz Nikkei (the world’s biggest business daily, see our J-Media report) reported as their top headline yesterday, that TowerJazz is planning to acquire interests in three of Panasonic’s reportedly largely written-off semiconductor fabs valued…

-

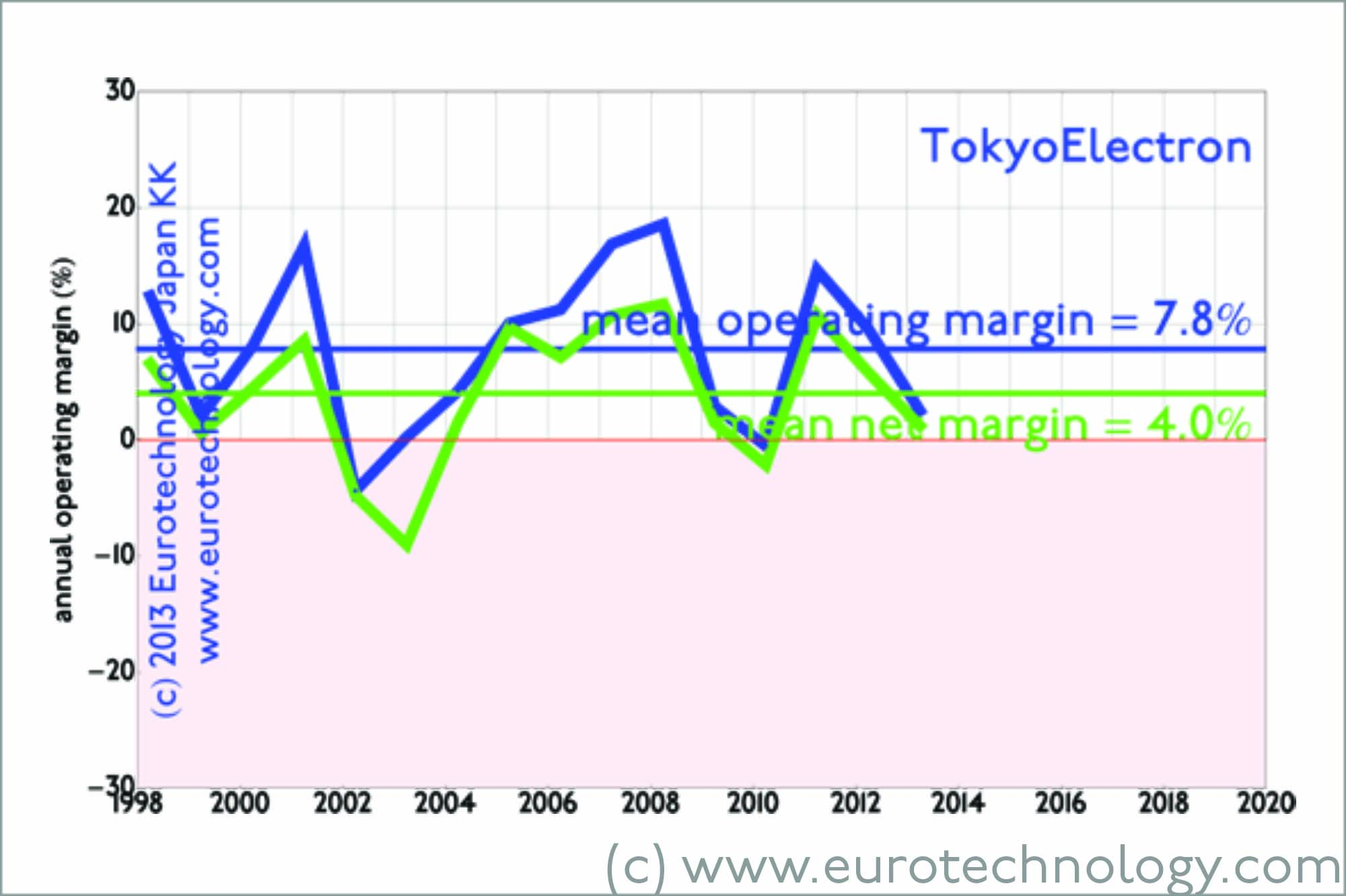

Applied Materials and Tokyo Electron plan merger (BBC interview and comments)

Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) plan merger Subject to regulatory approval in different jurisdictions Global No. 1 (Applied Materials) and No. 3 (Tokyo Electron) semiconductor manufacturing equipment makers on September 24, 2013 announced their “merger of equals” – creating a company with a nominal market capitalization of US$ 31.5 Billion,…