EU direct foreign investment into Japan could be 56% higher!

With improved management skills, EU owned business in Japan could be at least € 50 billion high than it is today

Many companies would wish to have a larger business in Japan, and generally the overall amount of direct EU investment in Japan is considered low. We show below that the value of EU investments in Japan could be at least € 50 billion higher than they are today, if some decisions had been taken differently.

We found a way to measure the value of management skills!

We analyzed the EUROSTAT data for direct investments between Japan and EU, and combining the EUROSTAT data with stock market capitalization data of relevant public companies we found a way estimate the value of management skills and management decisions in the EU-Japan direct investment field!

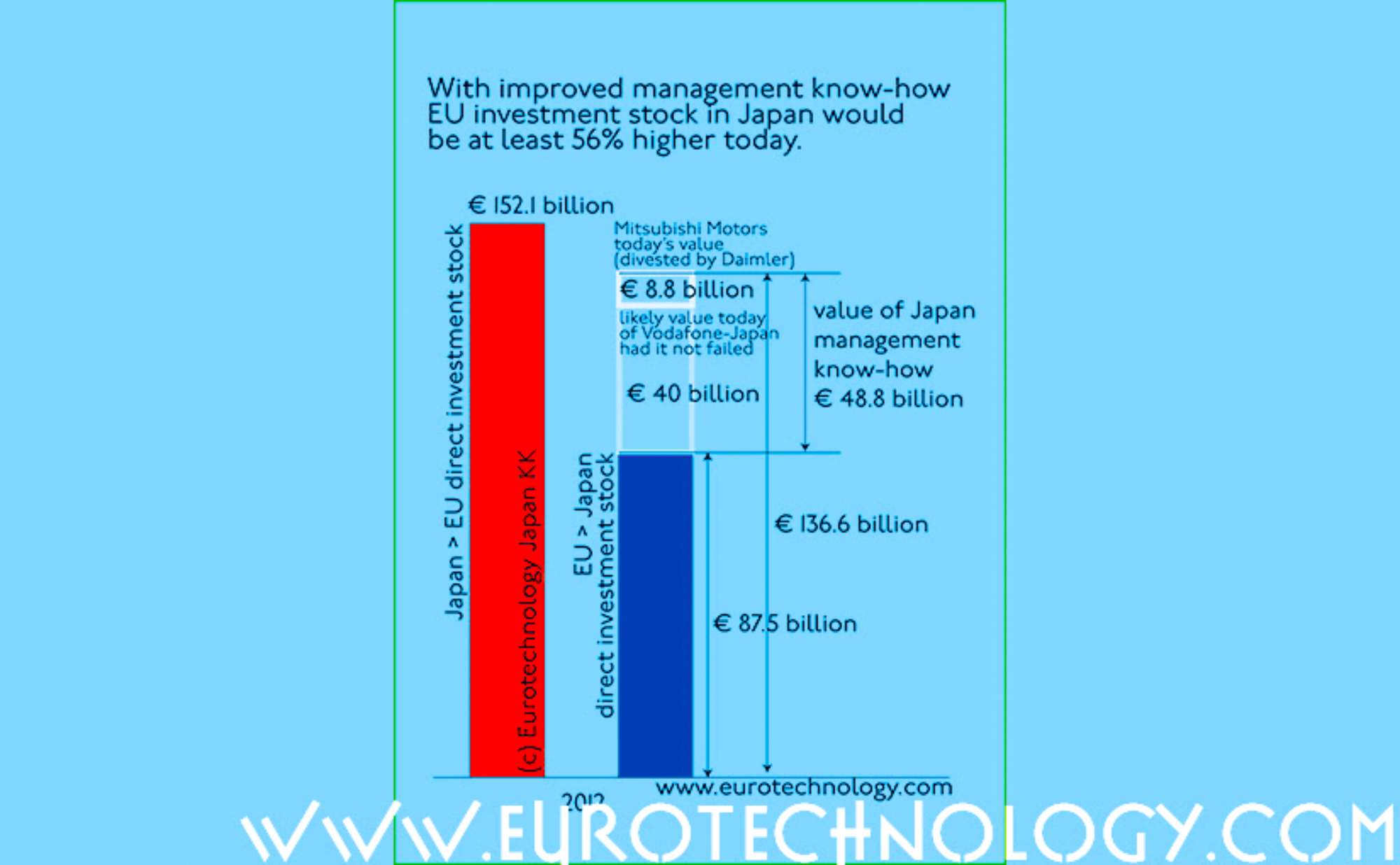

The figure above shows the EUROSTAT data for direct investment by EU companies in Japan and vice-versa:

- the combined total of Japanese direct investment stock in EU (i.e. the acquisition of EU based companies by Japanese companies) in 2012 was about € 152.1 billion,

- while the combined total of EU investment stock in Japan (i.e. the acquisition of Japanese companies by EU companies) in 2012 was about € 87.5 billion – substantially lower.

The fact of a relatively low EU investment stock is often superficially explained by “Japan is a closed country”, “cultural differences”, “low profitability in Japan”, “Japan is unattractive for foreign investment” etc.

Actually, the figure above shows, that if Vodafone would have been successful in managing Japan Telecom, that Vodafone had acquired, and if Daimler would have been successful in managing Mitsubishi Motors that Daimler had acquired, total EU investment stock in Japan would be at least € 50 billion higher than it is today.

How do we arrive at this estimation?

Mitsubishi Motors value today

Determining the value of Mitsubishi Motors today is straight forward. Mitsubishi Motors is a public company, traded on the Tokyo Stock Exchange (Securities Code 7211), and as of September 10, 2014, the market capitalization is YEN 1197 Billion = € 8.8 billion. If Daimler would have successfully managed Mitsubishi Motors Daimler would today own Mitsubishi Motors with a valuation of € 8.8 billion, and potentially even higher because of synergies.

Estimating the value of Vodafone’s acquisitions in Japan, had it been successful

Estimating the value of the companies Vodafone would own today in Japan, had it been successful in managing the company Japan Telecom it had acquired is more complex.

Essentially Vodafone acquired Japan’s 2nd largest full-service fix-net, internet, data-center and mobile general telecom operating company Japan Telecom (which had been built on railway rights of way, and had been majority owned by Japanese railway companies, before Vodafone acquired Japan Telecom). In about 30 or more separate investment banking transactions (which made investment bankers very happy), Vodafone acquired Japan Telecom, then split the company into several parts, and all parts in the end are today owned by SoftBank. The major transaction was the sale of Vodafone KK to SoftBank, however in total there were about 30 or more transactions.

As of today (September 10, 2014), there are three general telecom operating companies in Japan’s telecom market:

- NTT Group, (Tokyo Stock Exchange Code 9432), market cap YEN 8025 billion = € 58 billion

- NTT-Docomo (Tokyo Stock Exchange Code 9437), market cap YEN 8128 billion = € 59 billion

- NTT-East

- NTT-West

- NTT-Communications

- NTT-Data

- and 100s more subsidiaries

- KDDI: (Tokyo Stock Exchange Code 9433), market cap YEN 5655 billion = € 41 billion

- SoftBank: (Tokyo Stock Exchange Code 9984), market cap YEN 9545 billion = € 69 billion

Therefore, if Vodafone would have succeeded in managing the company Japan Telecom it had acquired, it can be expected that a fictitious “Vodafone-Japan 2014” today would have a market value on the order of somewhere in the range between € 40 billion (KDDI) and € 70 billion (SoftBank). Now, since Vodafone – if it would have been successful and continued to develop successfully until this day in Japan, would not have the Alibaba and Yahoo-Japan, and 1500 other investments that SoftBank owns, nor the dominating market share that Docomo owns in Japan, we can assume that a fictitious “Vodafone-Japan 2014” would have a valuation similar to the one KDDI has today. Thus we conclude that Vodafone if it had been successful in managing Japan Telecom, would today own a business in Japan worth about € 40 billion.

Of course there are many more companies than Vodafone and Mitsubishi-Motors & Daimler, but because of their enormous size, in terms of statistics these companies totally dominate the overall statistics.

Estimating the value of Japan management know-how: € 50 billion in the case of Vodafone and Mitsubishi Motors/Daimler

We argue now, that if Daimler would have known how to manage Mitsubishi Motors correctly, and if Vodafone would have known how to manage Japan Telecom correctly, then today this knowledge would have created value of about € 50 billion in Japan, and the EU investment stock in Japan would be about € 50 billion (56%) higher than it is today.

The pitfalls and traps facing EU companies over managing Japanese companies

Foreign companies doing business in Japan face a number of dilemmas. Maybe the biggest dilemma is a situation which arises, when there is no Japan know-how represented on the Board of Directors of the mother company. This was the case for Vodafone, and it took Vodafone’s CEO and Board of Directors several years to realize that Japan Telecom could not be managed with the same “standard global management methods” as in all other markets. At that time, when Vodafone’s global CEO realized that “Japan is special”, Vodafone removed Vodafone-Japan from reporting to a Singapore-based Asia-GM, and moved Vodafone-Japan to report directly to the CEO, however this was only of many other problems, and also came far too late. NOKIA’s NSN also made a similar move years later, fortunately not too late. Read here for a more detailed discussion of the Vodafone-Japan case.

Another dilemma regularly arises about the management and governance structure of foreign subsidiaries in Japan. There are 100s of ways of organizing the management of foreign subsidiaries in Japan, and “cookie-cutter” approaches usually fail.

There are many more dilemmas, and this article shows, that solving these dilemmas correctly is worth many billion Dollars/Euros in the case of large corporations, and of course also of substantial value for small corporations and venture startups.

With better Japan management know-how, the EU investment stock in Japan could be at least € 50 billion higher:

Copyright 2014 Eurotechnology Japan KK All Rights Reserved

Comments and discussions