Category: Corporate Governance

-

Japan’s corporate governance reforms: Joint event with the alumni of HEC, École Polytechnique, Sciences Po, Edhec, Essec and Trinity College/Cambridge University. Thursday 7 March 2019 in Tokyo

Japan’s corporate governance reforms joint event with the alumni organizations of HEC, École Polytechnique, Sciences Po, Edhec, Essec and Trinity College/ Cambridge University. Thursday 7 March 2019 19:00 in Tokyo On Thursday 7 March 2019 we will have a joint event by the alumni organizations of several French Grandes Écoles, HEC, École Polytechnique, Sciences Po,…

-

Corporate Governance Reforms in Japan, Swiss-Japanese Chamber of Commerce in Geneva

Corporate Governance Reforms: How the Way Japanese Corporations Take Decisions is Changing SJCC Swiss-Japanese Chamber of Commerce Friday 12 October 2018, 18:30-19:45, JETRO Office Geneva Prime Minister Abe’s corporate governance reforms are arguably one of the biggest success stories of his reform program to promote Japan’s economic growth. Japan’s Government in coordination with the Tokyo…

-

Corporate governance reforms: making Japanese corporations great again? Monday, May 28, 2018, 19:00-21:00 at CCIFJ

Corporate governance reforms: making Japanese corporations great again? Understanding how Japanese Boards of Directors function helps you close deals Monday, May 28, 2018, 19:00-21:00 at CCIFJ Stimulating Japanese companies’ growth is a key element of Prime Minister Abe’s economic growth policies. For companies to grow, management needs to be improved, Boards of Directors need to…

-

Corporate Governance Reforms in Japan, Gerhard Fasol at the Foreign Correspondents Club FCCJ 12 March 2018

Corporate Governance Reforms in Japan Monday, March 12, 2018, 12:00 – 13:30 at the Foreign Correspondents Club in Japan FCCJ While many Japanese corporations are still admired around the world, too many have for years suffered sluggish growth and low profitability. A string of corporate scandals and failures have shocked the pubic and corroded confidence…

-

Japanese Corporate Governance – The Inside Story, Daiwa Anglo-Japanese Foundation HQ London, Tuesday 16 January 2018

Gerhard Fasol and Sir Stephen Gomersall Daiwa Anglo-Japanese Foundation, London, Tuesday 16 January 2018, 6:00pm Topic: Japanese Corporate Governance – The Inside Story Speakers: Gerhard Fasol and Sir Stephen Gomersall Program: Tuesday 16 January 2018, 6:00pm – 7:00pm, Drinks reception from 7:00pm Location: 13/14 Cornwall Terrace, Outer Circle (entrance facing Regent’s Park), London NW1 4QP,…

-

Corporate governance reforms in Japan: hands-on insights as Board Director of a Japanese group

Corporate governance reforms are one of the key components of Abenomics, to improve economic growth in Japan Corporate governance reforms in Japan: talk at the OAG House in Tokyo, Wednesday 20 September 2017, 18:30-20:00 Wednesday 20 September 2017, 18:30-20:00 Talk: Gerhard Fasol: „Corporate Governance Reformen in Japan: Erfahrungen als Aufsichtsratsdirektor einer japanischen Firmengruppe“ Free of…

-

Japan GDP growth and losses at Japan Post – Gerhard Fasol interviewed by Rico Hizon on BBC TV

Japan’s economy grows five quarters in a row, and Japan Post books losses of YEN 400.33 billion (US$ 3.6 billion) for an acquisition in Australia Japan GDP growth, growth of 2%/year. Still, Japan’s economy is the same size as in 2000, while countries like France, Germany, UK today are double the size as in the…

-

Toshiba nuclear write-off. BBC interview about Toshiba’s latest nuclear industry write-offs

Toshiba is expected to announce write-off provisions on the order of US$ 6 billion today Toshiba is on Tokyo Stock Exchange warning list for possible delisting in March 2017 by Gerhard Fasol This morning 7:30am I was interviewed on BBC TV Asia Business Report about an update of Toshiba’s ongoing crisis, which has been 20…

-

Changing Japanese management – a talk on 6 October 2016 at the Embassy of Sweden

Corporate governance reforms in Japan Changing the way Japanese corporations are managed: Can it make Japanese iconic corporations great again? A talk by Gerhard Fasol at the Embassy of Sweden organized by the Embassy of Sweden, The Swedish Chamber of Commerce in Japan (SCCJ), and the Stockholm School of Economics You need to know more…

-

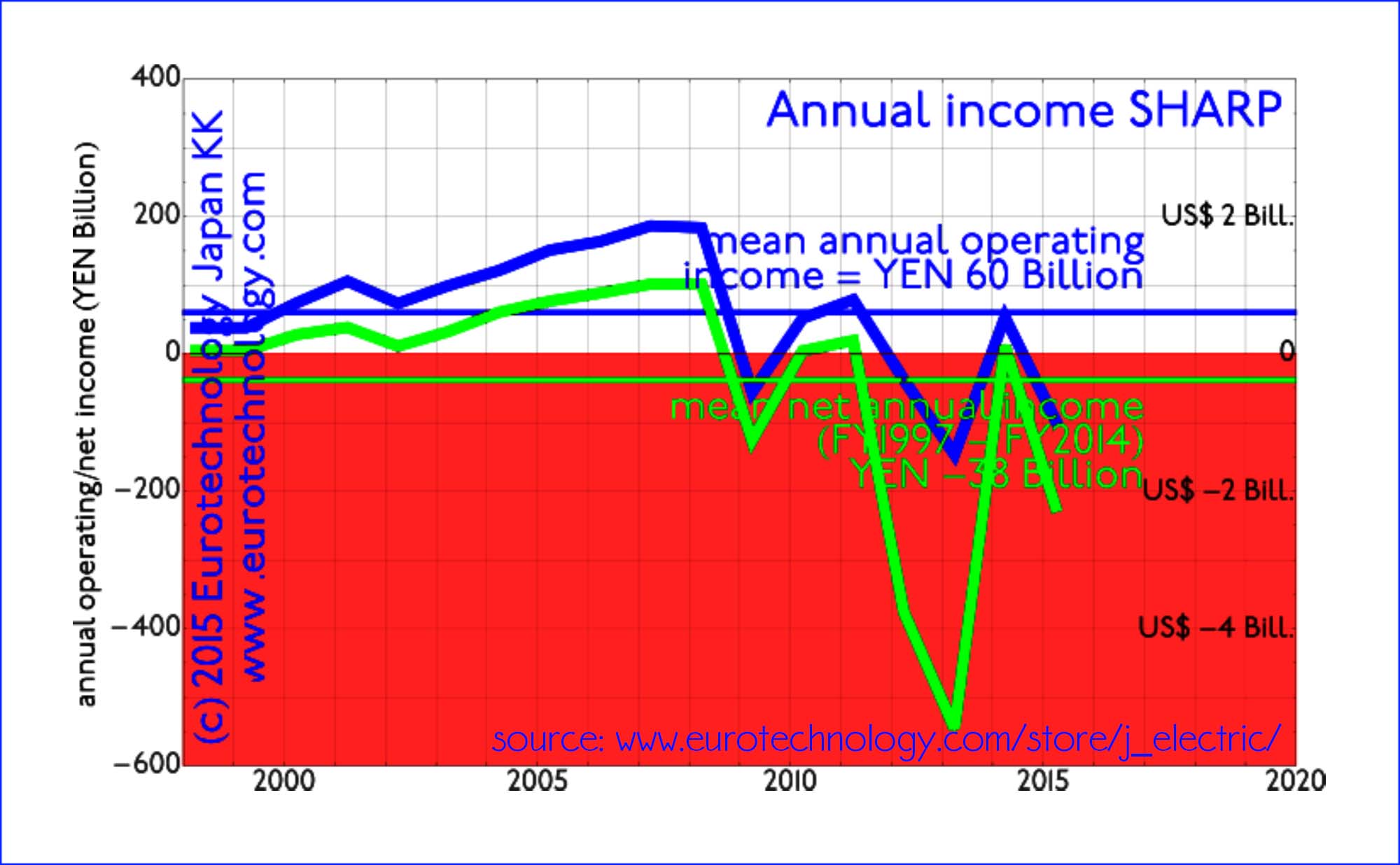

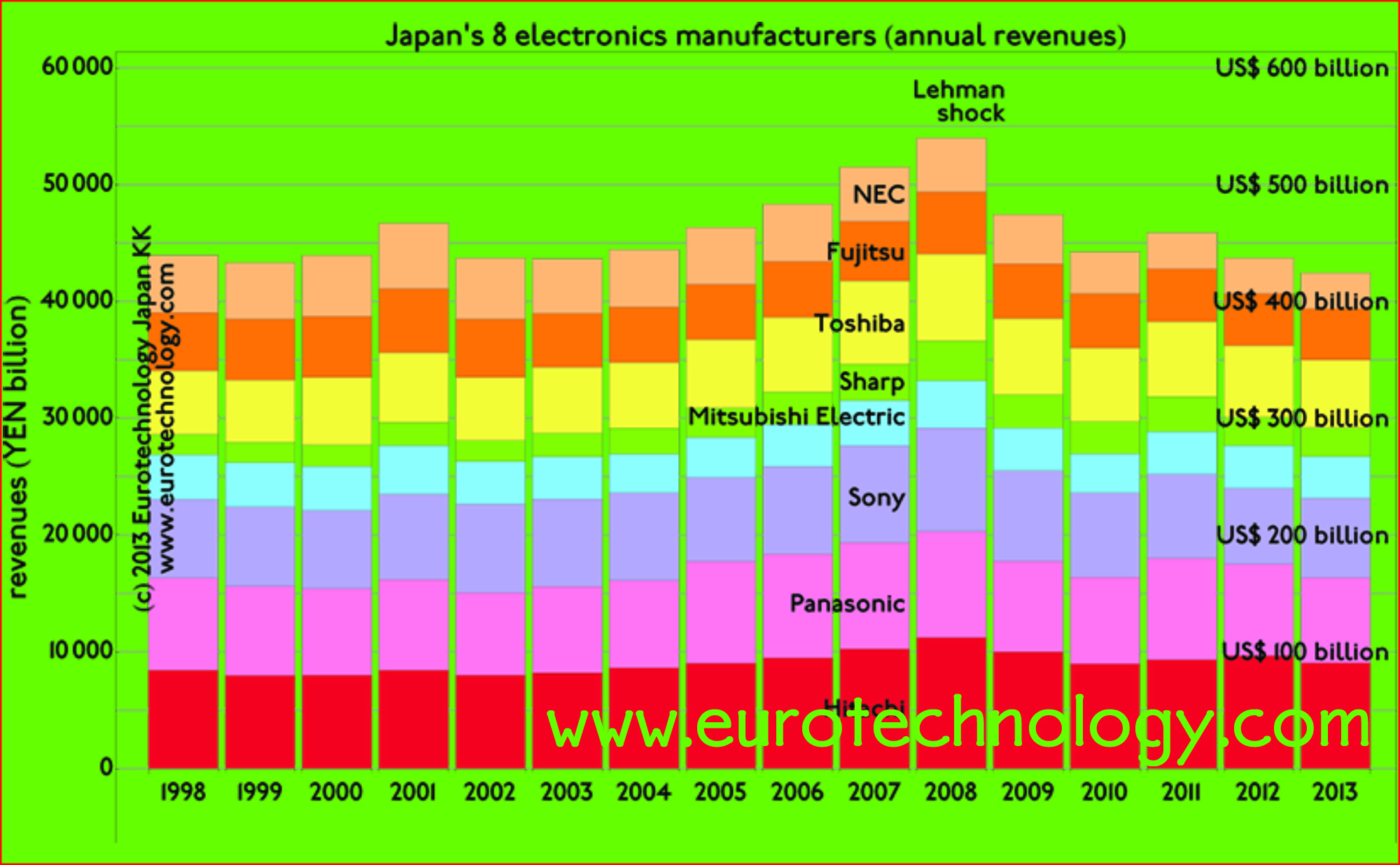

SHARP and the future of Japan’s electronics

SHARP is in the news, but its about Japan’s US$ 600 billion electronics sector The need for focus and active portfolio management SHARP, supplier of displays to Apple, faces repayment of about YEN 510 billion (US$ 4.2 billion) in March. Innovation Network Corporation of Japan INCJ (産業革新機構) and Taiwan’s Honhai Precision Engineering (鴻海精密工業) “Foxconn” compete…

-

Economic growth for Japan? A New Year 2016 preview

Economic growth for Japan in 2016? Economic growth: Almost everyone agrees that economic growth is preferred over stagnation and decline. Fiscal policy and printing money unfortunately can’t deliver growth. Building fresh new successful companies, returning stagnating or failed established companies back to growth (see: “Speed is like fresh food” by JVC-Kenwood Chairman Kawahara), and adjusting…

-

Corporate governance reforms in Japan – practical views of a Board Director

A Board Director’s view Corporate governance reforms in Japan progress faster than even one of their key promoters expected, and cost almost no tax payers money Author: Gerhard Fasol Corporate governance reforms in Japan are one component of “Abenomics” to bring back economic growth to Japan. Corporate governance reforms in Japan are driven at least…

-

Mr. Suzuki didn’t want to be a Volkswagen employee, and that’s understandable (Prof. Dudenhoeffer via Bloomberg)

Mr Suzuki (Chairman of Suzuki Motors), wrote in his Japanese blog, that “ending the partnership with Volkswagen (Wagen-san as he calls VW) was like the relieve I feel after having a fishbone stuck in my throat removed” No partnership works without meeting of minds, with opposite agendas and colliding expectations by Gerhard Fasol, All Rights…

-

Quarterly financial reports to go away: UK and EU remove requirements for quarterly financial reports

Voluntary quarterly reporting? Quarterly financial reports: can they be the trees which obscure long term growth of the forrest? As a Board Director of a Japanese company traded on the Tokyo Stock Exchange I have to study and approve monthly, quarterly and annual financial reports, and I share responsibility for the future success of the…

-

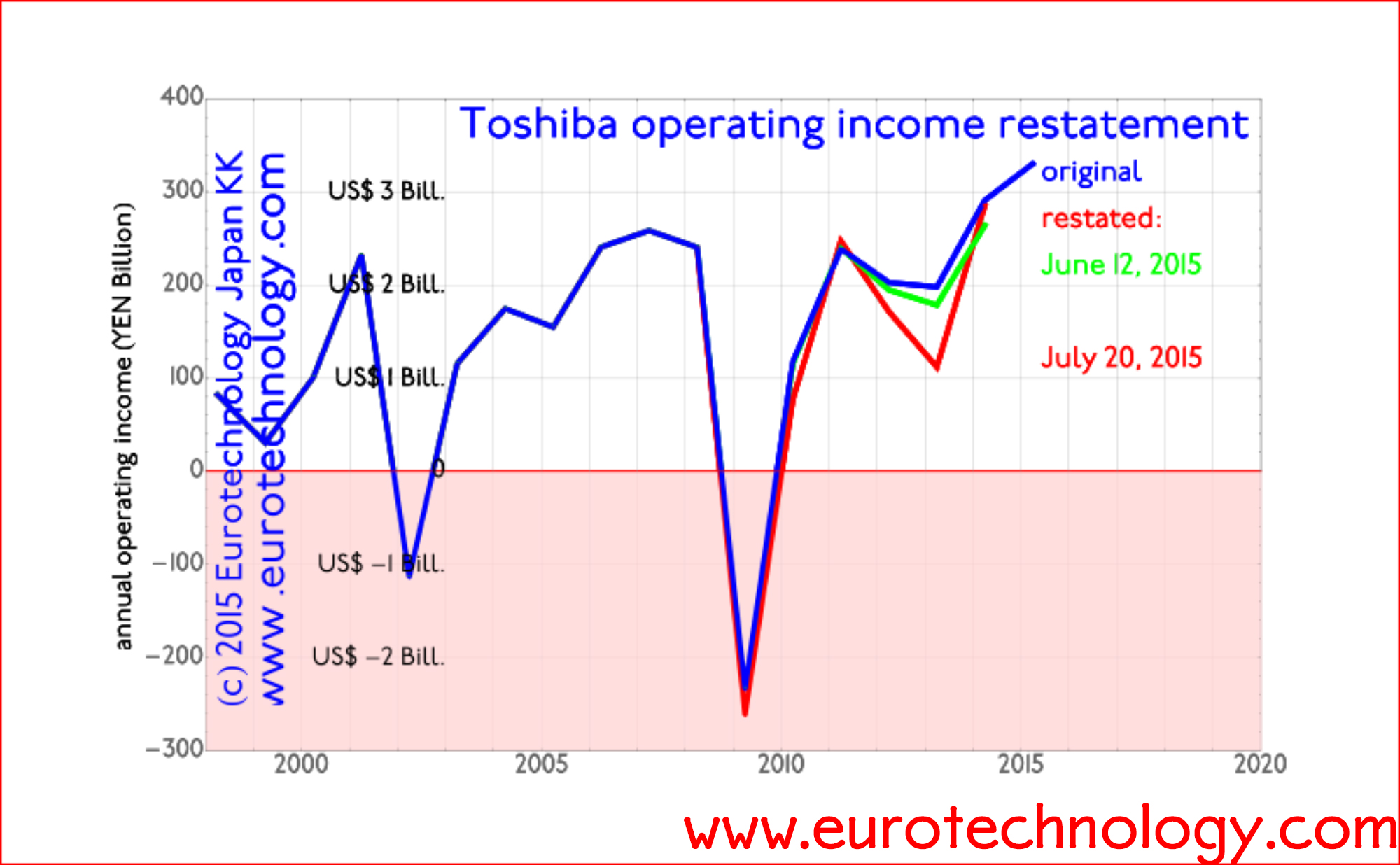

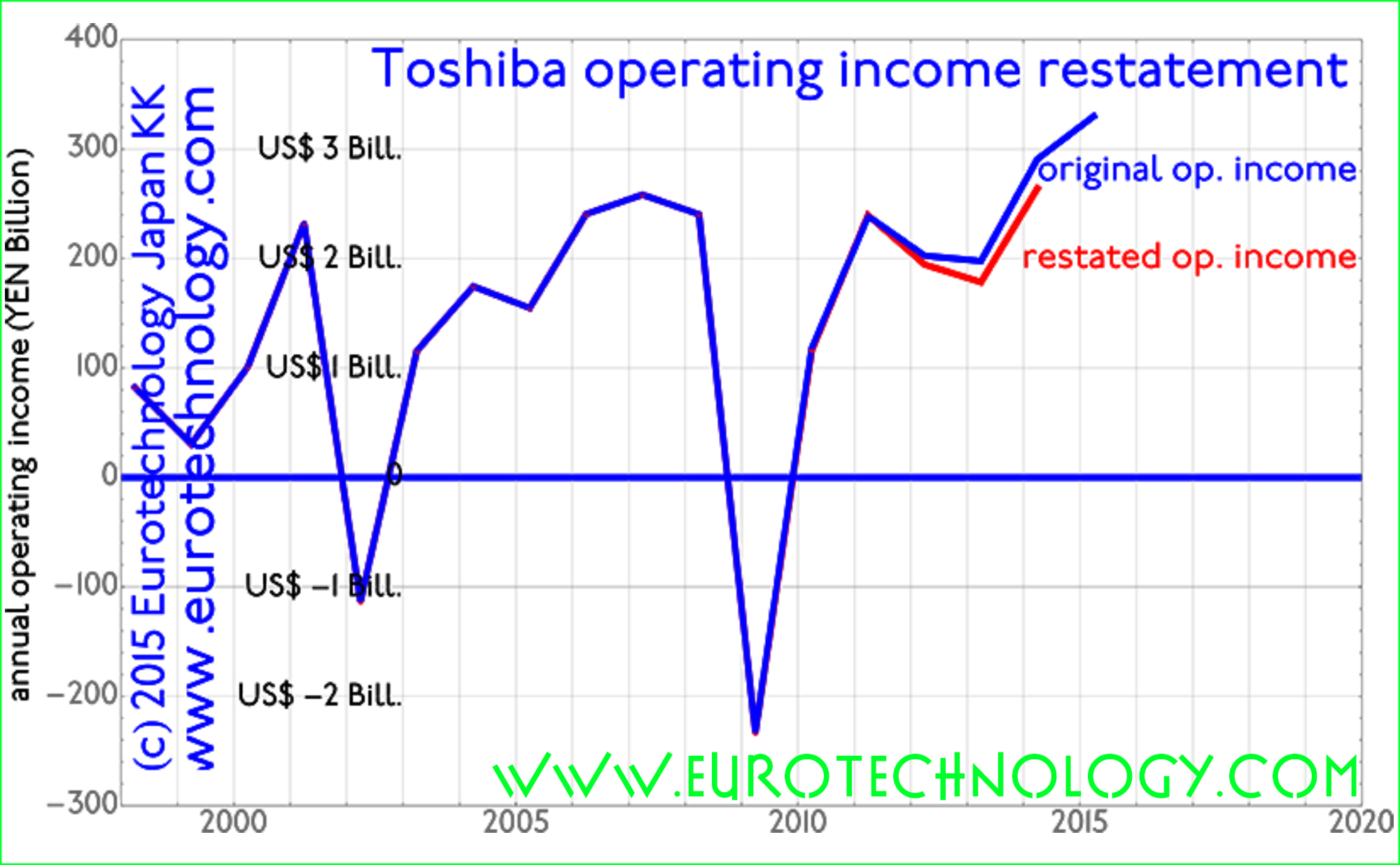

Toshiba income restatement: corresponds to one full year of average operating income

Toshiba’s income restatement announced by the independent 3rd party committee by Gerhard Fasol Independent 3rd party committee chaired by former Chief Prosecutor of Tokyo High Court On 12 June, 2015, Toshiba announced corrections to income reports, and at the same time engaged an independent 3rd party investigation committee headed by former Chief Prosecutor at the…

-

Toshiba accounting restatements in context

July 21, 2015: Update – report of the independent 3rd party committee chaired by former Chief Prosecutor of the Tokyo High Court. Corrections amount to 2 1/2 years (31.5 months) of average annual net profits by Gerhard Fasol Sales stagnation combined with almost zero net profit of Japan’s top 8 electronics companies creates increasing pressure…

-

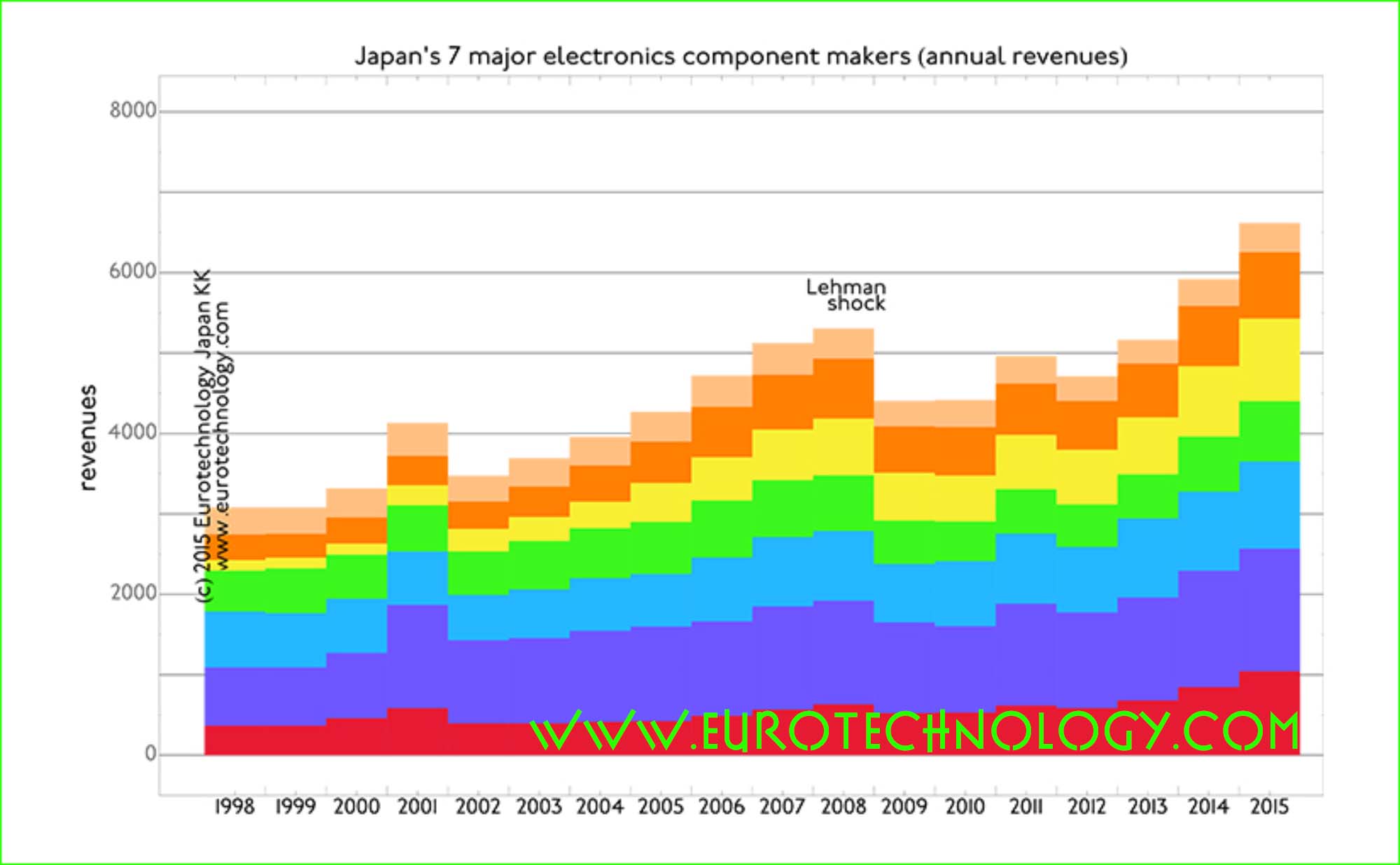

Japanese electronics parts makers grow, while Japan’s iconic electronics makers stagnate

by Gerhard Fasol Japan’s iconic electronics groups combined are of similar size as the economy of The Netherlands Parts makers’ sales may overtake iconic electronics groups in the near future – they have already in terms of profits In our analysis of Japan’s electronic industries we compare the top 8 iconic electronics groups with top…

-

Japan Exchange Group CEO Atsushi Saito: proud of Corporate Governance achievements, but ashamed of Toshiba

New Dimensions of Japanese Financial Market Only with freedom and democracy, the values of open society and professionalism can the investment chain function effectively The iconic leader of the Tokyo Stock Exchange since 2007, now Group CEO of the Japan Exchange Group gave a Press Conference at the Foreign Correspondents Club of Japan on June…

-

Corporate governance Japan: independent Directors not only execute control in emergency situations, continuous contributions are more important

Corporate governance Japan: Prime Minister Abe urges reform of corporate governance Reuters reports that Japan’s Prime Minister Abe urges company boards to reform corporate governance to include independent directors. I added the following comment. Corporate governance Japan: exercise of shareholder power and emergency situations The question of independent Board Directors is often framed in terms…

-

Corporate governance Japan: external independent directors on Japanese Boards

by Gerhard Fasol Corporate governance Japan is now in the focus of Prime Minister Shinzo Abe’s reforms Reform of corporate governance is an ongoing issue in Japan, and part of Prime-Minister’s Abenomics’ “third arrow” revival efforts. Here is a note, that I added to a recent article in The Economist, entitled “Corporate governance in Japan…

-

Japanese management – why is it not global? asks Masamoto Yashiro at a Tokyo University brain storming event

Japanese management – why is it not global? What should we do? Keynote speech by Masamoto Yashiro at brainstorming by President of Tokyo University summary of Masamoto Yashiro’s talk written by Gerhard Fasol Masamoto Yashiro is a legend in Japan’s banking and energy industry. He built Shinsei Bank from the ashes of the bankrupt Long…

-

Kazuo Inamori, founder of Kyocera and DDI (KDDI), rebuilds Japan Airlines using Amoeba Management (アメーバ経営)

Kazuo Inamori (稲盛 和夫) one of Japan’s legendary serial entrepreneurs Japan Airlines (日本航空株式会社) turnaround from bankruptcy Bad news from Japan’s electronics industry sector makes global headlines this week (I was interviewed on BBC, US National Public Radio etc) – in this newsletter, lets look at some good news from Japan. Kazuo Inamori (80 years old,…

-

Japan electronics groups: global benchmarking

Japan electronics groups have far lower income/profits than EU or US comparable corporations Ripe for drastic reform and transformation: 18 years no growth and almost no profits Lets look at global benchmarking of Japan’s top electrical groups Panasonic and Hitachi (representative of Japan’s top ten electrical giants) – in our previous blog we suggested that…