Tag: Square-Enix

-

Japan iPhone AppStore: 10 out of the 25 top grossing apps in Japan are by companies of foreign origin. Can you guess which?

Japan is No. 1 globally in terms of iOS AppStore + Google Play revenues, bigger and faster growing than USA 10 out of 25 top grossing apps in Japan are of foreign origin Japan game market report (398 pages, pdf-file) AppAnnie showed that in terms of combined iOS AppStore + Google Play revenues, Japan is…

-

Ericsson Mobile Business Innovation Forum – Tokyo

Ericsson Mobile Business Innovation Forum Tokyo: summary by Gerhard Fasol Ericsson held the Mobile Business Innovation Forum in the Roppongi Hills Tower in Tokyo on October 31 and November 1, 2013 delivering a great overview of the push and pull of the mobile communications industry: technology push, M2M and user pull, as well as how…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…

-

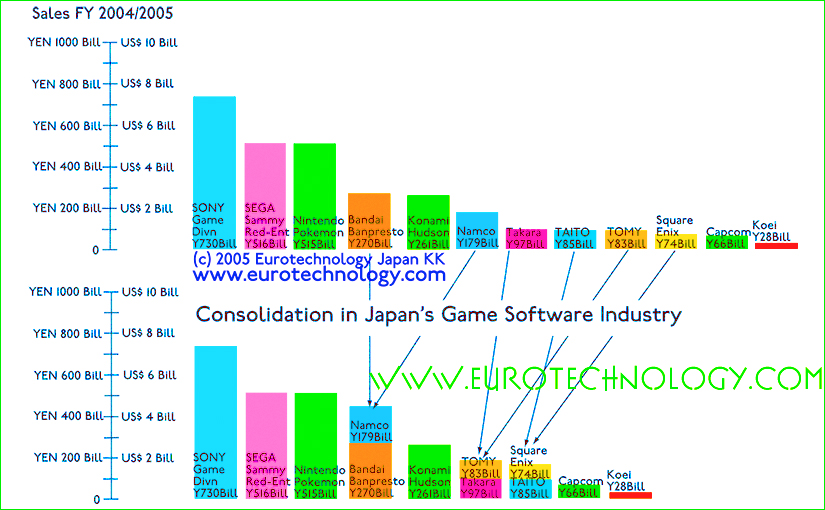

Japan game software industry consolidation

Japan’s historically grown game companies are global superpowers Shrinking traditional home video game software market and paradigm shift to online games, network games and mobile games forces consolidation by Gerhard Fasol Japan’s mobile game software companies are global superpowers. They are all historically grown and linked to other industry sectors, such as characters, arcade games,…