Tag: DeNA

-

Japan top grossing smartphone apps

5 top listed smartphone app companies have combined market cap of US$ 14 billion (excluding LINE) LINE is currently a private company and LINE’s company value is generally estimated in the US$ 10-15 billion range, so if we include LINE, the combined market value of Japan’s top 5 smartphone game companies is on the order…

-

Top Japanese game companies

25 listed top game companies listed on Tokyo Stock Exchange have total market cap of US$ 30 billion Japan game market report (398 pages, pdf-file): Japan is the cradle of many global games Japan created much of today’s global game market with icon’s such as Nintendo. However, today the moment has been taken over by…

-

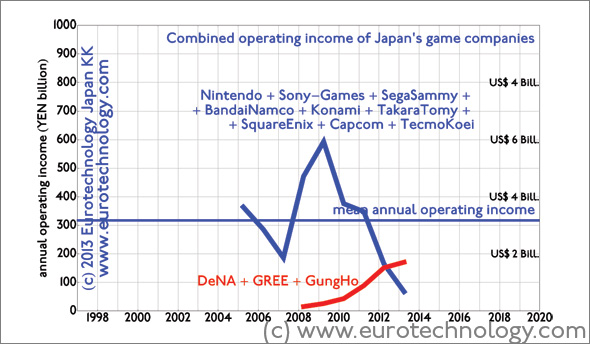

Japan game market disruption: GungHo + DeNA + GREE overtake Japan’s game icons

Japan game market disruption: new smartphone game companies overtake Japan’s game icons like Nintendo in income [日本語版はこちらへ] Since last financial year (ended March 31, 2013), three newcomers (GungHo, DeNA, and GREE) combined achieved higher operating income and higher net income than all 9 iconic Japanese game companies (Nintendo + SONY-Games + SegaSammy + BandaiNamco +…

-

Japan game sector disruption

Japan’s iconic game companies (Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix, Capcom, Tecmo-Koei) see brutal disruption by smart phone games Japan game sector disruption: Three newcomers (GREE, DeNA and GungHo) achieve higher operating income than all top 9 incumbent game companies combined Japan’s top 9 iconic game companies, Nintendo, Sony, Sega-Sammy, Bandai-Namco, Konami, Takara-Tomy, Square-Enix,…